2024-03-07 11:27

Project Ensemble will "seek to explore innovative financial market infrastructure (FMI) that will facilitate seamless interbank settlement of tokenized money," HKMA said. Hong Kong's central bank has announced the start of Project Ensemble, a wCBDC Sandbox to further research and test tokenization use cases. Hong Kong has been exploring wholesale CBDCs since 2017 and "officially" began researching a retail CBDC in 2021. Hong Kong's central bank announced the start of a wholesale central bank digital currency (wCBDC) project to support the development of the tokenization market. Project Ensemble will "seek to explore innovative financial market infrastructure (FMI) that will facilitate seamless interbank settlement of tokenized money through wCBDC," with an initial focus on tokenized deposits, the Hong Kong Monetary Authority (HKMA) said Thursday. Hong Kong has been exploring wholesale CBDCs since 2017 and "officially" began researching one for retail payments in 2021. The HKMA has already conducted two rounds of market consultations on issuing a digital Hong Kong dollar (e-HKD) but has not decided on whether or when to introduce an e-HKD despite stating in October 2023 that a retail CBDC could add unique value. Project Ensemble is the latest addition to its portfolio of projects in the space, including Project mBridge, Project Dynamo and Project Genesis. "At the core of Project Ensemble is a wCBDC Sandbox that the HKMA will launch this year to further research and test tokenization use cases that include, among others, settlement of tokenized real-world assets (e.g. green bonds, carbon credits, aircraft, electric vehicle charging stations, electronic bills of lading and treasury management)," the announcement said. The project will see the creation of a "wCBDC Architecture Community" consisting of stakeholders from public and private entities to meet industry standards. It could also result in a new financial market infrastructure to bridge the gap "between tokenized real-world assets and money in transactions." If the wCBDC sandbox garners sufficient interest from the industry, a “live” issuance of the wCBDC at the appropriate time could be conducted, the HKMA said. "Project Ensemble will provide fresh impetus to our vibrant financial industry and reinforce our forefront position in tokenized money and assets," said Eddie Yue, Chief Executive of the HKMA. Read More: Retail CBDC Could Add Unique Value, but Further Investigation Is Needed, Hong Kong Central Bank Says https://www.coindesk.com/policy/2024/03/07/hong-kongs-central-bank-announces-new-wholesale-cbdc-to-support-tokenization-market/

2024-03-07 11:08

The upgrade is the first step toward enabling the network’s rollup-centric roadmap, the report said. The Dencun upgrade is scheduled for March 13. It is expected to result in lower fees for users of layer-2 networks. It allows Ethereum to act as a proper database for other blockchains. The Ethereum blockchain's Dencun upgrade, scheduled for March 13, is the first step toward enabling its rollup–centric roadmap and will allow the network to function as a proper database for layer-2 blockchains to store data more efficiently and cheaply, Fidelity Digital Assets said in a research report on Wednesday. "Ethereum's improvement as a database unveils the opportunity for near-zero transaction fees for users of layer 2's," and this could attract more users, wrote analyst Max Wadington. The upgrade will provide the scaling needed to support millions of users on layer-2 blockchains, making it a more "fitting distributed database for other blockchains," the report said. The improvements are expected to bring substantially more users into the Ethereum ecosystem and should expand the network's total addressable market (TAM). The upgrade will lower costs for layer 2 blockchains to store data on the main blockchain, and this reduction will probably be passed along to users in the form of lower fees. Rollups are Ethereum protocols that process transactions separately from the main network to help increase speed and lower costs. Layer 2s are separate blockchains built on top of layer 1s, or the base layer, that reduce bottlenecks with scaling and data. Still, the upgrade will not have many direct positive effects for Ethereum users because the fee reductions promised to layer 2 users will not affect those transacting on the base Ethereum blockchain, the note said. "In the short term, users who wish to benefit from this fee change must sacrifice some decentralization and security by transacting on layer 2's instead of Ethereum," Wadington wrote. "This will certainly spur more users to bridge assets elsewhere." "However, we strongly believe that transacting on Ethereum for application-specific purposes will still be considered the best option in the medium term as layer-2 platforms continue to mature," the report added. https://www.coindesk.com/tech/2024/03/07/ethereums-dencun-upgrade-could-mean-near-zero-fees-for-layer-2-blockchains-fidelity-digital-assets/

