2024-01-17 20:20

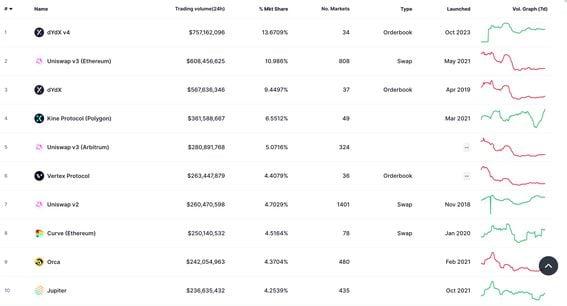

The decentralized exchange, which last year moved over to the Cosmos blockchain, just saw $757 million of volume over a 24-hour period. Decentralized exchange dYdX, which recently migrated from Ethereum to Cosmos, has topped one of Uniswap's markets to become the largest DEX by daily trading volume, according to data from CoinMarketCap. The Cosmos-based v4 version of dYdX just saw $757 million of volume over a 24-hour period, topping Uniswap v3, which had $608 million, the data shows. dYdX's v3 market, which still operates, had $567 million, enough for third place. According to dYdX, the total trade volume so far for its v4 market since launch is $17.8 billion. In 2023, dYdX's v3 saw a total of over $1 trillion in trading volume with several days exceeding $2 billion of trading volume. There were concerns when dYdX departed Ethereum that it might struggle to recoup the same level of activity that it experienced in previous iterations because Ethereum, while a more expensive chain, has significantly higher usage than the Cosmos ecosystem. dYdX's high trading volumes, which now surpass that of Uniswap and other Ethereum-based exchanges (including dYdX's own v3 DEX), might serve as a kind of validation of the company's decision to switch ecosystems. dYdX focuses on facilitating the trading of perpetual futures, which are contracts with no expiration date, thus allowing investors to speculate on the price of an underlying asset while bypassing the physical settlement of goods involved in standard futures trading. The platform recently transitioned to v4, which it coined as a "fully decentralized" chain, unlike its previous v3 chain, which the company said was not. dYdX said v3 on Ethereum will eventually be closed, but no firm date is set for the closure. According to Pantera Capital's Paul Veradittakit, decentralized finance (DeFi) users seek platforms that offer "high throughput for rapid, continuous trading." Veradittakit added that "high gas fees further compound the issue, diminishing user profits and platform appeal." Veradittakit said that dYdX v4's transition to a standalone blockchain using the Cosmos SDK addresses challenges head-on by "promising significantly improved trading throughput, reduced transaction costs and customized on-chain logic tailored to sophisticated and high-frequency trading needs." dYdX is backed by the likes of Patnera, Paradigm and Delphi Digital. Sam Kessler contributed to reporting. https://www.coindesk.com/markets/2024/01/17/dydx-tops-uniswap-as-largest-dex-by-volume/

2024-01-17 17:39

The broker says it prefers outperform rated mining stocks Riot Platforms (RIOT) and CleanSpark (CLSK). Bitcoin (BTC) mining stocks have underperformed in recent weeks, but any weakness in the near term represents a potential buying opportunity, broker Bernstein said in a research report on Monday, The mining stocks are facing two headwinds following the approval of spot bitcoin exchange-traded funds (ETFs). First is "lower investor appetite to use them as a proxy,” and second is a weaker BTC price, resulting in further underperformance, the report said. The Valkyrie Bitcoin Miners ETF (WGMI), which invests in publicly traded bitcoin mining stocks, fell nearly 38% this year, while the bitcoin price and broader equity markets were more or less flat. However, this underperformance might provide a window for investors looking for an opportunity to buy into mining stocks. “Just like bitcoin, the next two months offer a dip buying opportunity in bitcoin miners,” as the stocks will offer "higher beta trade" to the next bitcoin price inflection, analysts Gautam Chhugani and Mahika Sapra wrote. There may be a further temporary weakness in bitcoin, with a potential short-term bottom in the $38,000-$42,000 range for the world’s largest cryptocurrency, the report said. Still, investors should be "structurally long" ahead of the next halving event, expected in April. In a separate note on Wednesday, Bernstein reiterated its bullish call on the miners. The broker recommends “achieving bitcoin exposure via bitcoin miners that offer a higher-beta than bitcoin driven by EBITDA expansion and market multiple growth into the bull cycle.” Bernstein says it prefers outperform rated stocks Riot Platforms (RIOT) and CleanSpark (CLSK). Read more: Bitcoin Miner CleanSpark Cut to Neutral, Riot Platforms Upgraded to Neutral: JPMorgan https://www.coindesk.com/business/2024/01/17/bernstein-says-buy-the-dip-in-bitcoin-mining-stocks-ahead-of-btc-price-inflection/

