2024-02-13 06:33

The bullish flow is reminiscent of the 2020-2021 bull market when traders consistently snapped up bitcoin calls at levels well above the going market rate. Many calls at $65,000, $70,000 and $75,000 crossed the tape on dominant crypto options exchange Deribit over the weekend. The concentration of activity in these so-called out-of-the-money calls reflects bullish market sentiment. Move over fears of a bitcoin (BTC) price drop due to so-called overbought technical conditions and potential selling by bankrupt crypto lender Genesis. Crypto traders are snapping cheap out-of-the-money (OTM) bitcoin calls or bullish options bets at levels around the cryptocurrency’s lifetime high of $69,000. Over the weekend, many call options at strikes $65,000, $70,000 and $75,000 changed hands on Deribit, the world’s leading crypto options exchange by volumes and open interest. On Deribit, one options contract represents one BTC. Call options give investors the right to buy the underlying asset at a specific price by a stated date, while puts confer the right to sell. A call buyer is implicitly bullish on the market. The mass buying of higher strike calls reflects a bullish mood among sophisticated market participants. “We see a concentration of open interest in $50k calls and have seen flows in $50K, $60K and $75K calls in the listed options markets from April to June maturities”" Kelly Greer, Head of Americas Sales, Galaxy, told CoinDesk in an interview. “These flows demonstrate conviction from buyers willing to pay a premium to take on these positions, suggesting investors have a constructive view on bitcoin.” Greer added that a similar concentration of activity in the OTM calls at $30,000 and $40,000 in the final quarter of 2023 paved the way for a convincing price rally through those levels. Positioning in the options market has been a reliable indicator of impending price swings. The recent bullish flows are reminiscent of the 2020-2021 bull market when sophisticated market participants consistently bought calls at strikes at $80,000 and higher at cheap valuations. Bitcoin has nearly doubled to $50,000 since early October, with prices rising from $38,500 in the past three weeks, mainly due to strong ETF inflows. The cryptocurrency’s 14-day relative strength index, a popular technical analysis tool, has jumped above 70, signaling overbought conditions in the bitcoin market. An overbought reading is often taken as a signal of an impending bearish trend reversal, although it only means the market has rallied a little too fast in a short period and may take a breather.“ "Bitcoin posted its seventh consecutive day of gains, but the strengthening slowed over the weekend. It also coincided with a move above 70 on the RSI on the daily timeframes, which could increase players’ appetite for short-term profit-taking. Caution is also building as we approach the January peak,” Alex Kuptsikevich, senior analyst at FxPro, said in an email Monday. Besides, a looming concern is that failed crypto lender Genesis’ forced sale of $1.6 billion in bitcoin, ether and ethereum classics could drive prices lower. Genesis recently filed a motion asking a U.S. judge to approve the sale of the above-mentioned cryptocurrencies held in Grayscale’s trust products. https://www.coindesk.com/markets/2024/02/13/bitcoin-traders-scoop-up-options-bets-at-65k-and-higher/

2024-02-13 05:58

The CoinDesk 20, a liquid index of the top twenty cryptocurrencies, rose 4% in the past 24 hours. Ethereum ecosystem and layer-2 tokens, such as LDO, ARB, and MNT, jumped as much as 7% as Franklin Templeton filed plans for a spot ether ETF. Meanwhile, some market observers pointed out that Google search interest for bitcoin remained at an all-time low compared to the price, implying low retail interest in the topic. Solana’s SOL led the pack among crypto majors as bitcoin (BTC) briefly crossed the $50,000 mark late Monday, sparking renewed bullish sentiment among traders. SOL jumped 8%, while ether (ETH) rose 6.6% as bitcoin saw buying pressure after the New York market opened on Monday. Avalanche’s AVAX spiked 6%, while BNB Coin (BNB) and Cardano’s ADA rose a relatively lesser 3%. The CoinDesk 20, a liquid index of the twenty biggest tokens by capitalization and volumes, minus stablecoins, rose 4%. Some Ethereum ecosystem tokens, such as staking protocol Lido’s LDO, and layer-2 tokens, such as Arbitrum’s ARB and Mantle’s MNT, jumped as much as 7% as financial giant Franklin Templeton filed plans for a spot ether ETF, joining a rising cohort. Growth in major and alternative tokens has seemingly tracked the rise of bitcoin, which touched the $50,000 level for the first time since late 2021. Spot bitcoin ETFs have amassed more than 192,000 tokens as of Friday since they went live nearly a month ago. Low retail interest Meanwhile, some market observers pointed out that Google search interest for bitcoin remained at an all-time low compared to the price, implying low retail interest in the topic. Google Trends allows users to compare the relative volume of searches. However, this does not mean the total number of searches for that term is decreasing it just means its popularity is decreasing compared to other searches. A line trending downward means that a search term’s popularity relative to other popular terms is decreasing. As such, some traders caution that price retracements in the short-to-medium terms could still be on the cards. “There’s no upcoming news that may have a price correlation with bitcoin except the halving, which may provide returns in the medium to long term,” shared Ryan Lee, Chief Analyst at Bitget Research, in a note to CoinDesk. “It’s also important to take market’s psychological levels, such as BTC prices ranging from $50K to previous ATH, which may cause larger price retracements.” https://www.coindesk.com/markets/2024/02/13/solana-leads-gains-in-crypto-majors-bitcoin-metric-suggests-low-retail-growth/

