2024-01-12 08:00

Bitcoin's experience cautions traders against betting bullish on volatility on the day of the ETF approval. Bitcoin’s implied volatility has crashed since the SEC’s approval of spot ETFs, a lesson for volatility traders as the focus shifts to ether ETF optimism. Traders looking for clues on how ether may perform ahead of and following the potential ETF launch later this year may want to track how options are priced. Nearly a dozen spot bitcoin (BTC) exchange-traded funds (ETFs), assets that invest in the actual token, began trading in the U.S. on Thursday. The highly-anticipated investment products came into effect after years of wait as the Securities and Exchange Commission (SEC) approved them on Wednesday. While several things happened in the weeks leading up to their debut, some related to implied volatility and the options market are worth noting as speculators look at ether (ETH) as the next likely candidate for a spot ETF approval. Implied volatility represents investors' expectations of price turbulence and positively impacts the prices of call and put options. A call allows buyers to profit from or hedge against price rallies, while a put offers protection against price slides. When facing a binary event such as the earning’s date in a stock or the SEC’s decision on spot ETF applications, traders tend to buy options to build a “long vega” position that benefits from increases in implied volatility. The strategy, however, exposes traders to a potential post-event crash in volatility and the resulting slide in options prices. That’s precisely what happened in the bitcoin market, a lesson for ether traders that holding a long volatility exposure on the day of the ETF announcement may be risky, according to crypto quant researcher Samneet Chepal. "It’s a sea of red for vols right now. Something to remember with the ETH ETF story unfolding. Price action usually ramps up well before the big day, but volatility often spikes just as the event draws closer. By the time of the actual announcement, being net long vol might not be ideal,” crypto quant researcher Samneet Chepal said on X. “For the ETH ETF, considering a short vega (vol) position could be viable as we’ve been down this road with the BTC ETF, giving us a bit of insight into what might be coming up,” Chepal added. While bitcoin’s price began rallying on ETF optimism in early October, the annualized seven-day implied volatility kicked into high gear this month, reaching 96% ahead of the SEC’s approval. But since then, it has collapsed to 52%. Focus on options pricing Bitcoin rallied over 60% in the three months leading up to the ETF launch. Still, the consensus view early this week dismissed the possibility of a sell-the-fact pullback following the Jan. 10 launch, calling an unabated rally. Options, however, warned of a post-approval cooling period. Early this week, bitcoin puts began trading at a premium to calls, in a sign of sophisticated market participants seeking protection against price drops. Bitcoin rose from $46,000 to above $49,000 after the spot ETFs began trading Thursday. However, the pop was short-lived, and prices have retreated to nearly $46,000 since then. Therefore, traders may want to keep track of how ether options are priced as they speculate on the potential launch of an ether spot ETF. Several firms have filed applications for spot ether ETFs, including BlackRock, in November 2023. The earliest deadline for approvals is in May for VanEck’s ETF, followed by BlackRock’s in August. https://www.coindesk.com/markets/2024/01/12/bitcoin-etf-debut-serves-as-a-lesson-for-ether-etf-speculators/

2024-01-12 06:39

Bitcoin ETFs clocked up some $4.6 billion in volumes on their first day, but market volatility hit futures speculators as prices whipsawed. The debut of bitcoin (BTC) exchange-traded funds (ETFs) in the U.S. did not turn out to be an outright sell-the-news event as some expected but still impacted $80 million in both long and short bitcoin futures bets as prices rose rapidly and retreated. Shortly after the first ETFs started trading, bitcoin prices climbed to over $49,000 briefly – igniting bullish sentiment and levered bets amid the sudden spike. That drove prices of various majors, such as ether (ETH) and Solana’s SOL, up as much as 10% within hours. However, bitcoin reversed course as the initial euphoria wore off, and market observers stated the hundreds of millions in volumes driven by Grayscale’s bitcoin ETF were likely driven by sellers. Prices fell to as low as $45,700, or the level before the ETFs started to trade, and have not broken above the $47,000 mark since late Thursday. The Grayscale bitcoin ETF is an uplisting of Grayscale’s now-defunct bitcoin trust product – which held a certain amount of spot bitcoin in each share and had traded at a holdings-to-share value discount for all of 2023. Such a price whipsaw caused both long and short bitcoin futures traders to get liquidated amid the confusing price action. Nearly $40 million worth of bitcoin in either direction was impacted for a total of $83 million, with the most on the crypto exchange Binance. A slide in bitcoin prompted similar price action in other futures products, amounting to over $230 million in liquidation losses – meaning traders lost a significant amount even as the overall market remained flat over the past 24 hours. Liquidation refers to when an exchange forcefully closes a trader’s leveraged position due to a partial or total loss of the trader’s initial margin. It happens when a trader is unable to meet the margin requirements for a leveraged position (fails to have sufficient funds to keep the trade open). https://www.coindesk.com/markets/2024/01/12/bitcoins-wall-street-debut-ends-in-tears-for-futures-traders-leads-to-83m-liquidations/

