2024-02-19 15:37

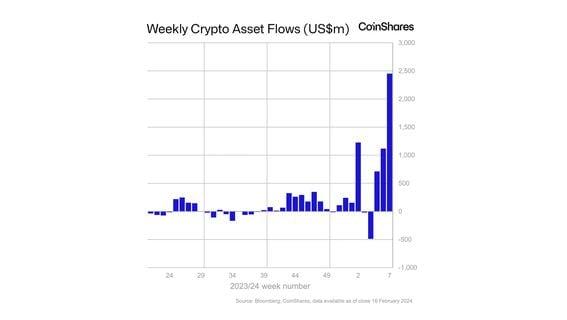

Inflows accelerated last week, indicating increasing demand for the new spot-based exchange-traded funds, CoinShares head of research James Butterfill said. Overall, a record $2.5 billion flowed into crypto exchange-traded products last week, with bitcoin funds responsible for 99% of all the inflows, CoinShares reported. Outflows from Grayscale's GBTC were compensated by massive allocation to BlackRock's IBIT and Fidelity's FBTC. Demand for bitcoin (BTC) exchange-traded funds (ETF) accelerated again last week as they raked in a record $2.4 billion of the $2.45 billion that flowed into digital asset investment products, crypto asset management firm CoinShares said Monday. Allocations to the newly approved U.S.-based spot bitcoin ETFs overwhelmed the $623 million outflows from Grayscale's Bitcoin Trust (GBTC), the incumbent fund that converted into an ETF structure. BlackRock's IBIT and Fidelity's FBTC attracted $1.6 billion and $648 million over the past week, respectively. "This represents a significant acceleration of net inflows, distributed widely among various providers, indicating an increasing interest in spot-based ETFs," said James Butterfill, CoinShares' head of research. Soaring demand for new bitcoin ETFs occurred as BTC hit $52,000 for the first time since December 2021, and investors are eyeing new all-time highs for the largest crypto later this year. Weekly inflow into the wider crypto asset class also hit a record, the CoinShares report noted. Bitcoin accounted for 99% of total net inflows into crypto funds, with ether (ETH) products experiencing the second-largest inflow of $21 million, according to the report. Meanwhile, blockchain equity ETFs suffered a $167 million outflow, signaling investors took profits, CoinShares said. https://www.coindesk.com/markets/2024/02/19/bitcoin-etfs-see-record-24b-weekly-inflows-blackrocks-ibit-leads-coinshares/

2024-02-19 11:44

However, WLD prices may run into headwinds as a token unlock worth $165 million is set to begin today, occurring until Feb.26, data from Token Unlocks show. Three Arrows participated in a $25 million round at a $1 billion valuation for Worldcoin’s developer Tools For Humanity. FTX’s founder, Sam Bankman-Fried, was an early investor as well. However, WLD prices may run into headwinds as a token unlock worth $165 million is set to begin on Monday. An over 200% surge in Worldcoin’s WLD tokens in the past week is seemingly benefiting a key group of investors – creditors of the bankrupt fund Three Arrows Capital (3AC), 3AC founder Su Zhu said on X on Monday. However, WLD prices may run into headwinds as a token unlock worth $165 million is set to begin this week, ending on Feb.26, data from Token Unlocks show. “I won’t be benefiting from WLD outperformance, but I'm glad 3AC creditors have one of the largest positions in WLD in the world,” Zhu said. “Got hated on a lot for this worldcoin investment in 2021.” Worldcoin is a controversial project that wants to scan everyone’s eyes in exchange for a digital ID and tokens. Every person receives depends on how early in the project’s roll-out they got involved and is distributed over two years, with 10% available immediately in a wallet app generated by the Orb. 3AC participated in a $25 million round for Worldcoin’s developer Tools For Humanity, which valued the firm at a $1 billion valuation, data from funding tracker Dealroom shows. The firm’s exact WLD holdings are unknown, and its founders owe creditors over $1.5 billion from investment losses, as per court filings. Another creditor group that could likely benefit is the FTX estate. In its Series A in October 2021, Worldcoin also received investment from Sam Bankman-Fried (SBF), the founder and CEO of crypto exchange FTX, which has since gone bankrupt with Bankman-Fried facing allegations of fraud. Data tracked by SpotOnChain shows wallets linked to Bankman-Fried’s company received over $185 million worth of WLD tokens in August 2023. The same Worldcoin address also sent tokens worth between $35 million to $170 million to several other addresses in the same month, blockchain transactional history shows. WLD’s rise has apparently come after AI developer OpenAI’s launch of a text-to-video generator, Sora, last week. Worldcoin’s parent company and OpenAI share the same founder, Sam Altman, and crypto traders are likely considering WLD a bet on the latter’s successes. The token’s nearly 50% jump in the past 24 hours has propelled prices to all-time highs of over $7 as of Monday, giving Worldcoin a full diluted valuation of a mammoth $75 billion. At launch and for 15 years, a total of 10 billion WLD will be released to the market. Tokens allotted to investors and the development team were locked for a year. https://www.coindesk.com/markets/2024/02/19/worldcoins-rocketing-wld-token-could-benefit-creditors-of-three-arrows-capital-ftx/

