2024-01-16 18:25

U.S. monetary policy, combined with the use of economic sanctions, have forced some countries to look for alternatives to the dollar, while growth of stablecoins may have emphasized the need of the fiat currency, the bank said. The dominance of the U.S. dollar as the linchpin of the international financial system is being increasingly questioned due to shifting geopolitical currents and the country’s growing twin deficits, Wall Street giant Morgan Stanley (MS) said in a report last week. Enter cryptocurrencies, which, while still in their early stages, have the potential to both erode and reinforce the dollar’s dominance in global finance, the bank said. “The recent growth in interest of digital assets such as bitcoin (BTC), growth of stablecoin volumes and the promise of central bank digital currencies (CBDCs), have potential to significantly alter the currency landscape,” wrote Andrew Peel, Morgan Stanley's head of digital asset markets. U.S. monetary policy, combined with the use of economic sanctions, have forced some countries to look for alternatives to the dollar, Peel said, adding that a “clear shift towards reducing dollar-dependency is evident, simultaneously fueling interest in digital currencies such as bitcoin, stablecoins, and CBDCs.” On the flip side, he noted that stablecoins pegged to the U.S. dollar are also important as they may actually emphasize the need for the fiat currency. “Their continued evolution and growing acceptance by mainstream financial entities underscore their potential to significantly alter the landscape of global finance and in fact reinforce the dollar as the dominant global currency,” Peel wrote. However, this growing adoption of stablecoins has triggered widespread interest in CBDCs. As these digital currencies become more widely embraced and technologically advanced, “they hold the potential to establish a unified standard for cross-border payments, which could diminish the reliance on intermediaries like SWIFT and the use of dominant currencies such as the dollar,” the report added. Read more: 2023 Was the Year That Crypto Markets Became Institutionalized: Goldman Sachs https://www.coindesk.com/business/2024/01/16/can-crypto-dethrone-us-dollar-dominance-here-is-morgan-stanleys-take/

2024-01-16 16:48

Larry Fink has been talking up a spot ether ETF, but index provider CF Benchmarks sees a conundrum when it comes to selling that product. Not long after the debut of BlackRock’s bitcoin exchange-traded fund (ETF), the asset manager’s CEO Larry Fink effectively began the marketing drive for a second spot ETF product with the underlying cryptocurrency of Ethereum, citing the value of that blockchain’s transformational utility. The Wall Street machine needs to be fed and pushing more crypto ETFs is an obvious choice, especially given the attention the bitcoin (BTC) product has garnered. This essentially means thousands of salespeople having meetings, showing a new product, saying what it does, and seeing if people want to buy it. But selling an ether (ETH) ETF could present an interesting conundrum to issuers. Investors may have just bought a bitcoin ETF, so the practical need to spice up portfolios is already being satisfied. Why would they need another crypto diversification tool? It’s something Sui Chung, the CEO of CF Benchmarks, an index provider for digital assets and partner firm on the BlackRock iShares bitcoin ETF (IBIT), has been thinking about, especially having recently published a cheat sheet explaining the benefits of a bitcoin-backed security to investors. Defining bitcoin technology and its potential application to finance is part of the explainer, but Chung believes that’s secondary to the bitcoin ETF’s investment role: a small allocation diversifies a portfolio and boosts the overall risk-adjusted return. "The primary thing is how bitcoin behaves and its price history," Chung said in an interview. "When you put bitcoin inside a portfolio with stocks, bonds and cash, it’s just the most potent diversifier in the history of investing. You put a little bit in and the Sharpe ratio doubles." It becomes really interesting as to how a mainstream financial institution– be it BlackRock, Franklin Templeton, Fidelity etc. – markets an ETH ETF to the typical TradFi investor, Chung said. "Because you’ve already sold bitcoin by going down the diversification route; someone’s already stuck 1.5% or 2% of bitcoin into their portfolio.” In a sense, BlackRock chief Fink has already started diving into the complex world of Ethereum by mentioning tokenization, a much vaunted concept among TradFi firms these days and something most ETF issuers likely believe in wholeheartedly. But such an educational foray should also explain smart contracts and decentralized finance (DeFi), Chung said, not to mention the can of worms that is blockchain staking and the SEC’s opinion of that. Of course, a key differentiator between Bitcoin and Ethereum is how the latter moved away from the energy-sapping proof-of-work security system to a greener validator model. "I don’t think ESG environmental, social and governance is how it’s going to be marketed,” Chung said. “Do you really want to go there given all the controversy around ESG investing today already? Probably not." BlackRock declined to comment. https://www.coindesk.com/business/2024/01/16/blackrock-wants-to-follow-bitcoin-etf-with-an-ethereum-etf-marketing-it-might-not-be-so-simple/

