2024-02-19 07:08

Data from past cycles entered around halvings and a key technical analysis tool suggest that the path of least resistance is higher. Bitcoin tends to rally over 30% in eight weeks leading up to the reward halving, according to 10X Research. Bitcoin's fourth halving is due on April 19. Bitcoin's daily RSI has crossed above 80, a threshold that has historically presaged 60-day gains of over 50%. Bitcoin (BTC) has had a stellar few months, with bulls ignoring a resurgent U.S. dollar and Treasury yields to push the leading cryptocurrency to the highest level since late 2021. While a price pullback looks plausible, the broader uptrend looks set to continue, with prices revisiting and potentially surpassing the record high of $69,000 before Bitcoin Blockchain's fourth mining reward halving due on April 19. That's the message from 10X Research after studying past data and a technical analysis indicator called the relative strength index (RSI). Let's discuss both in more detail. Pre-halving bullishness The theory that bitcoin, the leading cryptocurrency by market value, bottoms out 12-16 months ahead of halving and chalks out uptrends ahead of and a year after the halving is well known by now. More importantly for traders, the previous three cycles centered around the halving show prices surged by over 30% in eight weeks leading up to the quadrennial event, which reduces the pace of supply expansion by 50%. The halving due on April 19 will halve the per-block reward to 3.125 BTC from 6.25 BTC. "Bitcoin rallies an average of 32% in 60 days ahead of the halving," Markus Thielen, founder of 10X Research, told CoinDesk. At press time, bitcoin changed hands near $52,000. A 32% rally from here, in accordance with the past data, means prices could trade close to the record high of $69,000 on or before the halving day. "The closer we reach the Bitcoin halving, the higher the probability that bitcoin will rally, as the evidence from the last three halving cycles shows. This time will be no different as the perception within the crypto community is high that the halving is bullish. This perception is undoubtedly flowing into the TradeFi community, which is aggressively buying these Bitcoin ETFs ahead of the halving," Thielen added. Strong inflows into the U.S.-based spot exchange-traded funds (ETFs) suggest a bullish mood among traditional investors. These regulated ETFs allow investors to take exposure to the cryptocurrency, bypassing the hassle of storing coins. Monthly RSI points north RSI, developed by J. Welles Wilder, is a momentum indicator that measures the speed and change of price movements over a set period, usually 14 days, weeks, or months. Readings above 70 indicate a strong upward momentum in prices. A week ago, bitcoin 14-day RSI crossed above 80 for the first time since December. 12 out of 14 such previous RSI signals presaged accelerated uptrends, producing an average gain of 54% in the following 60 days, according to 10X Research. "As a reference, Bitcoin traded at $48,294 when the last signal was triggered, and if history (avg. return +54% in 60 days) is any guide, then bitcoin could rally to $74,600 based on this signal," Thielen noted. Past performance does not guarantee future results, and macroeconomic factors could single-handedly make or break trends. That said, the present macro picture looks supportive of increased risk-taking, thanks to the U.S. running the most stimulative fiscal policy in years. Goldman Sachs has raised its year-end forecast for the S&P 500 by 4% to 5,200, citing expectations for robust global economic growth and a weaker dollar. https://www.coindesk.com/markets/2024/02/19/2-reasons-bitcoin-could-challenge-record-high-of-69k-before-halving/

2024-02-19 06:23

However, ether will likely capture more hype and mindshare in the coming months on a potential ETF listing, one analyst said. Bitcoin remained steady, while ether gained over 5% as investors bet on an ETH ETF in the coming months. AI-related tokens zoomed in as the launch of OpenAI’s Sora sparked renewed hopes for the sector’s growth. Bitcoin (BTC) prices remained little changed over the weekend, hovering around the $52,000 level on relatively lower trading volumes compared to the weekdays. The price action was in line with a recent trend of low volatility over the weekends following the issuance of spot bitcoin exchange-traded funds (ETFs) in the U.S. in January, which seemingly changed the market structure for bitcoin trading. However, other major tokens, such as ether (ETH) and Polygon’s MATIC, recorded higher gains, rising more than 5% since Friday. Ether likely gained as expectations of an ether ETF product offering the asset to U.S. investors bumped up – a narrative that has boosted the Ethereum ecosystem in recent weeks. Meanwhile, the CoinDesk 20 Index (CD20), a benchmark for the biggest and the most liquid cryptocurrencies, rose 2.68% in the past 24 hours. Artificial intelligence (AI)-related tokens, such as Worldcoin’s WLD, Fetch AI’s FET, Bittensor’s TAO, and Sleepless AI’s AI, jumped as much as 10% as technology firm OpenAI revealed its text-to-video generator Sora, sparking a run in the AI sector. Meanwhile, some market observers are targeting a short-term level of $55,000 for bitcoin, with a long-term call of $70,000. “Bitcoin is nearing its peak and will likely be pushing for $55,000 in the coming weeks,” Ed Hindi, Chief Investment Officer at Tyr Capital, told CoinDesk in an email. “In 2024, we expect bitcoin to rally to its all-time highs, reaching the $70,000 mark early this year.” However, Hindi added that ether will likely see much hype for its potentially larger upside and investment opportunities in the coming months. “The real hype will be around Ethereum. With the potential introduction of an Ether spot-ETF in the U.S., in tandem with the increased global appetite for DeFi – $5,000 for ETH in 2024 could very well be a realistic objective,” he added. https://www.coindesk.com/markets/2024/02/19/bitcoin-steady-over-52ktraders-target-55k-in-short-term/