2024-01-17 16:39

MetaMask is quietly testing new tech that uses third parties to route user transactions. It will eventually be made available outside of MetaMask and will be closely scrutinized for how it manages to avoid centralization concerns. MetaMask is testing a "transaction routing" feature that could turn the biggest Ethereum wallet into an "intent-centric" protocol – meaning users will be able to lean on third parties to find the best path for their transactions. The goal of the tech will be to provide optimal execution and improved user experience. The routing tech is built by Special Mechanisms Group, which MetaMask owner Consensys bought last year. It will eventually be available to third parties. MetaMask joins a growing field of intent-centric protocols like Uniswap X, CoW Swap, Anoma and SUAVE – but Consensys says its approach has some differences that make it less risky. MetaMask, the most popular crypto wallet on Ethereum, is testing a new "transaction routing" technology that's likely to have major ramifications for how value flows through the second-biggest blockchain network. CoinDesk learned of the new technology from developers briefed on the plan, and key details were subsequently confirmed by officials with MetaMask's parent company, Consensys. The effort capitalizes on a concept known in blockchain circles as "intents" that is rapidly gaining momentum, potentially leading to a radical shift in how people interact with blockchains: Rather than specifying how they want to get something done (e.g. "sell X tokens on Y exchange for Z price"), blockchain users may only need to specify what they want the outcome to be (e.g. "I want the best price for my tokens"). The "what" versus "how" distinction might seem subtle, but it's a big departure from how MetaMask and other crypto wallets worked originally – as neutral, relatively simple pieces of software for connecting users to blockchains. The goal with the new tech is for users to get better execution on their transactions and improved ease of use, but intent-based programs ultimately represent a big shift to where – and to whom – value flows on blockchains. The new technology is being built by Special Mechanisms Group (SMG), a blockchain infrastructure firm that MetaMask owner Consensys purchased last year. According to Consensys, which confirmed details of the project but was only willing to discuss them at a high level, an early version of SMG's new routing tech is already being used to power "Smart Swaps," a feature in the MetaMask browser extension that helps users swap between tokens. In the past, a MetaMask user looking to sell tokens would have needed to submit a transaction specifying exactly how, where, and for what price they wanted their tokens to be sold. With Smart Swaps, which is an "opt-in" feature based around intents, a user can simply request that MetaMask sell their tokens for the best price it can find. Once MetaMask fully transitions Smart Swaps over to its new architecture, it will be powered by an underground ecosystem of third-party blockchain operators. These third parties will find the optimal route for a given swap, and they will then execute the requisite transactions on the user's behalf. Compared to a simple exchange aggregator that finds the best price for an asset by comparing different exchanges, Smart Swaps, with its new routing tech, will have total freedom over the path that it takes to satisfy a user's request. Consensys says it plans to expand its routing feature beyond Smart Swaps to other transaction types in the coming months, and it will also make it available to third parties that wish to use it themselves. On MetaMask, the technology will always be "optional," meaning users won't have to use it if they don't want to. Still, there are some risks. MetaMask, as the biggest player in the wallet world, might set a precedent for other wallet builders. Given that its new feature represents a radical re-think of how crypto wallets work, the new tech is likely to earn some scrutiny as its design becomes