2024-09-06 12:41

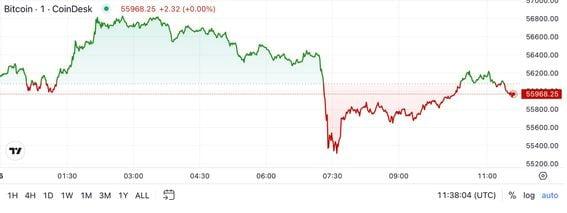

The bitcoin price rose about 1% just after the numbers hit, but remains lower by about 5% from one week ago. The U.S. posted August job growth of 142,000, slightly less than expected, but the unemployment rate dipped to 4.2% Sizable downward revisions to the July and June reports made the employment picture somewhat weaker than previously thought Under sizable pressure all week, bitcoin bounced following the report U.S. job growth was slightly less than expectations in August, but probably not weak enough to prompt the Federal Reserve to begin its rate-cutting cycle later this month was a 50 basis point move. According to Friday morning's Nonfarm Payrolls report from the government, the U.S. added 142,000 jobs in August versus economist forecasts for 160,000 and July's 89,000 (revised from a previously reported 114,000). The unemployment rate edged down to 4.2%, in line with expectations and from 4.3% in July. Down sizably in the days leading up to the report, the price of bitcoin (BTC) rose about 1% to $56,500 in the minutes following the report. The price remains lower by 5% from week-ago levels. A check of traditional markets shows U.S. stock index futures trimming early large losses, with the Nasdaq now lower by just 0.5% against a decline of more than 1% earlier. The 10-year U.S. Treasury yield is lower by 5 basis points to 3.68% and the dollar index has dipped 0.3%. Gold is up 0.5% to $2,557 per ounce, close to its all-time high. Will the Fed cut 25 or 50? Always a key data point, the jobs numbers for August had taken on extra importance given that the Federal Reserve is set to begin cutting rates at its mid-September meeting. The conventional thinking believed the U.S. central bank would enter this monetary easing cycle cautiously by lowering its benchmark fed funds rate just 25 basis points. The Fed, though, might be swayed by a weak August employment report to instead slash rates 50 basis points at that meeting. The headline numbers from this report don't appear to make the case for a 50 basis point move. The downward revisions to not just July (to 89K from 114K), but also June (to 118K from 179K) are somewhat troublesome though. Taken together, the three month average job growth of just 116,000 is sure to come up in the Fed's discussions. A check of other report details shows a somewhat stronger picture. Average hourly earnings rose 0.4% in August versus expectations for 0.3% and July's 0.1% dip. On a year-over-year basis, average hourly earnings were higher by 3.8% versus expectations for 3.7% and July's 3.6%. "It’s a solid, if unspectacular, report that largely confirms the cooling trend in place," wrote economist Joe Brusuelas minutes following the release. The details, he said, support a 25 basis point rate cut from the Fed. https://www.coindesk.com/markets/2024/09/06/us-added-142k-jobs-in-august-likely-setting-stage-for-25-basis-point-rate-cut/

2024-09-06 12:07

The latest price moves in crypto markets in context for Sept. 6, 2024. Latest Prices CoinDesk 20 Index: $1,773.25 −1.29% Bitcoin (BTC): $56,000.24 −1.27% Ether (ETH): $2,370.13 −0.8% S&P 500: 5,503.41 −0.3% Gold: $2,519.38 +0.09% Nikkei 225: 36,391.47 −0.72% Top Stories Bitcoin fell as low as $55,300 before recovering to trade around $56,100, down 1% in 24 hours and extending its seven-day loss to over 5%. The broader digital asset market as measured by the CoinDesk 20 Index (CD20) has dropped more than 1.3% over 24 hours. The U.S. government is set to release its nonfarm payrolls report for August later. If the reading is weak, as all the other economic data this week has been, it will strengthen the argument for an interest-rate cut of 50 basis points in September. Bitcoin's 200-day simple moving average is in danger of turning bearish as its upward momentum has slowed to a crawl for the first time since October. Since late August, the measure has averaged a daily increase of less than $50, a significant drop from the $200-plus moves seen earlier this year, according to data from charting platform TradingView. As of writing, the 200-day SMA was $63,840. The 100-day SMA recently moved below the 200-day SMA, confirming a bearish crossover. The averages signal a weakening bullish sentiment and growing caution consistent with the increasing macroeconomic uncertainty. At the end of August, the crypto market had dropped 24% from its March peak to $2.02 trillion, JPMorgan said in a research report. The bank highlighted the lack of major catalysts to support crypto assets in the face of challenging macroeconomic factors. Spot ether and bitcoin ETF flows were "somewhat uninspiring," JPMorgan said, adding that many viewed the launch of ETH ETFs as disappointing when compared with the bitcoin versions in January. Spot bitcoin ETF flows also disappointed, recording net outflows of $81 million in August. The bank said it awaits the next catalyst for development and "enhanced retail engagement." Chart of the Day The chart shows the number of ether held in wallets associated with centralized exchanges. The so-called exchange balance has increased by over 263,000 ETH ($624 million) since late August, a sign of investors looking to liquidate their holdings or use coins for derivatives trading. Source: CryptoQuant - Omkar Godbole Trending Posts Telegram Revamps Rules to Allow Moderation of Private Chats Following CEO Pavel Durov's Arrest Visa and Santander Selected by Brazil’s Central Bank for a Second Phase of CBDC Pilot Trump Promises to Embrace ‘Industries of the Future’ Including Crypto, AI https://www.coindesk.com/markets/2024/09/06/first-mover-americas-btc-treads-water-ahead-of-us-jobs-report/

