2024-09-05 12:11

The tokens equate to around 5% of EIGEN's total supply. EigenLayer will distribute around 5% EIGEN's total supply as a part of "season 2 stakedrop." The majority of the tokens will go to stakers and node operators. TVL on EigenLayer has waned to $11.3 billion in recent months. Restaking protocol EigenLayer will distribute 86 million EIGEN tokens to users that have interacted with the platform as a part of "season 2 stakedrop," it said in a blog post. Stakers and node operators will receive 70 million tokens, while ecosystem partners and the EigenLayer community will receive 10 million and 6 million respectively, with distribution due to start on Sep. 17. The tokens equate to around 5% of EIGEN's total supply, which will be 1.67 billion tokens at launch. EigenLayer initially announced its token in April after the protocol had received around $15.7 billion in deposits. Since then total value locked (TVL) has dropped to $11.3 billion, DefiLlama data shows. EigenLayer is a protocol built atop Ethereum, it lets users stake ether (ETH), which can be repurposed to secure additional networks or protocols in return for additional yield. Several restaking protocols have experienced a reduction in TVL over the past month. Renzo's total has dropped by 22% to $1 billion and Karak's has fallen 14.6% to $688 million. This is partly due to dwindling asset prices as ether trades at $2,388 compared to July's high of $3,536, and also results from outflows following the conclusion of several airdrop campaigns. Airdrop farming was a common strategy for crypto investors earlier this year. It involved staking assets on a protocol in the hope that would increase their share of an airdrop should a native token be released. https://www.coindesk.com/business/2024/09/05/eigenlayer-to-distribute-86m-tokens-to-stakers-node-operators/

2024-09-05 11:28

Crypto weakness may be a red flag for traditional risk assets, one analyst said. BTC's price bounces remain shallow and brief as concerns about the U.S. economy linger. Crypto weakness may be a red flag for traditional risk assets, one analyst said. Bitcoin (BTC) dropped below $57,000 on Thursday, reversing Wednesday's gains as lingering concerns about the strength of the U.S. economy prompted investors to sell risk assets as they rebounded. The leading cryptocurrency by market value fell over 2% to $56,700, having failed to secure a foothold above $58,000 on Wednesday. Prices peaked above $65,000 on Aug. 25 and have been falling ever since, with the downtrend characterized by brief, shallow bumps, a sign of a persistent "sell-on-rise" mentality. Most other cryptocurrencies, including ether (ETH), XRP, TON and others, also erased Wednesday's bounces, trading largely unchanged on a 24-hour basis, according to CoinDesk data. The CoinDesk 20 Index (CD20), a measure of the broader crypto market, was recently 0.9% higher. The sell-on-rise bias likely stems from concern that U.S. recession risks are growing, a sentiment that favors reduced exposure to risk assets, according to Valentin Fournier, an analyst at digital assets advisory firm BRN. "Economic reports are increasingly suggesting the risk of a recession should not be discounted," Fournier said. "The ISM manufacturing index has fallen 0.5% below expectations, and job openings are at 7.7 million compared to the anticipated 8.1 million." "Given the current economic uncertainties and potential for decreased liquidity, we recommend reducing exposure [to BTC] and waiting for a better entry point before increasing investments," Fournier added. The U.S. Bureau of Labor Statistics published the Job Openings and Labor Turnover Survey (JOLTS) on Wednesday, showing the number of job openings on the last business day of July at 7.67 million, missing the market expectation of 8.1 million and weaker than the downwardly revised June figure of 7.9 million, according to data source FXstreet. Meanwhile, the Federal Reserve's Beige Book, a summary of commentary on economic conditions, was the most downbeat in ages, pointing to a "slowing, slackening labor market," according to Julia Pollak, chief economist at ZipRecruiter. On Tuesday, the ISM manufacturing PMI signaled a continued contraction in the activity in August, reviving the growth scare that rocked risk assets, cryptocurrencies among them, early last month. The weak data has emboldened bets for Federal Reserve interest-rate cuts, although it has failed to put a floor under BTC's price so far. Alex Kuptsikevich, senior market analyst at The FxPro, said the weakness in bitcoin might be a red flag for traditional risk assets. "It is possible that the weakness in cryptocurrencies is a manifestation of a very limited risk appetite, and the rest of the markets may soon follow the lead of cryptocurrencies," Kuptsikevich said, noting BTC's inability to draw long-lasting strength from the recent weakness in the dollar index. "Bitcoin is down for the ninth day out of the last 11 as its attempt to consolidate above the 200-day average triggered an intensified sell-off. This pattern persists into Thursday morning as the price continues to test the lows of the last four months," Kuptsikevich told CoinDesk in an email. https://www.coindesk.com/markets/2024/09/05/bitcoin-retraces-below-57k-as-sell-on-rise-action-continues/