2024-03-07 09:28

As in previous bull runs, bitcoin's latest surge coincides with a burst of tech optimism on Wall Street. So traders might want to keep a close eye on a potential decline in the Nasdaq-to-S&P 500 ratio. Bitcoin continues to move in line with the ratio between the Nasdaq 100 Index and the S&P 500 Index. The persistent positive relationship suggests that the inflow of money into cryptocurrencies, an emerging technology, is linked to a positive outlook for technology stocks relative to the broader equity market. This bitcoin bull run stands out in several ways. For one, as Bloomberg's Joe Weisenthal explained in Wednesday's newsletter, the crypto community has been focused on market flows rather than narratives about how decentralized finance or Web3 will revolutionize traditional finance. Another factor that makes this rally stand out is that prices have surged despite signs of strength in the U.S. dollar and Treasury yields, as opposed to 2020-21, when both were weakening. One thing, however, remains the same. As in previous bull runs, the latest surge is accompanied by optimism directed toward technology stocks on Wall Street, characterized by a gain in the ratio between the tech-heavy Nasdaq 100 Index and the broader S&P 500, the NDX-SPX ratio. Since early 2017, bitcoin and the ratio have moved in lockstep through rallies and declines, with the ratio hitting record highs a couple of weeks before the cryptocurrency. Bitcoin's move this week to record highs above $69,000 comes after the NDX-SPX ratio set a new lifetime high of 3.6 in late January. The pattern is similar to the one seen in 2020-21. The positive correlation, clearly visible on the chart below, suggests that the inflow of money into cryptocurrencies, an emerging technology, is at least partly contingent on, or at least reflects, optimism regarding the outlook for technology stocks relative to the broader equities market. According to charting platform TradingView, the 52-week correlation coefficient between bitcoin and the NDX-SPX ratio stood above 0.60 at press time. The correlation has been mostly positive since early 2017. A positive correlation indicates that both variables are moving in the same direction. Note how BTC peaked with the NDX-SPX ratio in late 2021. Both entered a bear market in subsequent months, eventually bottoming out in December 2022. That means traders looking for signs of bitcoin's path forward might want to keep a close eye on the NDX-SPX ratio. Relative weakness in technology stocks might weigh on bitcoin and the wider cryptocurrency market. The consensus in the crypto market is that bitcoin's impending halving-induced supply reduction and the increased demand from spot exchange-traded funds (ETFs) will put the cryptocurrency on a path to $150,000 and higher. https://www.coindesk.com/markets/2024/03/07/this-bitcoin-rally-seems-different-in-several-ways-but-one-thing-stays-the-same/

2024-03-07 07:18

Local market observers pointed out that the so-called “Kimchi premium” crossed a two-year high mark on Thursday. The "Kimchi premium" refers to the difference in Bitcoin prices on Korean exchanges compared to global bourses. Bitcoin is currently trading at a 10% premium in South Korea. The arbitrage popularized by Sam Bankman-Fried involves buying bitcoin on a global exchange and selling it on a Korean exchange for a riskless profit in Korean won. Pocketing the actual gains is difficult due to South Korea's strict capital controls. A profitable yet operationally difficult arbitrage trade is back in vogue as bitcoin prices now command an average 10% premium in South Korea. As of Asian morning hours, bitcoin trades just above $66,000 on most global exchanges. It commands over 93 million won on Korean exchanges such as Upbit, worth over $71,000 at current exchange rates. The phenomenon is the so-called “Kimchi premium,” named after a popular Korean dish of fermented cabbage, which refers to the difference in bitcoin prices on local Korean exchanges compared to global bourses. The trade is simple in theory: One can buy bitcoin on a global exchange, transfer it to a Korean exchange, and sell it for a 10% riskless profit in Korean won. But pocketing gains from the arbitrage is quite difficult. Korea has strict capital controls, and it is challenging for foreigners to withdraw large amounts of money from the country. It means big funds cannot capitalize on the trade, and smaller investors may not have the required infrastructure. An infamous example of someone who took advantage of the Kimchi premium was Sam Bankman-Fried, founder of the now-bankrupt trading firm Alameda Research and FTX exchange. Bankman-Fried has claimed in several interviews that the premium was as high as 50% during 2019 and 2020, which allowed his firm to make as much as a million dollars a day, per CNBC. Meanwhile, some observers say the premium is a sign of retail participation and arises due to substantial local demand for the asset. “Korean retail investors are getting back,” Ki Young Ju, founder of on-chain analysis firm CryptoQuant, said in an X post. “Korea Premium Index(a.k.a. Kimchi Premium) is a pure retail FOMO indicator.” CryptoQuant’s head of research Bradley Park told CoinDesk in a Telegram message that some traders were likely taking advantage of the trade. “As the kimchi premium increases, traders will take advantage of the arb opportunity and bring their overseas holdings home, which means Upbit's Bitcoin reserves will increase,” Park said. “We have observed a significant increase (in these reserves) at the end of February.” Bitcoin prices are unchanged in the past 24 hours. The CoinDesk 20, a broad-based liquid index, is up 5.32%. https://www.coindesk.com/markets/2024/03/07/bitcoin-trade-that-gave-bankman-fried-his-millions-returns-in-south-korea/