2024-02-19 10:29

Ether has rallied 16% in seven days, outperforming bitcoin's 8.5% rise. Ether has outshone bitcoin in the past seven days. Ether's fundamentals look more constructive than bitcoin's, owing to the deflationary trend in ETH's supply. Ether (ETH), the second-largest cryptocurrency by market value, has outpaced bitcoin's (BTC) rally over the past week, a trend that could continue because the fundamentals for Ethereum's native token appear more favorable than those of the larger crypto, according to Greg Magadini, Amberdata's director of derivatives. Ether has gained over 16% in seven days to trade above $2,900 for the first time in nearly two years while the bitcoin price rose a more sedate 8.5% to $52,300, CoinDesk data show. The ether-bitcoin ratio has jumped nearly 7% to 0.055. CoinDesk Indices CD20, a measure of the wider crypto market, has rallied 10.7%. ETH's outperformance comes after weeks of trailing bitcoin as traders focused on the debut of spot BTC exchange-traded funds (ETFs) in the U.S. and the impending quadrennial reward halving, which will cut the per-block BTC payout to 3.125 BTC from 6.25 BTC. The focus could soon shift to the significant drop in ether supply since Ethereum transitioned to a proof-of-stake consensus mechanism in September 2022 in an upgrade dubbed The Merge, Magadini said. That contrasts with Bitcoin's halving, which just slows the cryptocurrency's rate of growth. "Everyone is talking about the Bitcoin halving in April, but that’s nothing compared to the active 'REDUCTION' in ETH supply already occurring since Sept. 2022," Magadini said in a weekly newsletter. "ETH is the next play here! Low ETH/BTC ratio, actively finding a bid, [with ETH's] fundamental supply picture even better than BTC." Since the Merge, 1,047,643 ETH ($3.05 billion) have been issued and 1,407,200 ETH burned, or taken out of circulation, causing a net supply reduction of 359,557 ETH or 0.209% year-on-year, according to data tracking website Ultrasound.money. Bitcoin's supply increased 1.71% in the same period. The reduction represents a deflationary trend stemming from Ethereum burning a portion of transaction fees paid to validators. The Merge replaced miners with validators, removing a significant chunk of ether supply from the market. Validators stake a minimum of 32 ETH to participate in the governing process and secure the blockchain in return for rewards. The number of ether staked or locked in the network surpassed 30.1 million, or 25% of the total circulating supply, early this month. The Dencun upgrade, due March, is expected to slash transaction costs. In addition, the Securities and Exchange Commission is expected to greenlight spot ether ETFs in the U.S. later this year. Franklin Templeton, BlackRock, Fidelity, Ark and 21Shares, Grayscale, VanEck, Invesco and Galaxy, and Hashdex, have submitted applications to run one. The SEC approved nearly a dozen spot BTC ETFs last month, paving the way for investors to take exposure to the cryptocurrency without having to own and store coins. Since the Jan. 11 debut, the ETFs have seen inflows of some $5 billion, generating excitement about the potential ETH ETFs. "Combine this ETH 'Supply BURN' with dormant STAKED ETH and mix in a SPOT ETF actively putting ETH into cold storage … all of a sudden, the supply story for ETH is as bullish as fundamentals can get," Magadini said. Read: Ether's RSI Warrants Your Attention. Here is Why https://www.coindesk.com/markets/2024/02/19/ethers-fundamental-supply-outlook-better-than-bitcoins-analyst-says-as-eth-tops-29k/

2024-02-19 08:44

The second-largest cryptocurrency is probably the only digital asset other than bitcoin likely to get spot ETF approval from the SEC, the report said. Ether may be the only digital asset other than bitcoin to get spot ETF approval in the U.S. There is a 50% chance of ETF approval by May. Dencun, the Ethereum blockchain's upgrade due in March, will slash transaction costs. Bitcoin's (BTC) recent rally has been driven by the spectacular introduction of exchange-traded funds (ETF). It may be time to now focus on ether (ETH), the second-largest cryptocurrency, broker Bernstein said in a research report on Monday. Ether is "probably the only other digital asset likely to get a spot ETF approval by the SEC," the report said. Bernstein says there is about a 50% chance of ether spot ETF approval by May and near-certain probability of approval in the next 12 months. A number of traditional finance firms are vying for an ether ETF in the U.S., which is boosting the token's medium-term outlook. Franklin Templeton, Blackrock (BRK) and Fidelity, all of which had bitcoin ETFs approved by the Securities and Exchange Commission, are among firms that have submitted applications for an ether ETF. "Ethereum with its staking yield dynamics, environmentally friendly design, and institutional utility to build new financial markets, is well positioned for mainstream institutional adoption," analysts Gautam Chhugani and Mahika Sapra wrote. Ether yield markets would grow in lockstep with the crypto's market cap and could "power unique ETFs, if the staking yields are included in the ETF design," the authors wrote. The broker notes that institutions don't just want to launch ether spot ETFs, they want to "build more transparent and open tokenized financial markets on the Ethereum network," adding that the "utility is beyond asset gathering." Ethereum's next upgrade, Dencun, scheduled for March, "provides for a dedicated corridor and blockspace for roll ups, making transaction costs cheaper by another 50%-90%," the report said. https://www.coindesk.com/markets/2024/02/19/ether-could-be-the-next-institutional-darling-bernstein-says/

