2024-03-07 18:12

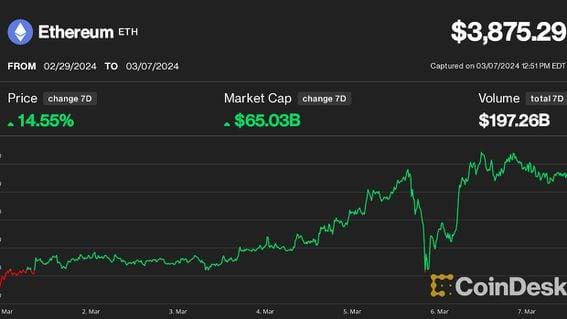

Bitcoin has already climbed to new all-time high while ether is lagging, but previous market cycles suggest change is coming. Bitcoin "sucked up all the attention" recently, but ether could more than double from current prices this year, a Bitwise analyst said. The upcoming Dencun upgrade and excitement around spot ETF applications are key catalysts. Ether (ETH) has been "largely overshadowed" by bitcoin (BTC) for the past several months, but the laggard could more than double in price in 2024, according to Juan Leon, crypto research analyst at asset manager Bitwise. "[Ether] could very well go above $8,000, $10,000 this year, maybe even higher," said Leon in an interview with CoinDesk Markets Daily. "Bitcoin has sucked up all the attention with the bitcoin ETFs launching, but [ETH] has at least two major catalysts that will come into focus," Leon noted. This month's Dencun upgrade will make transactions cheaper on layer 2 networks, which will bolster activity and even attract mainstream, mass consumer demand for the Ethereum, he explained. "Most of the positive sentiment will happen weeks and months after the upgrade as the effects take place," he added. Another catalyst are the spot ether exchange-traded fund (ETF) applications, with a regulatory decision deadline approaching in May. The odds for an approval are not as clear as were in the case for the spot bitcoin ETFs earlier this year, the Bitwise analyst said, but the possibility will bring excitement to ether. He gave a 50%-60% chance for an approval, but said it will happen "sooner or later." A potential approval would boost ether's appeal among more conservative, institutional investors, just as the new spot bitcoin ETFs launched in January attracted strong investor demand, amassing nearly $9 billion net inflows. Ether's deflationary supply, the restaking boom led by EigenLayer, and increasing decentralized finance (DeFi) activity also support higher prices for ETH, broker firm Bernstein said in a report last month. When ETH can break all-time highs While BTC already notched a new all-time high this week, ether has been lagging, still some 20% lower than its 2021 all-time high. This is similar to how the previous market cycle unfolded, with bitcoin – being the oldest and largest market cap cryptocurrency – leading the market recovery from the bottom, with ether and smaller cryptocurrencies lagging. Late November 2020, BTC was knocking at its all-time highs at $19,000 in, while ETH was hovering below $600, some 60% lower than its 2018 peak. A few weeks later, when BTC decisively broke above its former record price, ETH embarked on a multi-month rally to eventually hit a $4,400 peak in May. If history is any indication, bitcoin first has to surpass the $69,000 level for ether's shot to new all-time highs. Recently, ETH changed hands at $3,850, advancing 14% over the past seven days, outperforming bitcoin's 9% gain. The broad-market CoinDesk 20 Index (CD20) was up 13%. https://www.coindesk.com/markets/2024/03/07/ether-could-run-to-10000-or-higher-this-year-on-numerous-catalysts-bitwise/

