2023-12-12 03:36

The bonds are expected to launch in Q1 of 2024, several posts amplified on social platform X by President Nayib Bukele suggest. El Salvador’s long-planned bitcoin (BTC) bonds have inched closer to reality after apparently receiving regulatory approval for an early 2024 issuance, the country’s bitcoin-focused office posted on Tuesday. The bonds are set to be offered on Bitfinex Securities, a regulated division of crypto exchange Bitfinex. “The Volcano Bond has just received regulatory approval from the Digital Assets Commission (CNAD),” El Salvador’s National Bitcoin Office posted from its X handle. “We anticipate the bond will be issued during the first quarter of 2024.” President Nayib Bukele apparently confirmed the approval on X, posting “Wen volcano bond?” early Tuesday and reposting several posts that said the bonds would be issued in Q1 2024. The so-called “Volcano bonds” were announced in 2021 by President Nayib Bukele shortly after he passed a law recognizing bitcoin (BTC) as legal tender in the country. Bukele’s target was to raise $1 billion via the bitcoin-backed bonds – seeding a bitcoin mining industry reliant solely on renewable energy, including that generated by the country’s active volcanos. Issuance was initially planned for March 2022 but was postponed several times. However, the digital assets bill was finally introduced in the Legislative Assembly at the end of November 2022, where Bukele’s party, Nuevas Ideas, has a large majority. Sixty-two legislators voted for the law today, and 16 voted against it, and the law was finally passed in January 2021. The development is the second major bitcoin-focused move in as many weeks. Earlier, El Salvador kickstarted its "Freedom VISA" program, doling out residency to a maximum of 1,000 people annually who invest at least $1 million worth of bitcoin or tether (USDT) stablecoins. https://www.coindesk.com/markets/2023/12/12/worlds-first-bitcoin-bonds-receive-regulatory-approval-in-el-salvador/

2023-12-12 02:22

“Due to the rise of Ordinals and Bitcoin L2s, there are reasons to be bullish on the Bitcoin ecosystem. We are entering an era of Bitcoin that we have never seen before,” one market watcher told CoinDesk. Monday’s trading session saw crypto futures traders lose over $500 million in liquidations positions as steep volatility impacted highly leveraged longs and shorts, with some majors dropping as much as 12%. Bitcoin (BTC) whipsawed from $43,000 to as low as $40,300, data shows, leading drops across major tokens such as Chainlink (LINK), Cardano’s ADA and Solana’s SOL, which dropped over 8% before slightly recovering. Generally riskier bets shiba inu (SHIB) and dogecoin (DOGE), two dog-themed meme tokens, fared slightly better with a 5% drop. Meanwhile, BNB Chain’s BNB, Avalanche’s AVAX, and Celestia’s TIA showed strength with gains of as much as 20% – unaffected by weakness in bitcoin. Nearly $475 million in longs, or bets on higher prices, and $73 million in shorts, or bets against, booked losses amid a general unwinding of leveraged bets as high funding rates set the stage for a shaky market environment. Data shows that most liquidations took place on OKX at $190 million, followed by Binance at $148 million and Huobi at nearly $60 million. The largest single liquidation order happened on Bitmex, a chainlink (LINK) futures position that was worth over $33 million. Liquidations occur when an exchange forcefully closes a trader’s leveraged position owing to a partial or total loss of the trader’s initial margin. It happens when a trader cannot meet the margin requirements for a leveraged position, that is, when they don't have sufficient funds to keep the trade open. Meanwhile, some market watchers told CoinDesk that bitcoin’s recent rally was backed by strong fundamentals – one that catapults it to a “never seen before” era. “Momentum has been consistently building in the Bitcoin builders space all year, and we are now seeing the markets reflect the excitement around the increased activity,” shared Muneed Ali, founder of Bitcoin development firm Trust Machines, in an email to CoinDesk. “Due to the rise of Ordinals and Bitcoin L2s, there are reasons to be bullish on the Bitcoin ecosystem. We are entering an era of Bitcoin that we have never seen before. “I expect the interest in Bitcoin to increase a lot in 2024 with potential ETF approvals, the halving event and the influx of new developers,” Ali added. https://www.coindesk.com/markets/2023/12/12/bitcoin-ether-drop-spurs-500m-in-liquidations-but-btc-entering-never-seen-before-era/

