2024-03-11 20:15

The action could be a sign of traders rotating some of their capital to tokens that haven't moved yet. Ripple (XRP), the native cryptocurrency of the XRP Ledger payment network developed by Ripple Labs, advanced over 20% Monday, snapping its downtrend versus bitcoin (BTC) as the crypto rally broadened. CoinDesk data shows that XRP sharply jumped to $0.74 in a little more than an hour Monday afternoon UTC time, notching its highest price since a very short-lived spike last November amid speculation about a potential BlackRock-managed XRP ETF. Today's 20% gain made XRP the best-performing asset in the broad-market CoinDesk 20 Index (CD20), which was higher by 5%. While bitcoin had already broken record highs and some corners of the crypto space such as meme coins and artificial-intelligence (AI) tokens experienced exorbitant gains, XRP had so far been notably absent from the action. When measured against bitcoin, XRP prior to today's move had slid to a 3-year low, TradingView data shows. Even with this afternoon's big jump, XRP is now only up 17% year-to-date, substantially underperforming BTC's 64% advance and the broad-market CoinDesk 20 Index 54% gain. XRP's rally could be a sign of traders turning their attention and rotating some of their capital to tokens that haven't moved yet as the rally on digital asset markets broadens. Other older cryptocurrencies such as litecoin (LTC) and dash (DASH), which too had been laggards over the past months, also surged over the past 24 hours, gaining 18% and 9%, respectively. Avalanche's AVAX, Polkadot's DOT and Cardano's ADA, advanced 8-13% during the day. XRP transfers from Binance While there wasn't any apparent catalyst immediately before XRP's price action, large token movements from crypto exchange Binance sparked speculations among crypto observers. Blockchain data tracker Whale Alert noted a transfer of 300 million XRP – worth some $187 million at the time – leaving Binance's address and deposited into an unknown wallet. The transfer was then followed by a series of similar outbound transactions – worth 18-19 million XRP each – from Binance and deposited to different addresses. The transactions could perhaps indicate whales – large crypto investors – accumulating XRP before the move up, but may also be due to the exchange shifting coins to new addresses as part of an internal wallet maintenance. https://www.coindesk.com/markets/2024/03/11/xrp-jumps-20-after-mysterious-binance-transfers-as-crypto-rally-expands-to-laggards/

2024-03-11 17:00

MicroStrategy is the owner of 205,000 bitcoin worth nearly $15 billion at the current per token price of $72,000. MicroStrategy CEO Michael Saylor said bitcoin will "eat" gold in the future. Bitcoin has all the the metal's great attributes, but none of its problems. MicroStrategy on Monday purchased another 12,000 bitcoin, bringing its total holdings to 205,000 tokens. Appearing on CNBC after his company on Monday announced the purchase of an additional 12,000 bitcoins (BTC), MicroStrategy (MSTR) Executive Chairman Michael Saylor said the crypto will be a much more valuable asset than gold in the future. “Bitcoin is certainly at least digital gold, it’s going to eat gold,” Saylor said, “It’s got all of the great attributes of gold and it’s got none of the defects of gold.” As one well-worn example, Saylor said that gold can’t easily be moved from New York to Tokyo in a few minutes, unlike bitcoin. He also expects bitcoin to divert money away from other risk assets, including the giant SPDR S&P 500 ETF (SPY), and for bitcoin to begin showing up in other funds similar to the BlackRock setting plans to acquire spot BTC ETFs in its Global Allocation Fund. Bitcoin on Monday became the world’s eighth most valuable asset, surpassing silver as its market cap rose above $1.4 trillion. It has a long way to go before it reaches the value of gold, which stands at a whopping $14.7 trillion valuation. Saylor reminded of the upcoming Bitcoin halving in April, which will reduce the crypto's block reward by 50%, meaning just 450 new bitcoins hitting the market each day from the current 900. “The price of bitcoin is going to have to adjust up in order to meet that investor demand.” Saylor's MicroStrategy (MSTR) on Monday announced that it had bought 12,000 more bitcoin for just over $800 million, bringing its holdings to 205,000 tokens. Asset manager BlackRock's iShares Bitcoin ETF (IBIT) had briefly surpassed MSTR's stack on Friday when its holdings rose to about 196,000 coins. https://www.coindesk.com/business/2024/03/11/bitcoin-is-going-to-eat-gold-microstrategys-michael-saylor/

