2024-03-01 22:38

Christopher Harborne and his aviation fuel broker AML Global were wrongly accused of "committing fraud, laundering money, and financing terrorists," according to the lawsuit. Christopher Harborne and AML Global Ltd. have sued The Wall Street Journal for defamation, alleging false accusations of fraud, money laundering and financing terrorism in a March 2023 article. The article, largely about Tether and Bitfinex's alleged efforts to retain ties to the banking system, was subsequently edited to remove paragraphs about Harborne and AML. While Harborne owns a minority stake in Bitfinex, he does not have a managerial role, the lawsuit said. The owner of a Thai-based aviation fuel broker has accused The Wall Street Journal of defamation for an article he says falsely accused him of abetting allegedly illegal activities at stablecoin issuer Tether and crypto exchange Bitfinex. According to the lawsuit filed in a Delaware state court on Feb. 28, Christopher Harborne and his company, AML Global Ltd., were wrongly accused of "committing fraud, laundering money, and financing terrorists – even though the Journal and its reporters knew and possessed documentation that conclusively showed that those accusations are false." The March 2023 article, "Crypto Companies Behind Tether Used Falsified Documents and Shell Companies to Get Bank Accounts," reported that Tether and corporate sibling Bitfinex were "struggling to maintain their access to the global banking system." In response, "some of their backers turned to shadowy intermediaries, falsified documents and shell companies to get back in, documents show," the Journal said. "The companies opened new accounts by using established business executives and tweaking company names," the newspaper continued. And some of those accounts, the Journal said, engaged in illegal behavior. (After the story came out last year, Tether's Paolo Ardoino tweeted that it contained a "ton of misinformation and inaccuracies," though he wasn't specific.) When published, the story included several paragraphs on Harborne and AML. On Feb. 21, 2024, a week before the lawsuit was filed, an editor's note was added: "A previous version of this article included a section regarding Christopher Harborne and AML Global, which applied for an account at Signature Bank. The section has been removed to avoid any potential implication that AML's attempt to open an account there was part of an effort by Tether, Bitfinex or related companies to mislead banks, or that Harborne or AML withheld or falsified information during the application process." Asked about the lawsuit, a Wall Street Journal spokesperson said: "More than nine months after the article was published, counsel for Mr. Harborne and AML Global contacted us to dispute the five paragraphs that included reporting about them. Following our review, we removed this section from the article and appended an Editor's Note in accordance with our editorial standards. The lawsuit they filed against Dow Jones is itself replete with inaccuracies and distortions. We take our journalistic responsibilities seriously, and we intend to mount a robust legal defense." Harborne, in the lawsuit, said he does have a connection to Bitfinex: a roughly 12% ownership stake – the result of Bitfinex's reimbursement plan for customers stemming from a 2016 hack of the crypto exchange. "Mr. Harborne is not now and never has been in any management or executive role at Bitfinex or Tether; he is merely a minority shareholder," according to the lawsuit. https://www.coindesk.com/policy/2024/03/01/wall-street-journal-accused-of-defamation-over-2023-tether-bitfinex-article/

2024-03-01 21:24

Bitcoin has led the crypto advance this year, but altcoins could start outperforming soon, analysts said. Bitcoin (BTC), the largest and oldest cryptocurrency, has been leading the digital asset rally of late, but there are early signs of a so-called "altcoin season" impending, when smaller tokens are outperforming, analysts said. BTC is already near its all-time high set in 2021, hitting $64,000 this week alongside strong inflows into spot bitcoin ETFs. It's gained 48% since the start of the year, while the broad-market CoinDesk 20 Index (CD20) was up 33% during the same period, highlighting the underperforming altcoin sector. This could soon change, though, K33 Research analysts said in a Friday market report. "Judging by history, altcoins will start outperforming about the time we are now," K33 wrote. The report noted that bitcoin's market cap has doubled relative to the total value of all cryptocurrencies except BTC and ether (ETH) since the November 2022 market bottom. The setup, say the analysts, is similar to that of late 2020 before altcoins started to catch up to BTC's run. This week's "tremendous" meme coin rally might be a "possible early sign" of the impending altcoin season, they added. Popular dog-themed tokens dogecoin (DOGE) and shiba inu (SHIB) booked 40%-50% gains this week, while newer entrants like pepe coin (PEPE) bonk (BONK) and dogwifhat (WIF) doubled or more in price during the same period. However, the report pointed out that timing the altcoin season is a "risky sport," as the bitcoin ETFs have altered the crypto investment landscape, and there's no guarantee that the money flowing to bitcoin will eventually trickle down to smaller assets. "There is enough risk appetite to send a select few alts on big runs, but we have yet to see a new wave of retail entering the altcoin arena to create the rising tide that lifts all boats," said K33. Watch ETH for alt season confirmation Swissblock analysts said in a Friday market update that "signs point to an imminent alt season." According to a chart shared on Telegram, the median return of altcoins versus bitcoin appears to be reaching a bottom, and could turn soon, lifting altcoin prices relative to BTC. The key signal to look for to confirm the start of a period of altcoin outperformance is ETH's clearing the $3,500 price threshold, Swissblock said. https://www.coindesk.com/markets/2024/03/01/meme-coin-rally-may-signal-impending-altcoin-season-this-is-the-sign-to-watch/

