2023-11-29 16:58

The unknown entity acquired 875 bitcoin on Wednesday alone, prompting online speculation over who the buyer might be. The owner of one mystery wallet has purchased 11,268 bitcoin (BTC) worth $424 million since November 10 and is now the 74th largest holder of BTC, according to Bitinfocharts. The buys – which include 875 tokens acquired today – were made at prices ranging from $36,000 to $38,000, meaning the owner is sitting on around $9.8 million in unrealized profits at bitcoin's current price just below that $38,000 level. There's been some online speculation that the wallet could be tied to one of a number of U.S. asset management giants hoping to soon be granted regulatory permission to launch a spot bitcoin ETF, though it's not clear if such "frontrunning" is even allowed. Nevertheless, if a spot ETF is approved, fund managers will be required to hold and custody a large quantity of bitcoin in order to meet potential demand. This is unlike synthetic products like CME futures, which involve trading of contracts that represent the underlying asset. VanEck advisor Gabor Gurbacs said Wednesday that a spot ETF being approved would create "trillions in value" even with just minimal demand of around $20 billion to $30 billion. https://www.coindesk.com/business/2023/11/29/bitcoin-buyer-quietly-accumulates-424m-of-btc-in-three-weeks/

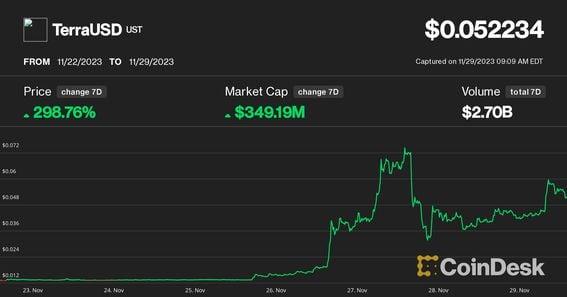

2023-11-29 16:05

USTC and LUNC tokens are remnants of the collapsed Terra ecosystem that some community members remained committed to revive. TerraClassicUSD (USTC) gained 300% in a week as plans of a bitcoin-backed revamp plan and a Binance perpetual contract listing unleashed a speculative frenzy. USTC and LUNC underpin the Terra ecosystem, which collapsed last May. TerraClassicUSD (USTC) and its sister token Terra luna classic (LUNC) – remnants of the blown-up Terra blockchain – skyrocketed this week, fueled by a new Binance perpetuals contract listing and the emergence of a bitcoin-focused revamp and airdrop plan. LUNC is up roughly 60% this week, including a nearly 20% rise over the past 24 hours, CoinDesk data shows. USTC, meanwhile, has almost quadrupled in price. For perspective, the USTC rally has only brought the price to $0.05 versus its original price peg of $1. The gains occurred as Binance, which remains the world's largest crypto exchange despite its regulatory issues, on Monday started offering perpetual contracts for USTC with up to 50x leverage. Increasing anticipation of a USTC revamp plan that would use bitcoin (BTC) as a foundation perhaps also fueled the rally. Bitcoin-focused payment project Mint Cash recently outlined a vision for a successor of Terra's failed stablecoin, this time being collateralized by BTC to mint tokens. The developer team also revealed a few days ago that they are working on an airdrop plan for USTC and LUNC holders. The recent developments unleashed a speculative frenzy around the token. Trading volume with USTC has exploded in the last few days, peaking at times above $1 billion in 24-hour activity, dwarfing the less than $10 million average earlier this month, CoinGecko data shows. Remnants of Terra Terra luna classic (LUNC) and USTC are remnants of the sister tokens that underpinned the once-huge, failed Terra ecosystem, developed by Terraform Labs and helmed by co-founder Do Kwon, who was arrested earlier this year. USTC was an algorithmic stablecoin, while LUNC – then named LUNA – was used to balance the stablecoin at a $1 peg. The design proved to be unsustainable and the tokens fell into a hyperinflationary death spiral last May, collapsing the whole multibillion-dollar Terra ecosystem in spectacular fashion. The U.S. Securities and Exchange Commission (SEC) this February charged Terraform Labs and Kwon with "orchestrating a multi-billion dollar crypto asset securities fraud involving an algorithmic stablecoin." Kwon was arrested in Montenegro with forged passports in March and last week a local court approved extraditing him to the U.S. or South Korea. Soon after the collapse, developers deployed a new version of the Terra blockchain with a brand new native token called LUNA, consequently renaming the old blockchain to Terra Classic and the tokens to LUNC and USTC. Some developers, however, remained committed to revive the ecosystem around Terra Classic. The community voted to stop minting – creating – new USTC tokens to help reduce its hyperinflated supply through token burning schemes. https://www.coindesk.com/markets/2023/11/29/terras-ustc-gains-300-as-bitcoin-focused-comeback-plan-binance-perpetuals-listing-fuel-speculative-frenzy/

