2024-09-04 16:42

"We don't wish the burden of unnecessary subpoenas on anyone," a spokesperson for Uniswap told CoinDesk. New York State Attorney General Letitia James has joined a regulatory offensive against cryptocurrency trading platform Uniswap, according to internal communications regarding the NYAG subpoenas seen by CoinDesk and two people who are familiar with the situation. Over the course of last month, subpoenas from James' office were sent to some venture capital firms that have invested in decentralized-finance giant Uniswap, including Andreessen Horowitz (widely known as a16z) and Union Square Ventures, the two sources said. A spokesperson for Uniswap said via email: "Uniswap Labs is a proud 'Made in New York' pioneer of DeFi technology, which offers a path for all of us to better, fairer access to financial services. We don't wish the burden of unnecessary subpoenas on anyone. But we welcome dialogue any time with any government agency or elected official about the future we can build together when we champion responsible DeFi innovation, especially in our home state." The NYAG's office and Union Square Ventures did not respond to a request for comment, while a16z declined to comment. Separately, on Wednesday, the U.S. Commodity Futures Trading Commission (CFTC) ordered Uniswap Labs to pay a $175,000 civil monetary penalty and to cease and desist from violating the Commodity Exchange Act, the agency said in a press release. U.S. regulators have targeted the cryptocurrency sector, particularly since the collapse of FTX and other crypto firms in 2022. The Securities and Exchange Commission sent Uniswap a so-called Wells notice in April 2024, which claimed the DeFi platform was acting as an unregistered securities broker and unregistered securities exchange. The SEC also reportedly recently sent letters regarding Uniswap to a16z and Union Square Ventures. Attorney General James has previously gone after crypto players such as Genesis, Gemini and Digital Currency Group, as well as CoinEx, KuCoin and Celsius founder Alex Mashinsky. "Letitia James seems to be following in the footsteps of SEC Chairman Gary Gensler, using crypto as a political punching bag," said one person who had seen the subpoenas, under the condition they would remain anonymous, voicing a widespread concern among crypto players about some politicians' view of the industry. https://www.coindesk.com/policy/2024/09/04/vc-giants-a16z-union-square-ventures-get-subpoenaed-by-new-york-about-uniswap-sources/

