2024-02-05 19:57

Positive news around the FTX bankruptcy has seen claims being sold for upward of 70 cents on the dollar, now climbing towards the eighties. Cryptocurrency investment firm Multicoin Capital is in talks to sell its FTX bankruptcy claim, which has a value of roughly $100 million, according to a person familiar with the plans. Positive news around the FTX bankruptcy has seen claims being sold for upward of 70 cents on the dollar and climbing towards the eighties. Firms like Multicoin, inadvertently caught up in the FTX collapse, have been approached by claims buyers for over a year now, and with the potential bids rising, these firms are weighing the opportunity cost of capital and opting to sell sooner rather than later. Multicoin Capital declined to comment. https://www.coindesk.com/business/2024/02/05/multicoin-capital-is-in-talks-to-sell-roughly-100m-ftx-bankruptcy-claim-source/

2024-02-05 19:56

The Crypto Open Patent Alliance is unable to provide direct evidence that Wright isn’t Satoshi, counsel for Wright fired back. A trial to sort out Craig Wright's claims to be Bitcoin creator Satoshi Nakamoto has begun in a U.K. court. The opening day saw accusations that Wright forged his proof and retorts that his challengers can't prove he's not who he says he is. A highly anticipated trial probing Australian computer scientist Craig Wright’s claim to fame as the pseudonymous author of the groundbreaking 2008 Bitcoin manifesto kicked off Monday at a U.K. high court, where a judge decided Wright could add some new evidence to back up his case. Wright, who maintains he is the mysterious visionary, Satoshi Nakamoto, has on numerous occasions legally pursued members of the crypto community – including developers building on the open-source Bitcoin project – alleging copyright violations. In 2021, the Crypto Open Patent Alliance (COPA), a nonprofit backed by Twitter founder Jack Dorsey and several high-profile industry players such as Coinbase and Microstrategy, sued Wright, challenging his claim to authorship of the manifesto, known as the Bitcoin white paper. While certainly not the first to have come after Wright, it might be the most intimidating alliance to take him on so far. COPA in January rejected a proposal from Wright to settle the lawsuit and said it hoped that a favorable outcome from the trial would mean an end to the would-be Satoshi’s legal wars with the bitcoin community. “The hope is at the end of this case, that when you stand up to a bully, the bully backs down and the bully stops,” a spokesperson for COPA told CoinDesk during an interview following Monday’s court session. “We're seeking an injunction that's going to preclude Dr. Wright from doing this ever again.” In its lawsuit, COPA alleges in great detail that Wright forged the documents he has hitherto produced as proof that he is Satoshi. “Wright's claim to be Satoshi Nakamoto is a brazen lie and elaborate false narratives afforded by forgery on an industrial scale,” the COPA spokesperson said. Things were (quite literally) heated on Monday at the business and property courts of England and Wales as counsel for both Wright and COPA went head-to-head on the extensive allegations made and new evidence that Wright sought to submit to the court. At the end of the day, presiding Judge James Mellor allowed new evidence from Wright to be admitted, subject to expert review and cross-examination by COPA. ‘Hamlet without the prince’ While COPA’s focus was on unveiling forgeries Wright allegedly committed in his efforts to prove he is Satoshi, the defense argued his educational and professional background made him someone capable of inventing something like Bitcoin. “COPA has been unable to point to any direct evidence that Dr. Wright is not Satoshi,” Wright’s counsel, Lord Anthony Grabiner, said on Monday. He also claimed that no one else has come forward as Satoshi, which, he argued, suggests Wright is a likely candidate. “It's a sort of Hamlet-without-the-prince point,” said Lord Grabiner, adding later that even if Satoshi prefers to remain in the shadows, he could have declared himself to the court anonymously, which hasn’t happened. COPA isn’t Satoshi either, and is only concerned with undermining Wright's claim, he added. “It is striking given the public interest and the unlimited resources deployed by COPA in these proceedings that COPA has been unable to point to any direct evidence that Dr. Wright is not Satoshi,” Grabiner said. The spokesperson for COPA said that the alliance isn’t interested in finding or revealing the real Satoshi, but it's concerned with proving once and for all that Wright isn’t. “We are hopeful that when all this is said and done, we will have stood up for the developers who couldn't stand up for themselves and that they'll be free to contribute to Bitcoin and won't be cowed in fear by a character like Craig Wright,” the spokesperson said. The trial will continue on Tuesday at 10:30 a.m. local time, and Wright’s testimony and cross-examination are set to begin on Tuesday and continue until around Feb. 13. A spokesperson for Wright told CoinDesk that his legal team led by U.K. law firm Shoosmiths is unlikely to comment on the ongoing trial. https://www.coindesk.com/policy/2024/02/05/craig-wright-accused-of-industrial-scale-forgeries-in-first-day-of-copa-trial/