2024-09-05 10:00

The EU-compliant security token gives investors exposure to the hashrate over a four-year period. Blockstream started a third round of sales for its tokenized note, BMN2 The round will be priced at $31,000 and give investors a share of the bitcoin produced by the mining company. The hashrate-backed note allows investors to lock in the hashprice for up to four years, Blockstream said. Blockstream Mining said it is opening a third round of investment for its hashrate-backed tokenized note, which gives participants a slice of the bitcoin (BTC) earned from the company's mining activities over the next four years. Two earlier rounds of the BMN2 note raised a total of around $7 million. The third will be priced at $31,000 and give holders the bitcoin produced by 1 petahash per second (PH/s) of hashrate. The sale will last for three weeks, a company spokesperson said in an interview. Blockstream is targeting $10 million in investment for the latest round. "Blockstream is able to offer mining for under 4.5 cents per kilowatt-hour (kWh), which is far below the industry average,” the spokesperson said. “Anyone investing in BMN2 will benefit from access to the most cost-effective mining around.” The company, co-founded by legendary bitcoin developer Adam Back, is working with Stokr for the sale of the note. Crypto markets are becoming increasingly financialized, and hashrate-backed contracts are not new. What’s unique about Blockstream’s note is its duration. Most contracts lock in the hashprice for up to 12 months, James Macedonio, Blockstream's SVP global head of mining sales and business development, said. BMN2, an EU-compliant security token, gives exposure to the bitcoin hashrate over a 48-month period. Hashrate refers to the total combined computational power used to mine and process transactions on a proof-of-work blockchain and is a proxy for competition in the industry and mining difficulty. Hashprice is a mining metric that calculates revenue on a per terahash basis, and is computed using network difficulty, the bitcoin price, the block subsidy and transaction fees. The advantage of buying Blockstream’s BMN2 note instead of buying hashrate futures from bitcoin mining companies is that investors are not exposed to counterparty risk or possible miner failures, and the price is locked in for four years, Macedonio said. Furthermore, the market hashprice adjusts quarterly, and is dependent on mining efficiency, and passes through risks such as energy price and counterparty risk, he added. "With the bitcoin mining market currently experiencing historically low hashprice levels, BMN2 allows investors to strategically enter the market at an opportune time," the company said in a July release announcing the note. In a report last month, Wall Street giant JPMorgan (JPM) noted that the hashprice is about 30% below levels seen in September 2022 and about 40% below the level before April's reward halving. Investors in the note’s predecessor, BMN1, were mainly international family offices and funds in Europe, Macedonio said. While BMN2 is starting to see interest from U.S. institutions, the product is not being offered there yet, he said. Macedonio said many BMN1 investors rolled over their investment into BMN2. BMN1 was highly successful. It “mined over 1,242 BTC and delivered returns of up to 103% over its three-year term,” Stokr said on its website. It is the "highest payout in real world asset (RWA) security token history," according to Arnab Naskar, co-founder and co-CEO of Stokr. BMN2's first two investor rounds started on July 18 and ended Aug. 12. Anchor investors who committed over $500,000 in investment were given a discount and invested in series 1. Investors who rolled over their investment from Blockstream’s BMN1 note and new backers invested in series 2. Money raised from the sale of the note is used to manage physical infrastructure and energy costs because Blockstream is responsible for producing the hashrate that backs the note. The company has mining facilities in Georgia, Montreal and Texas. The tokenised note will trade on crypto exchange Bitfinex. https://www.coindesk.com/business/2024/09/05/blockstream-mining-starts-third-investment-round-for-hashrate-backed-tokenized-note/

