2023-12-05 08:42

Shares in the cryptocurrency exchange have rallied nearly 300% this year, and the latest chart pattern suggests further gains could still be in the offing. Shares in Nasdaq-listed cryptocurrency exchange Coinbase (COIN) have surged nearly 300% this year, outperforming leading cryptocurrency bitcoin (BTC) by a significant margin. Per Fairlead Strategies, further gains could be in the offing, as COIN is on track to confirm a long-term base pattern breakout. Basing involves an asset consolidating in a price range for a prolonged time following a significant sell-off. The energy built up during the consolidation is unleashed in the direction in which the base is breached, that is, to the higher side, in case of a bullish breakout. “COIN is likely to confirm a long-term base breakout this Friday above near $116 resistance. The breakout is a positive long-term development, suggesting the primary trend has shifted higher,” Fairlead’s analysts team, led by founder and managing partner Katie Stockton, said in a note to clients Monday. According to analysts, the base breakout has opened doors for a rally toward resistance at $160 and potentially $200. The chart shows COIN crashed in the first half of 2022, subsequently entering a 15-month-long base formation between $30 and $116. Last week, prices moved past $116, the upper end of the base pattern, signaling a breakout. The bullish development will be confirmed, assuming prices hold above the said level this Friday. Traders often look for consecutive weekly or daily closes above resistance to confirm breakouts. https://www.coindesk.com/markets/2023/12/05/coinbases-rally-still-has-legs-chart-analyst-says/

2023-12-05 07:58

Altcoins futures took a hit Monday as sudden volatility liquidated both longs and shorts, causing unusually high liquidations on some lesser-known tokens. Unusually high liquidations on some altcoin futures led by Big Time’s BIGTIME and Ordi Protocol’s ORDI tokens created over $250 million in total altcoin liquidations in the past 24 hours, showcasing the inherent and sudden volatility of the sector. Liquidation refers to when an exchange forcefully closes a trader’s leveraged position due to a partial or total loss of the trader’s initial margin. It happens when a trader is unable to meet the margin requirements for a leveraged position (fails to have sufficient funds to keep the trade open). These figures were without the liquidations of futures trading bitcoin (BTC) and ether (ETH), which topped the charts at a cumulative $85 million in evaporated bets. Some $15 million in ORDI bets were liquidated, followed by $12 million on BIGTIME. These consisted of both longs, or bets on higher prices, and shorts, or bets against. Prices of both these tokens whipsawed in the past 24 hours, impacting traders on either side. Demand for Bitcoin-linked tokens has created hype for ORDI, which is tied to Bitcoin’s ecosystem – with the tokens gaining 580% in the past month. Meanwhile, an ongoing narrative for crypto gaming platforms has benefited BIGTIME holders, who have gained nearly 400% since the start of November. Traders of Celestia’s TIA and Memeland’s MEME – both tokens were issued last month – lost some $10 million. Elsewhere, bets on tokens tied to Terra’s once-titan ecosystem soured, with traders of LUNC, USTC and LUNA losing some $11 million. Prices of these tokens surged up to 70% on Monday on various catalysts, as CoinDesk reported. Large liquidations can signal the local top or bottom of a steep price move, which may allow traders to position themselves accordingly. https://www.coindesk.com/markets/2023/12/05/bigtime-ordi-tokens-lead-nearly-250m-in-altcoin-liquidations/

2023-12-05 06:46

Moving to an exchange could suggest the investor is likely to sell the asset for stablecoins or other tokens. An apparent large ether (ETH) holder moved nearly $90 million worth of the token to the crypto exchange Kraken after being dormant for five years, on-chain analytics tool Lookonchain posted early Tuesday. The “whale,” a term for a large holder of any token, deposited 39,260 ether to Kraken in Asian morning hours, blockchain data shows. The address previously received 47,260 ether, worth just over $11 million at the time, from one transaction in 2017. A CoinDesk analysis of the address shows previous transactions are not tied to the cold storage of any exchange. However, at least one transaction may be possibly connected to an address belonging to trading firm Cumberland, a labeling on data tool Arkham shows. Moving to an exchange usually means the holder could sell tokens for stablecoins – increasing selling pressure – or convert to other tokens. Meanwhile, data shows Kraken’s available market depth on ether trading pairs is over $5 million as of Tuesday morning – meaning a buy or sale of that amount could move the market by at least 2%. https://www.coindesk.com/markets/2023/12/05/early-ether-investor-moves-nearly-90m-eth-to-kraken/