2024-09-06 11:59

Total crypto market cap was $2.02 trillion at the end of August, a 24% decline from this year's peak of $2.67 trillion in March, the report said. Total crypto market cap was about $2 trillion at the end of last month, the report said. JPMorgan said the crypto ecosystem lacks major catalysts in the near-term. Stablecoins were the outlier, as total market cap grew and volumes also increased from the prior month, the bank said. Total crypto market was $2.02 trillion at the end of last month, a 24% decline from the March peak, JPMorgan (JPM) noted in a research report on Friday, saying it awaits the next catalyst for development and "enhanced retail engagement." "Overall, we continue to see the crypto ecosystem lacking major catalysts, and we thus expect crypto token and asset prices to be incrementally more sensitive to macro factors," analysts led by Kenneth Worthington wrote. Trading volumes increased in August despite the decline. Total average daily volumes (ADV) rose about 8% with bitcoin (BTC) and ether (ETH) ADVs increasing by more than 10% month-on-month, the report said. The price of bitcoin, the world's largest cryptocurrency, fell 8.7% last month, CoinDesk Indices data show. Stablecoins were an outlier, as market caps grew from the previous month and volumes also increased compared with July, the bank noted. Spot ether and bitcoin exchange-traded fund (ETF) flows were "somewhat uninspiring," JPMorgan said, adding that many viewed the launch of ETH ETFs as disappointing when compared with the bitcoin versions in January. Spot bitcoin ETF flows also disappointed. These products saw net outflows of $81 million in August, the report added. https://www.coindesk.com/markets/2024/09/06/crypto-market-lacks-major-near-term-catalysts-jpmorgan-says/

2024-09-06 11:04

The average, widely considered a barometer of the long-term trend, has hit stall speed for the first time since October. BTC's 200-day SMA is close to shedding its bullish bias for the first time since October. Short-term averages have already flipped bearish. The nonfarm payrolls report due later Friday is likely to show the U.S. jobless rate ticked lower in August. The 200-day simple moving average (SMA) of bitcoin's (BTC) price, a widely tracked barometer of the largest cryptocurrency's long-term trajectory, is about to lose its bullish momentum ahead of key U.S. jobs data that is set to influence the Federal Reserve's interest-rate outlook. Since late August, the gauge has averaged a daily increase of less than $50, well below the $200-plus moves seen earlier this year, data from charting platform TradingView show. It recently stood at $63,840 with bitcoin's spot price at $55,880. The slump in variability is a sign the average has hit stall speed for the first time since October, indicating a pause or impending bearish trend change. The latter cannot be ruled out: The short-term moving averages, namely the 50- and 100-day measures, have already peaked and turned lower. The 100-day SMA recently moved below the 200-day SMA, confirming a bearish crossover. Together, the three signal a weakening in bullish sentiment and growth in caution consistent with increasing macroeconomic uncertainty. "Looks pretty ugly out there right now, [with the] market rapidly pricing global recession risks," newsletter service LondonCryptoClub said on X Friday. Still, the final flush lower in BTC could set the stage for a bigger rally, it said. Alex Kuptsikevish, a senior market analyst at The FxPro, said the risk-off mood in the broader financial market is not helping. "Despite the dollar's weakness, the financial markets are still in an anxious and expectant mood, which is not helping Bitcoin as much as it is helping gold," Kuptsikevish said in an email to CoinDesk. "A critical technical support level for the BTCUSD remains just above $54,000, but slippage in the event of a volatility spike could see the price briefly drop below $53,000." The daily chart also shows major support at around $50,000, characterized by a trendline connecting corrective lows reached in May and July. Interestingly, several market observers, including Arthur Hayes, co-founder and former CEO of crypto exchange BitMEX and chief investment officer at Maelstrom, say they expect BTC to drop to $50,000. "$BTC is heavy, I'm gunning for sub $50k this weekend. I took a cheeky short. Pray for my soul, for I am a degen," Hayes posted on X. Price volatility may pick up the U.S. nonfarm payrolls report (NFP) for August. According to FXStreet, expectations are for a 160,000 rise in jobs following July's 114,000 increase. The jobless rate is forecast to drop to 4.2% from July's near three-year high of 4.2%. A weak print will likely strengthen recession concerns and boost the probability of a 50 basis point interest-rate cut by the Fed this month, potentially putting a floor under risk assets, including bitcoin. Traders, however, should be watchful of an August-like growth scare in stocks and cryptocurrencies, as discussed Monday. https://www.coindesk.com/markets/2024/09/06/bitcoins-200-day-average-about-to-lose-bullish-momentum-nfp-eyed/

