2023-12-18 11:51

EU-wide blockchain services could support the bloc’s pursuit of digital sovereignty, Mathieu Michel told CoinDesk. Belgium is set to take on the presidency of the EU Council, which gathers government ministers from member states. During its six-month presidency, Belgium's Digital Minister Mathieu Michel plans to gather political support for an EU-wide blockchain initiative. Belgium will give Europe’s ambitious blockchain initiative a political push when it takes the EU Council presidency in January, the country’s digital minister said in an interview with CoinDesk. Mathieu Michel has already shared his grand vision for an EU-wide digital infrastructure that – at the very least – could store records such as driving licenses and property titles on a common blockchain controlled by the bloc’s governments. Key to that plan is the European Blockchain Services Infrastructure (EBSI) initiative, which began in 2018 as a technical project. Michel said the goal is to rev up political support for it during Belgium’s six-month Council presidency and that eight member states are already on board. “In the coming months, what we will do is to propose to other European countries to be involved in the project or to use the project for application,” Michel said. The Council gathers government ministers from the European Union’s 27 member states and is the bloc’s highest political entity. Prolific regulation According to Michel, artificial intelligence and blockchain technology applications could be key to the EU’s pursuit of digital sovereignty, encompassing control over data and authority over cyberspace. When it comes to guardrails for the digital space, the EU has been prolific in recent years, introducing legislative plans for everything from crypto to artificial intelligence, data sharing, a digital euro and even the metaverse. In fact, with the Markets in Crypto Asset (MiCA) regulation finalized this year, the bloc is set to become the first major jurisdiction in the world to have a comprehensive regime for the digital asset space. Enough regulation, Michel says. Now, it’s time for Europe to put those digital innovations to good use. EU countries were told in 2020 how to join the EBSI blockchain network by setting up their own nodes. But to avoid data silos, applications built on it should be interoperable across member states – something Michel said blockchain can help achieve. “We are really bringing a lot of attention to privacy, but also transparency, control of the data. And with the blockchain, there is a technical aspect that can bring us that. And that's really, for example, the interoperability between the application in France, Italy and Spain,” Michel said. To be first Inviting political scrutiny to a technology project isn’t going to be a walk in the park. The EU’s big plans for a digital version of the euro have faced opposition from lawmakers in the bloc who are concerned about privacy implications and the expansion of government control. Michel assures a unified blockchain infrastructure won’t be designed to collect any new data from citizens. “Today, a lot of governments have data of the people, of the citizens. What we are talking about is a little bit of a paradigm shift,” he said, adding that the shift is in the way the government offers that data back to citizens. It’s not mandatory to use blockchain, especially if it’s not going to help, Michel said, noting there is also a chance that blockchain tech could be replaced by something else altogether. Quantum computing, which promises ultra-fast problem-solving but is still some distance from coming to fruition, is already viewed as an existential threat to blockchain. But that doesn’t mean the EU shouldn’t try, according to Michel. “If you look at the sovereignty of Europe, we were not the first at connectivity. We were not the first in cloud services. Here, with blockchain technology, we could try to be the first,” Michel said. “If we are not in advance, it means that we are already too late,” he added. https://www.coindesk.com/policy/2023/12/18/belgium-to-push-european-blockchain-network-during-eu-council-presidency-digital-minister-says/

2023-12-18 09:36

Asset values for creditor claims will be calculated at prices on the day FTX filed for bankruptcy in November 2022, the plan says. The estate of the collapsed crypto enterprise FTX submitted a proposal to end bankruptcy with a Delaware court, a filing from Saturday shows. The exchange founded by Sam Bankman-Fried imploded in November 2022 shortly after CoinDesk reported on the shaky balance sheet of the firm's trading unit, Alameda. The bankruptcy plan was expected by Dec. 16 following earlier informal proposals, which included plans to return up to 90% of creditors' recovered funds. In the new proposal, creditor and customer claims are classed according to the priority the estate plans to give them, and the value of claims will be calculated based on asset prices as of the date the company filed for bankruptcy. In a separate statement, the estate said the plan was designed to "maximize and efficiently distribute value to all creditors." As in other high-profile crypto bankruptcy cases, the plan is likely to face opposition from various creditor groups until it's approved by the court. A hearing date will be set in 2024. https://www.coindesk.com/business/2023/12/18/ftx-files-reorganization-plan-to-end-bankruptcy/

