2023-12-09 05:01

North Korea has stolen billions of dollars' worth of crypto in support of its nuclear and ballistic missile programs, National security officials with the U.S., South Korean and Japanese governments discussed North Korea's crypto thefts and other efforts to work on its nuclear and ballistic missile programs, the White House announced Friday night. U.S. National Security Advisor Jake Sullivan, Republic of Korea National Security Advisor Cho Tae-Yong and Japan National Security Advisor Takeo Akiba met in Seoul, South Korea to discuss various issues, including the Democratic People's Republic of Korea (DPRK, the official name for North Korea) and its ongoing weapons of mass destruction program, a White House readout said. "The National Security Advisors reviewed progress on a wide range of trilateral initiatives, including the Commitment to Consult on regional crises, the sharing of ballistic missile defense data, and our collective efforts to respond to the DPRK’s use of cryptocurrency to generate revenue for its illicit WMD programs," the readout said. The three officials also discussed North Korea's relationship with Russia, the readout said. North Korea's theft of billions of dollars' worth of crypto from various projects in the industry have drawn attention from various government entities. The U.S. government alleged that Lazarus Group, a notorious hacking entity tied to the DPRK, stole over $600 million from Axie Infinity's Ronin Bridge last year. The U.S. Treasury Department's Office of Foreign Asset Control (OFAC) has sanctioned multiple mixers it alleged North Korean hackers used to move stolen funds. Just last week, OFAC added two crypto addresses tied to the Sinbad mixer. Police officials from multiple nations jointly seized Sinbad's website as well. OFAC has also banned various wallet addresses and individuals from the dollar-based global financial system, alleging similarly supported North Korea's efforts to launder stolen funds in support of its weapons program. Most famously, OFAC listed privacy tool Tornado Cash as a sanctioned entity, alleging more than $100 million in stolen crypto has flown through the mixing service. Two of the project's developers, Roman Storm and Alexey Pertsev, are currently facing charges in the U.S. and the Netherlands respectively tied to their work on Tornado Cash. A third developer, Roman Semenov, was charged with money laundering and sanctions violations, but has not yet been arrested. Storm is set to go on trial next year. https://www.coindesk.com/policy/2023/12/09/us-south-korea-japan-discuss-north-korean-crypto-thefts-in-trilateral-meeting/

2023-12-08 22:31

The military-linked bill is viewed as must-pass legislation, so lawmakers sometimes try to tack on other things to get them passed, too. Two crypto provisions addressing anti-money-laundering concerns were dropped from a joint version of the National Defense Authorization Act, a military-funding bill viewed as must-pass legislation, ending a backdoor effort to get digital-asset rules passed this year in the U.S. According to a joint bill published Thursday by lawmakers from the U.S. House and Senate, provisions that would create an anti-money-laundering examination standard for crypto assets and require a report analyzing the use of privacy coins or other "anonymity-enhancing technologies" in crypto were dropped. The House of Representatives version of the NDAA did not contain the provisions that the Senate version did. The NDAA details the military budget for the upcoming year, though as one of the U.S.'s few must-pass bills, it's often amended with various other provisions. Senate amendments included one for the Secretary of the Treasury "to establish a risk-focused examination and review process for financial institutions" to look at whether reporting obligations for crypto assets under money-laundering rules were adequate and whether firms were compliant. The other would direct the Treasury Department to produce and publish a report on the use of mixers and tumblers, the magnitude of transactions using privacy tools, the extent to which sanctioned entities might be using those tools and more. It would also direct the Treasury to come up with "recommendations for legislation or regulation relating to the technologies and services described." Later on Thursday, Senators Mark Warner (D-Va.), Mitt Romney (R-Utah), Jack Reed (D-R.I.) and Mike Rounds (R-S.D.) introduced a bill intended to expand U.S. sanctions rules to any parties that "facilitate financial transactions with terrorists," naming Hamas as one key example. The bill focuses much of its attention on "foreign digital asset companies" that might process or otherwise support transactions to terror groups. https://www.coindesk.com/policy/2023/12/08/crypto-provisions-dropped-from-2023-us-defense-bill/

