2024-02-27 21:24

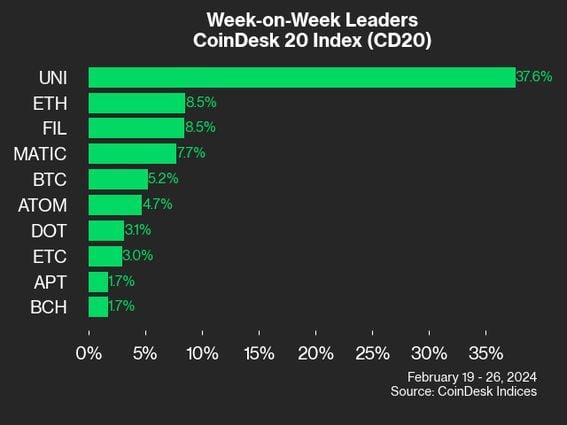

Just four cryptos in the index outperformed Bitcoin's 5.2% gain. CoinDesk Indices (CDI) presents its Chart Pack, a twice-weekly look back at the performance of individual names inside the CoinDesk 20 Index (CD20), along with a breakdown of sector performance inside the broader CoinDesk Market Index (CMI). The CD20 tracks the world's largest and most-liquid cryptocurrencies inside an investable index, while the CMI includes nearly 200 cryptos broken down by seven sectors and more than two dozen subsectors. https://www.coindesk.com/markets/2024/02/27/uniswaps-38-advance-leads-coindesk-20-gainers-over-the-past-week-coindesk-indices-chart-pack/

2024-02-27 20:45

"Many countries on the continent are grappling with high inflation rates and devaluing currencies, making it challenging for people to save and build wealth," the firm said in a blog post. Bitcoin-focused payments application Strike is expanding its services to the African continent, Jack Mallers, the company's founder and CEO, announced in a blog post Tuesday. "Today, we are launching Strike Africa, expanding our full suite of Bitcoin services into Gabon, Ivory Coast, Malawi, Nigeria, South Africa, Uganda and Zambia with more African markets to come in the future," the post reads. Strike, developed by the Chicago-based startup Zap, is a mobile payment application similar to Cash App or Venmo but uses blockchain tech to send and receive money. The company, which started off in the U.S. and El Salvador, announced plans last year to expand to more than 65 countries, pushing into new markets including not just Africa but also Latin America, Asia and the Caribbean. Strike Africa will offer customers to buy and sell bitcoin (BTC) and Tether's dollar stablecoin (USDT), local fiat currency on-ramps and off-ramps and global payments leveraging Bitcoin's Lightning network, allowing cheap and fast transactions for transfers and cross-border payments. Bitcoin (BTC) and stablecoins are increasingly in demand for savings and remittances in developing countries plagued by high inflation and fragile financial systems such as Argentina and Turkey. Crypto adoption in Nigeria, the largest market in Africa, is particularly high as people are turning towards digital assets as a hedge against local currency devaluation. The Nigerian naira plummeted by almost 50% against the U.S. dollar this month. "Africa presents immense opportunities for financial innovation and economic freedom," Strike's blog post said. "Many countries on the continent are grappling with high inflation rates and devaluing currencies, making it challenging for people to save and build wealth." https://www.coindesk.com/business/2024/02/27/bitcoin-focused-payments-app-strike-rolls-out-services-to-africa/

