2023-12-08 12:00

Strong miners might be about to eat the weak ones as the reward for mining BTC gets cut in half, experts say. Darwinism could soon pummel some bitcoin (BTC) miners as the halving, a once-every-four-year event that cuts the reward for creating new BTC gets cut by 50%, unleashes a "survival of the fittest" battle in April. To prepare for the disruptive event, larger companies are securing newer and more-efficient mining machines. But they might also consider gobbling up smaller miners as they figure out how to both survive and benefit from the halving. Just ask Marathon Digital (MARA), the largest publicly traded miner by hashrate (industry jargon for the computing power it can direct toward running the Bitcoin network). The firm said this week that it's got a hoard of money – more than $800 million of cash and bitcoin – and will seek to grow that to "capitalize on strategic opportunities, including industry consolidation" ahead of the halving. Meanwhile, another large miner, Hut 8 (HUT), just completed its all-stock merger with a privately held US Bitcoin. CleanSpark (CLSK) has been collecting cheap assets since the start of the bear market and said it has almost $170 million shored up to "take advantage of opportunities the halving may present." And Riot Platforms (RIOT), another institutional-grade miner, has just ordered 66,560 new mining machines for $290.5 million to stay ahead of the competition. The scene is set for a dog-eat-dog competition. "Leading up to the halving and in its aftermath, miners will need to place substantial emphasis on strategic planning. The adage, 'If you aren't growing, you are dying,' holds true," said Amanda Fabiano, the former head of Galaxy Mining who started her own consulting services company for the industry. In fact, mining consultancy firm Blocksbridge said that a dozen public mining companies have already committed over $1.2 billion so far this year to buy mining machines, with about $750 million signed over the past two months. Growth at any cost So, how did we get here and why are the miners racing to gear up for the halving? The bitcoin halving – also known as the halvening – in simple terms will make obtaining or mining new bitcoin much harder. The halving is part of the Bitcoin network's code to reduce inflationary pressure on the cryptocurrency and will cut the rewards in half for successfully mining a bitcoin block. A useful analogy that might resonate with the non-crypto crowd: think about extracting a finite natural resource, such as gold or oil, from the ground. The more that's obtained, the less that's left, making the remaining resource more valuable yet more expensive to extract. Now, swap out whatever traditional commodity you had in mind, and replace it with bitcoin and and crypto mining. That's the halving: a classic example of the supply-and-demand cycle creating scarcity-driven value for an asset. It's something Bitcoin creator Satoshi Nakamoto believed in. In fact, bitcoin might actually be even more scarce than gold. For a deeper understanding of the halving, read CoinDesk's explainer here. Historically, the event has increased bitcoin prices exponentially, creating generational wealth for investors – but a presenting challenge for the miners that actually create BTC. During the third halving, which occurred in 2020, bitcoin's price went from around $8,500 to nearly $18,000 within a few months, while the reward for successfully mining a block was cut to 6.25 BTC from 12.5 BTC. This time, the reward will sink to 3.125 BTC, making mining even more competitive. In previous cycles, there weren't many large-scale miners and even fewer publicly traded ones. During the lead-up to the bull market of 2021, a swath of miners jumped into the sector to reap nearly 90% profit margins at the peak. As bitcoin neared $70,000, miners were making money hand over fist and many were spending and taking on debt to grow faster. Investors, including traditional financial firms, lavishing miners with cash to fuel grow also incentivized breakneck spending and growth at any cost. It all came crashing down during the 2022 bear market. Profit margins got crushed, some big miners filed for bankruptcy and access to capital markets was shut. Many miners still operating are barely surviving, waiting for the next bull run to save them. The rally in bitcoin prices in 2023, fueled mostly by the optimism that U.S. regulators will approve spot bitcoin exchange-traded funds (ETFs) from the likes of BlackRock, has helped miners somewhat. But with the Bitcoin network's hashrate at an all-time high (a sign of high competition), the difficulty mining a single block also at a record, high energy prices (crypto mining rigs use a lot of electricity), intense regulatory scrutiny and still-bone-dry capital markets, the mining landscape remains tough. Consolidation 'wave' Miners who grew too fast are now cash-strapped and looking for a light at the end of the tunnel. Struggling miners need to cut costs, shore up their balance sheets and require more capital – all potential catalysts for mergers and acquisitions in the industry. Cutting "costs will likely be a major drive of an upcoming wave of consolidation in the mining industry. Executive salaries, insurance and other expenses benefit from economies of scale in the post-halving environment," said Ethan Vera, chief operating officer at mining services firm Luxor Technologies. M&A can take many shapes and forms and can be complicated. However, one of the trends that might be prominent, according to Vera, is private miners merging with public companies. "Off the back of bitcoin price momentum, shareholders of private and public mining companies will look for avenues to liquidate parts of this position through publicly listed vehicles. As such, many private companies will merge with public operating companies or shells to gain access to this liquidity," he said. They will likely follow Hut 8's merger and use that as a "case study to combine entities that have both strong balance sheets alongside high growth opportunities," Vera added. Fabiano echoed this when asked about how this will play out. "Mid-tier and small-scale miners should prioritize positioning themselves on the lower end of the cost curve, one likely path is M&A given the capital-constrained market. Meanwhile, larger miners should concentrate on growth narratives that set them apart from their rivals," she said. It seems the rule of the jungle is about to be unleashed on the mining industry, perhaps best expressed by a Japanese idiom: "Jakuniku-kyoushoku," which loosely translates to English as "the flesh of the weak is the food of the strong." https://www.coindesk.com/business/2023/12/08/bitcoin-halving-is-poised-to-unleash-darwinism-on-miners/

