2024-09-05 19:39

Remember the Max Headroom incident? NEAR seems to. Who woulda thunk a mostly forgotten 1980s TV character could help a crypto hackathon attract developers? That seems to be the gambit of NEAR Protocol, which this week staged a very weird takeover of its social media channels by a purportedly unknown "hacker." The fake breach started with mocking tweets and crescendoed with a masked villain disrupting founder Illia Polosukhin to rip on the crypto "pipe dream" and telling viewers "there's nothing waiting for you in Thailand" (where NEAR's holding its hackathon in November). Reverse psychology aside, the marketing stunt makes callbacks to a decades-old character of early digital culture: Max Headroom. He's the purportedly AI-generated television host of a series of 1980's TV movie and subsequent shows that aired in the U.S. and the U.K., and also the chief marketer of New Coke (a famous flop). What really makes Max memorable today, and notable for the purposes of NEAR's rather cringey gambit, is the broadcast that wasn't supposed to be: the Max Headroom incident. In 1987, an unknown signal pirate hijacked a "Dr. Who" broadcast in Chicago and went on a 90-second nonsensical ramble, all while wearing a Max Headroom mask. A good deal matches up between the Max Headroom incident (an unsolved crime that sparked a decades-long federal investigation) and NEAR's video takeover. Both star a masked, suited, sunglass'd, voice-altered man making fun of his viewers. Of course, the content of the two characters' criticisms differ. Chicago's signal pirate dropped blasts of gibberish during his unsanctioned broadcast, occasionally calling out people as "nerds." He ended his broadcast by getting his bare bottom slapped with a fly swatter. While the Max Headroom incident was a genuine hijacking of the airwaves, the NEAR takeover is a marketing stunt admitted to by the company's own spokespeople. An inauthentic hack. CoinDesk learned a bit of this NEAR-Max's lore: his name is "HiJack" and he's "the antithesis of Web3 values - a sleazy, corporate, desk-jockey who is satisfied with the current state of the world (because he and his cronies are on top)." "His aim is to sow dissent and doubt (literally FUD) because Web3, and particularly the intersection of AI x Web3 in which the user (us) comes first, is a tangible alternative to the current way the world, digital and otherwise, works" a representative told CoinDesk. Compared to Max, HiJack displayed a serious agenda. For nearly a minute he drop-kicked crypto fan boys including those following NEAR, telling them to "get a real job" and to give up on this "web3 trash." "You're gonna trust Solana or Ethereum over household names like Apple and Amazon," he asked. "Gimme a break, dude!" But HiJack has a point. People really don't trust any crypto network over Apple and Amazon. Not yet, anyway. The number of people who actually live on crypto – entirely separate from the traditional financial and technological system – is vanishingly small. Is it too early for crypto to make fun of its own struggles for relevance? NEAR seems to at least think it can help drive attendance at the Thailand hackathon, called REDACTED. A representative declined to comment for this story. At the very least, the fake hack caught people's attention. Emily Lai, an executive at crypto marketing agency Hype, tweeted the gambit increased NEAR's mindshare to its highest levels in three months. But the sentiment was resoundingly negative, she wrote, expressing doubt it would actually help REDACTED. NEAR's price was down around 2% over the past 24 hours as of press time. Commenters on NEAR's social channels were less diplomatic. Some praised the creative edge. But others chastised the gimmick for its potential to damage NEAR's reputation while delivering little brand upside. Messari pushed a real warning to its markets-intelligence software users warning them that NEAR had actually suffered a hack. "There is nothing waiting for you in Thailand," wrote one commenter. https://www.coindesk.com/news-analysis/2024/09/05/a-crypto-projects-weird-marketing-hack-riffed-on-infamous-1987-chicago-tv-hijacking/

