2023-12-06 10:02

A more than 70% surge since Sunday has catapulted bonk to the third-largest dog-themed token behind foremost dogecoin (DOGE) and shiba inu (SHIB). Dog token season is back, and some prominent tokens are returning multiples for their holders. Bonk, a Shiba Inu-themed token first issued last December, has returned over 1,000% in the past month amid a capital inflow to the Solana blockchain and an increase in riskier bets on tokens based on the network. A more than 70% surge since Sunday has catapulted bonk to become the third-largest dog-themed token, behind dogecoin (DOGE) and shiba inu (SHIB). Its $500 million market capitalization is now greater than floki's (FLOKI) $400 million and BabyDogeCoin’s $350 million. Despite being initially fashioned as a meme coin, bonk saw quick adoption in the Solana ecosystem after it was introduced. Several Solana projects integrated the token for use as payment for NFTs, and some introduced "burn" mechanisms for NFT-based events in the weeks after launch. Bonk has been a team of 22 individuals with no singular leader, all of whom were involved in the inception of the project, CoinDesk previously learned from one of the several developers. All have previously built decentralized applications (dapps), non-fungible tokens (NFT) and other related products on Solana. Since October, strong interest in the Solana ecosystem seems to have boosted the token's attraction. Trading volume crossed $80 million on Tuesday – a 10-fold increase from the $8 million daily average at the start of November. Data shows traders have also opened highly leveraged bets on the token with the rise in prices. Open interest – or the amount of unsettled futures positions – climbed to $100 million on Tuesday, compared with under $10 million at the start of November. Other dog-themed tokens also gained in the past 24 hours, CoinGecko data shows. DOGE surged 16% and SHIB jumped 10%. FLOKI, meantime, fell as traders took profits after a 25% jump on Tuesday. https://www.coindesk.com/markets/2023/12/06/solana-hype-bumps-bonk-to-third-largest-dog-token-behind-doge-shib/

2023-12-06 08:06

Short traders betting against higher bitcoin (BTC) prices lost some $90 million on Tuesday alone, adding on to the $70 million in short liquidations on Monday. Bitcoin’s ever-growing prices are leaving at least one group startled by the rapid bumps: Those placing highly leveraged short futures bets aimed at profiting from potential price reversal. Short traders betting against higher bitcoin (BTC) prices lost some $90 million on Tuesday alone, adding to the $70 million in short liquidations on Monday, according to data source CoinGlass. These may have contributed to the asset’s strength since the start of this week – a move that has seen it jump to $44,000 from $39,000. Liquidation refers to when an exchange forcefully closes a trader’s leveraged position due to a partial or total loss of the trader’s initial margin. It happens when a trader is unable to meet the margin requirements for a leveraged position (fails to have sufficient funds to keep the trade open). Large liquidations can signal the local top or bottom of a steep price move, which may allow traders to position themselves accordingly. Most of these liquidations have occurred on crypto exchanges Binance, OKX and Huobi, data from CoinGlass shows. Trading volumes have surged 25% in the past week, and open interest has grown to $20.2 billion from $17.2 billion at the start of December. Several factors look to be aiding bitcoin growth. There’s optimism around a possible spot exchange-traded fund (ETF) approval in the U.S., traders pricing in expected rate cuts in the U.S. – which buoys risky bets such as technology stocks and bitcoin – and possible sovereign adoption as bitcoin-friendly leaders take the helm in major economies. At least one group of traders placed a $200 million BTC futures position over the weekend, as reported, indicative of the high demand for bitcoin exposure. Such moves come alongside continual spot ETF application updates and changes. Some observers expect bitcoin prices to cross the $48,000 level in the coming weeks. “The staging for this rally already started in the week beginning 10/23 when BTC managed to overcome the iron-beam resistance in the $30k area,” shared Julius de Kempenaer, senior technical analyst at StockCharts.com, in a note to CoinDesk. “On the weekly chart, the next expected level of resistance is around $48k, the peak set at the end of March 2022.” “All in all, the trend for BTC is clearly up, with a first target around $48,000 and support near $38,000,” he added. https://www.coindesk.com/markets/2023/12/06/bitcoin-surge-blasts-170m-in-bearish-shorts-as-btc-price-targets-48k/

