2023-12-06 21:32

The legislation would tell the U.S. secretary of commerce to officially cheer for domestic blockchain technology, though its path toward becoming a law is uncertain. Another crypto bill has scored a victory in a committee in the U.S. House of Representatives, with the panel's unanimous approval of legislation that would direct the U.S. secretary of commerce to support blockchain technology. The brief, 13-page legislation isn't among the big-ticket bills that the industry is desperate to see emerge from Congress, but the so-called Deploying American Blockchains Act marks a small, forward step for congressional efforts friendly to crypto. It joins several other crypto bills that have – for the first time – cleared committee votes on the way to the House floor, though none have yet won approval by the overall House. The House Committee on Energy and Commerce, in a work session to weigh dozens of bills this week, voted 46-0 to clear the legislation that would direct the chief of the Department of Commerce "to promote the competitiveness of the United States related to the deployment, use, application, and competitiveness of blockchain technology or other distributed ledger technology." The bill doesn't yet have a counterpart in the U.S. Senate – the chief drawback of most of this year's crypto legislation. The Democrat-controlled chamber hasn't rushed to embrace any of the digital assets bills and is widely thought to be unlikely to change course. The best bet for such bills could be negotiations that meld them with other efforts into larger must-pass legislation. "At least on the tech side of things, Energy and Commerce is unanimously in support, and there’s nothing partisan about it," said Ron Hammond, the Blockchain Association's director of government relations, in an interview. "Largely these bills have either gotten looped together into larger bills or lead to agency action at Commerce, which has been very open to conversation." Read More: Commerce Dept. Asks for Public Comments on Framework for US Crypto Competitiveness https://www.coindesk.com/policy/2023/12/06/pro-blockchain-bill-clears-hurdle-in-us-house/

2023-12-06 19:57

The CEO of the powerful Wall Street bank would prefer canceling crypto, though JPMorgan is using intrinsically related blockchain technology to move billions. Even as Jamie Dimon's JPMorgan Chase has taken a prominent role among traditional financial firms in using blockchain, the CEO still says he loathes crypto. Sen. Elizabeth Warren built on the remarks from Dimon – usually an adversary – to call for more controls on industry transactions. JPMorgan Chase CEO Jamie Dimon has never been shy about trashing crypto, even while his giant Wall Street bank became a leader in using blockchain technology to move billions. At a U.S. Senate hearing Wednesday, he slammed the industry again, to the delight of Sen. Elizabeth Warren (D-Mass.), who is trying to impose restrictions to combat illicit digital transactions. "I've always been deeply opposed to bitcoin, crypto, etc.," he told senators in a hearing examining the U.S. banking industry. "If I was the government, I'd close it down," he declared. Lined up with other big-bank CEOs before the Senate Banking Committee, Dimon argued that the crypto industry gets to "move money instantaneously" without going through the regulatory conduits required by bankers, including sanctions and money-laundering controls. He contended that the primary use case for digital assets is criminality. Sen. Warren jumped in to get Dimon – a longtime adversary of the progressive Wall Street critic – and other CEOs to agree with her that crypto businesses should have to follow the same anti-money-laundering rules under the Bank Secrecy Act that other regulated financial firms do. That's the main thrust of legislation she's been pushing, which industry lobbyists have countered would rope in crypto projects that have no ability to comply, effectively killing them off. The bill has some overlap in other crypto legislative efforts, but an aggressive effort to impose such restrictions probably won't find sufficient backing in the Republican-controlled House of Representatives, so it isn't likely to move toward law in the near term. Meanwhile, Dimon's bank – which has over $3 trillion of assets, more than double the market cap of all crypto assets combined – is a major player in Wall Street's race to move their businesses onto crypto-powered infrastructure. The company just said its JPM Coin is conveying $1 billion per day, and JPMorgan's Onyx division is exploring how to meld traditional finance with blockchains. Dimon has long differentiated between "crypto" and "blockchain," the ledger technology that serves as the foundation for cryptocurrencies and something Dimon argues is a useful tool. Read More: JPMorgan Adds Programmable Payments to JPM Coin https://www.coindesk.com/policy/2023/12/06/jpmorgans-jamie-dimon-and-sen-elizabeth-warren-team-up-to-bash-crypto/