2024-09-06 07:34

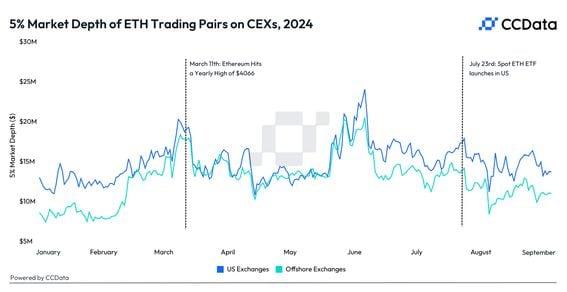

Order book liquidity refers to the market's ability to absorb large buy and sell orders without influencing the spot price. Ether's 5% market depth on U.S. exchanges has dropped by 20% since the introduction of spot ether ETFs in the U.S. Poor market conditions and seasonality effects are to be blamed, according to CCData. Exchange-traded funds (ETFs) will be net positive for market liquidity, making it easier to execute large buy and sell orders at stable prices. That's what CoinDesk reported in December 2023, before the ETFs were approved in the U.S. The liquidity boost materialized well enough in the bitcoin (BTC) market following the debut of spot ETFs on Jan. 11. With ether (ETH), however, the story played out differently. Ether's order book liquidity has declined since the July 23 debut of nine ETFs, according to data tracked by London-based CCData. Since the ETFs' introduction, the average 5% market depth for ETH pairs on U.S.-based centralized exchanges has declined by 20% to roughly $14 million. On offshore centralized venues, it's dropped by 19% to around $10 million. In other words, it's actually now easier to move the spot price by 5% in either direction, a sign of reduced liquidity and increased sensitivity to large orders. "Although the market liquidity for ETH pairs on centralized exchanges remains greater than what was at the beginning of the year, the liquidity has dropped by nearly 45% since its peak in June," Jacob Joseph, a research analyst at CCData, told CoinDesk in an interview. "This is likely due to the poor market conditions and the seasonality effects in the summer, often accompanied by lower trading activity." The measure refers to the amount of buy and sell orders within 5% of the mid-market price for an asset. Greater depth indicates strong liquidity and lower slippage costs. CCData considered the 5% market depth for all ETH pairs on 30 centralized exchanges. Ether ETFs have witnessed a cumulative outflow of over $500 million since July 23, according to data tracked by Farside Investors. Ether's price has declined by over 25% to $2,380, CoinDesk data show. https://www.coindesk.com/markets/2024/09/06/weeks-after-ether-etf-debut-eth-market-liquidity-has-dropped-by-20/

2024-09-06 01:28

"Establishing the right balance between privacy and security is not easy," he wrote on Telegram. CORRECTION (Sept. 6, 2024, 20:19 UTC): An earlier version of this story incorrectly said Telegram had changed its policy for private chats to permit moderators to police them. According to Telegram, there has been no change; moderators were already able to review private chats if a member of that chat requested that. Pavel Durov, the CEO of Telegram who was recently jailed in France over allegations his social-media and messaging giant failed to police illegal content, said Thursday that the app's rapid growth "made it easier for criminals to abuse our platform" and promised changes. Durov, in a post on Telegram, expressed surprise at his arrest in France, writing that it's unusual for a country to hold a founder accountable for what other people do on their platform. He nonetheless said that "establishing the right balance between privacy and security is not easy." Durov said that when Telegram is unable to agree with a country's approach, it leaves that country – as it did with Russia. https://www.coindesk.com/business/2024/09/06/telegram-revamps-rules-to-allow-moderation-of-private-chats/