2023-12-08 09:05

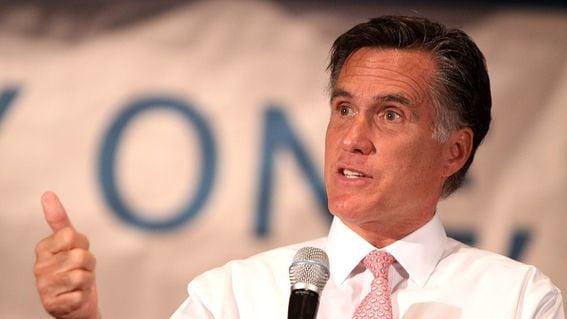

Legislation will crack down on terrorist organizations like Hamas by applying sanctions to foreign parties that facilitate financial transactions with terrorists. A bipartisan group of senators introduced legislation targeting terror financing from digital assets. Questions remain as to how useful crypto is for terror financing, with figures showing it is relatively small compared with traditional methods. A bipartisan group of U.S. senators including Mitt Romney (R-UT) introduced legislation that expands sanctions to foreign entities supporting all U.S.-designated terrorist groups, including through crypto transactions, giving law enforcement an additional toolkit to tackle terror financing. "The Terrorist Financing Prevention Act of 2023, introduced by the Senators, aims to prevent Foreign Terrorist Organizations and their financial enablers, including those using digital assets, from accessing U.S. financial institutions, imposing sanctions and strict regulations to counteract these activities," the bill reads. The proposed act broadens current sanctions, initially focused on Hezbollah, to include all U.S.-designated foreign terrorist organizations and their supporting foreign entities. “The October 7 attacks on Israel perpetrated by Hamas have made it more urgent and necessary for the U.S. to counter the role that cryptocurrency plays in the financing of terrorism," Romney said in a release. "Our legislation would expand financial sanctions to cover all terrorist organizations – including Hamas– and it would equip the Treasury Department with additional resources to counter terrorism and address emerging threats involving digital assets.” Disputed role in financing terror Crypto as a tool for terror financing has long been a concern of regulators and law enforcement. In the most recent debate among Republican presidential candidates, Vivek Ramaswamy – who has made support for crypto a pillar of his campaign – was asked a question that couched digital assets as a tool for "fraudsters, criminals, and terrorists." The debate on whether crypto finances terrorism, sparked by a Wall Street Journal report saying Palestinian groups received substantial funds in crypto, is complex and unresolved, with blockchain analytics firms like Chainalysis suggesting such claims are likely overstated, CoinDesk recently reported. There is no substantial evidence supporting significant crypto donations to Hamas, blockchain security firm Elliptic wrote in a recent post, and analysis suggests such claims are likely exaggerated. The transparency of the blockchain and the sophistication of monitoring tools mean fund flows can be tracked and frozen. Binance, the world's largest crypto exchange, has frozen more than 100 accounts thought to be linked to Hamas at the request of Israeli law enforcement since the Oct. 7 attacks. As early as April, Hamas' military wing stopped accepting crypto donations in order to protect its supporters. Hamas and Hezbollah, designated as terror organizations by the U.S. and many other jurisdictions worldwide, now increasingly use the Tron blockchain over Bitcoin, Reuters reported, but seizures amounted to less than 150 wallets and around $130 million. In comparison, publicly released intelligence reports suggest that Hamas generates $1 billion per year, with $500 million coming from tax revenue and approximately $100 million from Iran. https://www.coindesk.com/policy/2023/12/08/bipartisan-anti-crypto-terror-financing-bill-heads-to-us-senate/