2024-03-01 21:03

The comment period comes as the result of an agreement after crypto industry participants sued the DOE. The Energy Information Administration, a division within the Department of Energy, said it would solicit feedback on its crypto miner survey after coming to an agreement with the Texas Blockchain Council and Riot Platforms (RIOT). According to the agreement, the EIA will publish a notice proposing its planned miner survey, taking comments for 60 days. The notice will replace the previous survey, which was issued under emergency status. The survey, which asked miners questions about their energy usage, was originally published earlier this month, with EIA giving mining firms just a few weeks to respond or face fines. It was The Texas Blockchain Council and Riot sued, securing a temporary restraining order last week. A hearing scheduled for earlier this week was canceled after the parties announced they had reached an agreement. The EIA will "destroy any information that it has already received," the agreement said, as well as any other information it receives from the emergency survey. "Defendants agree that in considering the comments submitted in response to the New Federal Register Notice, EIA will also consider any comments submitted in response to the February 9 Notice as if they had been submitted in response to the New Federal Register Notice," the filing said. The agency may still choose to issue the survey after the comment period ends, according to the filing. The Department of Energy will also pay the plaintiffs' attorneys' fees, totaling just under $2,200. https://www.coindesk.com/policy/2024/03/01/us-department-of-energy-will-start-comment-period-on-miner-survey-proposal/

2024-03-01 17:33

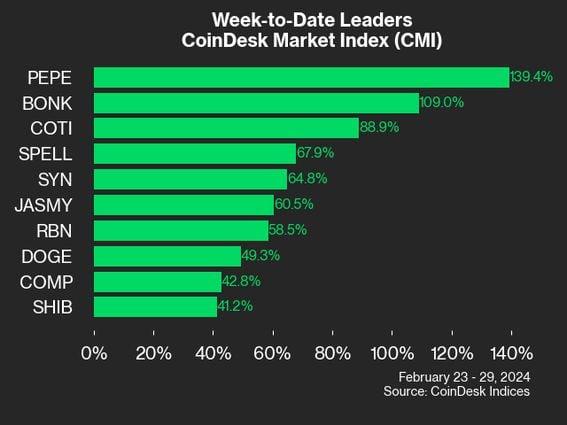

All 20 of the CD20 assets were positive on the week, with fourteen posting returns greater than 10%. CoinDesk Indices (CDI) presents its weekly charts, a twice-weekly look back at the performance of individual names inside the CoinDesk 20 Index (CD20) and the broader CoinDesk Market Index (CMI). The CD20 tracks the world's largest and most-liquid cryptocurrencies inside an investable index, while the broad-market CMI includes more than 150 tradable cryptos broken down into six sectors. The CD20 is up 19% since last Friday’s close, with all 20 tokens in the gauge having appreciated on the week. Meme coins dogecoin (DOGE) and shiba inu (SHIB) have seen outsized gains, posting advances of 49% and 41%, respectively. Among the CD20, only six assets have failed to earn double-digit returns on the week. These include Layer 2 side chain Polygon's MATIC (+3.1%), decentralized exchange Uniswap's UNI (+3.9%), shared storage platform FileCoin's FIL (+5.5%), Layer 1 Internet Computer's ICP (+5.7%), oracle platform ChainLink's LINK (+8.7%) and payments network Stellar's XLM (8.8%). Outside of the CoinDesk 20, meme coins PEPE (+140%) and BONK (+109%) lead the 189-asset broad market CoinDesk Market Index. https://www.coindesk.com/markets/2024/03/01/meme-coins-doge-and-shib-led-coindesk-20-gainers-last-week-coindesk-indices-charts/