2023-12-11 21:40

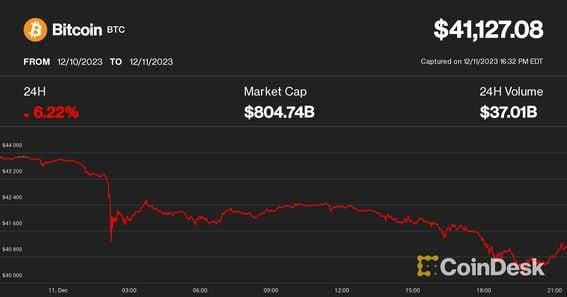

"Corrections shake out 'weak hands' and leverage, allowing for a stronger foundation for eventual moves higher," said well-followed analyst Will Clemente. Bitcoin tumbled over 7% in the worst daily drawdown since August as crypto markets cool off. Cryptocurrency prices may rally to new highs into the year-end as the pullback flushed out excess leverage and reset the market, LMAX market strategists said. Bitcoin (BTC) over the past roughly 24 hours has suffered its steepest daily drawdown in almost four months in a massive leverage wipe-out as traders were reminded of the crypto's occasional steep bull market corrections. Over the space of a few minutes Sunday evening, BTC plunged to near $40,500 from around $43,800 in what could be termed a "flash crash." Prices quickly recovered to $42,400, but then started to slide again during U.S. afternoon hours to as low as $40,200, a level it broke through on the way up a week ago. At press time, the largest crypto had bounced back above $41,000, still down nearly 7% over the past 24 hours, but on track to be the worst daily drawdown since BTC's drop below $25,000 on August 17. Ether (ETH), the second largest cryptocurrency, also tumbled over 7% in the same period to below $2,200. Most of the rest of the cryptocurrencies also suffered large declines, with Ripple-linked (XRP), dogecoin (DOGE), native tokens of Chainlink (LINK) and Cardano (ADA) nursing 8% to 12% losses during the day. Some altcoins defied the trend, with tokens of Avalanche (AVAX), Injective (INJ) and Optimism (OP) being among the very few gainers. The CoinDesk Market Index (CMI), which tracks a market capitalization-weighted basket of almost 200 digital assets, was also down over 7%, underscoring heavy declines across the board. Leverage flush Sharp drawdowns have been part of every previous bitcoin bull cycle but have been elusive in the past weeks as BTC rose nearly without pause from $27,000 to nearly $45,000 since Oct. 1. The current correction shouldn't have come as a surprise and was due to happen at some point, bitcoin-focused market analyst Will Clemente said. These pullbacks are necessary to unwind excessive leverage for a more sustainable price action, he added. "BTC just nearly doubled in 2 months with no pullbacks, a correction is not that surprising," Clemente posted. "Corrections shake out 'weak hands' and leverage, allowing for a stronger foundation for eventual moves higher." The decline wiped out over $520 million in leveraged trading positions on the crypto derivatives market, predominantly longs betting on rising prices, CoinGlass data shows. It was the largest level of daily liquidations in at least three months, according to the firm. Liquidations are forceful closure of a leveraged trading position usually because the trader's margin to cover the open position has run out. Large liquidation events often mark a local top or bottom in prices. Joel Kruger, market strategist at LMAX Group, noted that the cascading liquidations of leveraged longs intensified the current sell-off as traders faced margin calls. Additionally, a stronger U.S. dollar might have added to the crypto market weakness. He said the pullback helped cryptocurrencies come down from overbought levels, and asset prices could continue to rally to new highs. "We suspect these dips in bitcoin and ether will be eaten up rather quickly, in favor of higher lows and bullish continuations to new yearly highs,” Kruger said in an emailed note. “The outlook for crypto assets into the year-end remains bright." https://www.coindesk.com/markets/2023/12/11/bitcoin-dips-7-to-near-40k-pullback-will-be-short-lived-say-experts/