2024-03-07 17:10

The Federal Reserve chairman said his agency isn't anywhere close to making any recommendations and wouldn't want any direct connection to retail users' data. Federal Reserve Chair Jerome Powell tried to offer assurances in a Senate hearing that a CBDC wouldn't be built in the U.S. in a way that gave the government an ability to spy on people. Powell said the Fed isn't close to any digital dollar recommendation. Even if the Federal Reserve were close to recommending a central bank digital currency (CBDC) in the U.S., Chair Jerome Powell told lawmakers that the Fed has zero interest in a system in which it would have a view into user data. "We're nowhere near recommending – or let alone adopting – a central bank digital currency in any form," Powell told the Senate Banking Committee in a hearing Thursday on monetary policy, adding that "people don't need to worry about it." He told the lawmakers that if the Fed ever got closer to building a digital dollar, the banking system would be enlisted to manage people's accounts. "If that were a government account, that the government would see all your transactions, that's just something we would not stand for or do or propose here in the United States," Powell said. He contrasted the U.S. thinking with China, where the government can track user activity in its digital currency. Republican politicians, including presidential candidate Donald Trump, have been issuing angry admonitions against what they've characterized as a federal government intent to launch CBDCs, despite repeated remarks from U.S. officials that they're doing nothing more than studying the idea as it spreads through other jurisdictions, including Europe and the U.K. Trump and others have decried the government's plans for spying on its people's transactions. Read More: Donald Trump Vows to 'Never Allow' Central Bank Digital Currencies if Elected "If we were to ever to do something like this – and we're very long way from even thinking about it – we would do this through the banking system," Powell said. "The last thing we would want with the Federal Reserve would be to have individual accounts for all Americans, or any Americans for that matter." Powell and other officials have said in the past that the central bank will await specific authorizations from Congress and the White House before it would move forward on a digital dollar. In response to a question from Sen. Cynthia Lummis (R-Wyo.) Thursday, he reiterated that position. "Do you still agree that the Federal Reserve cannot introduce a U.S. central bank digital currency without congressional authorization?" the lawmaker asked. "Yes, I do," the central banker responded. Nikhilesh De contributed reporting. https://www.coindesk.com/policy/2024/03/07/us-fed-chair-powell-says-nowhere-near-pursuing-cbdc-wont-spy-on-americans/

2024-03-07 15:09

The airdrop will reward users based on their points totals. Kamino is the latest Solana-based DeFi protocol to set an airdrop date. Seven percent of KMNO's total supply is earmarked for the first airdrop. Solana-based DeFi protocol Kamino plans to airdrop its KMNO token in April after taking a snapshot of eligible users on March 31. "The amount of points you have will contribute to the amount of tokens you will get," Thomas, a contributor to Kamino, said on a monthly Solana developer call, explaining that the protocol will employ mechanisms to prevent airdrop farmers from sybil attacking the system with multiple wallets. Kamino is a platform for borrowing, lending and earning yield through various trading strategies on tokens in the Solana ecosystem. Last year, it deployed a points program to incentivize users and set up for an airdrop, following the example of Jito and Jupiter. The KMNO token will serve as a governance asset from launch day, Thomas said on the Zoom call Thursday. Its holders will ultimately have influence over Kamino's incentive programs, revenue disbursements, protocol operations and risk management, according to a tweet from Kamino. The token will have a total supply of 10 billion of which 10% will be circulating upon its April debut. Another 7% of the total supply is earmarked for the "initial community distribution," according to Kamino. Kamino plans to continue airdropping tokens with subsequent airdrop "seasons." The second will begin in April with another airdrop likely occurring at a later date. "Season 2 will emphasize loyalty & sustained usage of Kamino’s products," a tweet said. https://www.coindesk.com/business/2024/03/07/solana-defi-protocol-kamino-sets-kmno-token-airdrop-for-april/

2024-03-07 14:52

A Montenegrin high court on Thursday approved Kwon's extradition to the Asian nation to face criminal charges over the collapse of Terra. Terra founder Do Kwon will be extradited from Montenegro to South Korea to face criminal charges over the collapse of his crypto enterprise after March 23, his lawyer told CoinDesk. Kwon was arrested in Montenegro last year while attempting to travel with falsified documents. The U.S. and South Korea both requested his extradition, and Montenegrin authorities make the decision on where he goes. Do Kwon, a co-founder of Terraform Labs, is likely to be extradited to South Korea after March 23 following a Thursday decision from a Montenegro high court, his attorney told CoinDesk. In South Korea, Kwon will face criminal charges concerning the May 2022 collapse of his multibillion-dollar crypto enterprise. The South Korean national successfully appealed an earlier ruling by the same court, which approved his extradition to the U.S. Following Terra's collapse, Kwon managed to evade South Korean authorities until he was arrested last year in Montenegro while attempting to travel with faked documents. Kwon was arrested alongside former Terra executive Han Chang-joon, who was extradited to South Korea in February. Kwon will remain in Montenegro, serving a four-month sentence for possession of falsified documents. Following the sentence, he will likely be sent to South Korea, Kwon's Montenegrin attorney Goran Rodic told CoinDesk in a text. "The decision agrees with the evidence in the case files," Rodic said. "Kwon finishes serving his sentence on March 23 and will be extradited after that. That's all I can say now." Kwon successfully challenged multiple high court decisions on his extradition before Thursday's ruling. Rodic did not say if Kwon will be appealing this most recent decision. The U.S. and South Korea both requested Kwon's extradition. In the U.S., Kwon faces a securities fraud trial. Amitoj Singh contributed reporting. https://www.coindesk.com/policy/2024/03/07/do-kwon-can-be-extradited-to-south-korea-montenegrin-court-rules-reports/