2024-03-11 16:55

Issued by Baanx, the card would let users spend their crypto "on everyday purchases, everywhere cards are accepted," according to marketing materials CoinDesk reviewed. MetaMask is testing a Mastercard payment card, which it says is the first entirely on-chain card. Issued by Baanx, the card will let users spend crypto "on everyday purchases, everywhere cards are accepted," according to marketing materials CoinDesk reviewed. MetaMask, the popular cryptocurrency wallet for the Ethereum blockchain, is testing an entirely on-chain payment card running on Mastercard's giant network and issued by Baanx, according to promotional materials and a testing platform seen by CoinDesk. Such a product would unite two giants of their respective fields. MetaMask is the biggest self-custody wallet with more than 30 million monthly active users, while Mastercard provides key plumbing in the conventional financial system through its credit- and debit-card network spanning the globe. The MetaMask/Mastercard payment card would be "the first ever truly decentralized web3 payment solution," allowing users to spend their crypto "on everyday purchases, everywhere cards are accepted," according to the marketing materials. Mastercard and its rival Visa have been quietly courting public blockchain developer communities and self-custody wallet providers of late. Mastercard has been working with hardware wallet firm Ledger as well as MetaMask, CoinDesk reported in October of last year. Visa, meanwhile, has been working with the USDC stablecoin and the Solana blockchain on cross-border payments and smoothing out wrinkles like paying Ethereum gas fees. MetaMask developer Consensys did not respond to a request for a comment. When contacted by CoinDesk, a Mastercard representative pointed to the firm's statement from October: "Mastercard is bringing its trusted and transparent approach to the digital assets space through a range of innovative products and solutions – including the Mastercard Multi-Token Network, Crypto Credential, CBDC Partner Program, and new card programs that connect Web2 and Web3." https://www.coindesk.com/business/2024/03/11/with-mastercard-metamask-tests-first-blockchain-powered-payment-card/

2024-03-11 16:24

Spot bitcoin ETF inflows have surpassed expectations, the broker said in the report. Bitcoin ETF inflows have surpassed expectations. The broker is more convinced about its $150K bitcoin price target. Bitcoin mining stocks are the best way to play the crypto market rally. Bernstein analysts said on Monday that they were now more convinced about bitcoin (BTC) hitting $150,000 by mid-2025 after the largest digital asset rallied to reach a new all-time high this year. The analysts also predicted that bitcoin will ‘break out’ after the next halving event, reiterating its bullish call in some of the miners despite falling share prices. The broker repeated its $150,000 price target for the world’s largest cryptocurrency, citing booming exchange-traded fund (ETF) inflows, and said investors should buy bitcoin mining stocks to gain exposure to the coming rally. Mining stocks were sharply lower in early trading on Monday. CleanSpark (CLSK) led the declines down 9%, Marathon Digital (MARA) slumped 6.7%, and Riot Platforms (RIOT) fell 2.5% at the time of publication. “We believe bitcoin miners are still largely retail-traded stocks and institutions have largely stayed away from bitcoin proxies, as traditional investors remain skeptical and still approach crypto with a rear-view bias,” analysts Gautam Chhugani and Mahika Sapra wrote. “With bitcoin climbing new highs of $71K, we expect institutional interest in bitcoin equities to finally tip over, and bitcoin miners to be the largest beneficiaries,” the analysts said, adding that the long bitcoin miners trade requires “more patience.” The rising bitcoin price and transaction fees will provide a cushion for the miners into halving, even if production costs double post-halving, the report said. Outperform-rated Riot Platforms (RIOT) and CleanSpark (CLSK) “will clock ~70% and 60% gross margin respectively," the analysts added. Mining stocks have underperformed the bitcoin rally as investors are “long bitcoin and short miners.” The thinking behind the trade is that it's safer to buy spot ETFs rather than mining stocks that are exposed to risk from the upcoming halving. Bitcoin price was over 4% on Monday, at around $72,269 at the time of publication. The CoinDesk 20 index {{CD20}} also gained 4%. https://www.coindesk.com/business/2024/03/11/bernstein-is-now-more-convinced-that-bitcoin-will-hit-150k-after-massive-rally/

