2024-01-25 17:00

The mining business aims to reach 8 EH/s mining power and already has 4.5 EH/s operational after starting the unit in the summer of 2023. Swan Bitcoin's mining unit expects to raise its computing power by 44% by March. Swan Mining already has more than $100 million in investments and is looking to raise more for expansion. The parent company is looking to go public in the next 12 months. Bitcoin financial services firm Swan Bitcoin unveiled its newly formed bitcoin [BTC] mining business unit, Swan Mining, which already has 160 megawatts (MW) or 4.5 exahash per second (EH/s) worth of computing power up and running. Swan Bitcoin has been operational since the summer of last year and has been previously in stealth mode, according to a statement shared with CoinDesk. The mining business has been funded by institutional investors, with more than $100 million so far. The company intends to raise more capital to expand its operations, a Swan spokesperson told CoinDesk. "We bring financial expertise and operational excellence, while our investors provide equity capital to our mining unit in exchange for priority on initial payouts and continued shared upside," said Rapha Zagury, chief investment officer at Swan and head of Swan Mining. The timing of the new unit is notable as the industry is set to become more competitive this year due to the bitcoin halving event, which will see mining rewards cut by half. To prepare for this event, many miners are racing to order more efficient rigs, and some are buying up assets to become profitable post-halving. The miners have faced a brutal crypto winter as their revenue is directly correlated to the price of bitcoin. At the depth of the bear market, many large miners, such as Core Scientific (CORZ), went bankrupt, and others barely hung on. However, the recent rally in bitcoin price, helped by the spot bitcoin ETF, has helped the mining economics and even seen companies, such as Core, coming out of bankruptcy. Swan Mining has taken this opportunity to rapidly expand its operations. It aims to increase its computing power by 44% or 8 EH/s by March. The company has already purchased and taken delivery of the mining rigs required to hit this target this year. "Swan Mining developed and deployed at warp speed," Zagury said. "Our understanding is that this is the fastest-ever initial deployment of hashrate at this scale in Bitcoin history." The firm has mined more than 750 bitcoin through its seven operating mining sites in and outside the U.S., the Swan spokesperson told CoinDesk, adding that three more mining sites are currently underway. Swan Bitcoin, the parent company, is led by Cory Klippsten and raised $205 million of capital last year. The company intends to raise another round of funding in the coming months and expects to go public within the next 12 months, according to the statement. https://www.coindesk.com/business/2024/01/25/swan-bitcoin-unveils-mining-unit-as-parent-company-prepares-to-go-public/

2024-01-25 16:44

Artificial intelligence (AI) agents would probably use crypto when conducting financial transactions, adding that bitcoin, ether or solana would be the three choices, Lonsdale said. The growth of artificial intelligence (AI) in the economy could be a boon for cryptocurrency, according to Joe Lonsdale, co-founder of data analytics firm Palantir (PLTR). AI agents - entities that use AI technology to perform specific tasks - would probably use crypto when conducting financial transactions, adding that bitcoin (BTC), ether (ETH) or solana (SOL) would be the three choices, in an interview for CNBC's Squawk Box on Monday. "There's one type of buyer that could be very important here: AI agents are going to start doing a lot of things in our economy," he said. "For AI agents to coordinate with incentive systems, they're probably going to use crypto." Following the success of mainstream AI tools like ChatGPT last year, there has been plenty of discussion about how artificial intelligence may intersect with crypto. Lonsdale was opining on the drivers of bitcoin's price now that spot ETFs are finally trading in the U.S., adding that this largely hinges on the macro backdrop. "Are we going to be in massive deficit in 2025-2026 and spending money willy-nilly? If so, what asset's safe?" he posed. "If you have inflation come up again...that's a story I'm hearing from a lot of my friends who know macro better than me. You could see crypto do very well." Read More: A Beginner’s Guide to AI Tokens https://www.coindesk.com/markets/2024/01/25/ai-agents-could-be-important-buyers-of-crypto-says-palantir-co-founder-joe-lonsdale/