2024-09-04 15:54

The team could get 70% of World Liberty Financial's tokens, a significantly higher-than-normal allocation from a project marketed as a solution to the “rigged” traditional finance system. A whopping 70% of Trump-backed World Liberty Financial's WLFI tokens will be reserved for the project's insiders, according to a white paper draft obtained by CoinDesk. Of the remaining 30% of the tokens distributed via a public sale, the founding team will also receive a portion of the proceeds. When asked if a 70% allocation to insiders is high, one source who advises projects on such matters replied, "LMAO. Nice joke, ser." World Liberty Financial, the new crypto lending platform promoted by former U.S. President Donald Trump and his sons, advertises itself as a way of "putting the power of finance back in the hands of the people" and a solution to the "rigged" traditional finance system. CoinDesk has obtained a draft white paper for the project. It reveals that the vast majority of the power promised by World Liberty Financial will be concentrated in the hands of a select few insiders: 70% of WLFI, the project's "governance" crypto token, will be "held by the founders, team, and service providers." The remaining 30%, according to the white paper, will be distributed "via public sale," with some of the money raised from that also going to project insiders – though some will be reserved in a treasury "to support World Liberty Financial's operations." A 70% allocation to insiders is unusually high. Ethereum's Genesis block reserved a combined 16.6% of ether (ETH) for the Ethereum Foundation and early contributors (though co-founder Vitalik Buterin later said they received even less). The three companies behind Cardano, another popular blockchain project, retained a combined 20% of ADA at its launch. Satoshi Nakamoto, the pseudonymous creator of Bitcoin, is estimated to hold a little over 5% of the total supply. Asked if a 70% allocation to insiders is high, one source who advises early stage projects replied: "LMAO. nice joke ser." World Liberty Financial has not finalized its plans yet, according to a person close to the project. "The team is working with a lot of contributors, and we're not quite sure which version [of the white paper] you are referring to at the moment, but they have not finalized their tokenomics yet," according to a statement from World Liberty Financial. "All the information we've shared so far that is final/approved can be found on WLF's Twitter (X) and Telegram. Those will be the main channels for any announcements." The token details from the draft white paper follow a CoinDesk report Tuesday about World Liberty Financial, which revealed that the project's team includes members of the Trump family plus people behind a recently hacked crypto app. CoinDesk also reported that World Liberty Financial will be built atop Aave, the popular Ethereum-based lending platform. World Liberty Financial's allocation raises the question of whether the project is an attempt to cash in on the Trump family's fame rather than build a novel DeFi platform. Pre-sale proceeds have historically been largely invested back into projects, to grow them. If insiders plan to hoard most of the World Liberty Financial money for themselves, how will it deliver on its lofty promises? One of those lofty promises is to make the U.S. the "crypto capital of the planet." In a Wednesday Telegram post, the World Liberty Financial team advised skeptics that its "plan will speak for itself. The brightest minds in crypto are backing us, and what's coming will make all doubters think twice." "Our mission is crystal clear: Make crypto and America great by driving the mass adoption of stablecoins and decentralized finance," the post added. "We believe that DeFi is the future, and we're committed to making it accessible and secure for everyone. In general, public token pre-sales are rare in today's crypto industry, largely because initial coin offerings (ICOs) – which were once the preferred method for crypto startups to raise funds by selling tokens directly to investors – have fallen out of favor. This shift occurred due to increasing regulatory scrutiny, widespread fraud and the emergence of alternative fundraising models that offer more oversight and investor protections. World Liberty Financial's approach differs from a traditional ICO, however, because the WLFI token will be non-transferable, meaning it cannot be traded between users. This restriction is likely intended to protect World Liberty Financial from securities law violations. WLFI token that can't be transferred According to the white paper, "All $WLFI will be non-transferable and locked indefinitely in a wallet or smart contract until such time, if ever, $WLFI are unlocked through protocol governance procedures in a manner that does not contravene applicable law." It continues: "Each purchaser of $WLFI will be screened to ensure that no specially designated nationals or other persons sanctioned by FinCen are permitted to purchase $WLFI." "FinCen" seems to be a mistaken reference to the Office of Foreign Assets Control, or OFAC, a U.S. Treasury Department office that's distinct from the Financial Crimes Enforcement Network (FinCEN). Earlier this week, CoinDesk revealed World Liberty Financial's links to Dough Finance, a recently hacked lending app whose founders include Zak Folkman, a former pick-up artist and entrepreneur who is officially registered as the owner of World Liberty Financial LLC. While Donald Trump appears to hope that World Liberty Financial could help him earn favor with the blockchain industry, even some of the former president's supporters in the industry are warning that the plan could backfire. "Is there something that we, as crypto twitter, can collectively do to stop the launch of world liberty coin," Nic Carter, a prominent crypto industry figure and Trump supporter, asked on X (formerly Twitter). He added: "I think it genuinely damages trump's electoral prospects, especially if it gets hacked (it'll be the juiciest DeFi target ever and it's forked from a protocol that itself was hacked). it's also an obvious target for the SEC. at best it's an unnecessary distraction, at worst it's a huge embarrassment and source of (additional) legal trouble. so are we signing a petition or what?" Ahead of its launch, the project has attracted the attention of fraudsters and hackers. Yesterday, the X accounts of Eric Trump's wife Lara Trump and Trump's youngest daughter Tiffany Trump were hacked and used to promote a crypto scam crafted to look like World Liberty Financial. Donald Trump is officially listed as the project's "Chief Crypto Advocate." His two oldest sons, Don Jr. and Eric, share the role of "Web 3 Ambassador." Barron Trump, the former president's 18-year-old son, is World Liberty Financial's "DeFi Visionary." Though the Trump family appears to have been heavily involved in the promotion and inception of the project, the white paper takes pains to distance the project from any political affiliation, stating: "World Liberty Financial is not owned, managed, operated, or sold by Donald J. Trump, the Trump Organization, or any of their respective family members, affiliates, or principals. However, they may own $WLFI and receive compensation from World Liberty Financial and its developers. World Liberty Financial and $WLFI are not political and have no affiliation with any political campaign." Danny Nelson contributed reporting to this story. https://www.coindesk.com/business/2024/09/04/in-trump-backed-crypto-project-insiders-are-poised-for-unusually-big-paydays/