2024-09-05 09:27

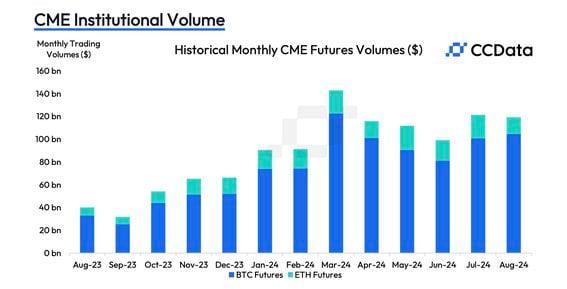

The decline in trading volumes for ETH instruments suggests lower-than-expected institutional interest in the asset, particularly following the launch of spot ether ETFs, according to CCData. Ether futures volumes on CME slipped in August as bitcoin volumes rose. Globally, there has been a shift from alternative cryptocurrencies and into bitcoin. Exchange-traded funds (ETFs) tied to the ether (ETH) price debuted in the U.S. late July, opening doors for investors seeking exposure to the cryptocurrency while bypassing the hassle of storing it. Since then, activity in ether derivatives listed on the Chicago Mercantile Exchange (CME) has cooled, according to CCData, a digital assets data provider based in London. Trading volume in ether futures declined 28.7% to $14.8 billion in August, the lowest since December 2023. Volume in ether options fell 37% to $567 million. "This decline in trading volumes for ETH instruments suggests lower-than-expected institutional interest in the asset, particularly following the launch of spot ETH ETFs," CCData noted. "The reduced inflows into spot ETH ETFs in August further support this trend. Additionally, seasonality effects in August may have also contributed to the decreased trading activity, with this trend likely to continue into September." Before the advent of spot ETFs, futures and futures-based ETFs were the only regulated avenues available for traditional stateside institutions. The spot products are generally perceived as superior to futures-based ETFs as the latter are vulnerable to "contango bleed." That said, demand for spot ETFs has not been impressive either. Data tracked by Farside Investors show ether ETFs have registered a net outflow of over $500 million since their debut. Bitcoin ETFs, in contrast, saw a net inflow of over $300 million in the first six weeks. "The launch timing of U.S. spot Ether ETFs on 23 July turned out to be less than ideal, coinciding with a tech stock sell-off. Ether’s high beta (~2.7) implies high losses in periods of risk aversion, and Ether prices had now seen a 30% drawdown since launch," DBS Treasuries said in a market insights post on Wednesday. Ether's price fell over 22% to $2,512 in August, its biggest monthly percentage slide since June 2022, amid volatility in traditional markets and crypto market leader bitcoin. Shift toward bitcoin Globally, there has been a shift toward market leader bitcoin, a sign crypto investors are becoming risk averse in the wake of the stalled bull run. In August, volume in CME's bitcoin futures rose 3.74% to $104 billion, according to CCData. Still, the volume of BTC options traded fell 13.4% to $2.42 billion. Data tracked by Wintermute show bitcoin futures now account for 48% of the total notional open interest in the crypto futures market, while alternative cryptocurrencies, including ether, account for the rest. In March, when optimism was at its peak, bitcoin represented just 31% of the global open interest. "This shift toward higher market cap assets like bitcoin signals a more conservative market sentiment, with traders displaying less appetite for risk and speculative positions in smaller, more volatile cryptocurrencies," Jake Ostrovskis, an over-the-counter trader at Wintermute, said in a market note shared with CoinDesk. https://www.coindesk.com/markets/2024/09/05/ether-cme-futures-volume-shrinks-as-eth-etfs-disappoint-crypto-market-ducks-risk/