2023-12-06 08:05

Futures and options market metrics suggest traditional finance players and sophisticated market participants may soon rotate money into ether from bitcoin. CME futures show money is starting to flow into ether at a faster pace than bitcoin. Options listed on Deribit suggest strengthening bias for ether call options. Key derivatives market metrics show that sophisticated traders are turning their attention to ether (ETH) from the recent market standout, bitcoin (BTC), hinting at a potential outperformance of Ethereum's native token in the coming weeks. Bitcoin has rallied over 60% this quarter, while ether, the supposedly deflationary currency with bond-like appeal and ESG-compliant label, has lagged big time, gaining 35%, CoinDesk data show. The performance gap is even wider in larger time frames, with bitcoin boasting a 163% gain on a year-to-date basis versus ether's 89%. The chasm could narrow as money is now flowing into ether futures faster than bitcoin. The notional open interest, or the dollar-value locked in Chicago Mercantile Exchange's cash-settled ether futures contract, has increased by 30% to $711 million in the past five days, beating bitcoin's 19% growth to $4.9 billion, according to Velo Data. CME's ETH standard futures contract is sized at 50 ETH while its bitcoin counterpart is sized at 5 BTC. The emerging positive spread between pricing for ether and bitcoin CME futures suggests the same. Per Reflexivity Research, the premium in ether futures relative to the spot index price was 5% higher than in bitcoin early this week. "The futures basis (which represents the difference between the spot and futures price) for Ethereum on CME is now trading at a 5% premium to that of bitcoin, now over 20%. In addition, we can see that open interest for ETH on the CME has now started to rise, after lagging the initial move up from bitcoin," Reflexivity Research said in a market update dated Dec. 5. "It may be too early to definitely say, but it appears 'tradfi' may be beginning to rotate into the ETH ETF trade after two months. This is something to continue monitoring for early signs of the market beginning to front-run a potential ETH ETF," Reflexivity Research said. Meanwhile, in the options market listed on Deribit, traders have started to lean toward ether calls and bitcoin puts. A call option offers the right but not the obligation to purchase the underlying asset at a predetermined price at a later date. A call buyer is implicitly bullish on the market, while a put buy is bearish. Per Amberdata, the one-month ether call-put skew, which measures the spread between implied volatility premium or demand for call and put options expiring in four weeks, has doubled to over 4% this month, a sign of strengthening call bias. Meanwhile, BTC's one-month skew has declined from 5% to 2%, a sign that traders are beginning to lean toward puts relative to calls. Perhaps bitcoin may take a breather, allowing ether to play catch up in the weeks ahead. https://www.coindesk.com/markets/2023/12/06/two-key-metrics-show-crypto-traders-turning-to-ether-from-bitcoin/

