2024-02-07 21:36

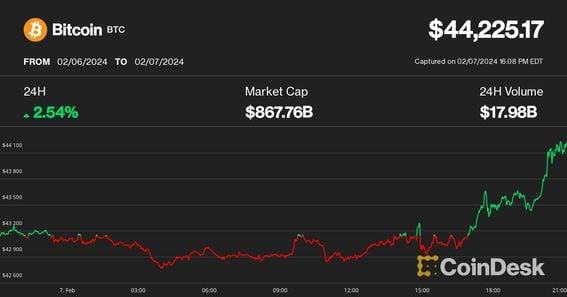

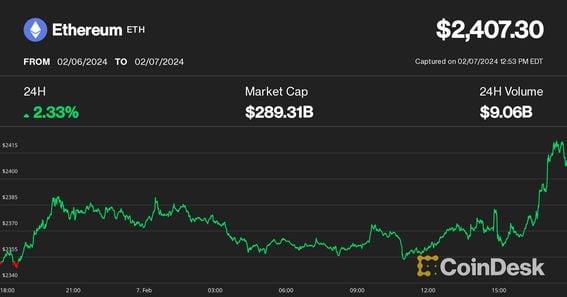

Continuing advances for U.S. stock markets also likely supported risk assets like crypto, with key indices making new all-time highs. BTC broke above $44,000 for the first time since Jan. 12, the day after the spot ETF debuts. Bitcoin addresses with over 1,000 BTC grew significantly over the past two weeks, one analyst noted. Bitcoin (BTC) surged Wednesday over $44,000 to a fresh four-week high amid increased BTC accumulation by large holders and new all-time highs in U.S. equity indices. The largest and oldest crypto by market value rose from $42,700 earlier in the day to as much as $44,300, its highest price since Jan. 12, the day after spot bitcoin exchange-traded funds (ETF) began trading in the U.S. Bitcoin's 2.5% advance over the past 24 hours is pacing the CoinDesk 20's 1.6% gain over the same time frame. Ether (ETH) is among other upside movers, ahead 2.3%. Lagging is Cardano (ADA) with a 0.4% decline. Bitfinex analysts pointed out earlier this week that increased selling by miners could have been a reason why BTC prices were pressured recently. However, an opposite dynamic today may have overwhelmed sellers. Crypto analyst Ali Martinez noted in a X post Wednesday that bitcoin whales – large investors – increased their asset accumulation. The number of bitcoin wallets holding over 1,000 tokens (roughly $44 million) rose to a multi-month high of 73, said Martinez, citing Glassnode data. Continuing advances for U.S. stock markets also likely supported risk assets like crypto, with S&P 500 closing at a record high just shy of the 5,000 level, The Dow Jones Industrial Average was just a few ticks from it all-time high, and the tech-heavy Nasdaq Composite continued to close in on its record. Concerns about the health of regional bank New York Community Bancorp (NYCB) appeared to ease, with shares erasing big early day losses and closing higher by 6.7%. The lender late Tuesday issued a statement to calm market participants about its liquidity and deposit stability after rating agency Moody's downgraded its credit to junk grade. Ether leads altcoin gains on ETF optimism Ethereum's ether (ETH) gain took it above $2,400 for the first time in two weeks on rejuvenated spot ETF optimism. Earlier in the day, asset managers Ark Invest and 21Shares amended their joint application to allow cash creations, bringing it more aligned with the recently approved spot bitcoin ETFs to perhaps preemptively appease regulators. The updated filing also tentatively opened the possibility of staking some of the fund's tokens to earn rewards. Ether-adjacent tokens such as scaling network Polygon's MATIC, Optimism's OPT, Arbitrum's ARB advanced 2%-4%, while liquid staking protocol Lido's LDO jumped 5%. https://www.coindesk.com/markets/2024/02/07/bitcoin-tops-44k-with-whale-accumulation-suggesting-conviction-in-more-price-gains/

