2024-02-26 21:08

"There are possibilities to solidify the treasury at low risk," pseudonymous JPEG'd contributor 0xTutti told CoinDesk. The hunt for high-yield crypto investments has prompted one on-chain lending project to consider deploying its treasury in airdrop farming, a favorite pastime for many trading degens. JPEG'd DAO, the governance group that runs the Ethereum-based lending platform that accepts NFTs as collateral, on Monday began voting on a proposal to deploy up to 50% of its ether (ETH) treasury to "airdrop farming strategies." So-called PIP-85 could see JPEG'd DAO utilize nearly $19 million worth of ETH tokens on EigenLayer and Blast, two of the most popular spots for airdrop hunters in the Ethereum ecosystem right now. Both protocols are expected to reward their users with potentially valuable tokens in the future. That expectation has prompted billions of dollars of crypto capital – much of which is from airdrop farmers – to flow into their protocols. "The DAO is sitting on a healthy treasury and there are possibilities to solidify the treasury at low risk," pseudonymous JPEG'd contributor 0xTutti told CoinDesk. https://www.coindesk.com/business/2024/02/26/seeking-yield-on-37m-ether-treasury-jpegd-dao-mulls-airdrop-farming/

2024-02-26 20:43

Ether is now the largest single asset held by institutions, with Bybit speculating that this may be because of a potential upward swing from the Dencun upgrade Institutions are heavily allocating their portfolios to ether and bitcoin, while retail users are more bullish on bitcoin, according to a Bybit report. Bybit's report highlights a shift in market sentiment since December, with institutions now favoring ether due to the anticipated Dencun upgrade and reducing their altcoin positions. Despite Solana's strong performance in Q3 2023, Bybit data suggests that neither institutions nor retail users are interested in hodling the token, with SOL now constituting only a single-digit percentage of institutional portfolios as of January 31. Institutions are over-allocating their portfolio to ether (ETH), followed closely by bitcoin (BTC), which is a contrast to retail users who are much more bullish on the latter, a new report from Bybit research said. Institutions have increased their portfolio concentration in bitcoin and ether to 80%, with a significant bet on ether due to the anticipated Dencun upgrade, according to Bybit's report, which surveyed traders with assets in the exchange. Meanwhile, retail users have a lower concentration in these assets and a higher tilt towards altcoins, the report added. Ether, which is now trading above $3100, has outperformed bitcoin with a 33% rally year-to-date, driven by factors such as its deflationary supply since the shift to proof-of-stake, low levels of ETH held on exchanges, and increased staking activity. In a recent report, Bernstein analysts Gautam Chhugani and Mahika Sapra also highlighted the growth of Ethereum's DeFi ecosystem and layer-2 networks, as well as the anticipated Dencun upgrade, as key catalysts for ETH's performance compared to the world's largest digital asset. This market sentiment had changed from December when Bybit published its last report, which showed that institutions were bullish on bitcoin, mixed on ether, and were moving more of their ether and altcoin holdings into bitcoin in anticipation of the bitcoin exchange-traded fund (ETF) ETF being approved. Bitcoin is up 20% since the beginning of the year, according to CoinDesk Indicies data, outpacing the performance of the CoinDesk 20, a measure of the largest digital assets, which is up 12%. Bybit also observed that Institutions have significantly reduced their altcoin positions, particularly in volatile categories like meme coins, artificial intelligence (AI), and BRC-20 tokens, despite their high returns in 2023. Instead, focusing more on stable assets like layer-1 tokens and decentralized finance (DeFi) protocols. AI tokens seem to be correlated with chip designer Nvidia's performance, as the GPU giant is practically synonymous with AI developments. The company's recent blowout earnings report sent AI tokens rallying, and many large-cap tokens in the category, like (AGIX) are up double digits in the last week. Despite Solana's (SOL) strong performance in the third quarter of last year, where it rallied and erased many of the losses of the crypto winter, Bybit's data suggests that both institutions and retail users have not been interested in HODLing the token that was once at the center of Sam Bankman-Fried's portfolio. SOL, says Bybit, now constitutes only a single-digit percentage of institutional portfolios as of January 31. https://www.coindesk.com/markets/2024/02/26/ether-is-now-the-largest-institutional-crypto-asset-bybit-research/

