2024-02-08 21:31

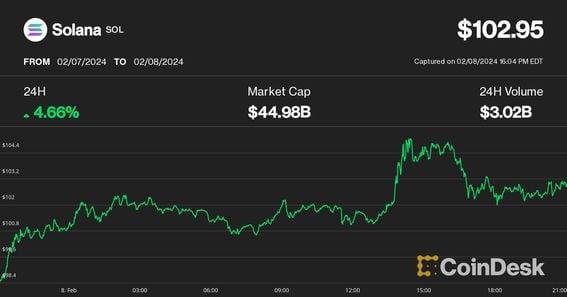

The broader altcoin market also showed signs of rebounding from oversold levels, one analyst noted. Solana's native token SOL bounced above $100, erasing a price drop spurred by a recent network outage. SOL is coiling for its next impulsive move, one trader suggested. Solana's SOL and Cardano's ADA led Thursday gains among major cryptocurrencies as bitcoin's (BTC) rally to four-week highs above $45,000 rejuvenated the crypto market. SOL, the fifth-largest token by market capitalization, reclaimed the $100 level, erasing the price drop when the Solana network suffered an outage of five hours. It was recently changing hands at $102, up 5% over the past 24 hours. ADA rallied even more, posting a 7% advance during the same time. They were the only cryptocurrencies in the broad-market CoinDesk 20 Index (CD20) that managed to outperform bitcoin's 3% daily advance. CD20, which tracks the performance of the largest crypto assets, was up 4%. Widely followed pseudonymous crypto trader Wick suggested there could be further gains for SOL. Pointing to its recent price action, the token is in the process of forming a chart pattern similar to the one seen inOctober and December before big moves. "Solana printing a shaded squeeze area," Wick said in an X post Thursday. "This usually warns up of an extreme move incoming." While other major cryptocurrencies mostly lagged behind SOL and BTC, the outlook for the broader altcoin market looks bullish as late last year's frothy sentiment reset, Caleb Franzen, founder of Cubic Analytics, noted. The total market capitalization of cryptocurrencies excluding BTC and ETH (TOTAL.3), a proxy for altcoins on TradingView, retested a key accumulation zone and now shows signs of bouncing off from oversold levels, Franzen explained. "This seems like bullish price action," he said in an X post. https://www.coindesk.com/markets/2024/02/08/solanas-sol-rebounds-after-network-outage-trader-hints-at-extreme-move-ahead/

2024-02-08 19:34

The bank’s survey of over 4,000 traders found that 78% of the participants do not plan to trade cryptocurrencies, while just 12% plan to do so in the next five years. Only 7% of the survey participants see blockchain as an influential technology, falling from 25% in 2022. 61% of the participants expect AI and machine learning to shape the future of trading in the next three years. Traders see inflation, the U.S. election, and recession risk as the top three catalysts that will impact the broader market this year. Banking giant JPMorgan's survey found that 78% of institutional traders aren't planning to trade cryptocurrencies in the next five years, and just a small group sees blockchain/distributed ledger technology (DLT) as the most influential technology in shaping the future of trading over the next three years. The bank interviewed over 4,000 institutional traders for its 2024 e-Trading annual survey, which covers upcoming trends and hot topics in the trading sector from traders around the world. The participants seem less enthusiastic about blockchain technology in 2024 compared to the previous two years. When asked which technologies will have the most impact on trading over the next three years, artificial intelligence (AI) and machine learning have dominated the answers. 61% of the participants predicted that AI and machine learning would be the most influential, up from 53% last year. Interestingly, blockchain was considered a more influential technology in 2022, with 25% (same as AI), declining to 12% last year and falling to 7% in 2024. The declining interest from traders isn't a surprise. In early 2022, the digital currency sector was cooling off from 2021's raging bull market, eventually leading to a harsh crypto winter after numerous bankruptcies and blowups that plagued the industry and prices. However, one metric that saw a slight positive bump is the number of active institutional traders in the digital currency sector. 9% of the participants said they are currently trading crypto, up from 8% in 2023. Meanwhile, 12% of the traders said they plan to trade crypto within the next five years. This might be because the entrance of large financial giants this year has led to a gradual recovery for the sector. January saw the much-anticipated approval of spot bitcoin exchange-traded funds (ETFs) in the U.S., an important milestone for institutional investors. The likes of BlackRock, Fidelity and WisdomTree all gained approval. The price of bitcoin (BTC) rose nearly 95% in the last twelve months, according to TradingView data. Even though the bank has been active in the digital assets sector, JPMorgan's CEO Jamie Dimon has long been vocal against crypto. In January, he said bitcoin is like a “pet rock” that “does nothing,” and his personal advice is not to get involved. In terms of macro events that are expected to move the broader market this year, inflation (27% of traders), the U.S. election (20%), and recession risk (18%) were the top three catalysts flagged by the participants of the survey. https://www.coindesk.com/markets/2024/02/08/jpmorgan-survey-shows-over-half-of-institutional-traders-dont-want-crypto-exposure/

