2024-02-07 06:50

A decision for approving or denying a joint Ether ETF product has been pushed back, in line with analyst expectations. The U.S. Securities and Exchange Commission (SEC) on Tuesday delayed a decision on a spot ether (ETH) exchange-traded fund (ETF) jointly proposed by Invesco and Galaxy Digital, a filing shows. The proposed product would allow professional investors to directly gain exposure to spot ether. Currently, ether futures listed on CME are one of the only ways for regulated U.S. investors and funds to bet on Ethereum’s growth. Bloomberg Intelligence analyst James Seyffart said the delay decision was in line with expectations. “100% expected, and more delays will continue to happen in coming months,” Seyffart said. “The only date that matters for spot #ethereum ETFs at this time is May 23. Which is @vaneck_us's final deadline date.” In January, the SEC delayed an application by Grayscale Investments to convert its Ethereum trust product (ETHE) into an ETF. It also delayed a decision on BlackRock’s application for an ether ETF. As such, financial giants expect ether to rise as much as 70% in the coming months as ETF applications are expected to be approved in May. “Heading into the expected approval date on May 23, we expect ETH prices to track, or outperform, bitcoin (BTC) during the comparable period," a Standard Chartered Bank said in a January note. ETH was the biggest gainer among majors in the past 24 hours with a 2.2% rise, data shows. https://www.coindesk.com/markets/2024/02/07/sec-delays-another-ether-etf-application/

2024-02-06 23:02

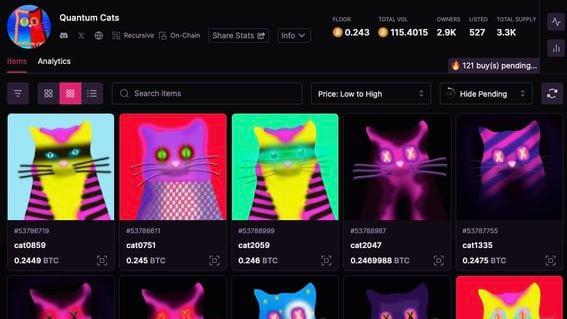

Even after a weeklong minting process marred by technical issues, the Quantum Cats digital images were going for more than $10,000 each on the NFT marketplace Magic Eden, on their first day of secondary trading. Investors who bought the freshly minted "Quantum Cats" NFT-like images from the Bitcoin Ordinals project Taproot Wizards were already flipping them on Tuesday for more than twice the initial sales price – in a sign of enduring demand for digital art inscribed onto the original blockchain. The lowest available price for the Quantum Cats listed on the NFT marketplace Magic Eden was 0.243 BTC ($10,481) on Tuesday, versus the fixed price of 0.1 BTC each in the primary mint that concluded Monday. According to Magic Eden, 115 BTC worth of trading volume had transpired within hours after the Quantum Cats were delivered to their original owners. Some 507 of the images were still listed for sale. The original minting of 3,000 Quantum Cats closed on Monday, with the series selling out – theoretically bringing in about $13 million of revenue for the Taproot Wizards project from its debut collection. That was despite much angst over the past week as the Taproot Wizards minting website was plagued by technical issues, causing frustration and leading to widespread complaints on the project's Discord channel. A suspension of the process on the first day was followed by multiple postponements. This week's results showed buyers undeterred, with the proceeds well exceeding the $7.5 million that the Taproot Wizards, led by co-founders Udi Wertheimer and Eric Wall, raised from investors last year. The project has ridden a wave of enthusiasm for the Ordinals inscriptions, sometimes referred to as "NFTs on Bitcoin." The Ordinals protocol and its "inscriptions" – launched in early 2023 by creator Casey Rodarmor – effectively allows NFTs to be minted and stored on the Bitcoin blockchain. Previous waves of NFT hype were focused on other blockchains, such as Ethereum, that have historically been seen as more programmable than Bitcoin, which is the oldest blockchain and still the largest by market capitalization. Read More: Casey Rodarmor: The Bitcoin Artist https://www.coindesk.com/tech/2024/02/06/taproot-wizards-new-bitcoin-nfts-already-trading-at-twice-the-initial-sale-price/