2023-12-08 20:32

Marinade's market cap is dwarfed by Jito, though, despite being a bigger crypto ecosystem. Jito's successful JTO token launch is lifting many ships in the Solana (SOL) ecosystem, including that of a direct competitor: Marinade. Marinade, which like Jito issues a liquid staking token (LST) for SOL investors, saw its governance token reach all-time highs this week. The brisk rally – MNDE doubled to $0.50 in a matter of hours – came as Jito's own JTO token launched and rallied, too. Marinade now has a fully diluted valuation of $500 million compared to Jito's valuation of $3.5 billion. This is in spite of Jito being a smaller business: Its total value locked (a measurement of the size of a crypto project) is $460 million, whereas Marinade has a TVL of $737 million. The seeming contradiction caused consternation in Marinade's community Discord server, where some investors speculated on why MNDE fell behind JTO. Both assets are governance tokens whose holders have sway over decisions like the fee rates and treasury of their respective LST protocols. "Jito has the added benefit of its block building engine and MEV infrastructure," said Barrett Williams, founder of Solana-based futures trading venue Cypher, explaining why investors put a premium on the smaller protocol. Still, the Thursday airdrop of JTO indirectly spread wealth to MNDE holders, too, by prompting the entire market to reevaluate how it was pricing the Marinade protocol, said Ally Zach, a research analyst for Messari. "Investors were probably speculating that they will be valued similarly over time," she said in a Telegram message. The psychology of free money airdrop also might have been a factor. Jito distributed at least 4,900 JTO tokens to around 10,000 wallets apiece, "which left a lot of people on the sidelines," she said. The token's post-launch surge put a spotlight on this corner of Solana, and then "a lot of these sideliners probably came in and started buying." Marinade and Jito have both drawn comparisons to Lido (LDO), the best-known and, by far, the largest LST protocol in crypto. Lido has commanded most LST activity on Ethereum (ETH) but struggled to replicate that success on Solana. In mid-October, right at the start of the recent Solana rally, it quit the ecosystem. This left a wider opening for Marinade and Jito, both of which started on and stuck with Solana. The repricing and market mechanics may also have to do with liquidity – or lack of it, said InfraRAY, head of partnerships for Solana-based DEX Raydium. There's only so many JTO tokens in circulation after Thursday's airdrop. Even though 95% of the current distribution has been claimed – and is therefore circulating – it's still only a fraction of the JTO's total supply. Fewer tokens floating around means fewer available to buy or sell. "Sometimes markets aren’t as efficient as they are made out to be," he said in a Telegram message. https://www.coindesk.com/markets/2023/12/08/jitos-token-launch-pushed-competitor-marinades-mnde-to-all-time-highs/

2023-12-08 19:19

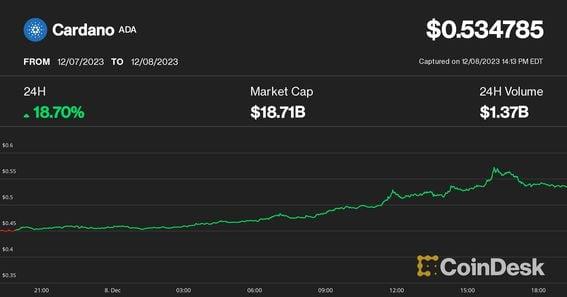

Market observers "underappreciate" future inflows from institutional investors to bitcoin, asset 21.co CEO said in a CoinDesk TV interview. Layer 1 tokens ADA, ALGO, AVAX and SOL among best performers as capital rotation from stalling BTC lifts altcoins. Bitcoin may revisit $40,000 to "fill CME price gap," crypto analyst Willy Woo speculated. Native tokens tied to layer 1 (L1) blockchains gained the most Friday, with Cardano (ADA) being the best performer, as steady bitcoin (BTC) price fueled capital rotation to altcoins. Bitcoin bounced between $43,000 and $44,000 during the day, quickly shaking off a minor dip following a stronger U.S. employment report than analysts expected that dampened interest rate cut expectations for next year. The top crypto was recently trading at around $43,800, consolidating as investors digested its swift rally to near $45,000 this week after its breakout from $38,000 a week ago. Altcoins, meanwhile, jumped across the board, resembling early November's "altcoin rotation" when slowing bitcoin momentum drove traders to realize some gains and invest in smaller, riskier cryptocurrencies. These capital rotations are typical in the crypto markets after large bitcoin run-ups, followed by a rally in bigger crypto assets then among meme coins and micro caps as traders chase tokens that haven't moved yet to profit. ADA surged 25% to 57 cents at one point during the day, its highest price since August 2022. It gave up some of the early gains later in the day, but was still up almost 20% today. Other notable top performers were native tokens of Polkadot (DOT), Algorand (ALGO), Avalanche (AVAX) and Solana (SOL), which posted 7%-11% gains. The CoinDesk Market Index (CMI), a basket of almost 200 cryptocurrencies, was up 1.5% through the day, more than BTC, underscoring altcoin outperformance. What's next for BTC As bitcoin's momentum stalled, some analysts speculated about a potential pullback to retest lower price levels. Bitcoin-focused analyst Willy Woo eyed a price level between $39,000-$41,000 based on a price gap in the Chicago Mercantile Exchange (CME) bitcoin futures market, which BTC might "fill" sometime in the future. These price gaps occur because the CME futures market, unlike native crypto exchanges like Binance or Deribit, don't trade around the clock, and there could be a difference between closing and opening prices depending on bitcoin's price action when the market is closed. Some analysts reckon that asset prices tend to revisit these levels during a correction, filling the gap. BTC rallied last weekend surpassing $40,000, when the CME futures market was closed, creating the price gap on the chart. "By my count 28 out of 30 gaps have been filled on CME daily candles (93%)," Woo posted on X, formerly Twitter. However, these gaps do not always get filled. For example, BTC hasn't revisited the CME gap at around $20,000 yet, formed in March during the weekend collapse of Silicon Valley Bank (SVB). Institutional inflows to bitcoin are "underappreciated" Despite a potential short-term pullback, bitcoin's outlook is bullish, with growing interest among institutional investors, Hany Rashwan, co-founder and CEO of digital asset management firm 21.co, said in a Friday interview with CoinDesk TV. Rashwan opined that market observers are "underappreciating" future inflows into BTC if – or once – a spot-based exchange-traded fund gets approved in the U.S, which will likely happen according to analysts. "There are a lot of prospective buyers, who for various reasons wanted to invest in crypto but has been prohibited to do so" because of regulations, he said. Rashwan noted that 75% of inflows into digital asset funds during the year happened in the past 60-90 days. "That's not normal," he said, adding that it's "a sign of change in sentiment across primarily institutional players." Rashwan prognosed all-time high prices for bitcoin, but not in the short term. "I think we will beat the bitcoin all-time highs sometime in the next 12-18 months," he said. "We are not fully out of the woods yet." https://www.coindesk.com/markets/2023/12/08/cardano-jumps-20-as-analyst-eyes-bitcoin-pullback-to-40k-to-fill-cme-gap/