2024-02-05 19:40

Of the new spot funds, WisdomTree has so far attracted the lowest amount of AUM at roughly $12.8 million. WisdomTree, one of the ten issuers of spot bitcoin exchange-traded funds (ETFs), expects its product to be more successful towards the second half of the year thanks to adoption by financial adviser platforms. Speaking during an interview with CoinDesk TV, WisdomTree’s (WETF) head of digital assets, Will Peck said that the fund manager’s WisdomTree Bitcoin Fund (BTCW) is built for adviser distribution and to this point many of those platforms haven’t yet been allowing the trading of the new products. “We didn’t have any kind of balance sheet, we didn’t seed with a lot of money or anything like that like some of the other players did,” Peck said. Nevertheless, he said the fund has seen strong trading in the past few days and it’s performing “exactly like we expected it to.” Out of the ten bitcoin ETFs, WisdomTree's BTCW has attracted the lowest amount of assets under management (AUM), roughly $12.8 million (296 bitcoin), according to Bloomberg Intelligence data. Asset management giant Franklin Templeton has the second lowest AUM with $64.5 million. Leading the way in asset gathering are BlackRock (more than $3B AUM) and Fidelity ($2.7B AUM). Grayscale, who converted its Grayscale Bitcoin Fund (GBTC) into an ETF and therefore came into the race with $30 billion in AUM, has bled about $10 billion of that since ETF trading began on Jan. 11. Peck, however, is optimistic and encouraged that WisdomTree will be more competitive going forward, saying that it’s still early in the race and that in roughly six months, more advisory platforms will allow trading of the ETFs, giving WisdomTree a competitive advantage over the other issuers. “I think the platforms are getting increasingly comfortable with bitcoin as an asset class … It's just a matter of time before these are more widely available on platforms where they'll be allowed.” “We're having very good conversations in the pipeline with financial advisers and financial adviser platforms,” Peck added. https://www.coindesk.com/business/2024/02/05/wisdomtree-bets-on-advisor-adoption-for-bitcoin-etf-success/

2024-02-05 17:28

The macro environment, monetary tailwinds, U.S. election cycle and increasing TradFi demand all point to higher prices. Unveiling his 2024 price target, 10X Research's Markus Thielen expects bitcoin (BTC) to rally about 65% from current levels to hit $70,000 by the end of the year. “Supported by the macro environment, monetary tailwinds, the U.S. election cycle, and gradually increasing demand from TradFi investors allocating to bitcoin ETFs, a bitcoin rally to $70,000 appears plausible,” wrote Thielen in a report on Friday. As for the sluggish price action so far this year, Thielen notes that even as bitcoin has rallied in 10 of its 13 years of existence, January returns have been more mixed with just seven up years against six down. One year ago this time, Thielen accurately predicted that bitcoin would nearly double to $45,000 by the end of 2023. Though not exactly getting it right with his January call for the spot ETFs to once again not win approval, Thielen did expect the price to fall back into the mid-high $30,000 area this January. “While the Fed has pushed out the first rate cut to (possibly in) May or June, inflation is coming in lower, and growth is holding up,” said Thielen in his Friday report. He also took note of the U.S. presidential election cycles which coincide with the Bitcoin halving years as historically being bullish for prices. Specifically, bitcoin gained 152% in 2012, 121% in 2016 and 302% in 2020, or an average of 192%. Bitcoin is currently down 4% year-to-date and trading at $42,700 at press time. https://www.coindesk.com/markets/2024/02/05/bitcoin-to-reach-70k-by-year-end-markus-thielen/