2024-02-06 21:36

From self-plagiarism to poor multitasking, the self-proclaimed Bitcoin inventor offered an explanation for every inconsistency pointed out by opposing counsel during his first cross-examination in the London court case. “If I had forged that document, then it would be perfect.” So spoke Australian computer scientist Craig Wright Tuesday, minutes into his first day of cross-examination in a U.K. trial that could lay waste to his controversial claim that he is the father of cryptocurrency. Denying an accusation from opposing counsel, Wright claimed that inconsistencies in a pdf showed not that it had been doctored but the opposite. Turning to presiding Judge James Mellor, the defendant said, "If you go into Adobe, My Lord, and I change everything, there's not going to be a font error." An alliance of crypto advocates and developers have sued Wright, accusing him of committing forgeries on an “industrial scale” to prove he is Satoshi Nakamoto, the pseudonymous inventor of the oldest and most popular cryptocurrency, bitcoin. Sporting a powder-blue, pinstriped, three-piece suit in what attendees described as a menacingly hot London courtroom on Tuesday, Wright curtly denied he’d forged item after item of what he’d previously presented as evidence that he is Satoshi, author of Bitcoin’s foundational document, known as the white paper. Skill issue? Aside from straight denials in the form of “No, that’s actually wrong” or “No, it sure is not” thrown at Bird & Bird LLP’s Jonathan Hough, counsel for the Crypto Open Patent Alliance (COPA), Wright attributed inconsistencies in his arguments to everything from self-plagiarizing and printing errors to the illnesses or deaths of various witnesses. For one, Hough asked Wright if he would accept that much of a research paper abstract shared on Twitter called BlackNet – which Wright has said is from 2002 – "directly reflects language and concepts which are in the bitcoin white paper," published in 2008. Wright disputed that characterization, claiming he had reused his own words. “You're again assuming that I have a linear function of how I write,” he told Hough, adding he had multiple versions of both the white paper and his BlackNet abstract. In another instance, when Hough questioned why the computer scientist had obscured the address bar of a web browser while recording separate videos of him purportedly accessing an email account linked to Satoshi, Wright blamed his multitasking skills. “You can't operate a mouse and a phone at the same time?” Hough asked. “And hold the thing still?" Wright replied. “No” When asked if Wright, as a forensic documents expert, would view the video as something one would do when trying to fake something, he answered no. Addressing Judge Mellor directly, Wright added: “My Lord, what you would do as someone skilled as I am, is, you would go to the developer bar and access and change online live.” Hemming and hawing Hough’s cross-examination continued for a full day, probing key pieces of evidence presented by Wright, including credit card payments, emails, documents and tweets that COPA says prove the computer scientist’s claim of being Satoshi is a “brazen lie.” But when Wright was asked if he would characterize what he and his solicitors had presented so far as the material he “primarily” relies upon to support his claim of being Satoshi, the defendant hesitated. “It's a simple question, Dr. Wright,” Judge Mellor said. On Monday, Mellor had allowed Wright to submit new evidence to the case but warned on Tuesday morning that he likely wouldn’t be allowed to produce anything further. Mellor will allow COPA to examine the new evidence and question Wright on the material if necessary. Wright’s interrogation will continue till at least Feb. 13, according to a tentative schedule shared by the court. The one hope among all in attendance was that the courtroom would be cooler on Wednesday. "The working atmosphere in this room is extremely oppressive and is not a great advert for the system that we're trying to run here,” Lord Grabiner, counsel for Wright, told Mellor. https://www.coindesk.com/policy/2024/02/06/craig-wright-denies-forging-evidence-hes-satoshi-on-day-2-of-copa-trial/

2024-02-06 21:01

Fidelity's spot ETF also garnered a ranking in the top 10 of fund inflows so far this year. Only 17 days after its launch, the BlackRock iShares Bitcoin Trust (IBIT) has become one of the top five exchange-traded funds (ETFs) of 2024 based on inflows, according to data from Bloomberg Intelligence. The only funds that have topped IBIT's $3.2 billion of year-to-date inflows are mammoth longstanding index ETFs from iShares and Vanguard that offer exposure to the S&P 500 or the total stock market. In the number one spot with $13 billion in inflows thus far this year is the iShares Core S&P 500 ETF (IVV), which has a whopping $428 billion in assets-under-management (AUM). Number two with $11.1 billion in inflows is the Vanguard 500 Index Fund ETF (VOO), which has nearly $398 billion in AUM. Also earning a spot in the top 10 of ETF asset gatherers this year is Fidelity's Wise Origin Bitcoin Fund (FBTC), whose $2.7 billion of inflows places it eighth on the list. While those are impressive achievements for new funds, overall investment into all of the new spot bitcoin ETFs has slowed in recent days. BlackRock’s IBIT and Fidelity’s FBTC, however, remain the only two funds that have continuously seen positive flows since going on the market. https://www.coindesk.com/markets/2024/02/06/blackrocks-bitcoin-etf-inflows-climb-to-fifth-highest-among-all-etfs-in-2024/