2023-12-08 08:46

The country's treasury owns just over 2,700 bitcoin (BTC), which has yielded over $3 million in unrealized profit so far. El Salvador is targeting bitcoin (BTC) and crypto millionaires in its latest push to attract long-term residents to the country. The nation kickstarted its "Freedom VISA" program on Thursday, doling out residency to a maximum of 1,000 people per year who invest at least $1 million worth of bitcoin or tether (USDT) stablecoins. Eligible participants receive a long-term residency permit and have a path to full citizenship. An application costs a non-refundable $999 in BTC or USDT, and the process has gone live as of Friday. The technical process is handled by Tether Global, the issuer of USDT. This is similar to the concept of a "Golden VISA" offered by several nations, where wealthy people can invest a certain amount into that country's bonds or property in return for a residency permit. Taking bitcoin or tether investments for residency is a first for any nation. El Salvador could receive at least $1 billion in deposits if the quora are filled every year. El Salvador created history in September 2021 after becoming the first nation to recognize bitcoin as legal tender. It has since made bitcoin investments and holds over 2,700 BTC in its treasury – a position that has yielded over $3 million in unrealized profit so far. These steps are part of a broader plan to reduce El Salvador's reliance on U.S. dollars and combat hyperinflation by attracting newer income sources, President Nayib Bukele has said over the years. https://www.coindesk.com/business/2023/12/08/el-salvador-could-rake-in-1b-bitcoin-per-year-with-new-freedom-visa/

2023-12-08 08:20

As of Friday, LayerZero has not outright mentioned how it intends to reward users for using its network. Airdrop season is back in some parts of the crypto world. LayerZero developers said Friday morning that they planned to issue a token sometime in the first half of 2024, confirming widespread rumors and causing an immediate uptick in the metrics of some projects built on that network. The network is an interoperability protocol that uses a novel technique to make it easier for different blockchain networks to connect. Its developer, LayerZero Labs, raised $120 million at a $3 billion valuation in April. “LayerZero has always been built with the ability to have a native token within the protocol, as seen in the immutable code launched on day 1,” developers said in an X post. “We’ve heard the community discussion over the last few months and the lack of clear communication around this.’ “We’ll state now in no uncertain terms that there will be a LayerZero token. We’re committed to getting its distribution right and expect it to happen within the first half of 2024,” they added. Airdrops refer to the unsolicited distribution of a project’s tokens to its users, usually in return for tasks or liquidity. These are often worth a lot of money. On Thursday, Solana ecosystem project Jito dropped its JTO token starting at 4,941 tokens and increasing depending on how much they used its so-called liquid staking token (LST), jitoSOL. Some users claimed to have received as much as $200,000 worth of JTO tokens. Not everyone is selling, however, with some users supplying their holdings back to other Solana projects in hopes of more airdrops in the future. Meanwhile, after the Friday announcement, some LayerZero ecosystem projects saw a boost in token prices and locked value. Tokens of Stargate and Radiant Capital, two projects that use LayerZero, surged as much as 10% before quickly reversing. As of Friday, LayerZero has not outright mentioned how it intends to reward users for using its network. However, popular strategies include merely interacting with LayerZero-based platforms by using their services, such as borrowing, trading or lending. https://www.coindesk.com/markets/2023/12/08/layerzero-confirms-airdrop-plans-boosting-some-ecosystem-projects/