2024-02-05 15:27

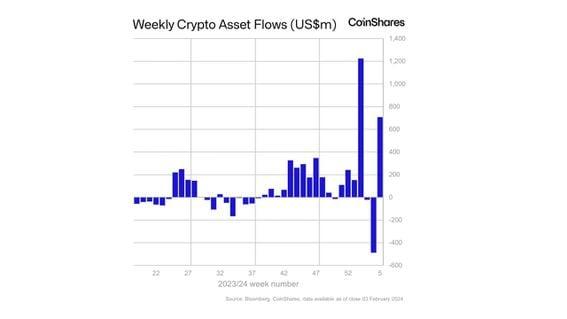

New U.S. bitcoin ETFs have amassed $7.7 billion in funds since debut, offsetting the $6 billion outflows from incumbents, according to CoinShares data. Bitcoin-focused investment vehicles received more than $700 million in fresh money last week as inflows to new spot bitcoin (BTC) exchange-traded funds (ETFs) offset the abating outflows from Grayscale's flagship fund, GBTC, asset manager CoinShares reported Monday. BlackRock-managed IBTC and Fidelity's FBTC, the two clear leaders among the newly issued spot bitcoin ETFs, booked $884 million and $674 million in weekly inflows, respectively. Both figures were slightly higher than the week before in dollar terms. Meanwhile, investors withdrew some $927 million from GBTC, a notable drop from the previous week's $2.2 billion bleed. "Data highlights a significant reduction in momentum of these outflows in recent weeks," James Butterfill, head of research at CoinShares, noted in the report. Outflows from existing bitcoin funds like GBTC have been a source of concern over the past weeks as spot BTC ETFs started trading in the U.S. on Jan. 11. After a short-lived wave of withdrawals – mostly related to profit-taking and FTX selling GBTC holdings – outflows have slowed while inflows to new entrants remain consistent. As of the end of last week, the new bitcoin ETFs had amassed $7.7 billion in funds, more than offsetting the $6 billion outflows from incumbents, the report highlighted. Solana (SOL), which managed a remarkable comeback last year with a 10-fold price gain, topped inflows to altcoin-focused funds with $13 million. Investment vehicles that hold Ethereum's ether (ETH) and Avalanche's native token (AVAX) endured $6.4 million and $1.3 million in outflows. https://www.coindesk.com/markets/2024/02/05/bitcoin-etfs-see-700m-net-inflows-as-blackrock-fidelity-gains-offset-gbtc-outflows-coinshares/

2024-02-05 13:16

Court filings show the crypto estate wants to agree procedures so that it can sell the shares at the "optimal" time. The estate for bankrupt crypto exchange FTX wants to sell its shares of artificial intelligence (AI) startup Anthropic, court filings from Friday show. A motion seeking a court order approving proposed sale procedures for the stake says Sam Bankman-Fried’s FTX estate owns around 7.84% of Anthropic as of January 2024. FTX and sister investment firm Alameda invested $500 million in Anthropic in 2021. While the estate sought to sell the sought-after stake last year, it was paused in June 2023 after months of due diligence by potential bidders. Setting up the sales procedures now will let the estate “coordinate the most optimal and appropriate time for the sale of Anthropic Shares in conjunction with Anthropic’s capital raising efforts” and maximize the value of the estate “for the benefit of all stakeholders" Friday’s filing said. A hearing on the matter could take place later this month. https://www.coindesk.com/policy/2024/02/05/ftx-seeks-to-sell-8-stake-in-anthropic-for-sake-of-shareholders/