2023-12-04 17:11

MicroStrategy held nearly 175,000 bitcoins in its treasury as of the end of November. Business intelligence company MicroStrategy (MSTR) earlier on Monday was sitting on more than a $2 billion profit on its massive holdings of bitcoin (BTC) following the crypto’s rally above $42,000. Led by then CEO and now Executive Chairman Michael Saylor, MicroStrategy began purchasing bitcoin in August 2020. The company's most recent purchases took place last month and as of Nov. 30, MicroStrategy held 174,530 bitcoin acquired for $5.28 billion, or an average price of $30,252 each. With bitcoin at $42,000 earlier Monday, the value of MSTR's holdings rose to roughly $7.3 billion, or more than a $2 billion profit. The price at press time had pulled back modestly to $41,700. Bitcoin (BTC) has not seen such a high level since April 2022, or before the crash of the Terra ecosystem. At its lowest during the bear market of 2022, bitcoin had pulled back to under $16,000, putting MicroStrategy's bet deep in the red. Saylor, however, continued to add to the company's holdings, funding purchases with a mixture of debt and equity issuance. Microstrategy (MSTR) shares were trading around 6% higher on Monday. Click here to read CoinDesk's Most Influential list for 2023, a series of 50 profiles of key people, companies and trends in crypto. https://www.coindesk.com/markets/2023/12/04/michael-saylors-bitcoin-bet-profit-tops-2b/

2023-12-04 13:03

"We have no intention of selling," Bukele added. The president of El Salvador took to the X platform early Monday morning to note his country's bitcoin (BTC) investment was now profitable by more than $3 million following the crypto's rally to the $42,000 area over the weekend. "We have no intention of selling; that has never been our objective," he added. "We are fully aware that the price will continue to fluctuate in the future, this doesn’t affect our long-term strategy." Click here to read CoinDesk's Most Influential list for 2023, a series of 50 profiles of key people, companies and trends in crypto. Based on public statements from Bukele, CoinDesk three weeks ago calculated that the country at that time owned roughly 2,744 bitcoins at an average price a bit lower than $42,000 and was sitting on a loss of about $16 million. https://www.coindesk.com/markets/2023/12/04/el-salvadors-bitcoin-investment-in-the-black-says-president-bukele/

2023-12-04 12:23

These tokens have been among the strongest performers among the top hundred tokens by market capitalization in the past week. Several tokens tied to the two Terra ecosystems – Terra 2.0 and Terra Classic – more than doubled over the past week, extending year-to-date gains to more than 10,000% in what could mark one of the best project reversal stories in the crypto industry. Three tokens, Luna Classic (LUNC), terra 2.0 (LUNA) and terraUSD classic USTC, have jumped as much as 70% in the past 24 hours, extending weekly gains to more than 300%. Cumulative trading volumes crossed the $2 billion mark, data from CoinGecko shows. Terra Classic is the original network created by Terraform Labs. It has continued as an independent blockchain rather than Terra 2.0, which is a forked version that was created in the wake of Terra's collapse. Terra 2.0’s LUNA is now actively traded on the market, and so are Terra Classic’s LUNC and USTC, the original tokens. These pumps came on various catalysts. Last week, Terraform Labs said it had put $15 million towards two projects in the Terra ecosystem to buffer up liquidity, making certain trading pools on those platforms more attractive for on-chain traders. Last month, Bitcoin-focused payment project Mint Cash said it was working on a USTC revamp plan that would use bitcoin (BTC) to back its intended dollar-pegged stability. The team said it would also have an airdrop plan in place for LUNC and USTC holders. Meanwhile, crypto exchange Binance continued to a burn scheme that permanently removes LUNC from circulating supply based on transactional fees earned on LUNC trading pairs. In June, six engineers calling themselves the “Six Samurai” proposed a Terra Classic ecosystem revival plan for the blockchain – such as a terraUSD testnet for testing financial services, an application for generating yield to token holders, and a plan to reward developers for the user activity that their applications generate. The infamous Terra network, helmed by Do Kwon, collapsed in May 2022 as a mechanism to back the algorithmic stablecoin terraUSD (UST) faltered – leading to Terra’s LUNA and UST tokens falling 99% in the weeks afterward. https://www.coindesk.com/markets/2023/12/04/tokens-linked-to-defunct-terra-shoots-70-on-bitcoin-linking-burn-program/

