2023-11-23 08:37

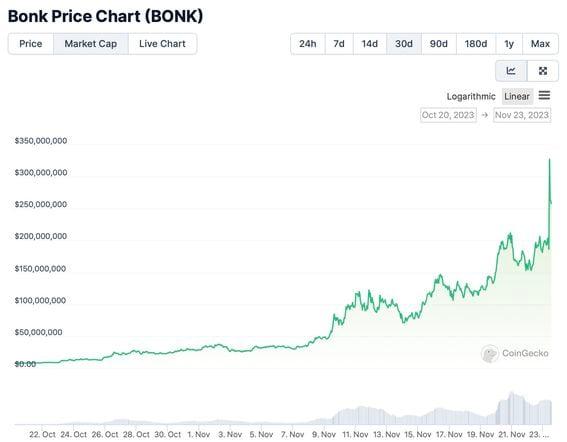

Historically, the exchange's decision to list perpetual contracts tied to smaller tokens has marked major price tops for the those cryptocurrencies. On Wednesday, Binance listed perpetual futures tied to the meme token BONK, which has rallied 1,800% in four weeks. The listing of perpetuals tied to smaller tokens has historically pricked bull runs in the respective cryptocurrencies. The market capitalization of bonk (BONK), a Solana token that came into existence as a meme coin in January, has surged over 1,800% in the past four weeks, outshining Solana's SOL token and industry leader bitcoin (BTC) by a significant margin. The good times, however, might be over. On Wednesday, Binance listed perpetual contracts tied to the token with 50x leverage. Historically, a decision by the exchange to list perpetual contracts tied to smaller tokens has marked major price tops for the relevant cryptocurrencies. Perpetuals are futures contracts with no expiry date, allowing investors to speculate on the price of an underlying asset while bypassing the physical settlement of goods involved in standard futures contracts. They also offer greater leverage than standard contracts. Here's an example: The market capitalization of Pepe memecoin's (PEPE) surged from nearly zero to $1.5 billion in the weeks leading up to the May 5 listing of PEPE perpetual futures on the exchange. The market value peaked that day, falling to as low as $380 million in the subsequent four weeks, Coingecko shows. A similar pattern played out in the decentralized lending and borrowing platform Hifi's HIFI token, which more than tripled in the first half of the month and crashed after Binance listed HIFI perpetuals on Sept. 16. Perhaps the arrival of perpetual futures saw skeptics and bears express their bearish views on the rallying cryptocurrency, pricking the price bubble. Perpetuals allow traders to short or take bearish bets on the cryptocurrency more easily than in the spot market. BONK may be following a similar course. The token's market cap has already pulled back from $327 million to $257 million in the past 24 hours, Coingecko data show. "Now, it isn’t guaranteed to work (nothing is), but if history were our guide, the likelihood of this transpiring is quite high. That said, only time will tell!," Priyansh Patel, analyst at Delphi, wrote to clients Wednesday, noting the phenomenon. Patel added that SOL's rally has been halted after it recently reached $68 and that could be another reason to worry for BONK bulls. "Seeing how BONK has pretty much mirrored SOL’s price action, it wouldn’t be unreasonable to assume that this continues and BONK produces some sideways price action if not corrective," Patel said. On Wednesday, Binance also listed perpetuals for Pyth Network's PYTH token, which has rallied 64% this week. https://www.coindesk.com/markets/2023/11/23/bonks-market-beating-price-surge-at-risk-as-binance-lists-perpetual-futures-tied-to-the-token/