2024-02-07 18:26

All but one of the recently launched spot bitcoin exchange-traded funds (ETF) charge a lower fee than the largest gold ETF, making them a cheaper investment into a gold-like asset. Gold and bitcoin are often compared as haven assets. The newly introduced bitcoin ETFs provide an even cheaper way to invest in "gold" – a digital version, anyway – as all but one charge a lower fee to investors than the biggest gold ETF. There's gold, the precious metal, and then there's digital gold, aka bitcoin. For about two decades, the relatively easy way to invest in the original gold was to buy an ETF like State Street's GLD. Starting last month, digital gold – bitcoin (BTC) – now comes in the same convenient package given the approval of bitcoin ETFs. The biggest gold ETF, the aforementioned GLD, has an expense ratio – a measure of how much an ETF issuer charges investors – of 0.4%. All but one of the 10 newly approved bitcoin ETFs (Grayscale's GBTC is the exception) have a lower expense ratio. In the blink of an eye, digital gold is cheaper to buy than the OG version. "*Nobody* expected that to happen this quickly," ETF Store President Nate Geraci posted on X. Gold – the conventional kind – is viewed as a haven for investors wanting out of the daily – sometimes hourly or less – twists and turns in financial markets. It's not the only option, though gold is generally easier to buy than other non-correlated assets like art, collectibles, real estate, music royalties, etc. A single ounce of gold is worth about $2,000, so a little bit goes a long way toward stashing one's savings. ETFs that hold them take up even less space – just a few bits of data in some brokerage's computers. Bitcoin is viewed by many as a more modern store of value. And, given that bitcoin ETFs are charging investors relatively little, it's an even cheaper hedge for investors. Ten issuers introduced them on Jan. 11. Franklin Templeton, for example, charges a 0.19% management fee, the lowest out of all issuers. Most are below 0.30%. By contrast, the biggest gold ETF, the SPDR Gold Trust, charges 0.40%. Gold is a useful analogy for bitcoin among some investors because of their similarities, but the metal also differs greatly from the cryptocurrency, said Matt Hougan, chief investment officer at Bitwise, one of the bitcoin ETF issuers. He said gold is better than bitcoin in one way because it has been around much longer, but it’s also worse because bitcoin is much easier to store, move, divide and use – and harder to fake. Does bitcoin have more potential than gold? “Many people focus on the fact that bitcoin is worse than gold in certain attributes, and that therefore its potential market cap is a fraction of gold's. But what if the more important thing is that bitcoin is better than gold in many ways, and that therefore its addressable market is much larger than gold?” he said. “I actually think that’s more likely.” Bitcoin's value comes from the fact that it has a limited supply of 21 million bitcoin, which makes it a scarce asset just like gold. It is also self-governed and cannot be influenced by the government, similar to the metal. “I like to think of bitcoin as digital super gold,” said Austin Alexander, co-founder of LayerTwo Labs, a venture focused on advancing bitcoin. “The digital gold does what gold does but better: It’s more scarce, more durable and more transmissible than gold." https://www.coindesk.com/business/2024/02/07/investing-in-gold-via-bitcoin-is-cheaper-than-ever/

2024-02-07 18:13

Michael Saylor's software firm called itself a “bitcoin development company” in its fourth quarter earnings presentation Tuesday night. Michael Saylor's MicroStrategy posted weaker-than-expected fourth-quarter earnings on Tuesday, its first report since bitcoin ETFs were approved in the U.S. The majority of its conference call presentation focused on bitcoin and how the cryptocurrency creates unique value for investors. The company called itself "the world's first bitcoin development company." MicroStrategy (MSTR), the software firm whose executive chairman is bitcoin maximalist Michael Saylor, reported weaker-than-expected fourth quarter earnings on Tuesday, but the majority of its conference call presentation focused on the world's leading crypto. Calling itself “the world’s first bitcoin development company,” the firm in presentation slides said it is “committed to the continued development of the bitcoin network through our activities in the financial markets, advocacy and technology innovation." Founded in 1989, Microstrategy was solely a software consulting business through mid-2020. That changed after then-CEO Michael Saylor began moving the firm's treasury assets out of cash and into bitcoin. Today, MSTR by far is the largest publicly traded holder of bitcoin with total holdings of 190,000 bitcoin or more than $8 billion. MicroStrategy's stock, however, has suffered since the launch of the spot bitcoin ETF products, falling 22% year-to-date even as the price of bitcoin is about flat. Addressing whether those wishing to allocate to bitcoin might be choosing to buy the ETFs rather than MSTR, the company in its earnings presentation attempted to make its case as the superior alternative. Among the arguments was that investors in MSTR have active control over the capital structure and that the company has the ability to innovate value as opposed to the ETFs, which simply hold the crypto asset. MSTR also pointed out other factors, such as the difference in management fees and MicroStrategy’s ability to generate cash and tap capital markets for attractive debt deals. “MicroStrategy shares continue to offer investors looking to gain exposure to bitcoin a number of important benefits, in our opinion, relative to spot ETPs,” TD Cowen analyst Lance Vitanza wrote in a note Tuesday. “Even with spot bitcoin ETPs now serving as potential substitutes, a significant premium [on bitcoin] will continue to be justified, we believe.” https://www.coindesk.com/business/2024/02/07/microstrategy-makes-its-case-as-alternative-to-spot-bitcoin-etfs/