2024-09-05 18:09

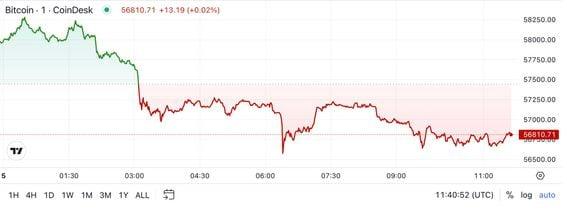

Bitcoin tumbled below the $56,000 level on Thursday before a modest bounce. Cryptocurrencies continued trending to the downside as recession fears weighed on risk assets ahead of Friday's key jobs data report. Bitcoin (BTC) declined more than 4% at one point Thursday before bouncing to $56,500 at press time, off 2.2% over the past 24 hours. Ethereum's ether (ETH) declined over 4% during the same period, trading below $2,400. The broad-basket CoinDesk 20 Index was down more than 3%, with dogecoin (DOGE), cardano (ADA) and litecoin (LTC) outperforming. Native token of layer-1 blockchain Aptos (APT) tumbled 7%, the largest loser among the CoinDesk 20 constituents, as an upcoming token unlock event weighed on its price. Some $65 million worth of locked tokens, 2.3% of the current supply, will be added to circulation next week including to early investor, per Token.Unlocks data. Cryptocurrencies usually underperformed the broader market in a window of seven days before and after large token unlocks over past years, a recent Messari research concluded analyzing hundreds of unlock events over the past years. Looking at traditional markets, key U.S. equities declined during the morning session in a broader risk-off sentiment. The Dow Jones Industrial Average (DJIA) was down 0.9%, while the broad-based S&P 500 lost 0.5% by 12:00 Eastern time. The tech-heavy Nasdaq 100 erased its opening gains and stood mostly flat. Crypto-focused stocks also performed poorly. Crypto exchange giant Coinbase (COIN) declined 1%, briefly slipping below $160 for the first time since February, taking out the lows hit during the early August crash due to the Japanese yen carry trade unwind. Large-cap bitcoin miners Marathon (MARA) and Riot Platforms (RIOT) were down 4% and 2%, respectively. https://www.coindesk.com/markets/2024/09/05/aptos-leads-losses-as-crypto-weakness-continues-coinbase-shares-fall-to-7-month-lows/

2024-09-05 17:59

If elected, the former U.S. president has said he will install Elon Musk as head of a new government efficiency commission. Former President Donald Trump only devoted a brief moment to crypto in an otherwise lengthy economic address on his intentions for the U.S. economy in a second Trump term. Trump repeated his promise to make the U.S. the world capital for crypto. Donald Trump reiterated his promise to make the U.S. the crypto capital of the world if re-elected president during public remarks Thursday, though digital assets only received brief mention in his wide-ranging speech about his economic agenda. “Instead of attacking industries of the future, we will embrace them, including making America the world capital for crypto and Bitcoin,” Trump told the audience at an Economic Club of New York gathering. Trump may have a direct role in the industry, himself, as the "chief crypto advocate" for a forthcoming crypto project tied to his family, World Liberty Finance. During his hour-long speech, Trump laid out his plans to overhaul the U.S. economy if granted a second term, including slashing regulations and promoting increased domestic energy production. “I will launch a historic campaign to liberate our economy from crippling regulation,” Trump said. “I’m pledging today that in my second term, we will eliminate a minimum of tenfold regulations for every one new regulation.” Trump added that, if elected, he will immediately issue a national emergency declaration to increase domestic energy production, citing the need for increased electricity to continue growing the artificial intelligence sector and keep the U.S. tech industry competitive with China. “With these sweeping authorities, we will blast through every bureaucratic hurdle to issue rapid approvals for new drilling, new pipelines, new refineries, new power plants, new electric plants and reactors of all types. Prices will fall immediately in anticipation of this tremendous supply that we can create rather quickly, and we will be the leader instead of the laggard,” Trump said. Trump also said he will take Elon Musk up on his suggestion to create a government efficiency commission tasked with auditing the federal government’s spending and ferreting out waste – as well as his offer to lead it, joking that the owner of X (formerly Twitter) and CEO of Tesla was "not busy." https://www.coindesk.com/policy/2024/09/05/trump-promises-to-embrace-industries-of-the-future-including-crypto-ai/