2024-01-16 16:27

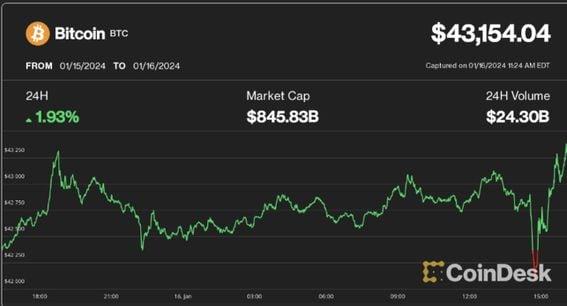

The news sent bitcoin tumbling early Tuesday, but the price quickly recovered. Grayscale, the owner of the Grayscale Bitcoin Trust (GBTC), sent an additional 9,000 bitcoin to an exchange early Tuesday as net selling of the product continues following its conversion to a spot exchange-traded fund (ETF). According to data from Arkham Intelligence, the coins moved in batches of 1,000 just after 14:30 UTC (when the U.S. stock market opened following the three-day weekend). Following U.S. regulatory approval for a spot ETF last week, Grayscale's GBTC has seen net outflows as investors sold for any number of reasons, the elimination of the discount to net asset value and lower fees at competing ETFs among them. The outflows resulted in Grayscale selling 2,000 bitcoin last week, a number that for now has risen to 11,000 and taken GBTC's holdings to below 610,000 BTC. Bitcoin (BTC) saw a sudden drop of nearly 2% to below $42,100 on the Grayscale news, but the price has quickly recovered to $43,100 as of press time. https://www.coindesk.com/markets/2024/01/16/grayscale-moves-another-9k-bitcoin-to-exchange-in-preparation-for-sale/

2024-01-16 08:24

Binance introduced zero-fee FDUSD trading in December, giving users an incentive to sell. The trueUSD (TUSD) stablecoin remains off its intended $1 peg as the Asia business day continues, and is currently trading at $0.988, CoinDesk Indices data shows. Data from crypto exchange Binance shows that in the last 24 hours, there have been over $444 million in TUSD sell orders versus $301 million in buy orders, resulting in a flow deficit of $142 million. "TUSD is related to Justin Sun, and its market cap is constantly shrinking," Bradley Park, an analyst at CryptoQuant told CoinDesk in a Telegram interview. "It is likely due to the potential impact of the HTX and Poloniex hacks." Park also pointed to Binance killing fees on First Digital's FDUSD trading pairs with ether (ETH), BNB Chain's BNB, dogecoin (DOGE) and Solana's SOL as another reason for the decline with the exchange not including TUSD as an option for staking new tokens on its Launchpad. The spike in FDUSD volume, coinciding with TUSD's de-pegging, suggests a transfer to FDUSD for participating in the FDUSD launch pool and joining the Binance Manta launchpad, Park explained. The launchpad is a popular service that rewards new tokens to investors that lock up specific assets, such as FDUSD or BNB, for a period of time. "We believe that TUSD holders sold as the Launchpad pool did not open, causing the de-pegging," he continued. There have also been continued concerns over TUSD's attestations. However, a spokesperson for Techteryx, the firm behind TUSD, told CoinDesk that "attestations continue in the ordinary course of business and any suggestion to the contrary is false." The spokesperson also said that Justin Sun is not a shareholder of Techteryx. "Recent community mining activities in relation to Binance Launchpool have been noted, leading to short term arbitrage opportunities which is part of the normal market dynamics and liquidity adjustment," they continued. https://www.coindesk.com/markets/2024/01/16/tusd-loses-1-peg-amid-binances-fdusd-focus-analyst/