2023-11-29 12:00

The idea of a yield-paying layer-2 blockchain atop Ethereum has clearly demonstrated market allure. But even the project's biggest investor has taken issue with the execution and marketing surrounding the initial rollout. On its face, the idea behind Blast doesn't seem so objectionable: a layer-2 blockchain atop Ethereum that pays interest to depositors – a differentiator that might help a new player stand out versus the current market leaders, Arbitrum, Optimism and Base, or against dozens of other competing networks. Clearly there's something attractive about the proposition, because in just a week since the project was unveiled, some $603 million has flooded into Blast, an amount that would immediately rank the project as the third-biggest Ethereum layer-2 network. By comparison, Base, backed by the prominent U.S. crypto exchange Coinbase, has amassed just $582 million since its launch a few months ago, a much slower rate of deposits that was nonetheless considered a coup when the chain launched. But Blast's marketing pitch has attracted critics alongside the crypto dollars, including a public scolding from a key financial backer, the venture-capital firm Paradigm, over how the project went about its splashy introduction. Blast's actual network isn't expected to launch until next year, but its leaders have begun accepting deposits anyway – promising "native yields" and dangling the prospect of an eventual token airdrop to early birds. People can earn "blast points" by depositing funds into an Ethereum wallet associated with the yet-to-launch Blast chain, or by inviting others to do the same. It's all neatly packaged on Blast's cyberpunk-themed website, which displays a videogame-like leaderboard showing who has earned the most points – with the highest-ranked among them entitled to a larger share of soon-to-be airdropped tokens. Aside from the garishness of it all, there's been criticism of what some commentators describe as a potentially risky setup, where depositors are essentially relying on faith in an undisclosed group of "engineers" – as opposed to more robust security measures – to safeguard their cryptocurrency ahead of Blast's real launch. For now, user deposits into Blast's crypto wallet can't be withdrawn. And at least initially, the juicy yields won't come from any internal workings of Blast, but from routing deposits to other yield-paying projects, primarily the liquid-staking protocol Lido, adding yet another layer of risk. Without any detailed technical specs, it's unclear so far what Blast's yet-to-exist network will even be; the primary disclosure is that it will be an optimistic rollup that pays interest. In an earlier era, such as in the halcyon days of degenerate decentralized finance (DeFi) in 2020, when crypto traders drunk on sky-high-returns happily overlooked project technicals in favor of vague promises, Blast's approach might have seemed par for the course. But the recent blowback speaks to how cautious some corners of the industry have become in recent months. Industry figures are afraid of getting swept up in the same empty excitement that fueled – and crashed – the last DeFi market, when crypto's reputation was tarnished by a downward spiral of token collapses, exchange failures and criminal charges. "Much of the marketing cheapens the work of a serious team," Dan Robinson, a researcher at Paradigm, which was one of Blast's lead investors, wrote on X. Robinson's thread marked a rare instance in which a major venture firm publicly rebuked one of its own portfolio companies. Robinson expressed strong disagreement with Blast's approach of accepting deposits into a token bridge – currently just a glorified Ethereum multisig wallet – before launching a real network, and without allowing withdrawals. The marketing strategy "crossed lines in both messaging and execution," according to Robinson. Neither Robinson nor Blast founder Tieshun Roquerre responded to requests for comment for this story. Paradigmatic provenance Paradigm, whose partners include a Coinbase co-founder, Fred Ehrsam, is looked to as a