2024-09-05 15:37

The U.S. central bank has indicated it will begin cutting the fed funds rate at its mid-September meeting, but the size and speed of the easing cycle is up for debate. Tomorrow's August jobs report is likely to go a long way to determining the size of the upcoming Fed rate cut Fed easing cycles are normally associated with good things for bitcoin, but not so much this time around The U.S. government tomorrow will release its Nonfarm Payrolls Report for the month of August in what will be one of the final economic data points for the Federal Reserve to ponder prior to its rate-setting meeting later this month. Economists are forecasting the U.S. to have added 160,000 jobs in August, up from July's soft 114,000 print. The unemployment rate is seen edging down to 4.2% from 4.3%. While a stronger-than-expected or even in line report is likely to result in the Fed just cutting its benchmark fed funds rate by 25 basis points, a soft number will surely have traders rushing to price in a 50 basis points move. The balance of economic news this week – the ISM Manufacturing PMI, the Fed's Beige Book and the ADP August jobs report – so far has leaned soft, amping up the idea that the Fed might go for a bolder path of policy easing. According to CME FedWatch, there's a 44% chance of a 50 basis point rate cut vs a 34% one week ago. Whither bitcoin? There was a point in time not long ago when a speedy pace of monetary ease was thought to be a major positive catalyst for bitcoin (BTC) prices. The original crypto, after all, was invented during the global financial crisis more than 15 years ago alongside the Fed's rush to cut rates to 0% and pump hundreds of billions of freshly minted dollars into the economy. Then the Fed's 2020 Covid-era push to again slash rates/pump money took bitcoin in the course of less than one year from a sleepy, fringy property into a $1 trillion asset class. This coming easing cycle, though, is thus far generating zero enthusiasm for taking prices higher. Each signal over the past several weeks that rate cuts were coming has resulted in only a momentary break from bitcoin's downtrend. At the current $56,300, bitcoin is lower by 5% over the last month and off more than 23% from a record high above $73,500 touched six months ago. Quinn Thompson, CIO of hedge fund Lekker Capital this morning was speaking about traditional markets, but it may as well have been bitcoin: "Every single piece of economic data this week has been weak," he wrote. "Conviction is rising in a 50 bps Fed cut in September. But you've been burned too badly for the past 6 months to press the buy button." https://www.coindesk.com/markets/2024/09/05/bitcoin-flounders-ahead-of-friday-jobs-report-that-might-push-fed-to-slash-rates-by-50-basis-points/

2024-09-05 14:24

The company received a takeover approach from an investor while exploring a Series B funding round. BCB Group has received a takeover approach from an investor. The approach came while the crypto payments firm was exploring a series B funding round. The business is not formally up for sale and there are no ongoing negotiations, one source said. BCB Group, a payments processor that links crypto firms to the banking system, has received a takeover approach from an investor, according to three people familiar with the matter. The buyout interest was initiated by the potential acquirer while the London-based company was exploring a Series B funding round, said the people, who spoke on condition of anonymity because the matter is private. The business is not formally up for sale, and there are no negotiations taking place, one of the people said. BCB declined to comment. M&A activity in the U.K. crypto industry has been heating up in recent months. Elwood Technologies, the crypto-focused trade execution and risk management platform backed by billionaire hedge fund manager Alan Howard, divested its over-the-counter trading division to Standard Chartered-backed Zodia Markets in July. BCB closed a $60 million Series A funding round in January 2022. The round was co-led by Foundation Capital with participation from BACKED VC, PayU (the e-payments business of Prosus), Digital Currency Group, Nexo, Wintermute, Menai Financial Group, Circle, Tokentus Investment, Cowa, Profluent Ventures and LAUNCHub Ventures. Previous investors North Island Ventures, Blockchain.com Ventures, Rockaway Blockchain Fund, Pantera and L1 Digital also participated in the Series A round. The payments firm was authorized by France's ACPR and AMF, the country's two primary financial regulators, to act as an Electronic Money Institution (EMI) and Digital Assets Services Provider (DASP) in April. It said France will serve as its regulatory base in Europe. BCB's former CEO, Oliver von Landsberg-Sadie, left the company in November to pursue new opportunities and was replaced by Oliver Tonkin. His departure came just five months after Deputy CEO Noah Sharp decided to exit the business after the failed acquisition of Sutor Bank in Germany. https://www.coindesk.com/business/2024/09/05/crypto-payments-firm-bcb-group-has-received-takeover-interest-sources/