2023-12-11 21:03

The cryptocurrency's volatility cuts both ways. Bitcoin (BTC) dropped 7.5% Monday morning, its steepest intraday drop since mid-August. Bitcoin is still up over 150% this year, though the massive, sudden and unexpected “red candle” on the charts is a reminder of the largest cryptocurrency’s volatility. Last week it seemed like very little could stand in bitcoin’s way, with many of the industry’s long-standing issues seemingly resolved. So why did bitcoin drop today? It might be better to start at why it was climbing in the first place. For instance, Binance, the largest and most controversial crypto exchange, agreed to pay a $4.3 billion fine to U.S authorities to keep operating, a “historic” penalty it seems likely to survive. This settlement also cast the U.S. Securities and Exchange Commission’s (SEC) legal imbroglio with U.S.-based exchanges Coinbase and Kraken in a better light. The regulatory front in the U.S., generally speaking, also seems to be easing. If there isn’t yet “regulatory clarity,” (that old industry adage), proposals have been made by high-ranking legislators giving a good indication of what’s likely to come. There are also predictable events like Bitcoin’s scheduled “halving” next year, when the network literally cuts the amount of BTC that enters into circulation in half, and the potential the SEC approves a bitcoin ETF application. Market watchers have been talking up both events, and the ETF could be said to be the prime driver of bitcoin’s price recently. Then there are the macroeconomic forecasts. Bitcoin, which is sometimes called “digital gold” because it theoretically could act like a similar store-of-value, has rallied alongside its physical metallic counterpart. Gold futures recently settled at a record end-of-day high, in part driven by inflation concerns. Interest rates, managed by the Federal Reserve, are at their highest level yet in the 21st century, as the U.S. central bank works to quell inflation and cool an overheated economy. Many experts think the Fed’s work will soon be done, with some saying it may even retrace ground and lower interest rates in the first half of next year. Lowered interest rates are good for bitcoin in the same way it’s good for economic activity, it “makes money cheaper” by making it cheaper to borrow, which means there is more money around, period. Then, because lower interest rates makes safer investments like government bonds less attractive, by lowering the expected return on investment, that capital then has a way of working its way down the risk curve, towards asset classes like crypto. I don’t really know what explains today’s “flash crash,” which began with a market correction on Sunday night. Crypto-related stocks like MARA and RIOT dropped double digits today even as tech-heavy equities exchange Nasdaq is on track to gain on the day. Many, like VDX research lead Greta Yuan, looked to macro forces. On Friday, there was a stronger-than-expected jobs report and the Wall Street Journal’s “Fed Whisperer” Nick Timiraos forecasts that the Fed itself aims to cut rates in 2024. The “minor adjustment” could be explained by “better-than-expected nonfarm payroll and lower unemployment," she said. Meanwhile, Lucy Hu, a Metalpha senior analyst, told CoinDesk last night it could be part of a “rational process of profit-taking,” meaning that traders essentially made as much as they wanted and decided to cash out. CoinDesk’s market watcher Omkar Godbole called funding rates in crypto derivatives “overheated.” While the amount of leverage in crypto derivatives markets may not explain the first mover problem of knowing what, if anything, caused a market correction, it certainly does help explain how an asset could drop so far so quickly. Godbole also used phrases like “excess bullish leverage” and “overcrowding of long positions.” When traders are overleveraged, they’re essentially trading borrowed money. That means that they’re helping to inflate asset prices with capital that doesn’t really exist and also that if prices drop they can be wiped out (aka liquidated) with a far bigger impact on the wider market. Leverage is great until it isn’t. What this also means is, for better or worse, the amount of leverage has also been reset to something healthier. And let it be a lesson to you, dear reader, that in crypto, especially when everything seems to be working in your favor, that prices can swing on a hiccup. So be sane, and recognize that volatility cuts both ways… https://www.coindesk.com/consensus-magazine/2023/12/11/explaining-bitcoins-flash-crash/