2024-02-26 18:57

The "turnover ratio" offers an indication of the proportion of a fund's assets traded each day. A fund's turnover ratio, or the dollar trading volume divided by the fund's net asset value, is preferred metrics to observe, NYDIG's Greg Cipolaro wrote. The spot bitcoin ETF group as a whole has seen a turnover ratio of 5.3%, with Valkyrie (BRRR) and Grayscale's GBTC seeing the lowest rates at 2.2% and 2.4%, respectively. While high trading volume in the new spot bitcoin ETFs is commonly thought to indicate strong investor buying interest, it may not necessarily be so, according to a NYDIG report. "Daily trading volume is not a reliable indicator of daily fund flows, a misconception prevalent in the industry,” Greg Cipolaro, global head of research at NYDIG, wrote in a note on Friday. For example, noted Cipolaro, it would be safe to assume that the Grayscale’s Bitcoin Trust (GBTC) is the best investment out of the ten bitcoin ETFs because it has consistently had the highest trading volume – in total over $20 billion since the spot ETFs launched on Jan. 11. Yet the fund has lost over $7 billion in assets, the clearest indication that there's little correlation between volume and inflows. BlackRock’s iShares Bitcoin Trust (IBIT), has only seen a little over half of GBTC’s volume, around $13 billion, but has seen AUM go from $0 to nearly $7 billion. Cipolaro prefers to look at a fund's turnover ratio, or the dollar trading volume divided by the fund's net asset value. "This ratio shows the proportion of the fund's assets traded on any given day, offering a glimpse into the investor and trader profiles and potentially what motivates their investment choices," he wrote. The spot bitcoin ETF group as a whole has seen a turnover ratio of 5.3%, said Cipolaro, with Valkyrie (BRRR) and Grayscale's GBTC seeing the lowest rates at 2.2% and 2.4%, respectively. At the high end is Ark 21 (ARKB) at 11.3%. He also took note of an upside outlier, WisdomTree's (BTCW), the smallest of the spot ETFs with just about $30 million in AUM, during one five-day period experienced a turnover ratio of 205%. Cipolaro noted that differing turnover ratios are not uncommon in other popular ETF families, the numerous funds tracking the S&P 500, for example. He suspects that options markets may help explain the differences and that once options on the spot bitcoin ETFs win approval, the turnover ratios for those vehicles may change from what's currently observed. https://www.coindesk.com/markets/2024/02/26/bitcoin-etf-high-volume-doesnt-always-mean-heavy-buying-nydig/

2024-02-26 18:37

The emails were disclosed by Wright's counsel after COPA's expert witness Patrick Madden spent a tense day on the stand. Craig Wright's former legal representatives at Ontier say emails purportedly showing their correspondence have been doctored as the fourth week of a U.K. trial probing his claims of having invented bitcoin started Monday. The emails were shared by Wright's wife Ramona Watts with his U.K. counsel, who then disclosed it to the court. Before the emails were revealed, Wright's team questioned a flustered Patrick Madden, whose digital forensics reports form the basis for accusations that Wright forged evidence that he's bitcoin creator Satoshi Nakamoto. Emails shared by Craig Wright's wife as evidence in the ongoing trial probing whether he'd invented bitcoin (BTC) are "not genuine," Wright's former lawyers said in court, as the fourth week of the legal proceedings kicked off Monday in London. The emails between Wright and his former representatives at Ontier became part of the trial after the self-proclaimed bitcoin inventor referenced them while he was under cross-examination last week. The emails were then shared by Wright's wife Ramona Watts with his current counsel at London law firm Shoosmiths, who in turn reached out to Ontier to confirm their accuracy. Wright claimed Ontier had access to the Australian accounting platform MYOB in 2019, and that he had the emails to prove it. Those emails that Wright's wife then shared with Shoosmiths were doctored, according to Ontier. Shoosmiths disclosed the emails and Ontier's response in court on Monday. The documents are now set to be analyzed by lawyers for both Wright and the plaintiff, the Crypto Open Patent Alliance (COPA). The emails were shared with the court by Wright's team after it had spent the day cross-examining digital forensics expert Patrick Madden, whose arguments that the Australian computer scientist forged key material he relies on to prove he's Bitcoin inventor Satoshi Nakamoto form the basis for COPA's complaint against Wright. Madden, who has penned extensive reports questioning the authenticity of numerous documents that Wright has presented as proof, appeared flustered and often downplayed his findings. Craig Orr, who cross-examined Madden for Shoosmiths, carefully hit a handful of arguments made by Madden to try and undermine the expert's work on the investigation and the strength of his findings. When asked if he could say for sure that a footer in a document presented by Wright could or could not have existed in 2008, Madden answered: "I can't say that 100%." When asked by Orr if he was speculating, Madden said, "It's a bit more than that, but, okay." Later, Orr questioned why Madden had relied on COPA's counsel Bird & Bird LLP to help draft his report instead of hiring an independent assistant. Madden said he didn't trust anyone else to do the work for him. When Orr asked if he had done anything similar for other cases, Madden answered no, and later disagreed with Orr when he suggested Madden had "undermined" his independence by his approach to preparing for the case. Madden's planned two-day cross-examination lasted less than a day, and Shoosmiths decided against questioning two more witnesses from COPA's camp lined up for the day. The trial will resume on Tuesday. https://www.coindesk.com/policy/2024/02/26/craig-wrights-former-lawyers-say-emails-shared-by-wife-are-fake-as-copa-trial-heats-up/