2024-02-07 18:07

The updated prospectus brings the spot Ethereum ETF application more "in line" with the recently approved spot BTC ETF prospectus, one analyst noted. Ether price jumped 2% above $2,400 after Ark Invest/21Shares amended their spot Ethereum ETF paperwork. The updates bring the ETF more "in line" with spot bitcoin ETFs that regulators approved last month, said Bloomberg Intelligence's Eric Balchunas. Ethereum's native token ether (ETH) jumped above $2,400 Wednesday afternoon to a two-week high as asset managers Ark Invest and 21Shares amended their joint spot ETH exchange-traded fund (ETF) filing. The updated S-1 paperwork filed Wednesday with the U.S. Securities and Exchange Commission (SEC) shows that the ETF would feature a cash creation and redemption mechanism, which that regulatory agency favored for spot bitcoin ETFs that were approved in January. "Looks like they updated to be only cash creations and some other things that bring it in line with the recently approved spot BTC ETF prospectus," Eric Balchunas, senior ETF analyst at Bloomberg Intelligence, noted in an X post. The document also added a section about possibly staking ether through "one or more trusted third party staking providers," opening the possibility for the fund to lock up some of its holdings and earn rewards. ETH's price advanced nearly 2% within an hour from when the news appeared, breaking above $2,400 for the first time since January 22. The second-largest crypto by market cap was up 2.4% over the past 24 hours and outperformed the broader cryptocurrency market, with the CoinDesk 20 (CD20) index that tracks the largest digital assets being up 1.2% and BTC gaining 0.4%. https://www.coindesk.com/markets/2024/02/07/ether-tops-24k-as-cathie-woods-ark-21shares-amend-spot-eth-etf-filing/

2024-02-07 17:58

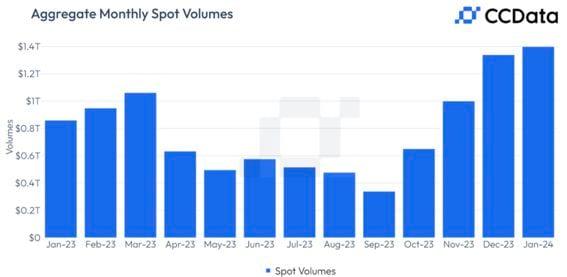

January saw higher spot trading volume on centralized exchanges amid the approval of spot bitcoin ETFs in the U.S. Spot crypto trading volume rose in January amid the approval of bitcoin ETFs in the U.S. Binance, the biggest exchange, saw more trading, while No. 2 OKX experienced a decline in volume, according to CCData. Spot trading volume across centralized crypto exchanges rose for the fourth consecutive month in January, climbing to a level last seen in June 2022 as the approval of bitcoin ETFs sparked renewed interest in digital assets. Volume increased 4.45% versus December to $1.40 trillion, according to CCData. The price of bitcoin (BTC) surged going into the Jan. 10 ETF approval but mostly fell after that. “The price action following the highly anticipated approval suggests that the sell-off marked the end of an uptrend that had persisted for months,” said CCData. Binance remains the largest cryptocurrency exchange by trading volume with its volume rising 2.73% in January to $473 billion. Binance currently holds a market share of 31.3% but did see its spot share gradually decline over 2023 as the company faced an array of charges from regulators that eventually forced founder and CEO Changpeng "CZ" Zhao to step down. Coinbase, the chosen custodian for most of the U.S. spot bitcoin ETF participants, saw its market share rise for the third month in a row to 5.42%. OKX, the second-largest exchange, saw its trading volumes and market share fall in January. In terms of derivatives trading volumes, January saw a decline of 2.79% to $3.25 trillion, the first decline in four months. The derivatives market, which is a bigger part of the crypto market than spot trading, saw its market share drop from 71.4% in December to 69.9%. CME saw the biggest increase in derivatives trading volume. https://www.coindesk.com/markets/2024/02/07/crypto-trading-hits-busiest-pace-since-june-2022/