2024-01-16 07:31

ETFs could open up a line of trading avenues centred around arbitrage, options and financing, Hayes said. Market inefficiency and the uncorrelated behavior of bitcoin (BTC) to traditional assets could serve as few of the factors that attract billions of dollars in capital from broader financial markets, Arthur Hayes, the chief investment officer of family office Maelstrom and the ex-CEO of BitMEX, said in a Tuesday post. Hayes, one of the earliest prominent bitcoin traders, said spot bitcoin exchange-traded funds (ETFs) could open up newer trading opportunities for traders as prices for the asset marked at U.S. benchmarks and the rest of the world fluctuate, allowing traders to profit from their difference. “bitcoin is a global market, and price discovery happens primarily on Binance (I guess based in Abu Dhabi). For the first time in a long time, the bitcoin markets will have a predictable and long-lasting arbitrage opportunity,” Hayes said. “Hopefully, billions of dollars of flow will be concentrated in an hour-long period on exchanges that are less liquid and price followers of their larger Eastern competitors. I expect there to be juicy spot arbitrage opportunities available,” he added. Hayes expects spot ETF products to pop up in major Asian markets, such as Hong Kong, which service “China southbound flow.” The presence of these highly regulated bourses and native crypto exchanges can create more market inefficiencies and thus profit opportunities, he said. ETF-based financing could be another sector poised for growth as bitcoin trading becomes commonplace in the coming years. Banks could open up desks that provide fiat loans against bitcoin ETF holdings, pocketing the spread and influencing bitcoin interest rates, further creating market imbalances. Meanwhile, Hayes said earlier in January that he is bearish on bitcoin in the short term and expects prices to undergo a 30% correction. It’s a sentiment shared by several other traders, who expect prices to fall as low as $38,000 before the next leg up. https://www.coindesk.com/markets/2024/01/16/arthur-hayes-believes-bitcoin-etfs-could-bring-in-billions-from-tradfi/

2024-01-16 07:12

The cumulative volume delta (CVD) indicator show traders from Binance have led the so-called "sell-the-fact" pullback in bitcoin. Bitcoin (BTC) has come under pressure since spot exchange-traded funds (ETF) began trading in the U.S. last Thursday. Data tracked by Paris-based Kaiko show the selling pressure has been concentrated on Binance, the leading crypto exchange by trading volumes, OKX, and Upbit. Bitcoin, the leading cryptocurrency by market value, changed hands at $42,700 at press time, representing a 12% drop from the high of $48,975 reached Thursday. The price drop seems to have stemmed from traders taking profits on long (buy) positions initiated in anticipation of ETFs’ debut. An indicator called the cumulative volume delta (CVD) shows traders from Binance led the so-called “sell-the-fact” pullback in bitcoin. The CVD tracks the net difference between buying and selling volumes over time, offering a total of net bullish/bearish pressures in the market. Positive values indicate excess purchase volume, while negative values suggest otherwise. Binance’s spot market CVD flipped positive last Thursday and has been falling ever since, representing a capital outflow equivalent to nearly 5,000 BTC, data tracked by Kaiko show. South Korea’s Upbit has seen the second-largest net capital outflow, followed by Itbit and OKX. “The ETFs began trading last Thursday, with a strong surge in cumulative volume delta (CVD) across all major exchanges; a net of nearly 3k BTC was market bought on Binance in the hour surrounding market open in the U.S. However, as some had feared, sell the news took hold, and Binance’s CVD quickly fell into the negative, as did OKX’s,” Kaiko said in a weekly report published Monday. “Itbit, another institutional exchange, though with lower volumes, showed consistent selling, along with Upbit, showing consistent selling with few retraces,” Kaiko added. The CVD on Coinbase, the custody partner for most of the ETFs, and Bitstamp has held positive, implying a net capital inflow amid the price weakness. Per some analysts, prices could slide further to $40,000 and lower before the pullback runs out of steam. The initial performance of the ETFs has been weak relative to Bloomberg analysts’ projection of $4 billion in inflows on the first day alone, which supports the case for a deeper price drop. https://www.coindesk.com/markets/2024/01/16/bitcoins-sell-the-fact-pullback-came-from-binance-okx-kaiko/