2024-01-12 05:26

The former CEO of Terra is being held in Montenegro after being caught in Podgorica's airport with falsified documents. Counsel representing Do Kwon, the former CEO of Terra, has asked a U.S. court to delay the Securities and Exchange (SEC) trial against him and his former company as he does not know when he will be extradited from Montenegro. In a filing first spotted by Inner City Press, his counsel said that extradition proceedings in the country are not going as quickly as planned, and they do not think their client will be in the U.S. until February or March at the earliest. Should the Court decline to postpone the trial, Kwon’s counsel asks that the jury be instructed that his absence and inability to testify be viewed as “not unduly prejudicial to him.” The trial is currently scheduled to begin at the end of January. Kwon’s extradition process has been delayed as his counsel has successfully appealed a Montenegro high court’s decision to extradite him to the U.S. or South Korea, with the Appeals Court ordering a retrial due to procedural issues. In the U.S., Kwon and the SEC have both filed for summary judgment in their legal dispute, each asking a federal judge to decide in their favor without a trial, arguing that the opposing party has not substantiated their case sufficiently. https://www.coindesk.com/policy/2024/01/12/do-kwon-tries-to-delay-secs-terraform-trial-so-he-can-attend/

2024-01-11 22:18

The banking giants' decisions contrast with Vanguard's decision to bar customers from buying bitcoin ETFs. UBS, the Zürich-based banking giant, will let some clients who desire to trade bitcoin ETFs do so, subject to some conditions, according to a person familiar with the matter. The conditions, according to the person close to UBS who asked to not be named, include: UBS cannot solicit the trades and accounts with a lower risk tolerance won't be able to buy them. A UBS spokesperson declined to comment. Citigroup, meanwhile, “currently provides our institutional clients with access to the recently approved Bitcoin ETFs from an execution and asset servicing perspective," a spokesperson told CoinDesk Thursday. The New York-based global bank is "evaluating the products for individual Wealth clients.” Bitcoin ETFs debuted to enormous excitement on Thursday, with billions of dollars worth traded on the first day they were available. Vanguard, the large U.S.-based investment firm, said Thursday it would not let customers trade them. There were unconfirmed rumors earlier in the day that UBS and Citi might join Vanguard in not offering them. Some of the largest names in finance are offering bitcoin ETFs, including BlackRock, Fidelity and Invesco. And Charles Schwab, the large U.S. brokerage, confirmed to CoinDesk on Thursday that it will let clients trade them. Optimists believe bitcoin ETFs will dramatically broaden the investor base for bitcoin, since buying ETFs is easier than purchasing bitcoin itself. https://www.coindesk.com/business/2024/01/11/ubs-will-let-some-customers-trade-bitcoin-etfs-contrary-to-rumors-source/

