2023-12-04 06:58

Overall market capitalization has risen 3% in the past 24 hours to reach a level previously seen in April 2022. Bitcoin (BTC) and ether (ETH) added as much as 4% in the past 24 hours as optimism around a possible spot exchange-traded fund (ETF) approval in the U.S. continued to grow, and peak prices in gold added to tailwinds. BTC crossed the $41,000 mark early Monday, extending year-to-date gains to over 152%. Data from CoinGlass show, exchanges have liquidated crypto perpetual futures positions worth $220 million over the weekend. Bullish longs accounted for nearly 85% of the tally. Over $120 million worth of bitcoin shorts, referring to bets against price rises, have been liquidated since Friday. Elsewhere, open interest grew 6% on Monday as traders increased leveraged positions to bet on further volatility. Meanwhile, analysts at Coinanlyze told CoinDesk in an X message that open interest on the exchange BitMEX spiked 90% within hours to $420 million from over $200 million on Saturday – indicating a large player had opened massive bets on the platform. Liquidation refers to when an exchange forcefully closes a trader’s leveraged position due to a partial or total loss of the trader’s initial margin. It happens when a trader is unable to meet the margin requirements for a leveraged position (fails to have sufficient funds to keep the trade open). Large liquidations can signal the local top or bottom of a steep price move, which may allow traders to position themselves accordingly. Such data is beneficial for traders as it serves as a signal of leverage being effectively washed out from popular futures products – acting as a short-term indication of a decline in price volatility. https://www.coindesk.com/markets/2023/12/04/bitcoins-price-rise-to-41k-buoyed-by-200m-in-weekend-short-liquidations/

2023-12-03 23:39

Ether also rose past $2,200 for the first time in months. The price of bitcoin (BTC) moved past $42,000 for the first time since April 2022 – a level not seen since before the crash of Terra – while Ether (ETH) moved past $2,200. Bitcoin’s price had been toying with the $40,000 level in recent days, but finally breached it Monday to trade above $41,600 as of press time, according to CoinDesk Indices data, a 24-hour rise of about 6%. Ether was trading around $2,240, a similar percentage gain. Click here to read CoinDesk's Most Influential list for 2023, a series of 50 profiles of key people, companies and trends in crypto. The advance spurred crypto stocks higher, too. Crypto exchange Coinbase (COIN) jumped almost 9% in pre-market trading, as did Microstrategy (MSTR). Crypto miners such as Marathon Digital (MARA) and Riot (RIOT) added more than 10%. The other top 10 cryptocurrencies by market capitalization marked smaller gains, and BNB coin (BNB), a token affiliated with the Binance exchange, was little changed. The price of the world’s largest and oldest cryptocurrency fell below $40,000 in April 2022, and has been rallying over the past few months largely due to seemingly dovish comments from U.S. central bankers and hopes that a spot bitcoin exchange-traded fund (ETF) may be approved to launch in the country. Ether had similarly not traded hands above $2,200 since May 2022, though it's come close a few times. Bitcoin holders withdrew 37,000 BTC between Nov. 17 and Dec. 1, suggesting they were taking direct custody of their coins, CoinDesk reported earlier this week. Bitcoin's move above $40,000 comes as gold hit a record high of over $2,100 per ounce during the early Asian trading hours in response to dovish comments from Federal Reserve chairman Jerome Powell. “The market is increasingly expecting a rate cut in the coming year, and investors are increasingly bullish on the outlook of Bitcoin ETF applications by some of the biggest names in asset management,” wrote Lucy Hu, Senior Analyst, Metalpha, in a note. "This is an official statement of a bull run, and the price could see more upticks in the coming weeks.” Last week, Powell said that interest rates are now well into restrictive territory, bolstering the narrative that the tightening cycle has peaked and adding to downward pressure on Treasury yields. “Crypto, on the other hand, has been moving nicely higher, along with Gold, on the back of lower yields,” crypto data provider Amberdata said in a newsletter Sunday. “Bitcoin has been eager to jump higher, even without the Spot ETF catalysts headline hitting the wires, the market is looking to get long,” Amberdata added. Traders have loaded up on topside option plays in recent weeks, betting on bitcoin’s eventual rise to $45,000 by the end of March 2024. The week ahead will bring U.S. ISM services PMI data and non-farm payrolls for December. A strong NFP figure might result in the unwinding of Fed rate cut bets for 2024, slowing BTC’s ascent. https://www.coindesk.com/markets/2023/12/03/bitcoin-breaks-40k-for-first-time-in-18-months-amid-broader-crypto-market-rise/