2024-02-13 04:21

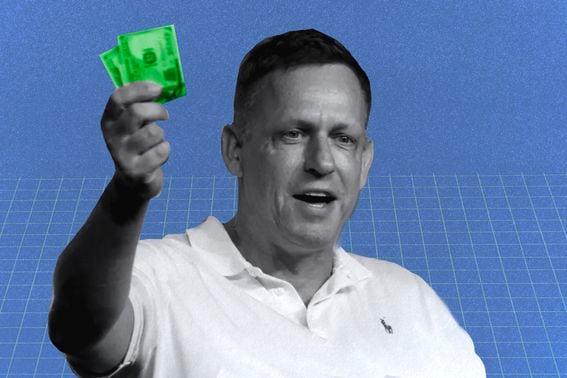

A source said that the investment was split evenly between the two digital assets. Peter Thiel's Founders Fund has made a $200 million investment in bitcoin and ether Thiel's fund sold crypto holdings for $1.8 billion before 2022's crypto winter. Peter Thiel's Founders Fund made a $200 million investment in bitcoin and ether before the bull run, per report by Reuters. According to CoinDesk Indices data, bitcoin (BTC) has increased nearly 124% in the last 12 months, while ether (ETH) has risen 75%. The CoinDesk 20 Index (CD20) has rallied approximately 86% in the same period. Founders Fund started to purchase bitcoin when it was below $30,000 and acquired more BTC and ETH in the subsequent months, sources told Reuters. Thiel has long been a proponent of bitcoin, linking its price rise to a critique of central banks and fiat money. During the 2021 bull run, he said he felt "underinvested" in the world's largest digital asset. Founders Fund sold most of its crypto holdings for $1.8 billion in March 2022, just before crypto winter began, the Financial Times reported last year. Founders Fund made a previous investment in bitcoin to the tune of $15 to $20 million during the 2017-2018 bull market. Thiel also backs the institutional crypto exchange Bullish, which in 2023 purchased CoinDesk from Digital Currency Group. https://www.coindesk.com/markets/2024/02/13/peter-thiel-made-200m-investment-in-btc-eth-before-bull-run-reuters/

2024-02-12 21:22

The asset manager is also one of the issuers of a spot bitcoin exchange-traded fund but hasn’t seen the same success as frontrunners BlackRock and Fidelity. Franklin Templeton has applied for a spot Ethereum exchange-traded fund (ETF), a filing with the Securities and Exchange Commission (SEC) shows. The asset manager joins BlackRock, Fidelity, Ark and 21Shares, Grayscale, VanEck, Invesco and Galaxy, and Hashdex, who have all submitted applications in recent months. The filing comes roughly four weeks after Franklin, among nine other issuers, launched a spot bitcoin ETF. Asset management giant BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC) have seen the most demand for their funds. Meanwhile, Franklin has had a less successful start, with only roughly $70 million in inflows since launching. IBIT has attracted over $3.5 billion worth of bitcoin in the past month, while Fidelity has seen roughly $3 billion. The SEC has so far delayed all decisions to approve an Ethereum ETF, as expected by experts. JP Morgan currently sees a less than 50% chance that such a fund would be approved before May. Although traders from Polymarket, a decentralized prediction platform, seem to be betting, there is a 50% chance that the ETFs will be approved by May 31. Franklin Templeton, often deemed “old-fashioned,” has made several pushes into crypto in recent years since CEO Jenny Johnson took over the company in 2020. Most recently, on social media platform X (formerly Twitter), the asset manager put laser eyes on its logo that features Ben Franklin as a nod to the crypto culture. The price of ether (ETH) climbed 5.5% in the last 24 hours, trading near $2,647, while bitcoin (BTC) hit $50,000 on Monday for the first time since late 2021. https://www.coindesk.com/business/2024/02/12/franklin-templeton-joins-ethereum-etf-race/