beacon of crypto investing – known for its widely-read research reports and think pieces on the state of the space. For startups in Paradigm's orbit, the "Backed by Paradigm" badge serves as a stamp of credibility, the idea being that the firm ostensibly does extensive due diligence on portfolio companies – to reduce the chance that a project might be one of myriad Ponzi-like schemes, rugpulls or other scams that are so prevalent in crypto. It's possible that Paradigm's participation provided an extra dose of confidence to traders as they have poured money into Blast in recent days. Blast backlash Many investors are still jaded by their scorchings from Terra (LUNA), Olympus (OHM), and other buzzy projects from DeFi's 2019-2021 heyday – hype-driven cryptocurrency experiments that ballooned into billion-dollar behemoths before crashing to pennies. Afraid of falling prey to empty buzz yet again, some traders and investors have tried pushing the industry into a new era – to clean up its act, at least as far as most marketing is concerned. A more sober set of norms has come to typify the crypto startup landscape. A focus on "zero-knowledge proofs" and other technical nomenclature has supplanted percentage-point-yield figures in ad copy and pitch decks. "Layer 2" infrastructure extending Ethereum has replaced "yield farming" as the product category du jour favored by investors. Blast's product pitch, which earned it $20 million in funding from Paradigm and other backers, wasn't completely out of step with the times. Similar at a high level to layer-2 networks like Arbitrum, Optimism and Coinbase's Base chain, Blast would "settle" user transactions on the "Layer 1" Ethereum network, but function separately as a way to ramp up bandwidth. Without much differentiating it mechanically from other layer 2 up-and-comers, however, Blast's marketing highlighted its plan to pay "yields" to users, in addition to an invitation-based reward system. Blast's big promises Blast made big promises that evoked crypto of old – instructing users to "lock up" their funds in a "bridge" for a period of three months in exchange for "risk-free" yields. The platform itself won't launch until February. Until then, users will be unable to withdraw their funds. Paradigm's Robinson took issue with this lock-up mechanic, saying "we don’t agree with the decision to launch the bridge before the L2, or not to allow withdrawals for three months, since we think it sets a bad precedent." Crypto history is filled with "rug pulls" – where someone creates a project and then runs off with the funds. There's no evidence that Blast is a scam, but similar setups have been employed by fraudsters in the past, where user funds were "locked" for some period, and then the whole pot was stolen. Notoriously, crypto bridges – used to transfer tokens between blockchains – have also been frequent targets for crypto-savvy hackers. Blast's bridge, where the half-billion-plus dollars of locked user funds now sit, is controlled by a "multisig" wallet – a set-up that, in Blast's case, requires three of five individual "signers" to approve transactions. Blast defended the system in a thread on X, positing that "Multisigs can be highly effective if used properly. This is why L2s like Arbitrum, Optimism, Polygon and now Blast use a multisig model." Blast has said nothing about who is behind its multisig, meaning users who deposit their money into the Blast bridge are entrusting their money to an unknown set of entities. This isn't completely out of the norm; Optimism keeps its multisig signers anonymous as a security measure, as do some other projects. But the fact that Blast is so far just a multisig wallet – rather than a bona fide bridge or blockchain – has fueled skeptics. Fear of missing out Blast's FOMO-inducing "native yield" and "blast point" mechanics, center-stage in its marketing, were also key focal points for critics. Yield is a genuinely useful tactic for attracting users, and Blast's promised yields – in the 4-5% range, plus extra "blast points" – pale in comparison to the obviously-too-good-to-be-true 