2023-12-08 16:31

The blockchain-oracle project's "v0.2" staking program expanded the capacity to 45M LINK tokens from 25M, and the portion reserved for the community quickly filled up. The LINK token surged in price. Chainlink, the biggest blockchain data-oracle project, saw a powerful uptake for its expanded crypto-staking program, pulling in over $632 million worth of its LINK tokens and filling up to the limit just six hours after the start of an early-access period, the company said in a press release. The "V0.2" community staking mechanism opened for early access from 12 p.m. ET, and within 30 minutes, some 32.8 million LINK had been staked; six hours later, the community pool had hit the new, higher capacity of 40.875 million LINK. The price of LINK was up by 12% over the past 24 hours to $16.72, according to CoinDesk data. Overall, the expanded staking pool capacity is 45 million LINK, up from 25 million under v0.1, a figure that includes the community pool allocation as well as a separate node operator pool. According to a Chainlink spokesman, there are currently 1.8 million LINK in the node operator pool, out of a capacity of 4.125 million. Some 21.9 million LINK migrated over from the earlier version of the staking program. Staking is part of what the company calls Economics 2.0 that is meant to help secure the Chainlink system. Chainlink staking enables node operators - which help engineers fetch external data - and community members to support the performance of oracle services with staked LINK. People can also earn rewards. "Staking v0.2 introduces important new security features and sets the system up for even further growth in the year to come," Chainlink co-founder Sergey Nazarov said in a press release. https://www.coindesk.com/tech/2023/12/08/chainlink-staking-program-quickly-pulls-in-600m-hitting-limit-link-jumps-12/

2023-12-08 13:37

Anticipating a slowdown in the economy and easier Fed monetary policy, investors have sharply bid down interest rates in the weeks leading up to this morning's numbers. The U.S. economy saw stronger-than-expected job growth of 199,000 in November. The unemployment rate also beat expectations, dipping to 3.7%. Economist forecasts had been for jobs added of 180,000, up from 150,000 in October. The unemployment rate had been forecast to remain flat at 3.9%. The price of bitcoin (BTC) fell about 0.5% in the minutes following Friday morning's release to $43,500. In traditional markets, interest rates are shooting higher, with the 10-year U.S. Treasury yield up 8 basis points to 4.24%. U.S. stock index futures have turned lower, the Nasdaq 100 off 0.7%. Bitcoin is in the midst of a sharp 60% rally since the beginning of October, at least in part thanks to lower interest rates on investor expectations that the Fed might soon shift to easier monetary policy. To the extent that this jobs report derails the lower rate forecast, the rally could pause or be modestly reversed. Checking other report details, average hourly earnings were up 0.4% in November versus 0.2% the previous month and expectations for 0.3%. On a year-over-year basis, average hourly earnings were higher by 4% in line with October and forecasts. https://www.coindesk.com/markets/2023/12/08/bitcoin-dips-as-us-november-job-growth-of-199k-tops-estimates/