2024-02-12 20:16

The octogenarian politician is sporting laser eyes on Twitter, seemingly unaware it is a symbol of support for the cryptocurrency. To answer the question: No, President Joseph Biden is not suddenly a backer of Bitcoin. But the octogenarian politician’s social media team is appropriating the imagery of hardcore Bitcoiners, after posting an image of the U.S. president with laser eyes on Twitter/X. The picture of Dear Old Joe is apparently a reference to “Dark Brandon,” a meme that Democratic campaigners are trying to force. As Mashable reports: “In response to the Chiefs beating the San Francisco 49ers on Sunday, the president posted the eerie portrait that liberals have reinterpreted and used since 2022 to depict Biden as a superhero … “The genesis of the Dark Brandon meme is peak internet, which really just means its story is murky and hard to trace. As Vox explained in 2023, the meme seemingly originated at a NASCAR Xfinity Series race in October 2021, when NBC reporter Kelli Stavast determined crowd chants of "F**k Joe Biden!" as "Let’s go Brandon!" during a live interview with winning driver Brandon Brown.” Biden, eyes inflamed, arms crossed and teeth twinkling, confused the world especially considering that bitcoin has been on a tear. The cryptocurrency is now trading at its highest level since December 2021. But orange-pilled, he is not. According to Mashable, the meme is a response to a right-wing conspiracy theory that the Biden administration would rig the Super Bowl to secure support from billionaire superstar country singer Taylor Swift. If that doesn’t make sense, congrats; you haven’t rotted your brain by spending all your free time online. To quickly unpack it: Swift, who campaigned for Biden in 2020, recently started dating Kansas City Chiefs’ tight end Travis Kelce, who, during the coronavirus pandemic, did public outreach trying to convince his fans to get the COVID-19 vaccine. This apparently puts them both in the pocket of Big Blue. Swift is already riding the wave of newfound fame after her blockbuster Eras tour, which is widely cited as the highest-grossing concert series of all time. The only thing that could boost her reputation, and therefore help her brainwash her fans into voting for Biden, would be if her boyfriend was part of the winning team of the highest-watched, live televised event of the year. Indeed, the Chiefs pulled ahead literally in the final seconds of overtime, becoming the first team to win back-to-back Super Bowl games since Tom Brady led the New England Patriots two decades ago. "Just like we drew it up," Dark Biden posted on social media, making light of the bizarro-land conspiracy. To be fair to Bitcoiners who got over excited by another politician posting laser eyes, two years after the joke stopped being relevant, Biden’s social media team’s “meme” wasn’t exactly easy to parse. But if there was any group that should have been in-the-know, it should have been crypto fanatics. After all, one of the biggest proponents of the idea that Swift and Kelce are in a sham relationship only for Biden’s benefit was Vivek Ramaswamy, who was the Crypto Candidate before dropping out of the race. He wrote last month on X: "I wonder if there’s a major presidential endorsement coming from an artificially culturally propped-up couple this fall." Almost all the top posts to Biden’s “meme” (can it be a meme if only democratic insiders can pick up on it?) were crypto/financial influencers asking “What is happening” or “Thought this was Joe Biden (Parody) at first.” How quickly we forget. Biden’s account has posted Dark Brandon a few times, and everytime the same people respond the same way — each time their dopamine receptors seem a little more fried. You do have to wonder why Biden’s social media team is copying crypto’s aesthetics. Is he trying to reconnect with a potentially large voter base after previously calling upon the whole of government to bring crypto in line? Is he trying to bait a “single-issue” voter base who is likely not going to back him anyway? Is he trying to woo Sen. Lummis? Social media is a powerful force for connecting to constituents, though it can backfire. It's notable that Florida Governor Ron DeSantis essentially based his failed presidential campaign around internet-tinged culture war issues, even choosing to announce his bid on a Twitter/X live voice chat alongside super-poster Elon Musk. Choosing what to post in electoral politics is often a question of choosing how to post, whether you're willing to debase yourself by trying to seem "with it" or sticking to more promotional language. To some extent, Dark Brandon's laser eyes shows how culture is created online, often as a bottom-up phenomenon of people who share interests (like the idea that bitcoin could hit $100K if everyone believes hard enough). It seems like an unlikely coincidence given the prominence of the “laser eyes” meme, which has been sported by elected officials as well as corporations like Franklin Templeton to signal their support of Bitcoin. But nothing seems out of the question these days when it comes to contemporary U.S. politics. https://www.coindesk.com/consensus-magazine/2024/02/12/did-president-biden-just-endorse-bitcoin/