2023-12-06 06:17

As unconfirmed transactions on the Bitcoin blockchain rise, Luke Dashjr, a prominent developer pledges that Ordinal Inscriptions are a 'bug' that will be fixed. As bitcoin (BTC) teases $45,000, and unconfirmed transactions rise on the bitcoin blockchain, the debate over Bitcoin ordinal inscriptions has once again flared up. "'Inscriptions' are exploiting a vulnerability in Bitcoin Core to spam the blockchain," Luke Dashjr, a Bitcoin Core developer, posted on X Wednesday. The spam Dashjr might have been alluding to is the number of transactions an ordinal generates. On-chain data shows that there are over 260,000 unconfirmed transactions on the bitcoin blockchain, which in turn drives up the price to complete a transaction. Memory usage has also surged past the 300mb alloted, because of the larger size or inscription transactions versus regular transactions. "Bitcoin Core has, since 2013, allowed users to set a limit on the size of extra data in transactions they relay or mine (`-datacarriersize`). By obfuscating their data as program code, Inscriptions bypass this limit," Dashjr continued. Back in May, when Ordinals first became popular, Binance had to temporarily pause bitcoin withdrawals after the network became overwhelmed and the number of unconfirmed transactions spiked to 400,000. While Ordinals have their critics, like Dashjr, there's also an equally large camp that says they are an evolution of Bitcoin's blockchain. Jason Fang, managing partner and co-founder at Bitcoin-heavy Sora Ventures, disagrees and argues that Bitcoin maintains its original consensus with innovations built on top, suggesting Satoshi's open-source approach encouraged experimentation. "Inscriptions are unstoppable," he said. "This gives miners more fees and higher profits." At the depths of last year's crypto winter, many miners needed to be bailed out, being hit hard by a nasty trifecta of a low price of bitcoin, and increasing difficulty. Miners, both private and publicly listed, faced margin calls and defaults as they struggled with debts up to $4 billion, used for building large facilities in North America, CoinDesk reported last year. Fang explains part of the animosity towards inscriptions because many are upset due to the attention and profits garnered by Ordinals and other BRC-20 investments – and they missed out. https://www.coindesk.com/markets/2023/12/06/bitcoin-inscriptions-divide-btc-community-amid-network-congestion-but-are-unstoppable/

2023-12-06 01:03

BTC just touched $45,000 days after topping $40,000 for the first time since early last year – and crypto-skeptics are taking another look. About two years ago, crypto prices topped out. Bitcoin (BTC) almost got to $70,000. Then things got bad, then they got worse and then they got cataclysmic. BTC sank toward $15,000 in the aftermath of FTX's blow-up. You probably remember! Prices have rebounded for most of 2023, but these felt like hard-won gains – rallies were quickly followed by setbacks. By mid-October, bitcoin was around $27,000. And then the market caught fire, fueled by optimism over bitcoin ETFs and sinking interest rates. Bitcoin just briefly touched $45,000 on Coinbase. It had only just managed to surpass $40,000 a few days ago, a level last seen in early 2022. A crypto-skeptic friend texted me Tuesday saying he was about to buy more bitcoin. A colleague says he's hearing from people wondering about crypto. Will this last? Is crypto making a move toward mainstream territory again? To the disappointment of my father, who has asked me for forecasts throughout my two-decade career covering markets and finance, I have no idea. But I know it's been two years since the mood in crypto markets felt this ebullient – before the collapses of Celsius, Voyager, Three Arrows Capital, FTX, Genesis … FOMO (you know, "fear of missing out") maybe mixed with a dose of YOLO ("you only live one") seems to be back. Wall Street is coming to crypto How things got this enthusiastic is not hard to fathom. It really is a big deal that Wall Street heavyweights BlackRock, Fidelity and Franklin Templeton are trying to list bitcoin ETFs in the U.S. Click here to read CoinDesk's Most Influential list for 2023, a series of 50 profiles of key people in crypto, including BlackRock's Larry Fink and Franklin Templeton's Jenny Johnson. Anyone with a plain vanilla brokerage account should be able to buy these products, if they're approved by regulators – and all signs point to approval being likely soon. That's easier and probably more realistic for regular Americans than setting up a Coinbase account or, heaven forbid, figuring out how a decentralized exchange or MetaMask work. So, BlackRock, Fidelity and Franklin Templeton's sales and marketing heft looks poised to be behind bitcoin ETFs. It's not crazy to think that will bring a lot of money into crypto. Whether that creates a sustainable rally is up for debate. Here's what else is on my mind: A ROCKY DEBUT: After FTX fell apart, many folks wondered if something bad was going to happen to its bigger rival, Binance. U.S. regulators and law enforcement seemed to be circling. We got our answer recently: The crypto exchange agreed to pay $4.3 billion to settle several U.S. investigations. Changpeng "CZ" Zhao stepped down as CEO. For all the angst in the run-up to this, though, the industry has taken it in stride. Anyway, CZ's replacement, Richard Teng, just had his first big public interview, and it was not a smooth debut, according to CoinDesk's Helene Braun. He came across as evasive. The company never says where it's based, and Teng was opaque about that and other issues. The question is whether this matters. Maybe traders don't care if the world's biggest crypto exchange is evasive? CRYPTO'S BEST CORRELATION: It's become a cliché: Elon Musk says or does something, and it moves the price of dogecoin (DOGE), the meme coin he's long loved. It just happened again. A regulatory filing shows he's trying to raise $1 billion for his AI efforts. DOGE immediately surged. One of the strangest correlations in markets persists. https://www.coindesk.com/business/2023/12/06/this-bitcoin-rally-feels-different-fomo-and-yolo-seem-to-be-back/