2023-12-11 18:55

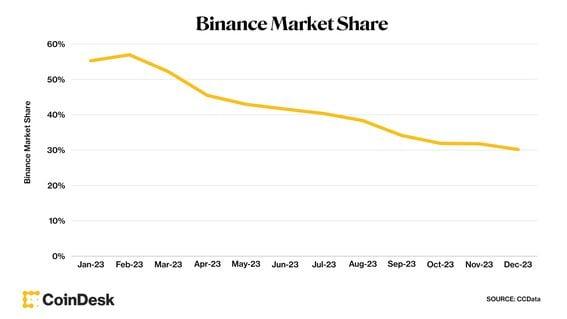

The exchange's monthly spot volume fell to $114 billion in September from nearly $500 billion in January amidst a regulatory crackdown in the U.S. Binance, the world’s largest cryptocurrency exchange by market volume, has seen its spot market share gradually decline over the year as the company faced an array of charges from regulators that eventually claimed its founder and CEO Changpeng "CZ" Zhao. According to numbers provided by CCData, Binance's market share so far in December was just 30.1% versus 55% at the start of the year. From January to September, the exchange’s monthly spot volumes declined by over 70% from $474 billion to $114 billion. CCData does note that Binance has begun to see a boost in monthly trading volumes since September even as its market share continued to slide. The company in November and its now former CEO CZ agreed to pay nearly $3 billion to settle a U.S. Commodity Futures Trading Commission lawsuit. This came alongside separate settlements with the U.S. Department of Justice and Treasury Department. In addition to the exit of its CEO, the company also witnessed a large number of executive departures this year, including its Chief Strategy Officer Patrick Hillmann, Senior Director of Investigations Matthew Price and U.K. chief Jonathan Farnell. Despite Binance’s decline in spot trading market share over the year, it still remains the largest cryptocurrency exchange by a wide margin. In second place to Binance's 30% is Seychelles-based OKX, which has seen its market share grow to 8% in December from around 4% to start the year, according to CCData. The numbers are similar when looking at combined spot and derivatives trading, where Binance saw a decline in market share to 42% from 60% while OKX's grew to 21% from 9%. https://www.coindesk.com/business/2023/12/11/binances-market-share-of-crypto-trading-tumbled-to-30-in-2023/

2023-12-11 18:01

Even when the financial regulator has the power to act, years can go by before it takes enforcement action, the U.K.'s National Audit Office said. The U.K's Nationa Audit Office said the country's financial regular is slow to take enforcement action against companies breaking rules. It highlighted the Financial Conduct Authority's (FCA) delays in registering crypto firms and taking action against crypto ATMs as examples. The U.K.'s public spending watchdog, the National Audit Office, has said the Financial Conduct Authority (FCA) is slow to take enforcement action, pointing to its handling of crypto firms over the years. While U.S. regulators recently made headlines for a $4 billion settlement with the world's largest crypto exchange, Binance, the U.K. has proceeded slowly by comparison. "Even when an issue falls inside the FCA’s perimeter, or it has the power to act, it can take years for the FCA to implement any enforcement action," the NAO said in a Friday report. The FCA has required crypto firms to register to comply with the country's anti-money laundering regulations since January 2020. Although it then began supervision work, including engaging with unregistered firms, "it did not begin taking enforcement action against illegal operators of crypto ATMs until February 2023," according to the report. "The FCA reported publicly that it saw a significant drop of 68% in reported crypto ATM activities in 2022, although not all of this could be attributed to FCA activity," the report said. The financial regulator has consistently faced criticism from the crypto industry over the slow processing of registration applications. According to the report, the FCA blames its lack of speed on poor staff retention. "The FCA has found recruitment and retention of staff with crypto compliance skills is difficult due to competition between employers for people with these skills," the report said. The report also noted that the FCA has dealt with 1,400 cases related to unregulated crypto activity between January 2020 and June 2023. The FCA received additional powers over the crypto sector with the passing of the Financial Services and Markets Bill early this year, which recognized crypto and stablecoins as regulated financial services and has begun to use its new powers. https://www.coindesk.com/policy/2023/12/11/fca-slow-to-take-crypto-enforcement-action-uks-public-spending-watchdog-says/