2024-02-08 19:12

Republican lawmakers wrote to the SEC chairman, arguing that its misrepresenting of evidence against DEBT Box casts doubt on the agency's other enforcement matters. The U.S. Securities and Exchange Commission is being targeted with criticism from Republicans on the Senate Banking Committee that oversees the regulator. The agency has said it's trying to get a handle on its enforcement practices that led to missteps in a court case against a crypto firm, but the lawmakers question what it means for other ongoing cases. The U.S. Securities and Exchange Commission's admission that it misrepresented evidence in a lawsuit against the blockchain project DEBT Box casts doubt on its wider enforcement practices, several Republican senators argued in a letter to Chair Gary Gensler. The commission's lawyers had misstated information in court and subsequently failed to correct themselves in accusations against Digital Licensing Inc., known as DEBT Box, that led the court – under the SEC's request – to freeze the company's assets. The agency's lawyers were rebuked by U.S. District Judge Robert Shelby of the U.S. District Court in Utah, and the lawmakers are piling on to chastise the regulator. "Regardless of whether commission staff deliberately misrepresented evidence or unknowingly presented false information, this case suggests other enforcement cases brought by the commission may be deserving of scrutiny," the lawmakers argued in the letter, dated Feb. 7 and signed by five senators on the Senate Banking Committee, including J.D. Vance (R-Ohio) and Cynthia Lummis (R-Wyo.) "It is unconscionable that any federal agency – especially one regularly involved in highly consequential legal procedures and one that, under your leadership, has often pursued its regulatory mission through enforcement actions rather than rulemakings – could operate in such an unethical and unprofessional manner," according to the lawmakers, whose committee oversees the securities regulator. The SEC, which moved to dismiss its case last week, said that "agency officials have taken and are taking broader corrective action to ensure the concerns raised by the court do not arise again, including holding mandatory trainings for all Enforcement Division staff involved in investigations and litigation on the importance of candor and the duty to promptly correct any inaccuracies." Read More: U.S. Judge Warns SEC Over 'False and Misleading' Request in Crypto Case https://www.coindesk.com/policy/2024/02/08/us-senators-berate-secs-gensler-for-agencys-unethical-handling-of-crypto-case/

2024-02-08 18:00

The announcement means that existing EVM chains or optimistic rollups can connect to the prover without modification, then plug into Polygon’s newly released Aggregation layer, providing access to "all of the liquidity and value on Ethereum itself,” Polygon said. The "Type 1 prover" has been cast as a technological feat that essentially makes layer-2 networks nearly equivalent to main "layer-1" blockchains like Ethereum. Polygon is betting that more networks will use the new prover to connect to its own blockchain ecosystem. Polygon had previously relied on a "Type 2" prover that doesn't provide the same level of Ethereum equivalence. Polygon Labs, the developer behind the Polygon blockchain, released Thursday a "Type 1 prover," a new component allowing any network compatible with Ethereum's EVM standard to become a layer-2 network powered by zero-knowledge proofs, and to connect to Polygon’s broader ecosystem. The Polygon team claimed the release as a major breakthrough, a technological feat that even Ethereum co-founder Vitalik Buterin has touted as key to making auxiliary layer-2 networks nearly equivalent to the base blockchain. The Type 1 prover comes as Polygon pursues its Polygon 2.0 roadmap, with a focus on making its ecosystem more interconnected, with big bets on "zero-knowledge" or ZK cryptography as a core technology. At a high level, the announcement means that existing EVM chains or optimistic rollups can connect to the prover without modification, then plug into Polygon’s newly released Aggregation layer, providing access to "all of the liquidity and value on Ethereum itself,” according to Polygon’s blog post seen by CoinDesk. Polygon currently uses a Type 2 prover, which means it isn't fully equivalent to the functionality that exists on the main Ethereum blockchain. The blog post also said that the type 1 prover will be able to generate these ZK proofs for Ethereum mainnet blocks, with an average cost of $0.002-$0.003 per transaction. The Type 1 prover is open-sourced and is available on GitHub, with licenses obtained from MIT and Apache 2.0. Vitalik Buterin, the co-founder of the Ethereum blockchain, has previously written about the different types of provers, arguing that the benefit a Type 1 prover is that it is perfectly compatible with Ethereum, while the disadvantage is that there’s a lot of computation power that goes into producing ZK-proofs that are compatible with Ethereum, taking up to hours to produce. “Delivering a performant Type 1 zkEVM was seen as impractical and cost-prohibitive,” said Brendan Farmer, a co-founder of Polygon, in an email to CoinDesk. “Polygon has again demonstrated that it leads the industry in the development of ZK technology by delivering a Type 1 zkEVM that is insanely efficient.” https://www.coindesk.com/tech/2024/02/08/polygon-releases-type-1-prover-claiming-milestone-set-by-ethereums-vitalik-buterin/