2024-09-05 12:11

The latest price moves in crypto markets in context for Sept. 5, 2024. Latest Prices CoinDesk 20 Index: $1,797.26 +0.88% Bitcoin (BTC): $56,839.07 +0.34% Ether (ETH): $2,395.07 −0.31% S&P 500: 5,520.07 −0.16% Gold: $2,516.37 +0.81% Nikkei 225: 36,657.09 −1.05% Top Stories Bitcoin fell below $57,000, erasing gains from Wednesday's brief rally above $58,000. BTC was trading around $56,800 at the time of writing, around 0.3% higher than 24 hours ago. The broader digital asset market, as measured by the CoinDesk 20 Index, added about 1%, with SOL and DOGE leading the gains. Bitcoin peaked above $65,000 on Aug. 25 and has been falling ever since, with the downtrend characterized by brief, shallow bounces, a sign of a persistent "sell-on-rise" mentality. This likely stems from increasing U.S. recession risks, which lead to a reduction in exposure to risk assets. Weak economic data from the U.S. this week has strengthened the possibility of rate cuts from the Fed, but that has yet to stem bitcoin's downward movement. The U.S. Bureau of Labor Statistics's latest Job Openings and Labor Turnover Survey on Wednesday showed the number of job openings at the end of July at 7.67 million, missing the market expectation of 8.1 million and weaker than the revised June figure of 7.9 million. BTC's weakness points to limited appetite for risk assets, according to Alex Kuptsikevich, a senior market analyst at The FxPro. "Bitcoin is down for the ninth day out of the last 11 as its attempt to consolidate above the 200-day average triggered an intensified sell-off," Kuptsikevich told CoinDesk in an email. Blockstream Mining is opening a third round of investment for its hashrate-backed tokenized note, which gives participants a slice of the bitcoin earned from the company's mining activities over the next four years. Blockstream has raised around $7 million from two earlier rounds of the BMN2 note. The third sale, which will last for three weeks, will be priced at $31,000 and give holders the bitcoin produced by 1 PH/s of hashrate. Hashrate-backed contracts are not new as crypto markets have become increasingly financialized. Blockstream has differentiated its note with a 48-month duration. Most rival offerings lock in the hashprice for a year. Chart of the Day The chart shows the spread between yields on the U.S. 10-year and two-year Treasury notes. The spread has normalized (de-inverted) from negative to zero for the first time in two years. "The return to a normal slope, rather than the inversion itself, seems to correlate with recessions," Marc Chandler, chief market strategist at Bannockburn Global Forex, said in Thursday's market update. Source: TradingView - Omkar Godbole Trending Posts Robinhood's Former Ban on Crypto Withdrawals Draws $3.9M Settlement in California Kamala Harris Is Not Directly Accepting Crypto Donations, a PAC Is, Coinbase Says Siemens Issues $330M Digital Bond on Private Blockchain with Major German Banks Including Deutsche Bank https://www.coindesk.com/markets/2024/09/05/first-mover-americas-btc-erases-gains-from-wednesdays-brief-rally/