2023-12-06 17:25

Money is flowing into more speculative names following bitcoin's big run higher. Following its roughly 15% move ahead over the past 72 hours, bitcoin is little changed Wednesday at $44,000. The speculative juices are flowing though, with a number of altcoins moving sharply higher. Among the leaders is Avalanche’s AVAX token, whose 17% gain on Wednesday makes it the leader among those cryptocurrencies with a market value above $1 billion. This comes following the token's near-doubling in price in November. Another big mover is Helium, the crypto connectivity project that migrated from its own blockchain to layer-1 Solana last year. It's higher by 42% on the day after the company announced it launched a mobile phone plan in the U.S. with unlimited data, texts and calls for $20 a month. Memecoins are moving too, led by dogecoin (DOGE), which is ahead 11% over the past 24 hours to rise past $0.10 for the first time since April. “The bitcoin rally has been quite extraordinary even by bitcoin's standards and highlights how excited the community is by the prospect of an ETF approval,” said Craig Erlam, a senior analyst at OANDA. Erlam said that lower interest rate expectations have also helped the cryptocurrency’s rise but he thinks the ETF hype is the primary driver. https://www.coindesk.com/markets/2023/12/06/altcoins-heat-up-with-avax-and-hnt-leading-the-way/

2023-12-06 16:36

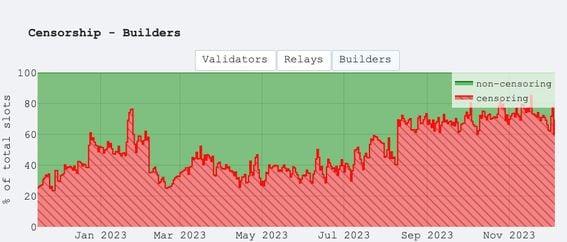

Four of the five biggest "block builders" on Ethereum are excluding transactions sanctioned by the U.S. government, data shows. For many believers in blockchain, the technology's allure lies in its open, uncontrolled nature – where decentralized networks are unfettered by the constraints and biases that shape today's internet. But some researchers and users of Ethereum, the world's second-largest blockchain, are increasingly troubled by data showing a marked increase in censorship – what appears to be a concerted effort by block builders to exclude transactions linked to entities sanctioned by the U.S. government. A turning point came last year when the U.S. government sanctioned Tornado Cash – a "privacy mixing" program on Ethereum that helped people transact without leaving a trace. The Treasury Department's Office of Foreign Assets Control (OFAC) said the program was used by terrorists and other U.S.-sanctioned entities, so it added Tornado's Ethereum-based computer code to the same blacklist as Iran, North Korea and Hamas. In response, some blockchain advocates were defiant; they balked at OFAC's attempt at "censorship" and gloated that Ethereum would be immune to it as a result of its decentralized construction. It hasn't really worked out that way. About 72% of data blocks posted to MEV-Boost, middleware that powers almost all of the validators that write blocks to Ethereum, are now considered "censored," up from about 25% in November 2022, based on research from Toni Wahrstätter, a researcher at the Ethereum Foundation. The metric measures blocks assembled by MEV-Boost "block builders" which, based on statistical analysis, appear to deliberately exclude sanctioned crypto addresses. As for why this is viewed as troubling, "block builders have the authority to decide which transactions (and in which order) they put into their blocks and which they want to censor," Wahrstätter explained in a message to CoinDesk. "This means block builders decide upon the content of the blockchain." Of the five largest block builders, only one of them, “Titan Builder,” claims explicitly that it does not “filter” transactions – a practice corroborated by Wahrstätter’s research. "If Titan would start censoring tomorrow, then Ethereum would be at over 90% censorship," Martin Köppelmann, the founder of Ethereum scaling network Gnosis Chain, said in an interview. "So essentially, we're just one builder away from quite heavy censorship on Ethereum." Sanction-breaking transactions can still sneak their way onto Ethereum, but getting them there typically costs extra and takes longer. Wahrstätter refers to this sort of transaction throttling as censorship – an affront to what crypto is all about. Infrastructure operators might just call it "compliance," a necessary step on Ethereum's journey toward mainstream adoption. It's a marked departure from Ethereum's original pitch – as a network where "code is law," where software replaces middlemen, and where "decentralized" networks can operate outside constraints from "centralized" companies and governments. Wahrstätter's research gives a glimpse into a growing shift in Ethereum's under-the-hood transaction apparatus. The network's infrastructure has quietly become dominated by a few big players: trading bots and block builders that touch virtually all of the transactions issued onto Ethereum before they officially hit