2024-02-07 16:12

The decentralized social network Farcaster is enjoying a breakout after last week's introduction of "Frames" – a new feature that could attract attention from developers and, eventually, mainstream users. CoinDesk's Jenn Sanasie sat down with co-founder Dan Romero in an exclusive interview. Dan Romero quit his job at the big U.S. crypto exchange Coinbase five years ago to help found Farcaster, described in the project's own documentation, as a "sufficiently decentralized social network built on Ethereum." Farcaster's launch was sufficiently notable to attract a sizable population of blockchain developers and crypto fans as users of the platform – who gravitated toward the idea of a decentralized version of Twitter, now X. It didn't hurt that Ethereum co-founder Vitalik Buterin signed up as a user of Farcaster's Warpcast app, and has made regular posts. But what has vaulted Farcaster to the center of Crypto-Twitter conversations over the past couple weeks is the project's release on Jan. 26 of its new "Frames" feature – essentially allowing apps to run within posts, so users don't have to click off to another site. According to a dashboard on Dune Analytics, average daily users on Farcaster has shot up from fewer than 2,000 as recently as late January to now nearly 20,000. CoinDesk's Jenn Sanasie interviewed Romero this week about Farcaster, the new functionality, and what it's like to break out. A video is here, and the following is an edited transcript. You've been a busy guy lately. Romero: Yeah, a little busy. For the uninitiated, take us down a little trip down memory lane. Talk to us about Farcaster's mission and how it came to be. Romero: I've been in crypto 10 years, actually this upcoming month, and I was at Coinbase for five of those and then have been building Farcaster for the last three. And Farcaster is a decentralized social network. So if you were to use the app, it feels very much like Twitter, but we have a few different features and one of those is Frames. And that's kind of been the big growth driver for us in the last two weeks. We've seen our user base 10X, in just two weeks because of this new feature and happy to talk about it. Yeah, let's talk more about Frames. It launched at the end of last month. It is all the rage on X right now. Talk to us about how it works and the functionality. Romero: Frames are interactive social media posts. And the best analog to think about is when you use Twitter, you can post a tweet with text, image, video, and then there's one type of post that you can do on Twitter that has some interactivity, and that's a poll, right? So you can pick the options you want, and then as a kind of a reader or a viewer, you can vote in someone's poll and then see the results. But with a poll, Twitter controls that entire experience and you can't modify it. You can't come up with a new creative way of displaying that poll or another use for those buttons. It's pretty constrained. With Frames, it gives developers a kind of total canvas within our app to kind of display content and then have interactivity, define what the buttons that will show up next to a frame. And so it's kind of almost like a mini app within an app. And it's kind of like a mini app within an app. What's important is it meets the consumer where they are. So there's no need to go install another app. There's no need to kind of fiddle with connecting a wallet and the kind of back and forth dance. You open up the app, you see a frame as a social media post in your feed. You're able to tap on a button and then have something happen. And there's a variety of different use cases. So kind of your more simple ones, polls. We now have polls on Farcaster, but you kind of have tarot card reading and playing chess. And then people got really creative and said, well, what can we do with the kind of on-chain side of things, right? And actually kind of enable people to have these frames in the feed do something on a blockchain. And so what we've seen people have are kind of like mint NFTs right from a frame. And we've even had creative use cases, like someone built a full shopping cart for buying Girl Scout cookies that you could kind of do all the interactivity right from inside a social media post. And then at the end, you click, and then you actually pay with crypto. And so what's been great about it is developers, even within this really simple canvas, have had just tremendous creativity. And what's been great for users is it just meets them where they are. So developers now get users, and users get actual delightful, interesting experiences right in their feed. Tell me a little bit more about that user feedback. I know your X account has been blowing up with feedback and new frames over the past few days. What have users been saying? Romero: We've had our scaling challenges. Went through this at Coinbase, right? So 2017 was basically an entire year of trying to keep the site up and keep up with demand. I think we've done a tremendous job and credit to the team on 10x increase in users. And downtime has been pretty minimal. So I think we're really focused on keeping