2023-12-05 06:40

The unknown seed investor agreed to purchase $100,000 shares on October 27, 2023, BlackRock’s latest filing reveals. BlackRock (BLK) revealed that it received $100,000 as “seed capital” for its proposed bitcoin (BTC) exchange-traded fund, the investment giant disclosed in a fresh application with the U.S. Securities and Exchange Commission (SEC). “The seed capital investor agreed to purchase $100,000 in shares on October 27, 2023, and on October 27, 2023 took delivery of 4,000 shares at a per-share price of $25.00 (the “seed shares”),” the filing said. Seed capital represents the initial funding that allows an ETF to fund the creation units underlying the ETF so that shares can be offered and traded in the open market. BlackRock’s proposed “iShares Bitcoin Trust” will invest in bitcoin rather than futures tied to the leading cryptocurrency and is one among the 13 applications awaiting regulatory approval. The SEC is widely expected to greenlight one or more spot ETFs early next year, with Bloomberg analysts putting the probability of an approval in January at 90%. CoinDesk reached out to BlackRock to confirm the identity of the seed capital investor and was awaiting response at press time. https://www.coindesk.com/business/2023/12/05/blackrock-received-100k-seed-funding-for-spot-bitcoin-etf/

2023-12-04 22:21

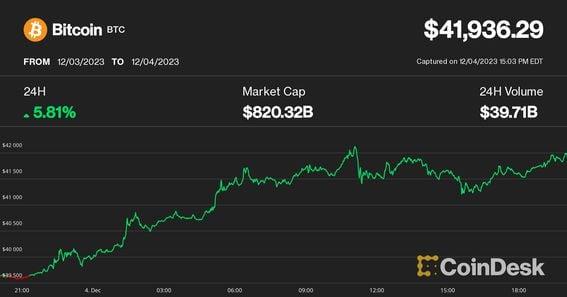

The combined market value of cryptocurrencies is the highest since May 2022, when Terra's collapse marked the beginning of the crypto winter. Bitcoin hit a fresh yearly high of $42,000, pushing the market capitalization of all cryptocurrencies over $1.5 trillion for the first since May 2022. Bets on lower interest rates, spot bitcoin ETF anticipation and "panic buying" helped the rally, analysts said. Bitcoin (BTC) hit a fresh 19-month high above $42,000 Monday, fueled by some "panic buying" as expectations for lower interest rates, looming spot bitcoin ETF decisions and flows into digital asset funds supported rising crypto prices. The largest crypto asset by market capitalization moved quickly over the weekend after it cleared significant resistance at $38,000, a level that capped prices for the most part of November. BTC late Monday afternoon was holding right around $42,000, up 5.8% over the past 24 hours. Smaller tokens lagged behind, with ether (ETH), BNB and ADA gaining 2%-3% during the day, while XRP traded flat. The CoinDesk Market Index (CMI) – which tracks the performance of some 200 cryptos – was up 4.2%. Bitcoin's rise pushed the total crypto market value to over $1.5 trillion for the first time since May 2022, when Terra's collapse marked the beginning of the crypto winter, TradingView data shows. Why bitcoin rallied Bitcoin's rise is still dominated by anticipation for a spot bitcoin exchange-traded fund (ETF) in the U.S., with market observers overwhelmingly expecting an approval by the U.S. Securities and Exchange Commission (SEC) in early January. See more: Bitcoin Spot ETFs Could See Inflows of $14.4B in First Year, Galaxy Says Crypto investment services provider Matrixport noted in a Monday report the elevated levels of bitcoin perpetual futures premium versus the spot price, suggesting that traders rushed into BTC driven by fear of missing out – or FOMO – of the rally. "Traders do not have enough upside leverage, this is the conclusion from the elevated premium that perpetual futures are trading at," the report said. Perpetual futures traded at around 5-10% premium versus the spot price for most of the year, which widened to 10-15%, with sometimes hitting 20-30%, the report explained. "This shows panic buying from traders who are closing out shorts or increasing leveraged longs," Matrixport analysts said. Investors show no sign of stopping throwing money into crypto funds, according to the lastest fund flows report from asset manager CoinShares. Last week saw another $172 million of net inflows, bringing the inflow winning streak to 10 weeks and $1.7 billion. The macroeconomic environment also supports bitcoin's price rise. "Dovish talk from some Fed officials, a weakening dollar, and relatively sturdy domestic data helped propel markets over the weekend," Alex Thorn, head of research at digital asset investment firm Galaxy, said in an email. Market participants increasingly bet on the Federal Reserve cutting interest rates next year, putting an 86% probability of lower Fed funds rate by May, according to the CME FedWatch Tool. Reasons for caution ahead While bitcoin's outlook looks bright, there are some possible short-term headwinds looming, analysts said. "The reason for concern is that even though selling pressure was being exhausted in the futures markets, there was a lack of follow-through from spot markets," Bitfinex analysts said in a Monday report. "The reason could be multifold, including short-term investors still anticipating lower prices being caught off-guard and now waiting for confirmation before entering long positions or simply interest from smaller market participants being driven towards higher returns on altcoins," the report added. Another reason for caution is that some 85% of bitcoin addresses are sitting in profits, Galaxy's Thorn noted, so "further moves higher could see profit taking." "Despite the run, bitcoin remains very constructive," Thorn said with overhangs reducing (bad actors exiting, bankruptcies resolving), catalysts on the horizon (spot ETFs, halving), holders remaining firm, a constructive macro environment, and institutional engagement still mostly on the sidelines." "BTC is up more than 150% year-to-date, and it is one of the world’s best-performing assets on a risk-adjusted basis," he said. https://www.coindesk.com/markets/2023/12/04/bitcoin-rally-to-42k-fueled-by-panic-buying-pushes-crypto-market-cap-over-15t/