2024-01-11 19:22

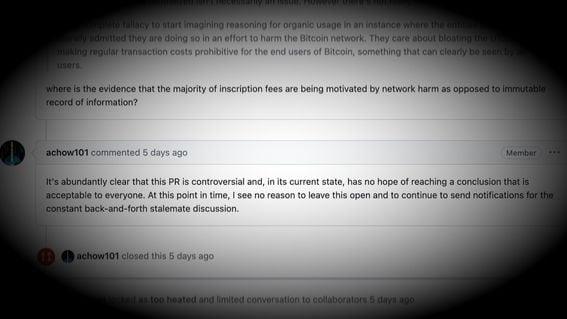

"All it was doing was generating noise," the Bitcoin Core maintainer Ava Chow says of Luke Dashjr's pull request, which would have severely curtailed the use of Ordinals inscriptions, sometimes known as "NFTs on Bitcoin." This week CoinDesk recounted the saga of Bitcoin developer's Luke Dashjr's proposal to amend key open-source software in a way that would have severely curtailed the use of data-oriented applications like Ordinals inscriptions – sometimes referred to as "NFTs on Bitcoin." Several days ago, as detailed in the piece, Ava Chow, a Blockstream developer who serves as a maintainer of the popular Bitcoin Core software – think of the position sort of like a glorified moderator or even a high priest or priestess – abruptly shut off discussion of the proposal on the GitHub platform. We sent Chow a series of questions and did not hear back before that article went to press. Chow subsequently came back to us with a pretty detailed response by email. She requested: "If you quote any of the following, I ask that you use the statements in full and with context." Typically we don't have space to include such responses in their entirety, and we also try to distill information for the benefit or our readers. In this case, we're making an exception – because the matter goes right to the heart of the governance of the Bitcoin blockchain and the thrust of the main question raised in our original article: Who gets to decide which transactions are appropriate for the $900 billion blockchain, and which ones aren't? It's the kind of existential question that all the new investors in bitcoin ETFs might need to ground themselves in at some point. Below are Chow's verbatim responses to our questions regarding her decision to close the proposal, technically known as a "pull request" or PR: We were wondering if you had any comments on why you closed the pull request? Chow: As I said in the comment I left when closing the PR, it was obviously controversial and had no hope of reaching a conclusion acceptable to everyone. PRs that are unlikely to achieve (rough) consensus for merging should be closed. The PR was additionally locked since all it was doing was generating noise. Bitcoin Core uses GitHub for code collaboration and it is essentially the developers' place of work. When someone makes a bold claim on twitter that angers people, and then encourages them to leave comments on GitHub, they end up disrupting the developers. These comments often contain accusations of bad faith, poorly informed statements about the code, and demands for the developers to make major changes, which drag the developers into arguments in order to defend themselves and correct misconceptions. Since there are commenters in favor of both sides, there were also discussions amongst them that did not involve the developers at all, but still sent a notification to everyone. Overall, this has a negative effect on productivity, results in a more toxic environment, and drives away developers from their place of work. Was this a decision you took independently or did it follow discussions behind the scenes with other Bitcoin Core contributors/maintainers? Chow: The decision to close it at that time was made independently by myself. It was done after reading review comments from several long time contributors that NACK'd the PR and also suggested that it should be closed. These review comments provided technical criticisms that generally concluded that the PR in its current state was not a good idea and was potentially harmful. We were curious if you have received any backlash and/or comments behind the scenes following the decision to close that PR? Chow: Yes. As with any other controversial PR, there are two camps within the wider Bitcoin community – one for merging and one against. Any action taken with the PR will of course result in both camps expressing their feelings on that action. This is expected. Dashjr has asserted that the PR was “inappropriately” closed – curious if you might have a comment on that? Chow: Since I closed the original PR, I do not believe that it was inappropriately closed. Of course, everyone is entitled to their own opinion. https://www.coindesk.com/tech/2024/01/11/steward-of-bitcoin-software-explains-why-she-nixed-an-acrimonious-code-debate/

2024-01-11 18:25

An attempt to purchase BlackRock's iShares Bitcoin Trust (IBIT) and the Grayscale Bitcoin Trust (GBTC) through Vanguard failed. Vanguard, one of the largest asset managers in the world, will not be allowing customers to buy the newly approved bitcoin ETFs. An attempt to invest in BlackRock's iShares Bitcoin Trust (IBIT) or Grayscale Bitcoin Trust (GBTC) via a Vanguard retirement brokerage account generated a "trade cannot be completed" warning. "Buy orders are not currently accepted for this security," the message said. "Securities may be unavailable for purchase at Vanguard due to a number of variables including regulatory restrictions, corporate actions, or various trading and/or settlement limitations." A Vanguard spokesperson told CoinDesk that "spot Bitcoin ETFs will not be available for purchase on the Vanguard platform" and that it has no plans to offer Vanguard Bitcoin ETFs or other crypto-related products. The spokesperson said the reason behind this decision is that crypto-related products don't align with the asset manager's focus on asset classes that "build blocks of a well-balanced, long-term investment portfolio." The Block reported Vanguard's plan to block bitcoin ETFs earlier. Vanguard's unfriendliness contrasts with the embrace of bitcoin ETF by some of the company's largest rivals, including BlackRock, Fidelity and Invesco, which have created bitcoin ETFs that started trading Thursday. They won U.S. Securities and Exchange Commission permission to do so on Wednesday. Charles Schwab, another brokerage, confirmed Thursday that it's letting customers trade bitcoin ETFs. Update (Jan. 11, 2024, 19:07 UTC): Added statement from a Vanguard spokesperson. https://www.coindesk.com/business/2024/01/11/investment-giant-vanguard-blocks-clients-from-buying-bitcoin-etfs/