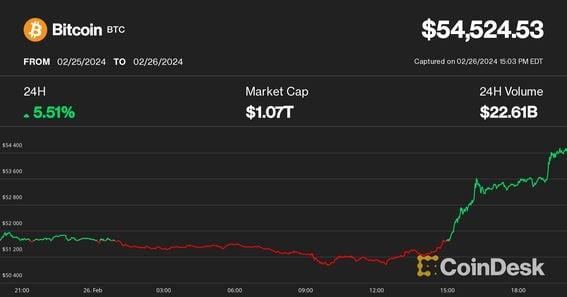

2024-02-26 16:35

Bitcoin could target $58,000 after the breakout, Swissblock analysts suggested. Bitcoin topped $54,000 Monday, breaking through a key resistance level that capped prices since mid-February. SOL, MATIC, ATOM led altcoin gains, while crypto-focused stocks Coinbase, MicroStrategy, Marathon Holdings and Riot Platforms booked double-digit advances. Bitcoin's next short-term target is $57,000-58,000, Swissblock said. Bitcoin (BTC) topped $54,000 on Monday surging to its highest price since November 2021, leaving past its recent sideways range as the crypto rally suddenly resumed. The largest crypto by market cap broke through its major resistance level at $53,000 during mid-morning U.S. trading hours, which halted price rallies over the past two weeks, and quickly ran just shy of $55,000 by afternoon hours before slightly retraced, CoinDesk data shows. At press time, BTC was changing hands at $54,400, up nearly 5% over the past 24 hours. It outperformed the broad-market CoinDesk20 Index (CD20), which advanced 4%, topping the 2,000 level for the first time. Ether (ETH), the second-largest crypto asset, also rose nearly 4%, hitting a fresh 22-month high of $3,200. Solana's native token (SOL), Polygon's MATIC and Cosmos' ATOM led gains among major cryptocurrencies in the CD20 index, with 5%-7% advances. The crypto rally also lifted digital asset-focused stocks. Shares of crypto exchange Coinbase (COIN) and the Michael Saylor-helmed MicroStrategy (MSTR) both gained 17% during the day. Large-cap bitcoin miners Marathon Digital (MARA) and Riot Platforms (RIOT) booked 22% and 15% gains, respectively. Bitcoin targets $58,000 While some market observers anticipated that bitcoin could correct to $48,000 as it stalled, Monday's bounce was a decisive breakthrough of one of the last historically important resistance levels before record highs. "BTC now seems to finally break out from the range it has been in since Feb. 15," crypto analytics firm Swissblock said in a Telegram market update Monday. "The momentum is moving up strongly. All sails are set." Swissblock analysts added that the next level for bitcoin's price target is the $57,000-$58,000 range, with new all-time highs in sight after that. The move was also coupled with an uptick in bitcoin's price premium on Coinbase compared to other exchanges, suggesting demand coming from U.S. investors. U.S.-listed spot bitcoin exchange-traded funds (ETF) also experienced heavy trading interest, with BlackRock's IBIT booking its largest daily trading volume since its debut, TradingView data shows. However, ETF trading volumes do not always translate to inflows for the funds, an NYDIG report pointed out. https://www.coindesk.com/markets/2024/02/26/bitcoin-blasts-past-53k-as-crypto-rally-resumes/

2024-02-26 13:45

The funds will be used to build out its three core products, "Avail DA," "Nexus" and "Fusion Security." Avail, among a handful of new "data availability" blockchain projects designed to handle transaction data produced by the increasingly sprawling networks, announced on Monday a $27 million fundraising led by the venture capital firms Founders Fund and Dragonfly. Avail, spun out of Polygon in March 2023 and is led by a Polygon co-founder, Anurag Arjun, will use funds from the seed round to develop three of core products: its data availability solution (DA), Nexus and Fusion, collectively marketed as the “Trinity.” Avail DA,the first core component, offers data space data for auxiliary "layer-2 networks" or "rollups" designed to handle transactions faster and cheaper than on base blockchains like Ethereum. The new DA project is expected to go live early in the second quarter of 2024. The emergence of these data availability solutions has become one of the most hotly discussed trends in crypto, since they could help to turn blockchain systems architecture into a more "modular" design, where core functions like transaction execution and data processing could be handled separately. They came into the limelight last year with projects like Celestia, which went live in October, and EigenDA, currently in development. The latter project is being developed by EigenLabs, the firm behind the restaking protocol EigenLayer, which last week raised $100 million from the venture capital firm a16z to keep building out its products. Avail Nexus is a “zero-knowledge, proof-based coordination rollup on Avail DA,” meaning that it will operate as an infrastructure layer that connects different rollups through the Avail ecosystem to talk to one another, according to a press release seen by CoinDesk. It will “act as the verification hub, which unifies a wide array of rollups both inside and outside the Avail ecosystem, utilizing Avail DA as the root of trust.” The project's “Fusion Security” will take crypto assets like bitcoin (BTC) and ether (ETH) and contribute to the security of the Avail ecosystem. Nexus’ first iteration is expected to go live during 2024, while Fusion Security will be ready in 2025, according to the company. The rollups space on Ethereum is fragmented, with major teams competing for many of the same users. Arjun, the Avail co-founder, argues that there is a need to work together with these rollups in order to make the user experience more unified. “You really need a credible third party like Avail to come and work with all these teams,” Arjun told CoinDesk in an interview. “We essentially want to be that unifying factor in that sense, and we have built out a technology so that it can enable these kinds of changes.” https://www.coindesk.com/tech/2024/02/26/avail-an-ethereum-data-network-to-rival-celestia-raises-27m-in-seed-round/