2024-09-04 15:42

ZKB’s new service also allows other Swiss banks to offer customers the trading and custody of cryptocurrencies, with Thurgauer Kantonalbank being the first partner bank to use the service. Swiss retail customers of the country’s largest cantonal bank now have the ability to buy, sell and hold the two most popular digital assets: bitcoin and Ethereum. ZKB is handling the custody of crypto-assets a service that can be offered to other Swiss banks. The fourth-largest bank in Switzerland, Zürcher Kantonalbank (ZKB), has begun offering retail customers the ability to buy, sell and hold the two most popular cryptocurrencies: bitcoin (BTC) and Ethereum (ETH). Thanks to a collaboration with Deutsche Börse-owned digital assets broker Crypto Finance, customers of the cantonal bank will have access to BTC and ETH through ZKB’s existing Mobile App, eBanking, and other established channels, the companies said in a press release Wednesday. Switzerland is ahead of the curve when it comes to digital assets, with many financial institutes offering customers ability to trade crypto in the country. ZKB is also no stranger to crypto innovation, as the bank was involved in the issuance of the world's first digital bond on Switzerland's SIX Digital Exchange (SDX) back in 2021. “When it comes to cryptocurrencies, Zürcher Kantonalbank takes on the critical function of securely storing the private keys. Customers and third-party banks therefore do not need their own wallet and therefore do not have to worry about storing their own private keys. Zürcher Kantonalbank takes care of both,” said Alexandra Scriba, head of institutional clients and Multinationals at Zürcher Kantonalbank, in a statement. ZKB’s new service allows other Swiss banks to offer customers the trading and custody of cryptocurrencies, with Thurgauer Kantonalbank being the first partner bank to use the service. Watch: Breaking Down the Crypto Scene in Switzerland https://www.coindesk.com/business/2024/09/04/switzerlands-fourth-biggest-bank-zkb-offers-retail-customers-bitcoin-and-ether/

2024-09-04 14:47

The next bail hearing has been scheduled for Oct. 9. A Nigerian court deferred a decision on a bail application by Tigran Gambaryan, crypto exchange Binance's head of financial compliance. Gambaryan's lawyer filed a new application for bail on medical grounds on Monday. A Nigerian court deferred a decision on a bail application by Binance's head of financial compliance, Tigran Gambaryan, whose health has been worsening since he was jailed earlier this year, a family spokesperson told CoinDesk. The next bail hearing has been scheduled for Oct. 9. Gambaryan's lawyer filed a new application for bail on medical grounds on Monday. Gambaryan's lawyer told the court that the executive has needed surgery since July 18 and requires urgent assistance that cannot currently be provided, Bloomberg reported. The executive was seen limping into court on Monday after being denied a wheelchair. While in prison he has developed malaria, pneumonia, tonsillitis and complications from a herniated disc in his back, which left him nearly unable to walk. https://www.coindesk.com/policy/2024/09/04/nigerian-court-postpones-decision-on-gambaryan-bail-application/