2023-12-05 21:20

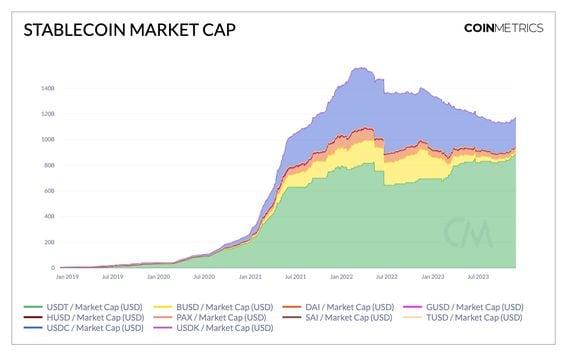

Tether's USDT added $7 billion to its market cap since September, a sign of capital entering the crypto market, Matrixport noted. Stablecoin market cap expanded for the first time since May 2022, with Tether's USDT being the main beneficiary, rising to an all-time high supply of nearly $90 billion. The trend reversal is a sign of improving liquidity in the crypto market as more capital enters the ecosystem, analysts said. Fresh money is entering cryptocurrencies as the stablecoin market is expanding for the first time in more than 18 months, highlighted by Tether's USDT rising to an all-time high market cap of $89 billion. Glassnode data shows that the combined market capitalization of the largest stablecoins increased by almost $5 billion over the past month to $124 billion. The expansion represents a major trend reversal from a sustained downtrend that started in May 2022, roughly coinciding with the beginning of the grueling crypto winter. Stablecoins are token versions of cash, serving as a crucial plumbing of the crypto ecosystem, bridging traditional (fiat) money and blockchain-based digital asset markets and providing market participants with liquidity for trading and lending. Thus, the trend reversal in the stablecoin market size is a bullish signal for the overall health of the recent crypto rally. "This upward trend can be interpreted as a leading indicator of improving liquidity on-chain, suggesting an environment where more capital is available for deployment," Tanay Ved, analyst at Coin Metrics, said in a market report Tuesday. Tether supply rises to all-time highs Most of the expansion comes from Tether (USDT), the largest stablecoin by market cap and mostly used on centralized exchanges and for transactions in the developing world. Its supply has increased by $7 billion since September, Matrixport noted in a Monday report, with minting picking up "in a meaningful way" since mid-October. Actually, USDT's market cap has grown has been growing through most of 2023 and is now nearing $90 billion, above its all-time high in 2022, CoinGecko data shows. But the contraction of competitors such as USDC and BUSD had offset USDT's growth until recently. "The trend seems to be up, which should be bullish for crypto assets as it signals growing investor interest," said Noelle Acheson, analyst and author of the Crypto Is Macro Now newsletter. "It’s still early as the total stablecoin market cap is still well below levels from earlier this year, when the outlook was arguably much worse than it is today," she added. We may earn a commission from partner links. Commissions do not affect our journalists’ opinions or evaluations. For more, see our Ethics Policy. https://www.coindesk.com/markets/2023/12/05/fresh-money-flows-to-crypto-as-stablecoin-market-expands-after-15-years-downtrend/