2023-12-08 07:19

Increased interest in the three-dimensional options trading suggests an influx of sophisticated traders in the crypto market. Bitcoin (BTC) and ether (ETH) options trading on Deribit are hotter than ever. As of Friday, the cumulative dollar value locked in the number of open or outstanding BTC and ETH options contracts, also known as notional open interest, was $23.6B, the highest ever, Deribit’s Chief Commercial Officer Luuk Strijers told CoinDesk. Bitcoin options accounted for 67% of the tally, with ether contributing the rest. On Deribit, one options contract represents one BTC and one ETH. “Deribit options notional open interest has reached a new ATH with $16 billion in BTC options and $7.6 billion in ETH options outstanding, resulting in a total of $23.6 billion. When adding the $2.2 billion in perpetuals and futures OI, Deribit has for the first time reached the $25 billion milestone (total now $25.8B!),” Strijers told CoinDesk. Options allow investors to take leveraged bets on the underlying asset and hedge their spot/futures market exposure. A call option gives the right but not the obligation to purchase the underlying asset at a predetermined price at a later date. A put gives the right to sell. Options trading is three-dimensional, allowing investors to bet on the direction of the price move, the degree of expected price volatility and time. The spot and futures markets are one-dimensional, focusing just on price direction. Therefore, the record options open interest represents an influx of sophisticated traders in the crypto market and promises better price discovery. At press time, most open interest in bitcoin and ether options was concentrated in call options. In bitcoin’s case, a large concentration of open interest is seen in calls at $50,000, $40,000, and $45,000 strikes. In ether’s case, calls at $2,300, $2,400, $2,500 and $3,000 are the most popular. The bias for calls is consistent with the ongoing rally in both cryptocurrencies and suggests expectations for continued upside. Bitcoin topped the $44,000 mark early this week, reaching the highest since April 2022, largely on the back of ETF optimism and receding U.S. Treasury yields. The leading cryptocurrency has gained over 150% this year. Ether neared $2,400 early today, the highest since May 2022, extending the year-to-date gain to 98%. https://www.coindesk.com/markets/2023/12/08/bitcoin-ether-options-value-on-deribit-reach-record-high-of-23b/

2023-12-07 22:42

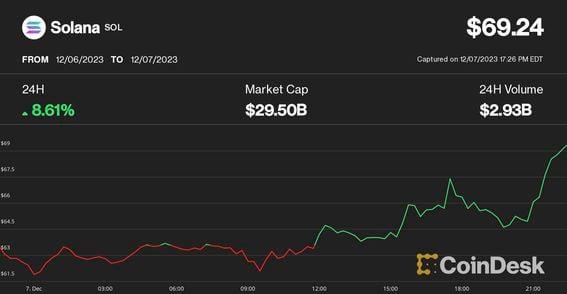

BitMex founder Arthur Hayes speculated about SOL hitting near $100 in a bullish weekend for altcoins. Ether, solana rallied to new 2023 highs as bitcoin dipped to $43,000. Bitcoin traders fear "bull trap," growing fear could propel BTC towards $50,000, Santiment said. Bitcoin's (BTC) rally halted Thursday, ceding the stage to cryptocurrency majors ether (ETH) and solana (SOL) which led the crypto rally after surging to fresh 19-month high. BTC dipped to $43,000 during the day following its breakneck climb to near $45,000 earlier this week, suggesting that traders took some profits after the largest crypto's breakout from $38,000 a week ago. Recently, bitcoin was changing hands at around $43,300, down 1.1% over the past 24 hours. ETH, meanwhile, popped 5% over the same period and hit $2,372, its highest level since May 2022. Its rally drove up the prices of other ETH-adjacent cryptocurrencies, making them the best performers of the day. Ether classic (ETC) appreciated 6%, while liquid staking protocol Lido's governance token (LDO) increased by over 11%. Native tokens of Ethereum scaling networks Optimism and Arbitrum also gained 22% and 9%, respectively, during the day. Solana (SOL) jumped over 8% to $69, the highest since May 2022, following a three-week cool-off since its mid-November local top. Arthur Hayes, crypto investor and BitMex exchange founder hinted at a $100 price target, speculating about a bullish weekend for altcoins in social media platform X (formerly Twitter) post on Tuesday. The CoinDesk Market Index (CMI), which tracks a market capitalization-weighted basket of almost 200 digital assets, was slightly up 0.6%. Traders fear bitcoin 'bull trap' Crypto analytics firm Santiment noted that BTC's flattening price coincided with traders increasingly calling for a potential "bull trap," a short-lived rally that bates investors back to the market before a major downtrend. "Traders are fearful that crypto markets may be in a bull trap at the moment," Santiment posted on X (formerly Twitter) Thursday, citing social media metrics. The growing disbelief could actually help propel BTC further toward $50,000, Santiment said, squeezing shorts who are betting on lower prices. "FUD fear, uncertainty, doubt could propel BTC to $50K if it increases," the firm added. https://www.coindesk.com/markets/2023/12/07/ether-solana-hit-19-month-highs-as-bitcoin-rally-halts-with-traders-fearing-bull-trap/