2023-11-23 06:06

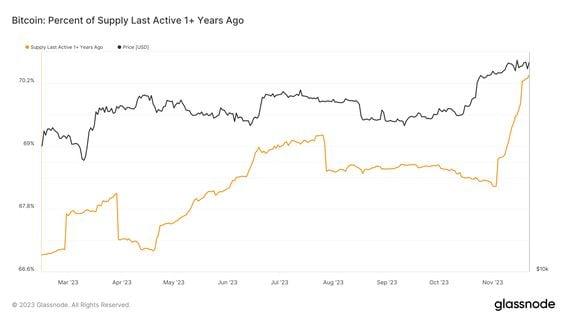

It appears bitcoin holders are not planning on offloading inventory at these price levels or any time soon, one observer said. The percentage of Bitcoin's (BTC) circulating supply that was last active on-chain at least a year ago has reached a record high of 70.35%, surpassing the previous peak of 69.35% in July, according to data tracked by blockchain analytics firm Glassnode. The new lifetime high reflects "a strong belief from bitcoin's holder base in the wake of crypto-wide contagion and macro headwinds after its all-time highs in 2021," according to Reflexivity Research. The percentage of supply that has not moved on-chain in two, three, and five years is also at their respective lifetime highs. It shows long-term investors are in no mood to sell even after bitcoin has more than doubled to $37,000 this year. "While higher prices will ultimately incentivize new sellers, with Bitcoin up over 100% in the same time period, it appears Bitcoin holders are not planning on offloading inventory at these price levels or any time soon," Reflexivity Research said in a note to clients. These metrics, however, may not paint an accurate picture once the financialization of bitcoin through alternative investment vehicles like spot-based exchange-traded funds (ETFs) and cash-settled futures gathers pace. For instance, in the ETF case, an issuer, with the help of the authorized participant, will pool the cryptocurrency and move it to custody, where it sits idle (inactive). However, investors will still take bullish/bearish trades on an exchange through the ETF units. We may earn a commission from partner links. Commissions do not affect our journalists’ opinions or evaluations. For more, see our Ethics Policy. https://www.coindesk.com/markets/2023/11/23/bitcoin-supply-inactive-for-a-year-hits-record-high-of-70/

2023-11-23 04:13

Zhao pleaded guilty to one charge of violating the Bank Secrecy Act on Tuesday. Binance's former CEO, Changpeng Zhao (CZ), cannot be allowed to leave the U.S. ahead of his February sentencing on one charge of violating the Bank Secrecy Act, federal prosecutors said in a court filing Wednesday. Zhao pleaded guilty and resigned from the crypto exchange he founded on Tuesday, alongside Binance pleading guilty to multiple criminal and civil charges tied to its allowing U.S. users and users from sanctioned regions to use the platform without adequate know-your-customer and anti-money laundering programs. Binance agreed to pay $4.3 billion in penalties, among the largest corporate fines in the history of the U.S. Department of Justice. In Wednesday's filing, prosecutors said Zhao, as a citizen of the United Arab Emirates (UAE), had "minimal ties to the U.S." and may not return should he be allowed to leave. They noted that they were not asking for him to be jailed ahead of sentencing – only that he be required to remain in the U.S. His sentencing is currently scheduled for Feb. 23, 2024, and he faces potentially over a year in prison, along with a fine. Under the terms of his current bond agreement, Zhao can leave the U.S., having put up $15 million in a trust account, signed a $175 million personal recognizance bond and found guarantors putting up additional funds. This is insufficient, prosecutors said in Wednesday's filing. If Zhao did not return to the U.S., they wouldn't be able to secure the $175 million bond as most of his assets are outside the country, and Zhao is wealthy enough that he could pay off the rest of the funds without an issue, they said. There also isn't an extradition treaty between the UAE and the U.S. During a hearing on Tuesday, Zhao's attorneys argued that forcing him to stay in the U.S. prior to sentencing would be a hardship for him and his family. His wife and children cannot relocate to the U.S. during the several-month period between Tuesday's hearing and February's sentencing. Magistrate Judge Brian Tsuchida asked prosecutors on Tuesday whether that Zhao voluntarily came to the U.S. to surrender and plead guilty meant there wasn't any serious risk of flight. There's a difference between voluntarily coming to the U.S. to plead guilty and doing so to face potential prison time, a prosecutor said in response. Zhao is currently in the U.S. until at least Nov. 27. If District Judge Richard Jones chooses not to review the DOJ filing by 5:00 p.m. Pacific Time on that day, Zhao will be free to return to the UAE, but must come back to the U.S. by Feb. 10. https://www.coindesk.com/policy/2023/11/23/binances-ex-ceo-cz-poses-a-serious-risk-of-flight-prosecutors-claim-in-asking-he-stay-in-us/

2023-11-23 02:20

The decentralized exchange had over $80 million in total value locked before the incident. Decentralized exchange (DEX) KyberSwap has been attacked for nearly $50 million, and administrators are advising users to withdraw all funds as a precautionary measure as the exploiter says negotiations will soon commence. On-chain data shows that the attacker is stealing funds mostly in Ether, wrapped ether (wETH) and USDC. The attacker has also hit multiple cross-chain deployments of KyberSwap, taking over $20 million on Arbitrum, $15 million from Optimism and $7 million from Ethereum. On-chain sleuths have ruled out this being related to a bug in the DEX's approval authorization code, and suggest that the theft is a directed attack against the liquidity provider pools themselves. The attacker has teased that "negotiations will start in a few hours when I am fully rested." The attacker also asked, "how is Ontario this time of year". Hackers teasing their victims via signing transactions with strings of text is an increasingly common trend with decentralized finance exploits. The DEX currently has $22.23 million in total value locked (TVL) according to DeFiLlama, down from approximately $80 million before the attack. https://www.coindesk.com/tech/2023/11/23/kyberswap-dex-hacked-for-48-million-attacker-teases-negotiations/