2023-12-18 09:13

Bored Ape Yacht Club and Mutant Ape Yacht Club NFTs were returned to their owners after Yuga Labs' Greg Solano and Boring Security DAO paid a bounty. Nansen’s NFT-500 and Blue-Chip-10 indexes were stable after nearly $3 million worth of non-fungible tokens (NFTs) were stolen from trading platform NFT Trader. The Nansen NFT-500 index is down 0.88% when denominated in ether (ETH), while the Blue Chip 10 index is down 0.51%. Nearly $3 million in NFTs were stolen in the hack, with the attacker demanding a ransom of 120 ETH ($260,000) for their return. A community effort organized by the decentralized autonomous organization (DAO) Boring Security led to the recovery of nearly all of the stolen collection after Yuga Labs’' Greg Solano contributed to a bounty. DAOs are organizations that are governed by code instead of leaders. NFTs are crypto assets that grant gamers and collectors ownership over their digital items. While the hack didn’t cause much fluctuation in the market, Nansen’s NFT-500 index is down 49% year-to-date in ether value, while its Blue Chip 10 index is down 45%. Meanwhile, ether is up nearly 80% year-to-date. https://www.coindesk.com/markets/2023/12/18/major-nft-indicies-stable-after-nft-trader-hack/

2023-12-18 09:05

There was a growth of regulated, centrally-cleared derivatives venues this year, the report said. Historically, cryptocurrency markets have been dominated by unregulated trading venues and retail investor activity. Still, this year shows how much market structure and participation has evolved and become institutionalized, Goldman Sachs (GS) said in a report last week. The crypto market saw a growth of regulated, centrally-cleared derivatives venues in 2023, including Coinbase Derivatives, CBOE, Eurex, GFO-X, AsiaNext and 24 Exchange, the bank observed. “The institutionalization of the market was most evident in the derivatives market,” the report said, adding that “CME saw a consistent increase in bitcoin (BTC) and ether (ETH) futures and options trading, and in Q4 has become the top BTC futures exchange by open interest.” Goldman notes that bitcoin and ether open interest was flat for the first nine months of the year; however, “October price action brought along interest from institutional investors, who took the opportunity to position themselves for a potential spot BTC ETF approval and/or hedge exposure via derivatives.” Bitcoin’s open interest surged to over $4 billion in the fourth quarter. Open interest is the total number of outstanding derivative contracts held by investors and represents active positions. Ether futures trading continued to lag throughout the year, with volumes making up around 20%-50% of the bitcoin futures market, the note said. The expectation for the approval of a spot bitcoin ETF was also reflected in inflows into existing exchange-traded products (ETPs) and futures ETFs, which saw total net inflows of $1.9 billion in the last quarter of the year, the report added. https://www.coindesk.com/business/2023/12/18/2023-was-the-year-that-crypto-markets-became-institutionalized-goldman-sachs/