2024-02-06 20:53

The Securities and Exchange Commission approved a final rule Tuesday that DeFi interests call "hostile" to that sector, potentially requiring projects to register as dealers. The U.S. Securities and Exchange Commission (SEC) widened its definition of a dealer today to pull many more financial operations into its jurisdiction – including, as it warned in a footnote of its original proposal – those dealing in crypto securities. "The commission is not excluding any particular type of securities, including crypto asset securities, from the application of the final rules," according to the SEC's description. "The dealer framework is a functional analysis based on the securities trading activities undertaken by a person, not the type of security being traded." The dealer rule is among several crypto-tied regulatory efforts that had been pending at the SEC and other agencies, including the Internal Revenue Service. While it drew less attention than IRS tax measures and the SEC proposals weighing expansion of the exchange definition and restricting crypto custody, the move could have serious consequences in the digital assets industry – particularly in decentralized finance (DeFi). "Absent an exemption or exception, if anyone trades in a manner consistent with de facto market making, it must register with us as a dealer – consistent with Congress’s intent,” SEC Chair Gary Gensler said in a statement. The text of the rule noted the extensive objections and stated confusions of crypto industry insiders, including those in DeFi. "While some commenters stated that the proposed rules should not apply to so called DeFi, whether there is a dealer involved in any particular transaction or structure (whether or not referred to as so-called DeFi) is a facts and circumstances analysis," the agency noted. "There is nothing about the technology used, including distributed ledger technology based protocols using smart contracts, that would preclude crypto asset securities activities from falling within the scope of dealer activity." The commission did consider a crypto carve-out, according to the document, but decided that would have "negative competitive effects" by giving crypto firms an advantage over those who have to register. While this effort – which goes into full effect in April of next year – was largely targeted at electronic participants in the U.S. Treasuries market, the requirements will be the same for any business roped into the expanded definition. A dealer must register with the SEC, comply with securities laws and join an industry-backed self-regulatory organization. As the crypto industry has often argued, many DeFi operations could find it impossible to register or maintain compliance with SEC demands. SEC Commissioners Mark Uyeda and Hester Peirce opposed the rule on Tuesday. "Under the Commission’s approach, any person can be a 'dealer' if they buy and sell securities as part of a regular business," Uyeda said, arguing that the change is "creating additional regulatory confusion for other markets, including crypto asset securities." "Not surprisingly, the rule reflects little thought regarding its practical application in the crypto markets," noted Peirce, who has for years called for the agency to establish tailored regulations for crypto. The DeFi Education Fund was among crypto groups that objected to the original proposal. The group called Tuesday's final version "misguided and unworkable." "The SEC not only failed to confront the substance of our concerns but also failed altogether to articulate any discernible path to compliance for DeFi market participants," the organization said in a statement. "Imposing obligations on entities in the DeFi ecosystem that cannot be complied with is wrong, impractical, and hostile to innovation." The crypto industry has been fighting with the regulator in federal courts over which cryptocurrencies meet the definition of a security that the SEC would have authority over. The outcome of that legal battle could have major implications in the debate over which firms count as dealers under this latest regulatory demand. Read More: The SEC's New Proposal to Redefine 'Dealer' Could Spell Bad News for DeFi https://www.coindesk.com/policy/2024/02/06/us-sec-clears-dealer-rule-expansion-that-could-rope-in-defi/

2024-02-06 16:37

"A federal regulator should have the ability to decide if a stablecoin issuer should be barred from issuing such an asset," she told lawmakers on Tuesday. U.S. Treasury Secretary Janet Yellen told lawmakers on Tuesday that the government's financial risk watchdogs want there to be a minimum level of federal oversight of stablecoin issuers – a system that sets universal compliance standards beyond what states like New York and Texas currently impose. The council of financial regulators she leads "believes it's critical for there to be a federal regulatory floor that would apply to all states and that a federal regulator should have the ability to decide if a stablecoin issuer should be barred from issuing such an asset," Yellen said in testimony before the House Financial Services Committee. That's been the primary sticking point of U.S. legislation on regulating stablecoins. Republicans have fought for more authority for state regulators while Democratic lawmakers and Yellen's Department of the Treasury have held the line on federal authority. Even given that rift, this committee had previously approved a stablecoin bill with some Democratic support, though that effort awaits a vote on the House floor. Committee Chairman Patrick McHenry (R-N.C.) has been leading that legislative push, and he used his opening question for Yellen on Tuesday to raise the issue during a hearing focused on the work of the Financial Stability Oversight Council – a group made up of the heads of several U.S. financial agencies. Yellen also addressed the U.S. Securities and Exchange Commission's proposal to further restrict how investment firms custody their client's assets, including their crypto holdings. The proposed rule, which is on the agency's agenda to complete this year, would require a wider range of client assets to be held with "qualified custodians," and it has drawn criticism from bankers, some lawmakers and even other regulators about its potential effects. "We've had some concerns about how it would impact banks, and that's something I've had to discuss with the chairman," Yellen said in the hearing. The FSOC has warned Congress and the crypto industry that if lawmakers can't mandate new regulations for digital assets, the council may be forced to act on its own. That could include imposing Federal Reserve oversight on aspects of the industry. https://www.coindesk.com/policy/2024/02/06/treasury-secretary-yellen-says-us-needs-better-stablecoin-regulation/