1000%+ yields promised in the days of "yield farming," when projects would just mint tokens willy-nilly in an unsustainable short-term bid to prop up yields. Blast's use of the phrase "risk-free" interest – possible due to money re-invested behind the scenes into interest-bearing assets like staked Ether – raised red flags. Countless projects have appealed to users with promises of high yields, only to collapse entirely once returns decrease. Blast also introduced a gamified invite system that rewards users for sharing the project – teasing the prospect of airdropped tokens to users who issue the most invites. Incentivized invites aren't new. Friend.tech, a popular social app on Coinbase's Base chain, recently employed a similar model, to much success. But such systems can bear a striking resemblance to multi-level marketing, and crypto-veterans have a particular allergy to the tactics given the industry's sordid history with pyramid-shaped business models. The Lido link Blast was founded by Roquerre, who typically operates under the pseudonym "Pacman" and initially came to prominence as the founder of the NFT marketplace Blur. In a thread on X last week, Roquerre attributed some of the Blast blowback to "misunderstandings." "There's a meme going around that Blast is a Ponzi," Roquerre wrote. "The yield that Blast provides users can feel too good to be true, so this meme is understandable. But to put it simply, the yield Blast provides comes (initially) from Lido and MakerDAO," another crypto protocol. That the lion's share of Blast's half-a-billion dollars in deposits has been poured directly into Lido, a liquid Ethereum staking protocol with deep Paradigm ties, only added to the scrutiny. Paradigm has been in the crosshairs of Blast's critics since the project was first announced, with some arguing that an influential firm like Paradigm – which backs Lido, Flashbots and a number of other industry cornerstones – shouldn't have its fingerprints on a project with such controversial tactics, particularly given the potential for conflicts of interest. "Paradigm had zero involvement in Blast's go-to-market," Roquerre wrote, adding that "they probably would have asked me to change a lot about Blast's launch if they had been involved," and in fact did request changes to Blast's strategy post-launch. While Paradigm did not pull its funding from Blast, and Robinson's statement did not address the Lido ties, his comments did appear to put some onlookers at ease. "Many of the tactics displayed with Blast go fully against the entire ethos of crypto, in exchange for some guerrilla marketing benefits," wrote Jordi Alexander, a blockchain investor who was one of the most vocal critics of Terra ahead of its spectacular 2022 collapse. "I am completely in favor of a seminal fund in our industry, that is playing a longer-term game, clarifying publicly when their fund's reputation is attached to an approach that has made many of us in the space uncomfortable." As the columnist David Z. Morris wrote on his Substack, "Paradigm probably can’t just take the money back, and this is only a minor blow to their reputation, as long as Blast’s creators actually don’t rug." Calculated risk? It's unclear whether Blast's approach was really all that much of a miscalculation in pure business terms. Even if a vocal contingent of the crypto Twitterati finds Blast's methods distasteful, the project has attracted eye-watering demand in dollar terms – this while the rest of DeFi is in a market slump. The money that's flooded into Blast may have come predominantly from a few big backers, or from mercenary yield farmers who will leave as soon as they snag their Blast airdrop. But if the funds in Blast do remain safe, and if the chain opens in a few months as promised, the project's big initial splash could prove a winning gambit – helping Blast to elbow its way into the competitive turf war between similar layer 2s. By then, the original marketing sins might be long forgotten. https://www.coindesk.com/tech/2023/11/29/blasts-one-week-600m-haul-shows-promise-of-yield-pitfalls-of-hype/