clearer. Intent-centric protocols With so many apps on Ethereum today, there are infinite paths one might take to accomplish a given task, and some will be far more lucrative (or will cost less) than others. With its new transaction routing tech, MetaMask joins a growing field of “intent-centric” protocols like Anoma, Uniswap X, SUAVE and CoW Swap that aim to make Ethereum less daunting to navigate. Users issue goal-oriented “intents” to the protocols (e.g. "Get me the best price for my tokens") rather than step-by-step transaction instructions. The behind-the-scenes third parties typically compete with one another to satisfy user requests for the best price, and, in exchange, get transaction fees or other economic incentives. In addition to improving the Ethereum user experience, these programs are usually designed to help users avoid the scourge of maximal extractable value (MEV), where bots preview Ethereum's transaction queue to find profitable trading opportunities, so they can skim marginal profits from end users – sometimes likened to the unsavory practice of front-running. However, there could be risks to the new intent-centric programs, including regulatory considerations and fears that some routing systems might entrench new power players at key points in a chain's transaction pipeline. The risks become even greater with the involvement of a player like MetaMask, the first touchpoint for a vast portion of the transactions that hit Ethereum. What we know so far Consensys says it has deliberately designed its new routing mechanism to sidestep certain key risks and to shift power from the validators that propose blocks (to earn fees and MEV) to the users who submit transactions. In response to questions from CoinDesk, Consensys provided emailed comments from SMG director Jason Linehan indicating that SMG's technology is different from some other intent-centric projects, in that "It is not a centralized solution, and it is not a vertical integration." Typically when a user submits a request to an intent-centric program, it lands in a kind of private mempool – a waiting area for yet-to-be-processed transactions that is cordoned off from the default, "public" Ethereum mempool (a big part of how the protocols shield their users from MEV bots). From there, the intent is scooped up by a third-party blockchain operator, sometimes called a "filler," that bids against other operators to fulfill the user's intent for the best possible price. Linehan wouldn't disclose the specifics of SMG's mechanism, but he did confirm that it would involve a kind of "auction-based optimization method." He pushed back against the idea that SMG would use a private mempool, however. "We have taken such a unique approach with this technology that it doesn't entirely make sense to call it a private mempool anymore," wrote Linehan. "People tend to think it's a public mempool if every node sees every message, and a private mempool if only some of the nodes see every message, but why should any node see every message in the first place?" MetaMask's "mechanism is a new design created by SMG and is a significant departure from existing solutions," Linehan told CoinDesk. Linehan said that MetaMask's transaction router would be completely permissionless, meaning anyone can theoretically participate in its order flow auctions. "There is a role to play for every searcher, builder, and solver, no matter how big or small," said Linehan. Linehan also said SMG's intent tech would be open to other protocols. "At this stage it’s too early to talk about licensing, but we like open source, so that’s going to play a role," he said. "We are currently focused on ensuring we have built the best system of its kind in terms of safety, features, performance, and control," he wrote. "Once we are satisfied, everyone in the industry will have a chance to use it for themselves, and will be free to use it how they want." https://www.coindesk.com/tech/2024/01/17/metamasks-secret-intents-project-could-radically-change-how-users-interact-with-blockchains/