2024-02-08 17:19

The bitcoin exchange-traded funds (ETFs) through Wednesday held a combined 192,255 bitcoin, more than 2,000 above that of MicroStrategy, the largest publicly traded holder of the cryptocurrency. The new spot bitcoin ETFs, excluding Grayscale's GBTC, now hold more bitcoin than MicroStrategy. "Concentration of coins held by these entities is not a risk to the Bitcoin Network," said one analyst. This excludes GBTC, which had been an operating fund long before it converted into an ETF. The recently launched spot bitcoin ETFs, excluding Grayscale's GBTC, added nearly another 5,000 tokens to their holdings Wednesday, and now at more than 192,000 BTC, own more of the crypto than MicroStrategy (MSTR), whose total stood at 190,000 as of the end of January. The funds have only been on the market for less than one month but have already attracted billions of dollars from investors looking to gain exposure to bitcoin without having to buy and store it directly. On Wednesday alone, there were over $1 billion in inflows into the ETFs, according to data from Bloomberg Intelligence These numbers exclude one of the spot ETFs, Grayscale's GBTC, which also began trading as a spot product at the same time as the other funds. As an operating closed-end trust for years prior, GBTC began as a spot ETF already with roughly 630,000 bitcoin. Tokens have been exiting GBTC for the past month on profit taking or a search for lower fees, with the fund as of yesterday holding just over 470,000 bitcoin. “Over time, we have seen bitcoin become an increasingly more distributed network in terms of the number of holders and their coins,” said Markus Levin, head of operations at California tech startup XY Labs and co-founder of XYO. “It could become an issue if too much BTC ends up becoming highly concentrated in any one country or company, but even with the likes of MicroStrategy and these ETFs, the concentration of coins held by these entities is not a risk to the Bitcoin Network.” Only 21 million bitcoin can ever exist, according to the cryptocurrency’s code, which means that the ETF issuers (ex-GBTC) – which include asset management giants BlackRock, Fidelity and VanEck, to name a few – now have combined with MicroStrategy to hold roughly 1.8% of all the bitcoin that will ever be available. Add in GBTC's 470,000 in tokens, and the percentage rises to 4%. https://www.coindesk.com/markets/2024/02/08/bitcoin-etfs-ex-gbtc-now-hold-more-btc-than-microstrategy/

2024-02-08 16:27

The largest crypto rallied every time in the last 9 years by 11% on average around the Chinese New Year festivity, says 10X's Markus Thielen. Bitcoin targets $48,000 in the short term fueled by a strong historic track record around the Chinese New Year, 10X Research's Markus Thielen said. BTC could hit $52,000 by mid-March with the bull run peaking in 2025, Thielen added. Bitcoin (BTC) is headed towards $48,000 in the short term after its breakout fueled by a strong track record of gains around the Chinese New Year celebration, according to Markus Thielen, head of research at Matrixport and founder of 10x Research. "The next few days are of paramount statistical importance as bitcoin tends to rally by +11% around Chinese New Year, starting on February 10 (Saturday)," Thielen wrote in a Thursday report. "During the last 9 years, Bitcoin has been up every time traders would have bought bitcoin 3 days before and sold it ten days after the start of the Chinese New Year." The largest crypto by market capitalization surged past $45,000 Thursday after yesterday clearing a key resistance level around $44,000, which had been capping prices since the spot ETFs began trading in the U.S. about four weeks ago. Thielen described the breakout as "very important" in that it marked the end of a corrective period that saw BTC decline to $38,500 in late January. "This opens the door to our shorter-term target of $48,000," Thielen added. Bitcoin to $52,000 by mid-March Looking further ahead, Thielen forecasted further upside for bitcoin based on Elliott Wave theory, a technical analysis that assumes that prices move in repetitive wave patterns. Price trends develop in five stages, according to the theory, of which waves 1, 3, and 5 are "impulse waves" representing the main trend. Waves 2 and 4 are retracements between the impulsive price action. BTC completed its wave 4 retracement by correcting to $38,500, according to Thielen, and has now entered its last, fifth impulsive stage of this uptrend targeting $52,000 by mid-March. The overall bull market could run well into next year, peaking sometime between April and September 2025, Thielen said. In an earlier report, he set a $70,000 price target by the end of this year amid supportive macro environment, monetary tailwinds, U.S. election cycle and increasing demand from traditional finance investors. https://www.coindesk.com/markets/2024/02/08/bitcoin-could-hit-48k-in-days-propelled-by-historic-chinese-new-year-gains-10x-research/