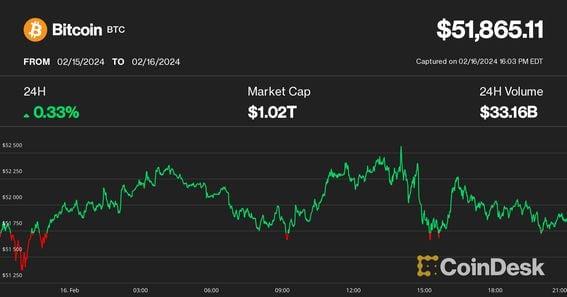

2024-02-16 21:20

Bitcoin's uptrend is supported by strong trading volumes, a bullish sign for continuation, a FalconX report said. Bitcoin's stalling momentum at the $52,000 resistance could signal an "imminent pullback" as 33% rise in a few weeks is "unsustainable", Swissblock said. The uptrend could still continue, with 10x Research setting a $57,500 price target for the next leg higher. Bitcoin (BTC) rose above $52,000 this week for the first time in 26 months, but its stalling momentum may foreshadow an "imminent" pullback before higher prices, Swissblock analysts said in a Friday market update. The largest crypto by market cap rallied 10% in a week, outperforming the broad-market CoinDesk20 Index's (CD20) 8% advance, extending its relentless rise from $38,500 in late January. The surge was coupled with accelerating inflows into U.S. spot bitcoin exchange-traded funds (ETF), with BlackRock's IBIT raking in over 28,000 bitcoin this week. However, the $52,000 area is a significant resistance level on long-term charts that capped prices in September and December in 2021, Swissblock noted, and now also posed a meaningful barrier for the rally to continue now. "A pullback seems imminent and necessary given the recent rapid ascent of approximately 33% over the past few weeks, suggesting an unsustainable rally," Swissblock analysts wrote. Beyond a short-term dip, the market looks poised for higher prices, the report added, and any forthcoming correction could be a buying opportunity as long as BTC holds its support at near $47,500. "At this point, any pullback should be thought of as a potential buying opportunity," the report said. Institutional crypto exchange FalconX also noted "exceptional" trading volumes that support the early 2024 uptrend, last seen during the 2023 March regional banking crisis. "Price increases followed by lower volumes have historically been a reliable indicator of false breakouts in crypto," FalconX analysts wrote Friday. "The good news at this point is that liquidity conditions surrounding the January rally remain generally robust." 10x Research analyst Markus Thielen said in a Friday update that bitcoin could run towards a $57,500 price target, citing strong liquidity and increasing demand for bitcoin futures. "Bitcoin appears to target 57,000 as its next resistance, and considering BTC's performance in the previous pre-halvings, the odds for another leg being higher are increasing," Thielen wrote. https://www.coindesk.com/markets/2024/02/16/bitcoins-stall-at-52k-may-foreshadow-imminent-pullback-before-higher-prices-swissblock/

2024-02-16 20:11

Coinbase reported strong fourth-quarter earnings on Thursday, partly driven by the launch of the ten spot bitcoin exchange-traded funds (ETFs). Even though the launch of the ten spot bitcoin (BTC) exchange-traded funds (ETFs) contributed to Coinbase’s better-than-expected fourth-quarter earnings, analyst at J.P. Morgan is skeptical if the benefits are as strong as the exchange makes them seem. “Management touted its involvement in the U.S. spot Bitcoin ETF as a net positive, but we’re still uncertain of its true earning impact as we see both positives and negatives,” J.P. Morgan analyst Kenneth Worthington wrote in a note on Friday. He specifically criticized the company’s lack of clarity around the business, which consists of providing custodial services for eight of the ten bitcoin ETFs. “Given the media attention and market anticipation for spot Bitcoin ETFs especially considering Coinbase’s direct participation and monetization efforts, we were hoping management would have provided more robust insight into the economics of the arrangements with issuers,” the note said. “Given this lack of detail, we remain skeptical as to the true monetization impact of these ETFs and its ability to outweigh the potential loss of volumes in the spot markets, which we still see as possible,” Worthington added. The criticism comes even as the crypto exchange crushed Wall Street's fourth-quarter estimates on Thursday, sending the shares soaring on Friday and turning many analysts more positive. Some analysts, including Wedbush and JMP Securities raised their price target on the stock, while KBW upgraded the rating to market perform from a sell-equivalent underperform rating. Analysts had warned before the approval of the ETFs that their low trading fees could pull investors away from exchanges like Coinbase and into these newly approved funds as the ETFs would be easier to put money into through brokers. However, Worthington noted that Coinbase doesn't seem to think ETFs are driving investors away. “Similar to comments we heard from Robinhood’s management earlier in the week, Coinbase alleged that the spot Bitcoin ETF drove no shift in client behavior, and all trading seemed additive to existent spot trading,” he wrote. Worthington, who went bearish on the Coinbase stock on Jan. 23, citing a disappointing ETF catalyst, upgraded the stock right before the fourth-quarter earnings, citing higher digital asset prices. His 12-month price target for the stock is $95, one of the lowest among Wall Street analysts and he is sticking with his neutral rating. https://www.coindesk.com/business/2024/02/16/jpmorgan-criticizes-coinbases-lack-of-insights-into-its-etf-business/