the site up. And then I think the second focus right now is also just quality. You have a surge of new users. Tons of really interesting accounts showing up. And then naturally you have some ones that are lower effort, kind of spammy. And so the team is relentlessly just kind of going through and trying to figure out the right changes to the product to kind of keep quality really high. I think prior to two weeks ago, the main way to describe Farcaster is, yeah, it's cool, not that many people using it, a lot of developers, but really high quality. And so I think that core level of quality is something that we're really focused on scaling. And so I think, you can do that through product, and it just requires focus. What do you think it's going to take for a mainstream audience to adopt a new social platform? And I ask that because we've seen a few decentralized social platforms pop up. We've seen a few competitors to X pop up, Threads, of course, launched last year, but none have really taken off. What's driving you? What do you think is going to bring that mainstream audience to your platform? Romero: So I want to start off by saying, I think anyone building a decentralized alternative to Web2 social – admirable, like we need 10 more attempts at doing that, because I think ultimately the world will be a better place if the primary ways we communicate over the internet, are protocols, not platforms. I think what Farcaster is doing differently, and just kind of speaking from our own strategy and experience, is we've been really focused on developers – our initial early community, mostly developers. Again, people would even critique us in saying that, oh, it's too nerdy, it's too developer-centric, like never gonna have an ability to kind of replace a Web2 social network. And our belief is by focusing on developers, if you can kind of get a flywheel going of developers building interesting apps, which attract users, which then attract more developers, more interesting apps, you can actually build a vibrant ecosystem that it's not just one type of social media experience, right? When you use our app today, it feels like Twitter, but there's nothing stopping someone from going and building something that looks more like TikTok or a completely new social network that someone even hasn't invented yet. And so I think that is, to me, gonna be the winning strategy, whether that's Farcaster or someone else, I hope it's Farcaster, is you crack the code to actually attract developers who are building the next generation of new social apps on top of your protocol. And I think if your strategy is clone Twitter and try to provide a different graph on Twitter or a different version of Twitter, I don't think that that's gonna work because Twitter's network effect, despite all of the hemming and hawing over the last year and a half, is pretty significant. And I think that the best example of this is Threads, Meta, all of the resources that they have, hasn't been able to make a dent. I was having a conversation with someone else this week that was saying something similar to what you're saying that VCs should focus more on companies that are focused on drawing developers in. Do you think that Web3 companies are focusing too much on the user and not enough on the developer? And that could be a hindrance to this mainstream adoption that we're always talking about? Romero: It's a bit of chicken-and-the-egg because you can't just focus on developers if you don't have users. And I think that's actually a lot of crypto protocols. They focus way too much on building technical stuff and documentation. And then they kind of have a Field of Dreams mentality where if you build it, they will come, when the reality is the technical stuff is necessary, but not sufficient. Like you actually have to have it work, obviously, but the thing that's actually going to get developers to show up. And I think Frames is a validation of the strategy, is you have to have users. You have to have engaged users. You have to have high quality users. And if you get to some baseline, then you can actually have a flywheel of new apps, pull in more users, which create more developers who want to create apps. That flywheel only happens if you've done the work to get users. And so I would say that Frames launched two years ago doesn't matter. Frames launched two weeks ago, 10x is the user base, right? So that I think is the sequencing is important. It's focus on getting users, and then you have an opportunity with developers. Just so happens that our early users were developers. So maybe that's one way to do it. How are you thinking about keeping the users that have all joined Farcaster to experience Frames in the last few weeks? I don't want to compare the platform to a Web2 social platform, but I'm going to, so just forgive me. It reminds me when Threads came out, everyone jumped onto the platform, but then kind of tapered off and never used it again. How are you hoping to solve that problem on Farcaster, keep these users coming back? Romero: I think two things. One, I wake up every day and think about this. It's like, how many people