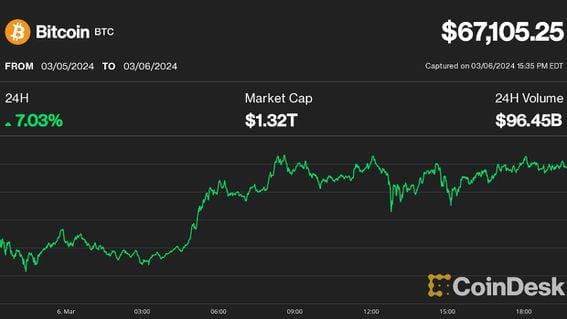

2024-03-06 21:07

The plunge from all-time highs turned the $60,000 area into a support level for prices, one observer noted. Bitcoin's sharp rebound from Tuesday's plunge indicates a start of a new rally targeting $76,000, Swissblock said. QCP Capital forecasted that bitcoin will break higher in the near term after "extremely impressive" bounce. U.S.-listed spot bitcoin ETFs saw massive inflows during the plunge, indicating that investors bought the dip helping prices recover Bitcoin's (BTC) record-setting move above $69,000 quickly turned into a bloodbath on Tuesday, but its rapid recovery to $67,000 one day later may foreshadow another imminent run for new all-time highs, according to crypto analytics firm Swissblock. Swissblock analysts noted that with yesterday's plunge, bitcoin successfully retested the $59,000-$62,000 price area, where it recently consolidated for a week before marching on to the all-time high. "V-recovery – and onwards towards new all-time highs," Swissblock said in a Wednesday Telegram update. According to a chart shared by Swissblock, bitcoin's quick break back above the $62,000 level marked the start of a fresh uptrend targeting the $76,000 price level. Singapore-based digital asset trading firm QCP Capital also forecasted an imminent leg higher for bitcoin. "The bounce has been extremely impressive," QCP analysts wrote in a Wednesday market update. "The dip was bought up very quickly and aggressively, and $60,000 proved to be a good support level." "With some of the leverage taken out, the path higher has now opened up and we look to a near-term break higher as the uptrend resumes immediately," QCP added. U.S.-listed spot bitcoin ETFs attracted massive inflows during Tuesday's drop, indicating that ETF investors were unfazed by the plunge and bought the dip. The ten new ETFs combined saw $648 million in net inflows, the largest daily allocation since their debut day in Jan. 11, data compiled by BitMEX Research shows. The BlackRock iShares Bitcoin ETF (IBIT) broke its daily record, enjoying $788 million of fresh investment and adding 12,600 BTC to the fund. At press time, BTC was trading at $67,200, up over 7% over the past 24 hours and outperforming the broad-market CoinDesk 20 Index's (CD20) 2.5% advance during the same period. https://www.coindesk.com/markets/2024/03/06/bitcoin-v-shape-recovery-opens-way-for-76k-price-target-swissblock/

2024-03-06 19:49

The cross-chain bridging project confirmed it will release a token. Token bridging service Wormhole confirmed its plans to release a W token on Wednesday, pledging to distribute 617 million tokens, or 6% of the token's total supply, to past users. The W token is set to become a governance asset the holders of which will vote within Wormhole DAO, a yet-to-launch entity that will make decisions for the platform, like how much to charge in fees. Wormhole is a cross-chain messaging platform that acts as a way to move money across blockchains, including Solana, Ethereum, Aptos and others. W will launch natively on the Solana and Ethereum networks, according to a webpage released Wednesday, which did not include a date. The upcoming airdrop appears to mirror that of Pyth – a fellow Jump Capital-linked crypto project that acts as a data bridge for blockchains – in many respects, including, most plainly, in website design. That airdrop debuted at a $500 million valuation. Wormhole officially parted ways with Jump last November and subsequently announced that the service had raised $225 million. Its financial backers are set to receive over 11% of the W token's circulating supply. This is a developing story. https://www.coindesk.com/business/2024/03/06/wormhole-to-release-617m-w-tokens-in-first-airdrop/