the chain's ledger. How Ethereum works Ethereum is a pretty simple network at its core: When a user submits a transaction, it isn't immediately added to the blockchain. Instead, it goes into a mempool – a waiting area for other yet-to-be-processed transactions. "Validators" then swoop in and organize those transactions into big groups, called blocks, which they officially add to the blockchain in exchange for fees and newly-minted ETH. This pipeline has become more convoluted in recent years as people have developed strategies to earn maximum extractable value or MEV, which is the extra profit that one can squeeze from Ethereum by previewing upcoming transactions in the mempool. Smart coders have figured out ways to "front-run" trades from other users, such as buying or selling tokens just before others to make an easy profit. They've also found ways to exploit spur-of-the-moment arbitrage opportunities – moving tokens between separate exchanges just before market prices will shift due to some other order in the queue. Today, 90% of validators aren't assembling blocks themselves. Instead, they use MEV-Boost to outsource this work to third-party "builders" – bots that put together MEV-optimized blocks and hand them to validators. From relayers to block builders Flashbots introduced MEV-boost as a way to spread out the riches of MEV, but its decentralized marketplace of "builders," "searchers" and "relayers" has quietly transformed how activity travels through Ethereum, cementing little-understood infrastructure at key chokepoints in the chain's transaction pipeline. Soon after the U.S. government sanctioned Tornado Cash, MEV-Boost's "relayers" were blamed for censoring Ethereum. Relayers are third-party software operators that hand transactions from builders to validators, and in November 2022, Wahrstätter found that 77% of them stopped passing along blocks with OFAC-sanctioned transactions. This large percentage resulted, in part, from the fact that a small number of relayers were available in MEV-Boost's early days, and the most popular ones were filtering out OFAC transactions. After a blowback from the Ethereum community, several "non-censoring" relayers entered the MEV-Boost fray, and it looked like the tide was turning back in favor of network neutrality. Today, only 30% of relayed blocks are "censored," by Wahrstätter's definition. But things seem to have swung in favor of OFAC's sanctions in recent months, largely due to a shift in behavior among MEV-Boost's builders, rather than its relayers. Just five builders contribute more than 90% of the blocks that go onto Ethereum. Four of those five are "censoring" transactions, according to Wahrstätter's research. It's not surprising to see that certain infrastructure providers, particularly those based in the U.S., have taken steps to operate cautiously when it comes to sanctions. The headline-grabbing guilty pleas last month from the crypto exchange Binance and its CEO, Changpeng Zhao, showed the consequences of running afoul of OFAC's rules. The U.S. Department of Justice also charged two Tornado Cash developers with money laundering and arrested one of them back in August. "Block builders are also just people like you and me (that have families, that might want to move to the U.S., etc)," wrote Wahrstätter. "It's understandable that they try to minimize the risk for themselves as individuals and their business." The path forward Beyond the neutrality concerns, Wahrstätter's research highlights how Ethereum's MEV economy has centralized key elements of the chain's inner workings, a potential security risk as well as a problem for the chain's neutrality. In addition to five builders assembling 90% of Ethereum blocks, just four relayers are behind 96% of the blocks that are sent to validators. Centralization and censorship are top of mind for Ethereum's builders. Wahrstätter, who has been one of the loudest voices on this issue, works at the Ethereum Foundation, the main non-profit that stewards the network's development. Vitalik Buterin, Ethereum's co-founder and chief figurehead, has added censorship-curbing software updates to the most recent version of his proposed roadmap for the blockchain. But even some of those solutions raise problems. For instance, some users who wish for their transactions to remain uncensored have opted to use "private mempools" – issuing transactions directly to builders, rather than Ethereum's mempool, to guarantee their inclusion. While this can help circumvent the censorship problem, it's not hard to see how the normalization of private order flow might introduce different problems to the network – like higher fees, less transparency and the same sorts of middlemen that blockchains were built to avoid. https://www.coindesk.com/tech/2023/12/06/ethereums-censorship-problem-is-getting-worse/