2024-03-07 12:28

Data from CoinGecko shows the artificial-intelligence token category rallied 25% in the past 24 hours, while bitcoin gained just 0.3%. Prices of AI-linked tokens such as FET and AGIX are surging on speculation a crypto product will feature at an Nvidia conference later this month even though AI can't run on the blockchain. Inflows into such projects is coupled with a sell-off in meme coins, which have led crypto gains in the past week. Expectations that a crypto project will be mentioned in an Nvidia (NVDA) conference later this month are driving traders to bid on artificial intelligence (AI)-linked tokens, propelling CoinGecko 's category for the coins up 25% in 24 hours. Tokens of Fetch.AI (FET), Render Network (RNDR), Sleepless AI (AI) and SingularityNET (AGIX) climbed as much as 40%. These projects claim to utilize AI in various ways, such as providing a virtual companion and being a marketplace for graphic processing cards. Behind the surge are reports that crypto AI project developers are attending the chipmaker's conference or taking part in panels, according to Lookonchain. The event will be held from March 17-21. The advance compares with bitcoin’s 0.3% increase and a 0.4% gain in the CoinDesk 20, a broad-based liquid index of major tokens. AI tokens remain a hot narrative for crypto traders because the technology is expected to drive key innovations in the global economy in the coming years. However, the relationship between AI and crypto is unclear: Artifical intelligence cannot run on a blockchain. Even so, developments in traditional AI companies, such as OpenAI, drive gains in AI tokens as traders utilize them as a proxy bet on the industry. The tokens also rallied last month after Nvidia beat fourth-quarter earnings and first-quarter guidance expectations. Meanwhile, the inflows into AI tokens seem to have put the brakes on a multiweek rally for meme coins, data shows. Tokens such as dogecoin (DOGE), pepecoin (PEPE) and dogwifhat (WIF) have more than doubled over the past few weeks as bitcoin briefly broke its all-time highs. Some observers attributed the surge to meme coins being more friendly to retail traders, who are typically driven to crypto markets during bitcoin rallies. The rally seems to be done for now. DOGE, SHIB and PEPE lost over 15% in the past 24 hours, data shows. And in another sign of money leaving the market, open interest on DOGE-tracked futures has dropped $400 million from record highs since Tuesday. https://www.coindesk.com/markets/2024/03/07/crypto-ai-tokens-in-focus-as-doge-shib-rally-starts-to-ease/

2024-03-07 12:03

Prices of Solana’s SOL are up nearly 600% over the past year, CoinGecko data shows. Cryptocurrency fund Pantera Capital is seeking fresh capital to purchase discounted Solana (SOL) tokens from the beleaguered FTX estate, Bloomberg reported Thursday. SOL tokens rose 2.2% in the past hour, contributing to an 8% gain in the past 24 hours. The firm is floating the Pantera Solana Fund to investors, stating it has an opportunity to buy up to $250 million of SOL tokens at a 39% discount below a 30-day average price of $59.95, Bloomberg said, citing documents sent to potential investors last month. The purchased tokens would be vested for at least four years and could allow the FTX estate to liquidate its SOL holdings, freeing up funds for creditors. Pantera was aiming to close the fund by the end of February and raised some money by the deadline, as per the Bloomberg report. CoinDesk did not immediately get a reply seeking confirmation and additional information sent to Pantera’s press email address. FTX was a crypto exchange owned by convicted fraudster Sam Bankman-Fried, an early Solana backer who held millions of dollars worth of the tokens. SOL was one of the top-performing major tokens in 2023, and is up nearly 600% over the past year, compared with bitcoin’s 200%. https://www.coindesk.com/business/2024/03/07/pantera-looks-to-purchase-discounted-solana-tokens-with-new-fund-bloomberg/