2024-01-17 13:31

Perpetual futures based on the index at crypto exchange Bullish, which owns CoinDesk, could help the CoinDesk 20 become a widely followed benchmark akin to the 128-year-old Dow Jones Industrial Average. CoinDesk Indices introduced the CoinDesk 20, intended as a broad cryptocurrency market benchmark that can underpin tradeable products – akin to the S&P 500 or Dow Jones Industrial Average, which play a big role in the stock market. Bullish, the crypto exchange that owns CoinDesk, is offering perpetual futures contracts based on the CoinDesk 20. Cryptocurrencies just got a new benchmark that, similar to the stock market's Dow Jones Industrial Average, explains how the market is broadly doing. And the index has an investable product based on it, potentially giving the measure a shot at broader adoption – something previous marketwide benchmarks have failed to win. CoinDesk Indices on Wednesday introduced the benchmark, called the CoinDesk 20 Index, that tracks the world's largest and most-liquid cryptocurrencies. The behemoths, bitcoin (BTC) and Ethereum's ether (ETH), are among its 20 members, but it goes well beyond them to give traders a diversified summary of the market's performance. Bullish, the cryptocurrency exchange that owns CoinDesk, is offering perpetual futures contracts tied to the CoinDesk 20. Trading volume for these products, which can be used to hedge crypto portfolios or speculate on the broader market, exceeded $1 million within a few hours of their introduction on Tuesday. "We are delighted the CoinDesk 20 is already generating liquidity at the institutional level," Alan Campbell, the president of CoinDesk Indices, said in a statement. The Dow or S&P 500 for Crypto? Indexes are a key part of financial markets. The Dow has for more than a century given a sense of how the whole stock market is doing (though it only has 30 stocks out of the thousands that trade in the U.S.). Its younger cousin, the Standard & Poor's 500 Index, steers the value of futures contracts and exchange-traded funds that are some of the most popular products in finance. The CoinDesk 20 is aimed at a similar objective. At present, there's no widely followed index that serves as the flagship barometer for crypto and provides the foundation for tradeable products. In other words, crypto has no Dow or S&P 500 that is cited by basically everybody. "As the digital asset marketplace develops as an asset class, it needs an accessible, tradeable and trusted reference, and I believe the CoinDesk 20 is that reference," Tom Farley, CEO of Bullish, said in a statement. A different index with the same name was discontinued by CoinDesk Indices in 2022. The company also still offers the CoinDesk Market Index, but it includes almost 200 cryptocurrencies, many of them fairly illiquid, so it is a less-suitable launch pad for futures and ETFs. Immediate availability of futures at the Bullish exchange could give the CoinDesk 20 a boost that prior efforts lacked. Bitcoin and ether, the world's largest cryptocurrencies by market capitalization, have the biggest weightings at 31% and 22%, respectively. But the CoinDesk 20 goes pretty far down the size rankings, too. Tokens from Aptos (APT) and Filecoin (FIL) tie for the smallest weighting of 0.7%; they're the 30th and 33rd biggest cryptos by market cap, respectively, according to coinmarketcap.com. Meme coins such as dogecoin (DOGE) and shiba inu (SHIB) are included in the group. Stablecoins like Tether's USDT and Circle's USDC are excluded. There is a 30% limit on the weighting for the largest cryptocurrency in the CoinDesk 20 – at present, bitcoin – and no other member can exceed 20%, an attempt to ensure the index is diverse. Excluding stablecoins, the CoinDesk 20 includes more than 90% of the total market cap of the entire crypto industry. Here are the members of the CoinDesk 20 and their weightings in the index as of Jan. 15: https://www.coindesk.com/markets/2024/01/17/the-dow-for-crypto-markets-new-coindesk-20-index-underpins-futures-contracts-at-bullish/