2024-01-25 15:00

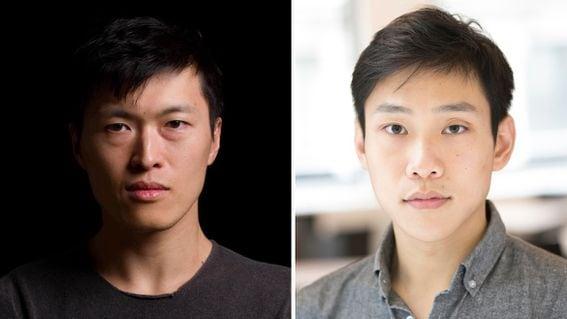

The funding will go towards further developing the protocol and adding new hires. Axiom allows smart contract developers to access historical data from Ethereum and then perform intensive computations off-chain. Axiom, a protocol that allows smart contract developers to access historical data from Ethereum and then perform intensive computations off-chain, has raised $20 million in a Series A funding round led by Standard Crypto and Paradigm. The funding will go towards growing the team as well as developing their platform, according to a draft blog post sent to CoinDesk. “We're really focused on helping the smart contract developers access this new primitive and plug it into their applications in a native way,” said Yi Sun, the co-founder of Axiom, in an interview with CoinDesk. Axiom is among a new breed of protocols that use zero-knowledge proofs (ZK proofs) – a type of cryptographic proof that confirms a certain transaction took place without revealing the details of the transaction – to access historical data on Ethereum. Currently, smart contracts on Ethereum are not able to access old data, and solutions like oracles have come into existence to solve these hurdles. But oracles can easily get expensive and have computational limits. This is where solutions like Axiom come in, which runs a coprocessor, a piece of software which processes data off-chain and then transports that data to the main Ethereum blockchain, and verifies it with ZK proofs. “We try to work on systems and mechanisms that try to provide lower cost and lower trust requirements to their users, because those are more scalable and can reach a wider user base," said Georgios Konstantopoulos, chief technology officer at Paradigm, in an interview with CoinDesk. Axiom’s latest announcement comes on the heels of its latest V2 upgrade, which focused on making the protocol more usable for smart contract developers. In July, Axiom launched its mainnet. “At the end of the day, a zero-knowledge proof is basically a computer that can provide a receipt for what it did,” said Alok Vasudev, the co-founder of Standard Crypto, in an interview with CoinDesk. “In Axiom’s case, I think now we're starting to really uncover new areas and think about new markets that can be opened up by this same core technology." https://www.coindesk.com/tech/2024/01/25/axiom-protocol-for-historical-ethereum-data-raises-20m-led-by-paradigm-standard-crypto/

2024-01-25 14:58

More of those surveyed said they expect bitcoin to disappear than those who said they expect it to continue to exist, the bank said. The world’s largest cryptocurrency, Bitcoin [BTC], has slumped following the launch of spot exchange-traded funds (ETFs) in the U.S. earlier in the month, and the digital asset could drop even further according to a survey of retail investors by German lender Deutsche Bank (DB). The bank surveyed 2,000 consumers in the U.S., U.K., and Europe following the approval of spot bitcoin ETFs, the bank said in a report on Tuesday. Over one-third of respondents said that bitcoin prices will drop below $20,000 by year end, and more people expect the cryptocurrency to disappear rather than stay. The survey showed that 39% of participants say they believe that bitcoin will continue to exist in the coming years, while 42% “anticipate its disappearance.” The approval of spot bitcoin ETFs in the U.S. was seen as a game changer by many in the industry, with mainstream money now expected to flood into the sector. Investors who couldn’t trade digital assets are now able to use cheap and liquid ETFs to gain exposure without having to own the underlying cryptocurrency itself. The crypto winter may not be over, as “more than half of the respondents expressed concerns about a major cryptocurrency experiencing a collapse within the next two years,” the bank said. Deutsche notes that this poor sentiment is likely due to past events, such as the demise of crypto exchange FTX in 2022 and the collapse of terraUSD (UST). The ongoing regulatory crackdown in the U.S. is also seen as an overhang. The bank’s survey results also highlighted a lack of understanding of cryptocurrencies, with two-thirds of consumers having little or no understanding of digital assets, the report added. https://www.coindesk.com/markets/2024/01/25/many-retail-investors-see-bitcoin-price-dropping-below-20k-by-year-end-deutsche-bank/

2024-01-25 10:57

SAVM jumped several thousand percent to a market capitalization of as high as $90 million a few hours after issuance. SatoshiVM’s SAVM is facing controversy in crypto circles due to the apparent presence of a handful of wallets controlling a sizeable share of the initial token supply – millions of dollars worth of which were dumped on market participants shortly after going live. SatoshiVM has seemingly included most of the trendy buzzwords in defining its protocol. It claims to be a Bitcoin layer 2 protocol powered by zero-knowledge rollup technology – a string of terms that, together, can be thought of as a network that settles transactions on Bitcoin without having to share extra data with network validators. SAVM was one of the most-hyped token issuances in recent months. It jumped several thousand percent to a market capitalization of as high as $90 million a few hours after issuance, DEXTools data shows. But the controversy began shortly after it went live on Jan.19. Data cited by on-chain analysis tool @bubblemaps shows 15% of the token’s supply was sent to a handful of wallets supposedly owned by market influencers who “immediately sold upon receiving the tokens.” Some prominent investors who participated in SatoshiVM’s private sale confirmed they took profits from their positions – but faced backlash as market observers questioned the motive of selling allocations in the first few hours after issuance. Analysis service @Lookonchain reported a wallet that received SAVM tokens from the publicly-known SatoshiVM team wallet received upward of $4 million worth of tokens after launch, selling $1.2 million worth in the first 48 hours after issuance. The SatoshiVM has, so far, thwarted all accusations and is holding a community ask-me-anything session on Thursday to directly answer queries. The team did not immediately respond to an X message sent by CoinDesk in Asian morning hours on Thursday. Meanwhile, SAVM tokens have shown resilience amid the ongoing controversy. Prices have ranged in the $7 and $14 bands since Jan.19 and remain a hot favorite among retail traders on X. https://www.coindesk.com/markets/2024/01/25/satoshivm-marred-by-controversy-days-after-savm-issuance/

2024-01-25 10:33

Many respondents to the digital pound consultation said that they had concerns about privacy and control. The U.K. government has said it will ensure that future legislation that comes out for a digital pound will provide protections to privacy and control of money in its consultation response on Thursday. The consultation on a central bank digital currency (CBDC) was conducted by the government’s finance ministry alongside the Bank of England, and concluded in June. It received over 50,000 responses. A chief concern in the consultation was privacy and control of money. Countries around the world are exploring the benefits of CBDCs , with Nigeria and the Bahamas being among the first countries to issue them. Major economies like the European Union and China are also running investigations or tests. https://www.coindesk.com/policy/2024/01/25/digital-pound-legislation-will-provide-protections-to-privacy-and-control-govt-says/