2024-02-12 18:55

Wright continued to blame a host of reasons and people for inconsistencies pointed out by opposing counsel on Monday as his cross-examination intensified. The second week of a highly anticipated U.K. trial that could decide if Australian computer scientist Craig Wright invented Bitcoin kicked off Monday. During his cross-examination, Wright continued to place blame on a number of individuals and entities for inconsistencies in his arguments. Australian computer scientist Craig Wright unleashed fresh allegations against several members of the crypto community and was in turn accused of offering different versions of the same story in court as his cross-examination in a trial over his claims of having invented Bitcoin (BTC) continued in a U.K. high court. The Crypto Open Patent Alliance (COPA), a nonprofit backed by crypto players such as Coinbase, Microstrategy and Twitter founder Jack Dorsey, sued Wright in 2021, accusing him of committing forgeries of “an industrial scale” in trying to prove he is Satoshi. The second week of the highly anticipated trial kicked off on Monday with Wright’s cross-examination by counsel COPA continuing for a fifth day. In a particularly heated exchange following a lunch break, COPA counsel, Bird & Bird LLP’s Jonathan Hough, asked Wright to stop making “irrelevant allegations” and to “answer the question.” Wright had just accused COPA members of turning Bitcoin into a “money-go-up-token scam.” When Wright protested, presiding Judge James Mellor intervened, saying arguments about the current state of the Bitcoin system were not going to help him make a judgment on the case – which is focused on whether or not Wright is Satoshi Nakamoto, the pseudonymous author of Bitcoin’s manifesto, called the white paper. “Counsel is quite right to stop you because it sheds no light whatsoever on the issue I have to decide. Do you understand?” Mellor said, to which Wright replied: “I do.” Since last week, COPA has been trying to poke holes in material – called “primary reliance documents” – that Wright has submitted to the court as evidence that proves he invented the popular cryptocurrency. Wright continued to blame a host of reasons and people for inconsistencies pointed out by Hough. Similarities between a dissertation by Wright and a paper authored by Bird & Bird alum Hilary Pearson were blamed on an attribution error made by third-party editors. Wright also sought to blame his ex-wife Lynn Wright’s testimony in a previous case – that she didn’t recall him ever mentioning Bitcoin – on her battle with breast cancer. Although he had previously testified in another case that he’d typed an email to the father of Dave Kleimann saying “Dave” and Wright were two of the “three key people behind bitcoin,” the computer scientist went back on his story Monday, saying he had someone under his employment type and send the email to make Kleimann’s father “feel proud of him.” (He also said during the same exchange on Monday that he had typed the sentence but not the email itself.) “The versions just keep changing, don't they?” Hough asked during that exchange, to which Wright replied: “No.” Wright also insists he didn’t think much of Bitcoin at the time of its creation in 2009 – which he calls his invention. “I thought it might get me either a partnership or a professorship with tenure. And that was about the extent of what I thought of my invention,” he said. Wright’s cross-examination will continue at least through Wednesday, and the court may also consider a new “box” of evidence he said his wife has just discovered. https://www.coindesk.com/policy/2024/02/12/craig-wright-told-by-uk-court-to-stop-making-irrelevant-allegations-as-copa-trial-continues/