2024-09-04 13:00

The crypto exchange was previously dropped by auditing firm Mazars which had been helping the firm with a proof-of-reserves report. Binance has tapped U.K.-based accounting firm grant Thornton to advise the exchange on accounting and tax matters. The firm will also help Binance prepare for an audit. Binance previously worked with auditing firm Mazars which paused its work with the exchange in December 2022. Binance has hired U.K.-based Grant Thornton's Singapore devision to advise on accounting and tax matters, it announced Wednesday. The crypto exchange previously worked with auditing firm Mazars to produce a proof-of-reserves report for crypto clients, however, Mazars in December 2022 said it had paused work with Binance and other crypto clients amid concerns over the public’s misunderstanding of those reports. Grant Thornton, which previously worked with stablecoin issuer Circle, will help Binance navigate matters related to technical accounting, financial reporting, audit preparedness and tax matters, a Binance spokesperson said. After the collapse of former crypto exchange FTX, the crypto industry increasingly demanded exchanges provide regular proof-of-reserves to ensure that they indeed had the assets that they claimed to hold. But proof-of-reserves only shows a snapshot of an exchange’s balance sheet at a given time, leaving possible loopholes for companies, which Mazars claimed to be the reason behind it pausing its work on those reports. Clients are now asking crypto exchanges to provide real financial audits. According to Binance, Grant Thornton will help the exchange to prepare for such an audit, but will not act as the exchange’s auditor. https://www.coindesk.com/business/2024/09/04/binance-hires-uk-accounting-firm-grant-thornton-to-advise-on-audits/

2024-09-04 11:17

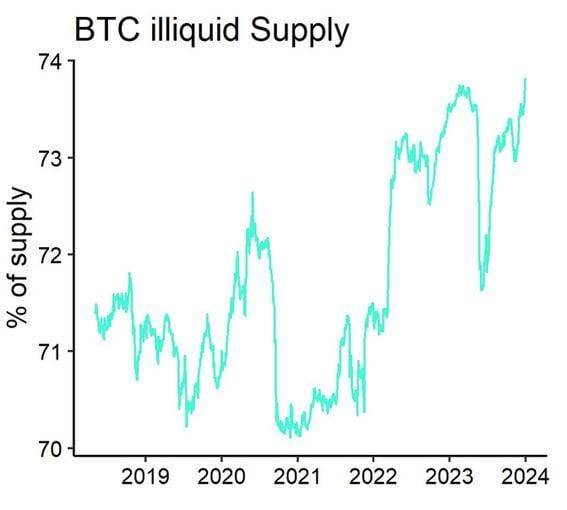

According to ETC Group, the new high is a sign that the halving-induced supply shock is intensifying. The illiquid bitcoin has risen to a record high of 74% of the circulating supply. The level reflects the increasing scarcity of BTC in the market and a potential bullish impact on its price. Almost three-quarters of bitcoin produced is considered illiquid, a record level that suggests increasing scarcity of the cryptocurrency in the market and a potential bullish impact on its price. Data tracked by ETC Group and Glassnode shows that illiquid entities now own 14.61 million BTC, worth over $826 million at current prices, equating to 74% of the cryptocurrency's total circulating supply of 19.75 million. "Bitcoin's illiquid supply reached a new all-time high of almost 74% of circulating supply according to data provided by Glassnode, signaling that the Halving-induced supply shock is actually intensifying. This should provide an increasing tailwind for Bitcoin and other crypto assets over the coming months," André Dragosch, head of research at ETC Group, said in a report shared with CoinDesk. Glassnode identifies illiquid entities based on the ratio of cumulative outflows and inflows over the entity's lifespan. Increasing BTC scarcity in the market means a pick-up in demand could have an outsized bullish impact on the cryptocurrency's going market rate. As of writing, BTC was changing hands at $56,600. The bull run has stalled since prices hit lifetime highs above $70,000 in the first quarter. https://www.coindesk.com/markets/2024/09/04/illiquid-bitcoin-entities-now-control-record-74-of-btcs-circulating-supply/