2024-02-19 07:20

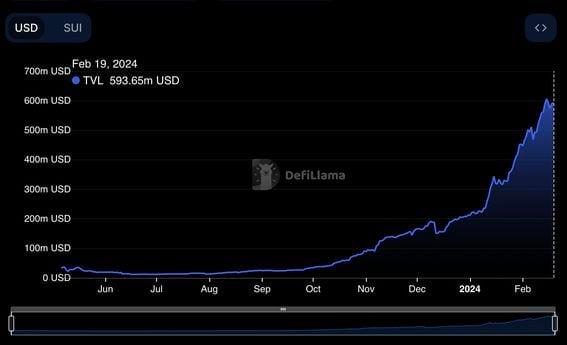

The Sui blockchain reached a peak of 6,000 TPS in December as it produced 13.8 million blocks in one day. The total amount of capital locked on Sui has risen from $211 million to $593 million since the turn of the year. The SUI token is up by 131% in the same period. Sui has now overtaken Aptos, Cardano and Near in terms of capital locked on DeFi protocols. Layer 1 blockchain Sui has experienced a sharp increase in inflows this month, a spike that has seen it overtake Cardano, Near and Aptos in terms of total value locked (TVL). The network, which was built by former Meta (META) employees, now has over $593 million in capital locked across various decentralized finance (DeFI) protocols, more than double its total at the turn of the year when it had $211 million, DefiLlama data shows. Data published by wormholescan.io, which tracks the flow of funds through the cross-chain bridge Wormhole, shows that $310 million had been bridged to Sui from Ethereum in the past 30 days. Sui is often compared to Aptos as they are both built using Move, a programming language that was originally developed at Meta to power the Diem blockchain. Sui experienced a turbulent start after it debuted on Binance’s launchpad in May last year. SUI, as its native token, nosedived 68% in the first five months of trading. This came to a crescendo in October when Sui founders were accused of manipulating token supply, claims they quickly dismissed. However, Sui soon found its stride after a wave of inscription-related activity. First seen on Bitcoin during its recent NFT phase, inscriptions are a way of recording arbitrary data on the blockchain without the use of smart contracts. On Dec. 22, Sui produced 13.8 million blocks, with transactions per second (TPS) reaching a peak of 6,000. In contrast to other layers 1s, like Ethereum, gas prices during this high traffic phase decreased, according to a Sui blog post. According to Suiexplorer, there are currently 106 validators operating 413 nodes to secure the Sui blockchain. This buoyed the confidence of developers and investors as both the SUI token price and on-chain TVL increased in the following weeks. The two largest protocols on Sui are Scallop Lend and Navi Protocol, two lending platforms that have both seen TVL quadruple since the turn of the year. SUI is currently trading at $1.80, having risen by 131% since Jan. 1, outperforming the CoinDesk 20 index, which is up by 10% in the same period. https://www.coindesk.com/business/2024/02/19/sui-overtakes-aptos-cardano-in-value-locked-sees-310m-inflow-in-30-days/

2024-02-19 07:15

ARK sold Coinbase shares from ARK Innovation ETF, ARK Next Generation Internet ETF, and ARK Fintech Innovation ETF. ARK sold 499,149 shares of Coinbase from its three funds. The sale came after Coinbase beat its fourth-quarter earnings expectations, leading to a string of analyst upgrades. ARK Invest sold nearly half a million shares of Coinbase Global (COIN), worth around $90 million, on Friday as the Nasdaq-listing cryptocurrency exchange witnessed a slew of analyst upgrades after its fourth-quarter results beat Wall Street expectations. ARK is one of the largest institutional backers of Coinbase. The Cathie Wood-led investment firm sold 397,924 COIN shares from ARK Innovation ETF (ARKK), 45,433 shares from ARK Next Generation Internet ETF (ARKW), and 55,792 shares from ARK Fintech Innovation ETF (ARKF), bringing the total number of shares sold to 499,149. Shares in Coinbase rose nearly 27% to $180.31 last week, as it reported upbeat fourth-quarter results. After the results, KBW upgraded the stock to market perform from underperform and raised its price target to $160 from $93. Analysts at Wedbush, Canaccord Genuity, and JMP Securities increased its price target. However, other analysts were less optimistic, with JPMorgan criticizing the exchange for its lack of clarity on how the spot bitcoin exchange-traded funds boosted its business. Mizuho was also critical of Coinbase’s performance and maintained its underperform rating and $60 price target. ARK also sold $6.72 million shares of trading platform Robinhood (HOOD) on Friday. https://www.coindesk.com/business/2024/02/19/cathie-woods-ark-offloads-90m-coinbase-shares-amid-slew-of-analyst-upgrades/