are going to be still using the app 30 days from now? Great to have the signups, but 30 days from now, that's when you really want to talk to me. I think the first is quality. So you have a surge of new people on the app. People are trying to figure it out, and you have to make that experience great. And otherwise, people are going to churn. And then you run the risk of actually alienating your early users and having them say, oh. You know, this is too overwhelming. It's too chaotic. And so team is really focused, outside of keeping the website up, is really focused on quality right now. And I think that the second thing, and I think this is where it is great to be a small startup, is we just have to keep the shipping velocity of new product development really, really high. So if people feel the energy of the social network in terms of, it is making progress, there are new exciting features, developers have new ways to interact with users via kind of new functionality for frames. That is to me the single best strategy for kind of keeping people interested. I think a lot of times what happens is people get a lot of growth and then they get so overwhelmed with just like basic blocking and tackling on their infrastructure, they lose the kind of that velocity of what makes the kind of thing special to begin with. And so from our standpoint, we're fortunate, you know. You asked me last year, maybe I wouldn't have said the same thing, but we've been building for three years. So we have three years of infrastructure under our belt. And so a lot of the core things that in a sudden viral app you have to go tackle, we've already built out. Still a lot of work to do, but I'm optimistic that if we nail quality, and there will be some bumpiness, but I think the team can really deliver on it. And we can keep the pace of new feature development and kind of momentum there. Then I think we can create a kind of retained and durable user base, which that's exciting, because more developers are gonna show up, because now, instead of having 5,000 daily active users, you have 50,000 or 100,000 daily active users, right? And those are all potential users for that developer's next thing. You've launched in a time where people are generally frustrated with the traditional social platforms out there. What are some features on X or Twitter or whatever it's called now that some folks are frustrated with that might cause them to look to Farcaster? Romero: There's one big one: links. So you post a link, if you post a link to this interview on X, the algo nerfs you, and you don't get any distribution. So you have all these people putting videos or photos just because it's okay, I need to make sure I get the distribution. Links are not nerfed on Farcaster. We love links. Frames are actually just a link. That's the beauty of it. You can actually take a Farcaster frame and tweet it out on Twitter and it doesn't have the interactive functionality but the link still kind of like, just works. So you can think of it as a green bubble, blue bubble if you use an iPhone. The green bubble shows up on Twitter, but the blue bubble, the fun one, shows up when you use Farcaster. And so I think our view is, links are freedom in terms of whether you're a content creator sending you to a video or a sub stack or you're a developer and you want to build a frame. Let the links go wild basically. Do you anticipate X coming out with their own version of Frames? Romero: Maybe, I'm not sure. I think it would be a huge validation for what we're doing. And that goes back to my point is focus on quality and focus on speed of feature development, because if you get complacent, other people will copy you and you and you'll lose that momentum. How decentralized is the platform? And do you see it getting more decentralized as you continue to build? Romero: Farcaster, at the protocol level, is decentralized. Anyone can go sign up. They don't have to use any app. They can do it themselves. They can build an app that sits on top of Farcaster and provides the sign up, so system works. It's not coming soon. That went live in October. And I think where we are going to see more is right now, I think Warpcast, our app, is the biggest one. We've been building it for three years. But as the number of daily active users in the protocol increases, you are going to get more and more sophisticated teams looking at that saying, hey, I can go build an app just as good as this or even better. And I think that's a great thing. That is how Farcaster the protocol will succeed. And so I think from a technical standpoint, protocol’s decentralized, like that's part of the perk of working on it for the last three years. And I think now we're moving up to the point where getting to a sufficient number of daily active users means the kind of the sophistication of the developers coming into the ecosystem is going to increase, which means you're going to have more diversity of kind of apps that use Farcaster, which, which I think is very healthy for the protocol. https://www.coindesk.com/tech/2024/02/07/farcasters-dan-romero-explains-how-frames-did-what-x-twitter-doesnt/