2024-01-17 11:22

The crypto market's de-dollarization expectations look premature as the greenback remained the preferred currency in international transactions in 2023, data show. Bitcoin's share in international transactions hit a decade high in 2023, while foreign holdings of U.S. government bonds held steady, Credit Agricole said in a note to clients. USD's persistent lead means investors could continue to park money in the currency during times of stress in the global economy. Since bitcoin’s (BTC) inception over a decade ago, crypto propounders have been obsessed with “de-dollarization,” a term used to describe shifting away from the U.S. dollar’s (USD) role as the global reserve currency. The calls grew louder last year as several regional banks in the U.S. faced turmoil and the federal debt hit a record $34 trillion. However, data shows the dollar remained the most favored currency in international transactions, with global demand for U.S. government bonds holding steady. "USD’s share in international SWIFT transactions surged in 2023 to reach its highest level in more than ten years. In contrast, the EUR share collapsed, and that of the JPY and GBP moderated,” Credit Agricole’s G10 FX strategy team said in a note to clients on Monday. “The growing importance of the USD as the currency of choice for international payments and transactions is another reason for global official and private investors to buy the currency. In turn, this should slow down further any push towards de-dollarisation," the strategists, led by Valentin Marinov, added. In other words, the dollar is likely to remain the currency of choice or haven asset during times of stress, sucking money from other assets like bitcoin and stocks. The note said the USD’s share in foreign exchange reserves maintained by central banks worldwide held steady at 59% in 2023, the same level as the previous three years, citing data tracked by the International Monetary Fund's data. The euro's share dipped to its second lowest since 2017. Concerning trends in foreign investment in U.S. Treasury bonds (USTs), the note said that non-Asian nations compensated for the decline in China, Hong Kong, and Japan’s holdings in 2023, keeping the global tally steady. “We continue to think that expectations of aggressive unwinding of USD holdings are quite premature. Indeed, we note that whereas the UST holdings of China and Hong Kong (and to a lesser degree Japan) have been on a downtrend throughout 2023, demand for USTs from the rest of the world held up reasonably well,” Credit Agricole said. “In addition, it is worth highlighting that the UST holdings of Ireland and Belgium that are seen as proxies for custodial holdings of foreign investors like China have held up reasonably well as well.” Per Global Times, China’s stockpile of U.S. Treasury bonds totaled $769.6 billion in October, marking a seventh consecutive monthly drop and a decline of $97.5 billion in ten months of the year. The continued unwinding of China’s Treasury holdings fueled the de-dollarization narrative. Per Credit Agricole, the decline in Treasury holdings of some nations correlated with the fall of their respected foreign exchange reserves. Nations like China have long been parking reserves earned through trade surpluses in U.S. Treasury bonds, underwriting American consumption. https://www.coindesk.com/markets/2024/01/17/bitcoins-de-dollarization-narrative-loses-ground-as-usd-tightens-its-grip-on-international-transactions/

2024-01-17 09:03

Some have forecasted sharp declines in bitcoin's price as traders 'sell the news' post-ETF approval, but Fidelity's Director of Global Macro disagrees. Bitcoin (BTC) is down almost 7% in the last week, as the market impact of the recently approved BTC ETF works its way through the system. While many contrarian bets about the price of bitcoin after the ETF approval have been proven right, Fidelity's Jurrien Timmer doesn't expect the sell-off to continue much longer. In a thread on X, Timmer, Fidelity's Director of Global Macro, said current trends in bitcoin's price are suggestive of a short-term positioning adjustment rather than a long-term trend reversal. While some have forecasted that bitcoin might drop and find support anywhere between the $32K to $38K mark, Timmer expects consolidation of recent gains. "The short-term question is whether this a sell-the-news moment. My guess is that it will take a little time to consolidate the recent gains, now that the big moment has arrived," Timmer posted on X. "There were more than a few participants who 'equitized' future spot positions through either the futures market or bitcoin-sensitive equities." Per Timmer, bitcoin's current price is reasonable and is affected by how much its network is growing and the actual interest rates in the economy and the longer-term prospects look bright. ""Will this be a new chapter towards Bitcoin’s widespread adoption as a commodity-currency?" Timmer posted. "It seems that way, although it could take some time to get there." While the rally has stalled, many asset managers, according to Timmer, continue to have a significant net long position in the bitcoin futures market. Meanwhile, CoinDesk recently reported that for the first time ever, Bitcoin's 50-week simple moving average has crossed above its 200-week average. This event is known as a "golden cross," which suggests a long-term bullish market, although its predictive accuracy is debated among traders. https://www.coindesk.com/markets/2024/01/17/fidelitys-jurrien-timmer-says-bitcoin-to-consolidate-recent-gains-amid-etf-hangover/