2024-09-04 22:01

A spokesperson for Coinbase said the Future Forward PAC, which is dedicated to supporting Kamala Harris, is accepting crypto donations, rather than her campaign directly. A Coinbase (COIN) executive appears to have misspoken – or been imprecise – when she said Vice President Kamala Harris is accepting crypto donations. Harris "is accepting donations," Coinbase Chief Financial Officer Alesia Haas said at a Citigroup event Wednesday. Fortune first reported that news. "She's using Coinbase Commerce now to accept crypto for her campaign." But, according to a Coinbase spokesperson, Haas was referring to the Future Forward USA PAC, not her campaign. "Coinbase can confirm that the Future Forward PAC has onboarded with Coinbase Commerce to accept crypto donations," the spokesperson told CoinDesk. While the Harris campaign isn't taking crypto contributions directly, Future Forward USA, is a major source of support for Harris, and the development is, at minimum, possibly a signal that Democrats are warming to cryptocurrencies. Harris' opponent in the presidential election, Donald Trump, has courted – and won – support from crypto fans and companies. The presidential administration in which Harris serves has been strongly criticized by the industry for what's viewed as an anti-crypto stance. Future Forward is a hybrid PAC, first used for President Joe Biden, that can contribute directly to the campaign or pay for independent advertising that's not coordinated with Harris' camp. Harris' campaign website does not currently offer ways to donate in crypto, and advocacy group Crypto4Harris told Fortune that it was not aware of the development. A representative for the Harris campaign didn't immediately comment when contacted by CoinDesk. https://www.coindesk.com/policy/2024/09/04/kamala-harris-is-not-directly-accepting-crypto-donations-coinbase-official-clarifies/

2024-09-04 19:52

The Crypto Fear & Greed Index has plunged to levels that previously have presaged a sizable move higher in bitcoin prices. Bitcoin, ETH, SOL and other cryptocurrencies modestly reversed their losses from earlier in the day. The Crypto Fear & Greed Index sentiment indicator sank to deep fear levels similar to the lows in early July and August. Investor sentiment is so negative that a "tradable local bottom" could be close, Lekker Capital's Thompson said. Continuing downward price action in crypto may be about to reverse in a big way, at least in the short term based on the readings of one popular sentiment indicator. Bitcoin (BTC) during Wednesday U.S. trade recovered to around $58,000 from an earlier low of $55,600, now about flat over the past 24 hours, as is ether (ETH). The broader crypto market benchmark CoinDesk 20 Index was up 1% as native tokens of Solana (SOL), Near (NEAR) and the Internet Computer Protocol (ICP) outperformed the two largest cryptos. The price action happened as the widely-followed Crypto Fear & Greed Index returned to deep "fear" territory, sinking to as low as 26 out of 100 in the past few days. The metric represents market enthusiasm towards bitcoin and other large cryptocurrencies, with zero showing extreme fear and 100 corresponding to extreme greed. "With recession fears reaching a fever pitch and crypto sentiment washed out, I believe we are at or very close to a tradable local bottom," Quinn Thompson, founder of digital asset hedge fund Lekker Capital, wrote in a Wednesday update. Thompson pointed out that the U.S.-listed bitcoin ETFs on Tuesday saw their biggest daily outflow since May 1, which interestingly corresponded to a local bottom in bitcoin's price at $56,500. BTC then rebounded 27% in three weeks to $72,000. And that's not the only time low levels Crypto Fear & Greed Index offered tactical long opportunities over the past few months. The metric fell to 25 in early July as BTC plummeted to $53,000 amid sell pressure from the German and U.S. governments and Mt. Gox distributions. Prices then climbed 32% to nearly $70,000 by the end of the month. The early August crash to $49,000 pushed the index into the extreme fear zone of 17, subsequent to which bitcoin rebounded 32% to $65,000 in three weeks. Despite a potential bounce, the longer term outlook for digital assets are still murky as growing concerns about the U.S. labor market and a potential recession concur with the Federal Reserve's forthcoming interest rate cuts. Bitfinex analysts said bitcoin could fall to around $40,000-$50,000 in a bearish, recessionary scenario following rate cuts. https://www.coindesk.com/markets/2024/09/04/bitcoin-posts-negligible-bounce-but-extreme-fear-suggests-larger-rebound-in-store/