2023-12-04 12:04

Having created trading pairs on Archax between bitcoin and tokens showing ownership of an abrdn money-market fund, the firms talk for the first time about using this institutional-grade token as collateral elsewhere. Imagine a token that denotes ownership in a money-market fund, works like a yield-bearing stablecoin and can also be posted as collateral for trades. That's where U.K. investment firm abrdn and regulated exchange Archax are in the race to tokenize traditional assets. Archax, one of the first crypto firms to be regulated by the Financial Conduct Authority (FCA), and abrdn, with $626 billion of assets under management, went live with an institutional-grade money-market fund token back in October. The two are now putting it to use, lining up customers looking for new and flexible ways to allocate capital. Big financial firms have realized there are a host of operational and cost-saving efficiencies to be had by representing assets on blockchains, but few have gone far beyond the conceptual testing phase. Clients have to be onboarded, wallets have to be whitelisted, and the token is available only to professional investors, Simon Barnby, Archax’s chief marketing officer, said in an interview. But the tokenized tranche of the abrdn fund, which uses the Hedera Hashgraph system of shared ledgers, is available for as little as $5,000, potentially opening up the product to a new channel of investors. “There’s about a $400 million pipeline of customers whose interest has been thoroughly piqued,” Barnby said. “We’re talking to a lot of payment firms, and a lot of people who are perhaps sitting on a stablecoin like USDC or USDT, which doesn’t generate any yield. In previous years, when interest rates were low, treasury functions of businesses were not so worried about where the money was and if it was generating any return. But now they want to put their assets to work.” The onset of a higher interest-rate environment is changing patterns of innovation. Not only is this accelerating tokenization plans focused on low-hanging fruit like treasury bonds, it’s also garnering a response from decentralized finance (DeFi), trending toward new models of yield-bearing stablecoins. Early next year, Archax will introduce trading pairs of the abrdn money-market fund (MMF) token and bitcoin (BTC). In other words, rather than trading BTC against the U.S. dollar or USDC, users can trade bitcoin against U.S. dollar MMF tokens. The obvious next step (but something the firms have not spoken about publicly until now) is using the MMF ownership token as collateral. “This is what happens in the DeFi world, where people borrow against assets, lend assets out,” Barnby said. “A token that represents ownership in the money-market fund could be used as collateral in an area like regulated DeFi, which is an area we’re looking at for next year.” The somewhat diminished DeFi universe is interesting, but it’s just a speck on the landscape compared with the scale of traditional markets. Abrdn has a long pipeline of financial products to tokenize, the firm’s alternative investments leader Duncan Moir pointed out, but wanted to start out with “something straightforward,” where there's already demand, with the expectation it would be for the crypto native investors. “The stablecoin replacement was a no-brainer when there’s 5% getting left on the table,” Moir said in an interview. Following discussions with more and more institutions, it became clear that posting for collateral is potentially a larger use case, Moir added. “Swap dealers accept money-market funds, so it could be used to post margin on a swap, for example,” Moir said. “Looking ahead, I'll be interested to see if it can be used for settlement of tokenized securities. I can certainly imagine a future where there are other tokenized funds, and this as the cash asset you’re trading against makes a lot of sense.” https://www.coindesk.com/markets/2023/12/04/asset-manager-abrdn-crypto-exchange-archax-strive-for-pole-position-in-race-to-tokenize-tradfi/

2023-12-04 10:04

Bitcoin is trading at levels not seen since April 2022, shrugging off a tough year marked by several implosions and regulatory clampdowns. Shares of Coinbase (COIN) and MicroStrategy (MSTR) both jumped more than 4% Monday as bitcoin (BTC) extended its year-to-date gain to over 150%, at one point touching $42,000. Traders consider the two companies as proxy bets for the crypto markets, given their close ties to the largest cryptocurrency by market cap, which has added 4% in the past 24 hours. Coinbase is one of the largest crypto bourses by trading volumes and is among the few publicly listed crypto companies in the U.S. The firm, which has historically maintained a regulated stance, is listed as a custodian for several proposed bitcoin spot exchange-traded fund (ETF) products in the country. The crypto exchange’s Nasdaq-listed shares had added 4.34% to $139.45 as of 11 a.m. ET (16:00 UTC), their highest level since April 2022. Business software company MicroStrategy is the largest public holder of bitcoin, with 174,000 BTC, a position it acquired over three years by investing company funds and proceeds from bond sales. The value of the holdings is now equal to over 88% of MicroStrategy’s $8.2 billion stock market capitalization. MSTR traded at $554.17, up around 5%, also a level last seen in April 2022. Bitcoin has surged recently amid optimism U.S. regulators will approve exchange-traded funds (ETFs) that hold BTC, a move some experts believe will prompt a flood of investment into the foremost cryptocurrency. Crypto miner Marathon Digital (MARA) gained 5% and rival Riot Platofrms (RIOT) 6.7%. Hut 8 (HUT), which completed its merger with U.S. Data Mining Group on Friday, jumped 380%. However, this astronomical jump can be attributed to a stock consolidation due to the merger. Taking the 5:1 ratio into account, the shares are down some 11%. https://www.coindesk.com/markets/2023/12/04/coinbase-microstrategy-jump-in-premarket-trading-as-bitcoin-rallies/