2023-12-01 18:44

The suit alleges that Ronaldo "promoted, assisted in, and/or actively participated in the offer and sale of unregistered securities in coordination with Binance." Soccer great Cristiano Ronaldo faces a $1 billion class-action lawsuit linked to his commercial relationship with cryptocurrency exchange Binance. The suit, dated Nov. 28 and filed in the District Court for the Southern District of Florida, in Miami, alleges that Ronaldo "promoted, assisted in, and/or actively participated in the offer and sale of unregistered securities in coordination with Binance." The action purports to represent "consumers who purchased unregistered securities offered of sold by Binance." The lead plaintiff was identified as Michael Sizemore, a California resident who allegedly bought unregistered securities from Binance "after being exposed to some or all of defendant's misrepresentations and omissions regarding the Binance platforms." "Mr. Ronaldo’s promotions solicited or assisted Binance in soliciting investments in unregistered securities by encouraging his millions of followers, fans, and supporters to invest with the Binance platform," the legal filing said. The suit could add to a growing list of legal matters at Binance. In June, the U.S. Securities and Exchange Commission sued Binance, the operating company for Binance.US and founder Changpeng "CZ" Zhao on allegations of violating federal securities laws. Last week, in a separate case, Binance agreed to pay $4.3 billion to settle charges brought by U.S. prosecutors related to alleged violations of breaking sanctions and money-transmitting laws. Ronaldo partnered with Binance in 2022 in the creation of a non-fungible token (NFT) collection, featuring animated figures depicting moments from his career. He is accused of "soliciting investments in unregistered securities by encouraging his millions of followers, fans, and supporters to invest with the Binance platform." "Mr. Ronaldo’s promotions were published on public websites, television and social media accounts accessible to plaintiffs nationwide, including in Florida," the suit reads. "On information and belief, in exchange for his services, Mr. Ronaldo received a substantial total compensation package which likely included compensation in the form of digital assets transmitted through the Binance platforms." The suit cited prior SEC warnings that virtual tokens may be securities, and that celebrities must disclose when they are getting paid to promote securities. CoinDesk requested comment via a cristianoronaldo.com email address but did not immediately receive a response. Read More: Binance Has No Real Argument for Dismissing SEC Suit, Regulator Says https://www.coindesk.com/policy/2023/12/01/cristiano-ronaldo-faces-1b-class-action-lawsuit-over-binance-endorsement/

2023-12-01 18:38

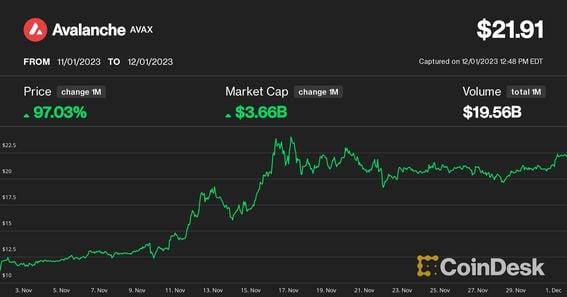

Tokens in the DeFi and Culture & Entertainment sector indexes gained 39%-42% over the past month, showcasing the widening breadth of the crypto rally. Smaller tokens outperformed bitcoin during bullish November for crypto markets. AVAX, HNT, BLUR and RUNE were among the best performers with doubling prices in a month. The widening breadth of the crypto rally indicates "alt season," ByteTree said. November brought explosive gains for altcoins as a wide range of smaller cryptocurrencies outperformed bitcoin (BTC), prompting calls for an altcoin season. The native token of Avalanche (AVAX) surged 97% over the past month, the most among large-cap digital assets, benefitting from news that finance giants JPMorgan and Apollo are using the network to test real-world-asset tokenization. Transaction volumes on Avalanche's blockchain also experienced an uptick over the month, recording its highest weekly traffic of $2 billion in transactions in a year, a report by blockchain analytics firm IntoTheBlock pointed out. The report also noted a sizable increase in inflows to Avalanche over the last two quarters of the year, with $79 million in net inflows in Q3 and $56 million in Q4 through late November, helping rejuvenate the ecosystem. Internet-of-things communications protocol Helium (HNT) also stood out with a 110% rally last month, CoinDesk data shows. Other notable best-performers include non-fungible token (NFT) marketplace Blur's token (BLUR) and decentralized cross-chain liquidity protocol THORchain's native crypto (RUNE), both doubling in prices through the month. Altcoins outperform as BTC grinds above $38,000 Bitcoin (BTC), meanwhile, booked a 10% monthly gain, spending most of the month between $34,000 and $38,000. After multiple previous breakout attempts being sold quickly, the largest crypto by market cap apparently jumped above the range on the last day of November, hitting a fresh yearly high of $38,800. The second-largest crypto, ether (ETH), increased 13% in November, stabilizing above the $2,000 level for the first time since April and consolidating there. Slowing momentum for large-cap cryptocurrencies prompted investors to rotate profits into riskier corners of the digital asset market. This is visible in CoinDesk Market Index sector performances, which posted larger gains than BTC. The culture and entertainment sector index (CNE) – a proxy for NFT and metaverse tokens – and DeFi sector index (DCF) rose 42% and 39% over the past month, respectively. The widening breadth of the crypto rally signals that we are in the midst of an "altcoin season," investment advisory firm ByteTree said in a report this week. Market observers refer to altcoin seasons as periods when smaller cryptos outperform bitcoin. ByteTree data showed that about half of the top 100 cryptocurrencies are in neutral or rising trend versus BTC. "That confirms it is alt season," the report said. https://www.coindesk.com/markets/2023/12/01/avalanche-helium-lead-monthly-crypto-gains-as-bullish-bitcoin-consolidation-spurs-altcoin-season-call/