2023-12-18 07:31

The sealed and unopened phone boxes contain an airdrop of 30 million bonk tokens, which has seemingly revived dismal Saga sales. A dog-themed meme token may have just resurrected sales of Solana’s Saga phone – with some now selling for as much as $5,000 after earlier being deemed a “failure” by its makers. Several Saga phones on online marketplace eBay (EBAY) have been sold for upward of $2,000 apiece, site data shows. Most of these phones are listed as “sealed and unopened,” and their sellers are predominately from the U.S. One phone was sold for as high as $5,000, The Block earlier reported. Sales of Solana Saga phones picked up last week as some arbitrage traders appeared to be chasing a 30 million BONK token airdrop given to every phone owner. The airdrop was worth over $700 at peak last week – for a phone that costs $599. Earlier in November, the dog-themed BONK gained rapid popularity among blockchain users, spiking as much as 110% during one 24-hour period and extending 30-day gains to over 700%. That seemingly lifted the fortunes of the Saga phone, whose disappointing sales prompted uncertainty about its future previously “We haven’t seen a ton of signal whether that’s a compelling enough thing to sell 50,000 units,” Solana founder Anatoly Yakovenko said during an interview at the time. “I think 25,000 to 50,000 units to feel like there is a hardcore user base for developers to be compelled to ship applications.” The phone first went on sale earlier this year, and in August, its price was cut to $599 from $1,000. Saga has since sold out in the U.S. and European Union, Solana co-founder Raj Gokal posted last Friday. https://www.coindesk.com/business/2023/12/18/bonks-surge-send-prices-of-solana-saga-phone-flying-to-2k/

2023-12-18 06:48

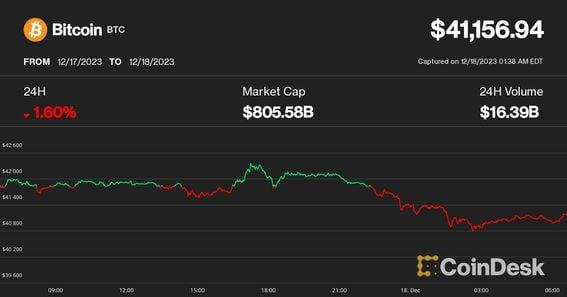

Longs continue to get liquidated as the price of bitcoin and other major digital assets gyrate. Bitcoin (BTC) opened the trading week marginally higher, trading above $41,000. Ether (ETH) was also up slightly, trading above $2,100. Data from Coinglass have been $103.5 million in liquidations of token-tracked futures in the past 12 hours, and $95 million of them have been longs, or bets on higher prices. Of the $103.5 million in total liquidations, $33 million in bitcoin positions were liquidated, with $29 million of those being long bitcoin positions. Lucy Hu, a Senior Analyst with Hong Kong-based digital asset management firm Metalpha says the broader market continues to hold up quite well despite the recent Ledger hack with rate cuts on the horizon and things like ordinals driving more interest in bitcoin. “The massive Ledger hack did swing some sentiment in the DeFi space and raises important questions on wallet security," she said in an email interview. “Besides, the stellar rise of Bitcoin Ordinals continues to fuel enthusiasm for Bitcoin miners, who have been heavily rewarded. We expect the long-term growth momentum of Bitcoin to remain on track." Predictions still optimistic Despite bitcoin’s current correction phase, end-of-year predictions for 2024-2025 still remain optimistic, especially when compared to last year's dour predictions of $10-12k bitcoin. In a recent end-of-year report, Woo Network targets a $75K price point for BTC for “early 2024.” Bitwise, has a similar price target, with the fund predicting that bitcoin will trade above $80,000. “Spot bitcoin ETFs will be approved, and collectively will be the most successful ETF launch of all time," Bitwise also predicted. "Coinbase’s revenue will double, beating Wall Street expectations by at least 10x." Memecoins clogging up Layer-1s Gas fees are spiking on Ethereum and many layer-1 chains, such as Avalanche, as dozens of new meme coins flood the market. Avalanche has generated $5 million in fees over the last 24 hours, while Ethereum, with its significantly larger market cap, has generated $13.52 million. Arbitrum and Optimism have also seen a large spike in gas fees during the last week. Some of these layer-1 tokens declined faster than bitcoin or ether, with AVAX down 6% and Solana’s SOL token down 4%. https://www.coindesk.com/markets/2023/12/18/bitcoin-dips-under-41k-to-begin-the-week-in-red-as-memecoin-ordinals-frenzy-clogs-up-blockchains/