2024-02-27 18:30

Spot bitcoin ETFs again booked a strong day, recording over $2 billion in daily trading volume but slightly fell short of Monday's record. BlackRock's IBIT traded $1.35 billion on Tuesday, surpassing Monday's record daily volume. U.S.-listed spot bitcoin ETFs attracted $520 million in net inflows Monday as bitcoin rallied to $57,000. BlackRock's spot bitcoin (BTC) exchange-traded fund (ETF) had another massive trading day Tuesday, recording over $1.3 billion in daily trading volume for the second consecutive day, fueled by bitcoin's rally to $57,000. BlackRock's IBIT booked $1.357 billion in trading volume during the day, breaking Monday's record of $1.3 billion, Bloomberg Intelligence ETF analyst Eric Balchunas noted in an X post Tuesday afternoon at market close. Nearly 42 million shares changed hands, Nasdaq data showed, more than double of the average since it started trading in January. IBIT was the fifth most-traded among all U.S.-listed ETFs during the morning hours, pseudonymous HODL15Capital noted in an X post, adding that Fidelity's bitcoin ETF (FBTC) also experienced "strong" trading volume. U.S.-listed spot bitcoin ETFs traded over $2 billion, according to data cited by Balchunas, but slightly fell short of Monday's record-breaking daily volume of $2.4 billion. While trading volume can sometimes indicate positive interest in an investment product, it might not always be the case as the metric looks at both buy and sell orders. However, Monday’s high volume was certainly characterized by heavy inflows as the funds saw some $520 million in net inflows with only minor outflows from Grayscale's incumbent GBTC, according to BitMex Research. Fidelity saw the strongest inflows at roughly $243 million, followed by Ark and 21Shares’ ARKB, which attracted $130 million. IBIT came in third place at $111 million, a relatively low number for BlackRock’s fund compared to its average inflows since its debut. The large trading volumes happened as bitcoin broke out from its sideways consolidation Monday, rallying over 10% and hitting $57,000 after the U.S. market close, its highest price since Nov. 2021. BTC is up 6% over the past 24 hours, outperforming the CoinDesk20 Index's (CD20) 3.5% advance. https://www.coindesk.com/markets/2024/02/27/blackrock-bitcoin-etf-heads-for-second-consecutive-day-of-over-1b-volume/

2024-02-27 14:55

A price target of $990 is based on the assumption that bitcoin will reach $125,000 by year-end 2025, the report said. Benchmark initiates coverage of MicroStrategy with a buy rating and a $990 price target. Stock valuation is based on an assumption bitcoin will reach $125,000 by the end of 2025. Spot bitcoin ETFs and the upcoming halving are tailwinds for the crypto’s price. MicroStrategy (MSTR) has a unique business model based on the acquisition and holding of bitcoin (BTC), which represents the majority of the software company’s valuation, investment banking firm Benchmark said in a Tuesday research report initiating coverage of the stock. Benchmark has a buy rating on the shares with a $990 price target. MicroStrategy added about 8% to $860.75 in early trading on Tuesday. “We believe the boost in demand for bitcoin resulting from the launch of multiple spot bitcoin ETFs, combined with the reduced pace of supply resulting from the halving, has the potential to drive the price of the cryptocurrency meaningfully higher during the next couple of years,” analyst Mark Palmer wrote. When bitcoin halving occurs, miners' rewards are cut by 50%, reducing supply of tokens to the market. The firm’s bitcoin price assumption of $125,000 used to value MicroStrategy is based on the compound annual growth rate (CAGR) of the cryptocurrency’s price over the last 10 years applied over a two-year forward period. MicroStrategy’s software business acts as “ballast to that valuation” and generates cash flow that can be used to buy additional bitcoin, the report added. Benchmark notes that the first three bitcoin halvings were associated with bull runs in the price of the cryptocurrency. MicroStrategy is the largest corporate owner of bitcoin. In the past couple of weeks it bought an additional 3,000 tokens for $155 million, bringing its total holdings up to 193,000 coins, the firm said in a SEC filing yesterday. Read more: Michael Saylor’s MicroStrategy Purchased an Additional 3K BTC, Now Holds $10B Worth https://www.coindesk.com/markets/2024/02/27/microstrategy-is-a-timely-play-on-bitcoin-halving-initiate-at-buy-benchmark/