2023-12-01 17:37

John Hoffman spent over 17 years at investment manager Invesco and will lead Grayscale's distribution and partnerships team. Crypto asset manager Grayscale has hired former Invesco Head of Americas John Hoffman to lead its distribution and partnerships team, six weeks before a decision is set to come out on whether the company will be allowed to launch a spot bitcoin (BTC) exchange-traded-fund (ETF). Hoffman – an ETF veteran – spent over 17 years at investment manager Invesco, first as the director of ETF institutional sales and capital markets at Invesco PowerShares Capital Management, before moving into an adviser role and most recently, leading the Americas, ETF and indexed strategies team. “The Grayscale team is thrilled to have John Hoffman join us as Managing Director and Head of Distribution and Strategic Partnerships. John has a wealth of industry and ETF expertise, which will be invaluable to our team and clients, especially during this exciting time at Grayscale,” Dave LaValle, Global Head of ETFs at Grayscale said. Invesco is one of the biggest issuers of ETFs in the U.S. with currently over 200 ETFs traded on U.S. markets and roughly $425 billion in assets under management (AUM). The company recently suffered another big departure. Anna Paglia, who served as global head of ETFs, indexed strategies, SMAs and models at Invesco for the past seven years, left to join State Street Global Advisors - the investment management division of State Street - as executive vice president and chief business officer. Grayscale is hoping to convert its GBTC bitcoin trust into an ETF in January, when the Securities and Exchange Commission (SEC) decides whether to approve the launch of 13 potential spot bitcoin ETFs, including that of BlackRock, Invesco, and Franklin, among others. https://www.coindesk.com/business/2023/12/01/grayscale-gears-up-for-bitcoin-etf-race-by-hiring-industry-veteran-from-invesco/

2023-12-01 16:15

The hacker group stole the funds over the last six years, which was likely used to fund the country's projects, a report said. (Soohwan Oh, CoinDesk Korea) - North Korea-linked hacker organization Lazarus Group has stolen $3 billion in cryptocurrency over the past six years, according to a report by cybersecurity firm Recorded Future. The report released on Thursday reveals that in 2022 alone, the group plundered $1.7 billion in cryptocurrency, likely to fund North Korean projects. Blockchain data analysis firm Chainalysis indicates that out of this total, $1.1 billion was stolen from decentralized finance (DeFi) platforms. A September report published by the U.S. Department of Homeland Security (DHS) as part of its Analytic Exchange Program (AEP) also highlighted Lazarus's exploitation of DeFi protocols. The U.S. Treasury Department introduced new sanctions against North Korea's cyber activities, adding 'Sinbad' to the Office of Foreign Assets Control's specially designated sanctions list. Sinbad has been implicated in laundering the cryptocurrencies stolen by the Lazarus Group. The group is known to have used Sinbad's mixer services to hide the origins of the stolen funds. Such mixers obscure individual transaction trails by blending multiple users' transactions. Lazarus Group's specialty is fund theft. In 2016, they hacked the Bangladesh Central Bank, stealing $81 million. In 2018, they hacked the Japanese cryptocurrency exchange Coincheck, diverting $530 million, and attacked the Central Bank of Malaysia, stealing $390 million. The story first appeared in CoinDesk Korea. https://www.coindesk.com/markets/2023/12/01/north-korean-hackers-lazarus-group-stolen-3b-in-cryptocurrency/