2024-03-01 17:25

The key driver behind the selling could potentially be crypto lender Genesis, which last month received bankruptcy court approval to sell 35 million GBTC shares. Grayscale's GBTC saw nearly $600 million in outflows Thursday, its largest single-day redemption since Jan. 22, but inflows into other spot bitcoin ETFs offset the sales. BlackRock's IBIT had another strong day and surpassed $10 billion assets under management. Outflows from the Grayscale Bitcoin Trust (GBTC) spiked Thursday, but inflows into the other nine U.S.-listed spot bitcoin exchange-traded funds were more than enough to offset the GBTC sales. Data compiled by BitMEX Research shows that GBTC saw $599 million of outflows, almost triple of Wednesday's redemption and the largest single-day outflow since January 22. Confirming those numbers, Arkham Intelligence showed Grayscale moving nearly 10,000 bitcoin (BTC) to crypto exchange Coinbase Prime (presumably to be sold) as markets opened in the U.S. on Friday morning. The large outflow could perhaps indicate that crypto lender Genesis started or ramped up the pace of unloading its GBTC holdings, capitalizing on bitcoin's rally. Genesis received bankruptcy court approval on Feb. 14 to sell 35 million GBTC shares – then worth $1.3 billion, now roughly $1.9 billion – but outflows from GBTC were muted over the past two weeks until Thursday's spike. Thursday's GBTC exit was reminiscent of mid-January, when the bankruptcy estate of collapsed crypto exchange FTX sold roughly $1 billion worth of shares. Grayscale's GBTC operated as a closed-end fund without redemptions until its conversion to a spot ETF this January. Its shares traded at a significant discount to net asset value during the crypto bear market in the last two years, but that discount vanished in the run-up and finally the conversion to the ETF. BlackRock's bitcoin ETF surpasses $10 billion in AUM Inflows into the other U.S.-listed spot bitcoin ETFs, however, offset the big Grayscale outflows Thursday. The net $92 million of inflows, though, was the lowest in a week, per BitMEX Research. BlackRock's iShares Bitcoin ETF (IBIT) recorded another massive session of inflows, raking in $604 million of fresh funds and adding more than 9,700 bitcoin. This followed a record-breaking Wednesday.. The fund has now surpassed $10 billion in assets under management and holds over 161,000 bitcoin only seven weeks after its debut. Buying pressure through spot bitcoin ETF demand has been one of the key narratives over the past weeks as BTC's price rallied past $60,000 for the first time since Nov. 2021. Bitcoin gained 44% in February, its best month since Dec. 2020, slightly outperforming the broad-market CoinDesk 20 Index's (CD20) 41% advance. https://www.coindesk.com/markets/2024/03/01/grayscale-gbtc-selling-accelerates-but-bitcoin-etf-inflows-remain-positive-led-by-blackrock/

2024-03-01 16:38

Wright returned to the stand in the U.K. COPA trial to defend accusations of forging doctoring emails he’d sent his former lawyers. Craig Wright denied forging emails between him and his former lawyers on Friday during his last cross-examination in the COPA trial. The trial will resume on March 12 for closing statements. Craig Wright accused critics of bugging his home and spoofing an email he’s been accused of doctoring during a Friday cross-examination in the U.K. trial probing his claims of having invented Bitcoin. Spoofing involves changing the metadata of an email to – among other things – make it look like it was sent from a different address. When asked by presiding Judge James Mellor if he could specify who did the spoofing, Wright said, “Unfortunately not. I suspect a number of people, My Lord.” The Australian computer scientist has long maintained he’s Satoshi Nakamoto, the pseudonymous author of Bitcoin’s foundational document known as the whitepaper. A group of industry participants called the Crypto Open Patent Alliance (COPA) and several Bitcoin developers filed suit against Wright, alleging he’d committed forgeries of an “industrial scale” in trying to prove he’s Satoshi. On Friday, Wright vehemently denied accusations made by COPA of backdating the email in question to support a statement he’d made in court the previous week concerning his former legal representatives at Ontier. Wright instead blamed the timestamp and other discrepancies on email spoofing, spam folders, domain migrations, surveillance and hacking. Judge Mellor asked why someone seeking Wright’s downfall would doctor an email to support something he’d said, to which Wright replied, “Oh, no. It doesn’t support.” He said that the email was doctored by a malicious actor to fabricate an excuse to bring him back to court. After Wright, COPA’s expert witness Patrick Madden returned to the stand to defend his new analysis of the Ontier emails. Wright’s counsel sought to establish spoofing was an easy thing to do. When asked by Wright’s lawyer Craig Orr if the email could have been spoofed, Madden said he didn’t think it was. “I do not think it’s practical to consider that,” Madden said. Friday was the last day for discussing evidence. The trial will resume on March 12 for closing statements from both sides. Camomile Shumba contributed reporting. https://www.coindesk.com/policy/2024/03/01/craig-wright-accuses-critics-of-bugging-his-house-spoofing-emails-to-bring-him-back-to-court/