2024-02-27 14:02

The category has gained more than 13% on average in the past 24 hours, CoinGecko data shows. Prominent meme tokens on Ethereum and Solana ecosystems, such as PEPE and WIF, have rallied significantly, gaining up to 51% in the past 24 hours. The surge in meme coins is seen as a way to bet on the growth of a blockchain and is spreading to tokens on other networks, with an average gain of 13% in the past 24 hours. Prominent meme tokens of the Ethereum and Solana ecosystem rallied on Tuesday as the sector is quickly gaining prominence among crypto enthusiasts as a way to bet on the growth of a blockchain. Pepe (PEPE), the frog-themed meme token on Ethereum, was up as much as 51% in the past 24 hours to reach price levels previously seen in May. Bonk, the dog-themed token on Solana, was up as much as 25% before retreating in European afternoon hours on Tuesday. The CD20, a measure of the broader market, added 6%. The Solana-based Dogwifhat (WIF) zoomed over 65% before giving back some gains. Meanwhile, The CoinDesk 20 Index (CD20), a benchmark for the biggest and most liquid cryptocurrencies, jumped nearly 8%. Futures tracking pepe tokens saw less than $5 million in liquidated bets, suggesting the price surge was mostly driven by spot demand. Such price action could spread to meme tokens on other networks, with several meme tokens zooming since Monday night. The category has gained more than 13% on average in the past 24 hours, CoinGecko data shows. The meme coin rally comes as ether (ETH), and Solana’s SOL gained more than 8% in the past 24 hours as bitcoin (BTC) topped the $57,000 mark for the first time since November 2021. Such tokens are usually considered to have no intrinsic value – have recently risen in prominence as a beta bet on whichever ecosystem they are based on. Some, like the Avalanche Foundation, a non-profit that maintains the Avalanche blockchain, have even started to invest in meme tokens built on the network in recognition of the online culture and memetic value that such tokens can drive among investors. Some say meme coins are also a profitable, albeit risky, way to gain from ecosystem growth. “While meme tokens have been out of the narrative, they often pump following blue chip rallies, and traders reposition from ETH and BTC to altcoins,” Nick Ruck, COO of ContentFi Labs, told CoinDesk in a Telegram message. Meanwhile, at least six wallets sold over $4 million worth of PEPE tokens early Tuesday, contributing to some selling pressure. “6 wallets sold 1.98T $PEPE($4.37M) to take profits, with a total profit of ~$2M,” analysis firm Lookonchain posted. “5 wallets (possibly belonging to the same person) deposited 1.5T $PEPE($3.3M) to $Binance, making $1.49M(+82%).” https://www.coindesk.com/markets/2024/02/27/pepe-and-wif-jump-50-putting-ethereum-and-solana-meme-coins-in-focus/