2023-12-04 07:09

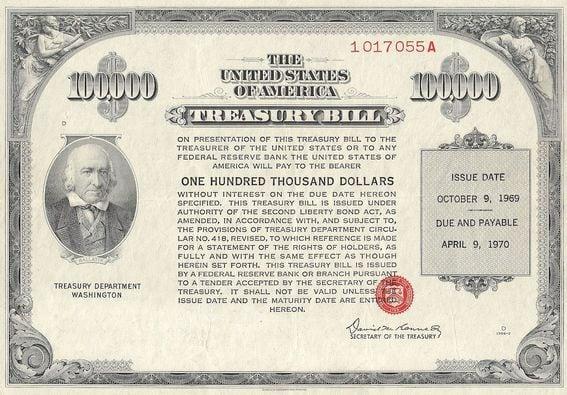

The "basis trade," a standout in the 2020/2021 bull market, is hinting at a resurgence, one observer said, referring to the rising futures premium. The market-neutral bitcoin "basis" trade offers an annualized double-digit return as futures premium rise above 10%. The strategy could become more attractive with the launch of spot ETFs next year, one analyst said. Bitcoin (BTC), the leading cryptocurrency by market value, has surged past $41,000 for the first time since April 2022. While the rally is undoubtedly good news for directional traders, market-neutral traders who intend to make steady returns irrespective of price trends need not feel left behind, as return on such strategies is steadily climbing. The bitcoin cash and carry arbitrage or the so-called basis trade, a market-neutral strategy seeking to profit from mispricings in the spot and futures market, now offers at least 10% annualized return, data from crypto derivatives exchange Deribit show. The basis is the difference between prices for futures and the spot price of the underlying asset. The strategy involves taking a long position in the spot market and simultaneously selling futures when futures are trading at a premium to the spot price. Setting opposing positions helps traders collect a fixed return as the premium evaporates over time and converges with the spot price on the futures contract’s expiry date, irrespective of the spot market trend. Front-month, three-month and longer-dated futures contracts listed on Deribit traded at an annualized premium of 8% to 12% at press time. In other words, a trader setting a cash and carry strategy today can expect an 8% to 12% return (excluding trading costs) from the mispricing in the two markets. “The cash-carry basis trade, a standout in the 2020/2021 bull market, is hinting at a resurgence. Currently, the futures basis is hovering near YTD highs, around 10%,” crypto quant researcher Samneet Chepal told CoinDesk. The basis trade now offers a notably higher return compared to the so-called risk-free rate of 4.2% offered by the U.S. 10-year Treasury note. That said, the spread between yields on the basis trade and the 10-year note is nowhere close to what we saw in early 2021 when three-month BTC futures traded at a premium of 40% and the 10-year note yielded around 1.5%. But things could improve, assuming BTC extends the recent bull run. "This could be just the beginning. With ETF news expected in early Q1 next year, we might see these numbers climb even higher, potentially surpassing previous cycle highs," Chepal added. All else being equal, futures contracts typically trade at a premium to the spot price, and the premium widens during bull runs. Bitcoin has risen 54% since Oct. 1, for several reasons, including the expected launch of one or more spot-based exchange-traded funds in the U.S. Deribit attributes this surge to a confluence of factors, including widespread optimism in anticipation of the pending ETF decision, easing concerns following the settlement of Binance’s legal matters, escalating geopolitical tensions, and the steady increase in institutional engagement, the exchange’s Chief Commercial Officer Luuk Strijers told CoinDesk. “Another supporting sign is the futures basis rising beyond 10%, a strong indicator of current market sentiment,” Strijers said. https://www.coindesk.com/markets/2023/12/04/bitcoin-market-neutral-bets-offer-10-return-as-btc-tops-41k-analysts-say/