2024-03-11 16:00

The 2025 budget proposal projects these taxes could generate $10 billion next year if taken up. U.S. President Joe Biden unveiled his proposed fiscal year 2025 budget proposal, which included a crypto mining excise tax and addressing crypto in wash-sale rules. These are similar taxes to those proposed last year, which ultimately weren't taken up by Congress. U.S. President Joe Biden will once again pitch a wash trading rule, crypto mining tax and other regulations in his proposed budget for the upcoming year, taxes that the administration suggests could generate nearly $10 billion in 2025, and north of $42 billion over the next decade. The president's proposed budget for the upcoming fiscal year, released Monday, includes line items for applying wash sale rules to digital assets; information reporting requirements for financial institutions and digital asset brokers; foreign crypto account reporting rules; including crypto in mark-to-market rules and an excise tax on mining. "The Budget saves billions of dollars by closing other tax loopholes that overwhelmingly benefit the rich and the largest, most profitable corporations. This includes: closing the so-called 'like-kind exchange loophole' that lets real estate investors defer tax indefinitely; reforms to tax preferred retirement incentives to ensure that the ultrawealthy cannot use these incentives to amass tax-free fortunes; preventing the super-wealthy from abusing life insurance tax shelters; closing a loophole that benefits wealthy crypto investors; and ending a tax break for corporate jets," the proposal said. Wash trading rules, in traditional markets, aim to stop people from selling an investment for a loss and then quickly rebuying it. The practice has been prevalent in the non-fungible token (NFT) markets in the crypto industry. "A crypto investor – unlike an investor in stocks or bonds – can sell a cryptocurrency at a loss, take a substantial tax loss to reduce their tax burden, and then buy back that same cryptocurrency the very next day. The Budget eliminates this tax subsidy for crypto currencies by modernizing the tax code’s anti-abuse rules to apply to crypto assets just like they apply to stocks and other securities," a fact sheet published after the budget was released said. According to a summary table, the administration projects it could generate over $1 billion in the 2025 fiscal year by including digital asset transactions in wash sale rules alone, and north of $8 billion by including cryptocurrencies in mark-to-market rules. Over a 10-year period, these two rules could generate $25 billion and $7.3 billion, respectively (the budget seems to expect the mark-to-market rules adding to the national deficit after 2025). An excise tax on mining could remove some $7 billion from the national deficit over the next decade, the file said. Monday's budget proposal isn't the first time the Biden administration has sought to impose a mining excise tax or close the wash sales trading loophole. Last year's budget proposal included similar provisions, though those proposed taxes were ultimately not taken up by Congress in drafting budget bills. Biden's unveiling of his budget proposal comes days after his State of the Union address, though he did not mention digital assets in his speech. The speech came two days after Super Tuesday, when Biden and former President Donald Trump seemingly secured their respective parties' nominations for the 2024 general election taking place this November. https://www.coindesk.com/policy/2024/03/11/us-president-again-proposes-crypto-mining-tax-wash-sale-rule-for-digital-assets-in-new-budget/

2024-03-11 14:55

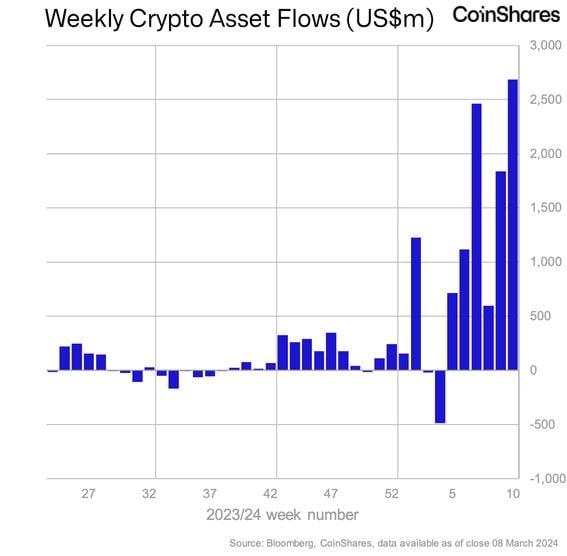

The record annual inflow set in 2021 is likely to be reached next week. It was another big week for digital asset investment funds, with a record $2.7 billion of inflows bringing the total to $10.3 billion year-to-date, according to CoinShares. The record annual inflow of $10.3 billion in 2021 seems likely to be taken out next week, less than three months into 2024. It's all about bitcoin (BTC), which accounted for $2.6 billion of last week's inflows as the U.S.-based spot ETFs continued to add thousands of coins per day alongside a major rally in prices. Year-to-date bitcoin inflows now account for 14% of bitcoin assets under management, said CoinShares. A check of other notable tokens finds Solana (SOL) having garnered $24 million of inflows last week. Bitcoin hit a fresh lifetime high on Monday, surpassing $72,000. https://www.coindesk.com/markets/2024/03/11/crypto-funds-weekly-inflows-surge-to-record-of-27b/