2023-12-04 17:21

How CoinDesk chose 50 people who defined the year in crypto. It was a year of retrenchment and transition for the crypto industry. After 2022’s scandals, including FTX, Three Arrows and Celsius, asset prices had gotten crushed and the industry was in hunker-down mode: building, retooling, sharpening up compliance. Regulators went on a warpath, launching major investigations against Coinbase, Binance, Kraken and others. Long-standing, and potentially momentous, legal cases, like Ripple’s with the SEC over the sale of XRP, reached a conclusion. THIS POST IS PART OF COINDESK'S MOST INFLUENTIAL 2023. SEE THE FULL LIST HERE. By year-end, the industry’s prospects seemed more clear. Sam Bankman-Fried was found guilty of massive securities fraud in November and everyone, proponents and critics alike, was ready to move on. The industry had hopes for greater regulatory clarity going forward, with several bills on Congress’s agenda and MiCA’s comprehensive legislation going into force in Europe, covering 450 million users. At the time of writing, bitcoin (BTC) has more than doubled in price since this time last year and many other cryptocurrencies are rising, too. TradFi is looking at digital assets ever more seriously, getting involved with staking and the tokenization of real-world assets as never before. With spot bitcoin ETFs likely to be approved early next year, millions more people are set to join crypto markets and the industry has finally, properly, joined the mainstream. CoinDesk’s “Most Influential” package tells the story of the year in crypto, profiling 50 people we think define the main stories and themes. It features a lot of names from regulation, lawmaking and policy-advocacy, as you would expect. SEC Chair Gary Gensler is in our top 10, for instance, as is Ryan Selkis, the Messari CEO who became a leading advocate for crypto in Washington, D.C., this year. Also in the top 10 are Casey Rodarmor, the creator of the controversial Ordinals Theory, which brings data inscription (and digital collectibles) to Bitcoin; Coinbase CEO Brian Armstrong, who launched the Base layer 2 and moved strongly in derivatives; and Jose Fernandez da Ponte, who led fintech powerhouse PayPal's initiative for its own Ethereum-based U.S. dollar stablecoin. Similarly, Paolo Ardoino, the new Tether CEO, gets a nod for his resilience in leading arguably the most successful crypto (after bitcoin), despite criticism of its stablecoin business. The rest of the list includes names from across the wide range of industry sub-sectors, from NFTs and DeFi to hardware and central bank digital currencies. The list is a mix of familiar names (like Ledger CEO Pascal Gauthier) and new faces from TradFi, reflecting the increasing convergence of the two. Larry Fink, the BlackRock CEO and chairman who once dismissed bitcoin, gets a mention because his company is now looking to launch a bitcoin ETF along with other major names from Wall Street. Also honored, last but so not least, is CoinDesk’s own Ian Allison, who broke the story of Bankman-Fried's Alameda Research’s dodgy balance sheet, setting off the collapse of FTX and SBF's trial that culminated (jaw-droppingly) in November. If nobody believed it before, journalists were influencers in crypto this year. CoinDesk asked 10 leading artists to create 10 pieces of original artwork for the series. These pieces will now be available as NFTs during an auction set to begin after 12 p.m. ET (17:00 UTC) on Dec. 4. It will run for 24 hours following the execution of the first bid on Transient Labs’ sales platform. Part of the proceeds from the NFTs will go to The Hunger Project, a New York non-profit that works to reduce hunger around the world. Check out all the art here and make your bid. It’s the 10th year CoinDesk has been proud to publish its “Most Influential” list, our annual appraisal of what moved on crypto that year. Looking back, many names from earlier years are still prominent (Ethereum co-founder Vitalik Buterin has made three appearances on the list as has prominent crypto intellectual Balaji Srinivasan). Names like Blythe Masters, Theymos and Adam Ludwin, who were honored in 2015 and 2016, are less prominent these days. We’re aware that a list like this won’t please everyone. There are many names who might have deserved to be on this year’s roster and aren’t – for which we are sorry. Most Influential is meant, above all, to represent industry trends and themes (and the people associated with those themes). It can never be comprehensive in actually tracking brute influence! It’s meant more as a snapshot, and it’s definitely not a ranking. Outside of picking the top 10, we don’t order the names; they appear randomly, more or less. We hope you enjoy the profiles and artwork here and that you will offer feedback on the choices we made. Please do check out the NFTs and make a bid: the artists and the Hunger Project will appreciate your generosity. https://www.coindesk.com/consensus-magazine/2023/12/04/introducing-most-influential-2023/