2023-11-29 11:52

Doge-1 is a cube satellite that will orbit the moon and broadcast a video feed. A planned moon mission funded by dogecoin (DOGE) took a step closer to launch following a key regulatory approval from the National Telecommunications and Information Administration (NTIA), which forms a precursor to the final Federal Communications Commission (FCC) license. The DOGE-1 satellite is being developed by space technology firm Geometric Energy Corporation, which announced the project in May 2021. The satellite will be launched aboard a SpaceX Falcon 9 rocket. “The National Telecommunications and Information Administration approved DOGE-1 X-Band (0083-EX-CN-2022 on http://ntia.doc.gov),” confirmed Samuel Reid, CEO of Geometric Energy Corporation, in an X post. “We have yet to get the FCC license grant which will address X-Band and S-Band.” A miniature screen on the DOGE-1 satellite will display advertisements, images and logos, which will subsequently be broadcast to the Earth. DOGE-1 was the first satellite launch to be paid for its entirety in DOGE tokens. The launch of DOGE-1 was first announced by SpaceX founder Elon Musk in 2021 as a rideshare abroad a collaborative rocket launch between Intuitive Machines and NASA, the U.S. space program. However, that has been repeatedly postponed by Intuitive Machines' launch provider SpaceX, which in turn postponed DOGE-1’s planned launch from 2022 to the now-targeted January 2024. DOGE-1 is one of the two dogecoin-related missions planned in the coming months. Earlierthis month, Dogecoin developers said a physical dogecoin token could reach Earth’s moon in a space payload mission planned by Pittsburg-based firm Astrobotic. The mission is currently planned for December 23 and carries 21 payloads (cargo) from governments, companies, universities, and NASA’s Commercial Lunar Payload Services (CLPS) initiative. https://www.coindesk.com/tech/2023/11/29/dogecoin-funded-spacex-doge-1-moon-mission-gets-a-step-closer-to-launch/

2023-11-29 10:16

The regulator is also seeking to have the platform blocked in the country. The Philippines Securities and Exchange Commission is warning users in the country that it may soon block access to Binance as the exchange is operating without a license in the country. In a notice, the regulator said that Binance is not authorized to sell or offer securities to the public. The regulator also said Binance is actively promoting crypto trading to Filipinos on social media, an offense in the country that may have criminal liability for the promoter. “Those who act as salesmen, brokers, dealers or agents, representatives, promoters, recruiters, influencers, endorsers, and enablers of Binance in selling or convincing people to invest in its platform within the Philippines, even through online means, may be held criminally liable under Section 28 of the Securities Regulation Code," it said in the notice, warning of fines of 5 million Philippine Pesos ($90,000) or up to 21 years in jail. The regulator is also seeking the assistance of the National Telecommunications Commission to block Binance in the country, and it has ordered Google and Meta to block local ads from Binance. This block, if approved, will take place in three months allowing local users to liquidate and withdraw their positions. Local media in the Philippines published a response from Binance, where the exchange said it was "committed to aligning with applicable local regulations. Under our new leadership, we have taken proactive steps to address the SEC's concerns.” Binance recently settled with U.S. authorities, agreeing to pay $4.3 billion in fines on charges that it failed to maintain a proper anti-money laundering program, operated an unlicensed money-transmitting business, and violated sanctions law. https://www.coindesk.com/policy/2023/11/29/philippines-security-regulator-warns-binance-is-operating-without-a-license/

2023-11-29 10:02

Major creditors are opposed to the restructuring plan and have requested an independent review. Troubled cryptocurrency exchange Zipmex has proposed paying creditors 3.35 cents on the dollar in its latest restructuring plan, according to Bloomberg, which cites people familiar with the matter. The figure could rise to as high as 29.35 cents on the dollar depending on recoveries in relation to its debt restructuring plan. The proposals have been pushed back by major creditors, who have requested a review of Zipmex's assets and liabilities, Bloomberg reported. The Singapore-based exchange has $97.1 million of debt, the report said. Zipmex CEO Marcus Lim told Bloomberg the information contained inaccuracies. He did not immediately respond to CoinDesk's request for comment. Zipmex froze withdrawals in July 2022 after it was struck by market-wide contagion following the collapse of the Terra ecosystem and subsequent crypto lenders. Zipmex lost $48 million after lending it to Babel Finance with an additional $5 million in exposure to bankrupt Celsius Network. It was one of several crypto firms that applied for creditor protection as it sought to raise external capital to fill the void left by its losses. Zipmex reportedly agreed to a $100 million deal with V Ventures, a Thailand-based venture capital firm, only for that deal to stall after V Ventures missed one of its scheduled payments in March. https://www.coindesk.com/business/2023/11/29/troubled-crypto-exchange-zipmex-proposes-to-pay-creditors-335-cents-on-the-dollar-bloomberg/