2024-02-27 14:00

According to Gauntlet, the move offers the potential for more money with greater flexibility. Less than a week after its high-profile split from blockchain lending platform Aave, crypto risk manager Gauntlet announced Tuesday that it's teaming up with Morpho, a rival decentralized lender. Under the new plan, Gauntlet will create its own lending products – relying on a direct competitor to Aave called MorphoBlue, a service launched by Morpho in January that allows anyone to spin up a lending pool for a particular pair of digital assets. "Gauntlet has decided it could better pursue its mission of making DeFi safer and more efficient by joining forces with Morpho, which endorses a layered risk management approach rather than the traditional monolithic approach," Gauntlet said in a statement shared with CoinDesk. Aave and Morpho are similar in that they both allow users to lend and borrow cryptocurrencies without traditional middlemen. Gauntlet was initially contracted to help Aave manage risk beginning in 2021, but Gauntlet co-founder John Morrow, made the surprise announcement last week that his team was splitting up with Aave because they "found it difficult to navigate the inconsistent guidelines and unwritten objectives" of the lender's "largest stakeholders." While the abrupt breakup left some members of the crypto community scratching their heads, the Morpho news could help shed light on Gauntlet's decision to part ways. Gauntlet will manage its MorphoBlue pools using a new feature called MetaMorpho, which allows "risk curators" (like Gauntlet) to create pools, manage their risk parameters, and earn associated fees. From a risk management perspective, the Morpho model is designed to be more efficient than Aave's, and Gauntlet's embrace of Morpho could be viewed as a swipe at its old partner. But Gauntlet's rationale for switching allegiances may be clearest when viewed in strict business terms, since it offers the risk manager the potential to earn more money, with greater flexibility. The Morpho Model Aave is far-and-away the market leader in decentralized lending, with more than $9 billion in total value locked (TVL), according to DefiLlama. Aave's lending pools are managed by the Aave DAO, a collective of holders of the AAVE token, which confers governance rights over the protocol. The DAO regularly votes on changes to risk parameters, and it pays "risk stewards" (like Gauntlet, until last week) to perform analyses and weigh in on key decisions. Aave's risk stewards are given limited emergency controls to help safeguard the protocol, but parameter changes are generally left up to community votes, which can be an arduous process given the hundreds of risk parameters that Aave must oversee on a day-to-day basis. Morpho started out as one Aave's biggest users, funneling more than $1.5 billion into the lender via its "Morpho Optimizers," which help investors earn extra yields on their Aave deposits. Morpho's new competing service, which places risk managers directly in control of their MorphoBlue pools, is designed to streamline things. MetaMorpho's "risk curators" take on risk management responsibilities for the pools they create – like setting collateral requirements, borrowing limits, and other parameters – and can directly set the fees they charge users. On Aave, risk managers "answer to the DAO," Gauntlet's vice president of growth Nick Cannon told CoinDesk this week. "Morpho," on the other hand, "makes Gauntlet and other risk curators closer to a first-class person." Why the move? After Gauntlet's Aave exit was announced last week, Cannon told CoinDesk that his team was motivated, in part, because Aave wanted "exclusivity from Gauntlet without paying for it." "We will explicitly not have exclusivity with Morpho," Cannon said this week. Aave DAO paid Gauntlet $1.6 million per year to serve as an official risk steward. That sum was reduced from $2 million to bring Gauntlet's compensation in line with that of rival risk manager Chaos Labs, which joined Aave as its second risk steward in 2022. When the Aave community was mulling whether to renew Gauntlet's contract last year, some members of the DAO threatened to pull their support because Gauntlet had done risk management work for Morpho. "We did this one-off economic audit with Morpho, and they said we were moonlighting for them," Cannon said. "Moonlighting? We made it very public and didn't have any explicit exclusivity at all." According to Cannon, Gauntlet felt as if Aave DAO gave its competitor and fellow risk steward, Chaos Labs, more leeway to work with other lenders. "If you want to pay for exclusivity, there's plenty of models to do that," said Cannon. "I'm happy to find a number there, but it's definitely tough when we have a direct competitor that's eating our market share." Different business models Chaos Labs CEO Omer Goldberg denied that Aave DAO gave his firm special treatment. According to Goldberg, Chaos has a different business model from that of Gauntlet: Chaos offers an automated risk management platform on top of its traditional "white glove" risk management service. The white glove service is reserved for Aave, whereas anyone can use its risk platform. "Aave's never thrilled that we're working with other borrow/lends, but it's not really been an issue," Goldberg told CoinDesk. "We have a platform so we're able to do these things, we're able to scale very quickly." The different business models help to explain why a risk firm like Gauntlet might stand to earn more from a partnership with Morpho. Aave DAO pays Gauntlet a yearly fee, but Cannon says his team would have preferred if its compensation scaled up with its performance. "You want to fix your costs as a DAO," said Cannon, but he added that the flat rate made it difficult for Gauntlet to "align incentives" with Aave and "grow over time." On Morpho, Gauntlet will earn fees directly from users of its pools, meaning profits can scale up in proportion to usage. https://www.coindesk.com/tech/2024/02/27/days-after-ditching-aave-risk-manager-gauntlet-moves-to-rival-lender-morpho/