2023-12-06 15:05

DOGE surged Tuesday after an SEC filing showed xAI had already raised $134.7 million and might seek $1 billion. A dogecoin (DOGE) surge started to reverse in U.S. morning hours Wednesday after technology entrepreneur Elon Musk said that his artificial intelligence startup xAI was not "raising money." DOGE fell to $0.10 and is down 1.1% in the past hour, reversing some gains from a 14% rally over the past day. DOGE jumped 7% on Tuesday after a U.S. Securities and Exchange Commission filing, first reported on by CoinDesk, showed xAI (which is called X.AI in legal documents) might try to raise up to $1 billion – and had already raised $134.7 million. DOGE has historically pumped on Musk's comments and public posts given his apparent infatuation with the dog-themed meme token. In April, Musk teased DOGE payments on X, then known as Twitter, proposing dogecoin as one of the payment options for Twitter Blue, the site's subscription service with premium features. Musk's electric car company Tesla already accepts DOGE payments for merchandise purchases in the Tesla Store. https://www.coindesk.com/markets/2023/12/06/elon-musk-halts-dogecoin-surge-by-saying-his-ai-business-is-not-raising-money/

2023-12-06 10:44

An increase in open interest alongside a rise in price is said to confirm an uptrend. Bitcoin's recent rapid rally has revived risk-taking in the crypto market, spurring investors to pour money into non-serious cryptocurrencies like dogecoin (DOGE), which was created as a joke 10 years ago. DOGE, the world's leading meme cryptocurrency, has gained over 10% in the past 24 hours to trade above $0.10 for the first time since April, according to data tracked by TradingView. The prices has gained 27% in seven days, seemingly tracking bitcoin's surge to $44,000 from $38,000. The notional open interest – or the dollar value locked in the number of active futures and perpetual futures contracts – tied to DOGE has risen by 58% to $625 million in one week, reaching the highest since Nov. 2, 2022, according to data source CoinGlass. That increase, alongside a rising price, is said to confirm the uptrend. Funding rates on several exchanges have surged to an annualized 50% or more, indicating a steep premium in perpetual futures relative to spot prices, Velo Data data show. Positive rates indicate investor preference for long, or bullish, bets and reflect collective optimism that prices will likely increase. Joke cryptocurrencies are high-beta assets with a history of moving in the direction of bitcoin, only more so. In other words, they behave as leveraged plays on the largest cryptocurrency. Thus, investors should be watchful of potential extreme bullish action in DOGE relative to bitcoin as an indicator of speculative froth often observed at the tail end of the marketwide bullish trend. DOGE's latest surge, though impressive, isn't necessarily a sign of excess greed, considering the DOGE/BTC ratio remains at bear-market depths. A rapid surge in the ratio presaged BTC's April 2021 top above $60,000 and the market-wide FTX-induced panic of November 2022. https://www.coindesk.com/markets/2023/12/06/over-600m-locked-in-open-dogecoin-futures-as-doge-price-hits-highest-since-april/