2024-02-16 15:43

The platform will feature deeper analytics and lower fees than the digital bank's app. Digital bank Revolut is testing a beta version of a cryptocurrency exchange targeted at "advanced traders." The exchange will offer lower fees than trading through the Revolut app alongside enhanced market analytics. Digital bank Revolut is set to introduce a cryptocurrency exchange targeting "advanced traders," according to a customer email seen by CoinDesk. Revolut currently offers basic crypto services to many of its 30 million customers. The exchange will offer lower fees and enhanced market analytics. "We're launching a new crypto exchange, built with advanced traders in mind," the email, which asked the customer to test the new platform, read. "You'll find deeper analytical tools and lower fees than the app." Fees have been set between 0% and 0.09%, and functionality has been added to allow users to trade using limit and market orders. Limit orders are typically used when a trader wants to purchase or sell an asset at a specific price. Limit orders will incur no fees. Revolut suspended crypto services for business customers in the U.K. in December, citing the Financial Conduct Authority's (FCA) new regulations covering crypto promotions. The email seen by CoinDesk was received by a U.K.-based customer. Earlier this week, it emerged that Revolut plans to list Solana's biggest meme coin, BONK, in a "learn and earn" campaign that will see the distribution of BONK to some of its customers. Revolut did not immediately respond to CoinDesk's request for comment. https://www.coindesk.com/business/2024/02/16/revolut-to-introduce-crypto-exchange-targeting-advanced-traders/

2024-02-16 15:05

On Friday, Craig Wright's sister Danielle DeMorgan recounted how she once saw him dressed as a ninja and another time he was working in a room full of computers, evidence, she says, he created Bitcoin. The trial to see whether Craig Wright is the creator of bitcoin completed its second week. Wright's sister took to the stand on Friday along with two other witnesses representing him. Wright left the stand on Wednesday after being accused of lying and making irrelevant allegations. Crypto Open Patent Alliance's (COPA) trial to solve the mystery of whether Australian computer scientist Craig Wright is Satoshi Nakamoto, the infamous anonymous creator of bitcoin (BTC), has just completed its second week. The week ended creatively. Wright's sister Danielle DeMorgan took to the witness stand on Friday to recount a blog post that she wrote that stated when she heard the name Satoshi, a Japanese name, she knew that was Wright. In the blog, DeMorgan recounted the time she saw Wright in the park dressed as a ninja when he was 18 or 19 – a tale she says explains why she connected the dots. She added that she once saw Wright around 2007 or 2008 in a room full of computers and he explained he was working on something important. Satoshi's Bitcoin white paper came out in late 2008. Wright's witness Mark Archbold also took the stand on Friday. He had a discussion with Wright about digital currency in 2005 and believed Wright was Satoshi because of the encryption software he wrote in the 2000s. Cerian Jones, a patent attorney, was also questioned on Friday and her statement centered around how Wright's patents showed he could have been the creator of bitcoin. Being associated with Wright isn't necessarily a good thing, Jones said, and when asked why by COPA's lawyer Jonathan Hough, she responded because "he's a very divisive character." His first witnesses entered the courtroom on Thursday, and COPA's lawyers at that time called some of their memories "hazy" and not reliable. Wright finished his testimony on Wednesday, and COPA lawyers declared that many of his statements were "lies." Earlier in the week, he was also told by COPA's lawyers to stop making "irrelevant allegations." The trial is set to continue next week. On Monday, more Wright witnesses will testify, according to the court schedule. David Bridges and Max Lynam will take to the stand, followed by his factual witness Stefan Matthews. COPA's witnesses will be questioned from Tuesday, and Wright is set to appear again on Friday for another cross-examination. https://www.coindesk.com/policy/2024/02/16/craig-wright-trial-on-day-10-includes-ninja-anecdote-cited-as-proof-hes-satoshi/