2023-11-22 20:06

After a blockchain sleuth reported that the Bitcoin mining pool may have censored a transaction from an address blacklisted by U.S. authorities, critics responded, and so did the project's co-founder. F2Pool, the third-biggest Bitcoin mining pool, drew ire on social media after a report that it might be censoring transactions from an address subject to U.S. government sanctions. One of the F2Pool project's leaders subsequently appeared to confirm the report, stirring up controversy since "censorship resistance" is considered by many Bitcoiners to be a cardinal principle of the largest and original blockchain. At the same time, many government officials around the world have expressed concern that blockchain networks can be used to finance criminal activity and terrorism. The Bitcoin development-focused blogger 0xB10C wrote Nov. 20 that his "miningpool-observer" project "detected six missing transactions spending from OFAC-sanctioned addresses." OFAC stands for the Office of Foreign Assets Control, a lead agency in U.S. government efforts to enforce economic sanctions. A few of the instances "are likely false-positives and not the result of filtering," the blogger wrote. "The transactions missing from F2Pool's blocks are, however, likely filtered," according to the piece, which was cross-posted to the website Stacker News. Bitcoin mining pool A Bitcoin mining pool is where operators working to confirm transactions on the network join together to coordinate their efforts and then share any resulting rewards – typically with the goal of providing a steadier income stream. Because they end up controlling big chunks of the network's processing, or "hashpower," their decisions can have broad ramifications. And participants in a mining pool can, relatively easily, switch to a different pool. F2Pool is responsible for about 14% of mined Bitcoin blocks over the past year, the third-most after Foundry USA's 30% and AntPool's 22%, based on data from Blockchain.com. F2Pool co-founder Chun Wang subsequently posted on X (formerly Twitter), "Why do you feel surprised when I refuse to confirm transactions for those criminals, dictators and terrorists? I have every right not to confirm any transactions from Vladimir Putin and Xi Jinping, don’t I?" The post has since been deleted. Chun later wrote that "a censorship-resistant system must be designed to resist censorship at the protocol level, rather than relying on each participant to act conscientiously and refrain from censorship." "The Internet and TCP/IP have failed this," he added. "Bitcoin should learn from the failure." A couple hours after that, Chun tweeted again, "Will disable the tx filtering patch for now, until the community reaches a more comprehensive consensus on this topic." The term "tx" is often used as shorthand for "transaction." 'Expect blowback' Based on the replies on X, the community reaction was quite negative. "The community has been in consensus on this for a very long time. You don't do it," one poster wrote. "Expect blowback," a poster wrote. Another jab displayed the project's name prominently next to the U.S. Treasury Department's seal: https://www.coindesk.com/tech/2023/11/22/bitcoins-anti-censorship-ethos-surfaces-after-mining-pool-f2pool-acknowledges-filter/

2023-11-22 19:33

Analysts suggest the Binance deal may have cleared the decks for the long-awaited U.S. spot bitcoin ETF. Volatile crypto markets this week have resolved to the upside Wednesday afternoon, with bitcoin (BTC) pushing through $37,400 and now higher for the week despite the exit from the scene of another major crypto figure. Crypto markets were initially buffeted Monday on the leak of a potential massive settlement of U.S. criminal charges against Binance, the world's largest crypto exchange. Confirmation on Tuesday of the $4.3 billion fine as well as a guilty plea by its founder and CEO Changpeng "CZ" Zhao – who also agreed to step away from the company – shook markets further, sending bitcoin plunging below $36,000 at one point that evening. Markets have been bouncing since, though, with bitcoin now higher by about 1.5% over the past 24 hours and just shy of $37,400 after having begun the week at about $37,000. The broader CoinDesk Market Index (CMI) is ahead by more than 2% over the past 24 hours, led by a 5% gain for ether (ETH) and 6% advances for Solana (SOL) and Chainlink (LINK). Stepping away from the headlines, a number of observers have noted that the Binance settlement in essence may have cleared the decks for the U.S. Securities and Exchange Commission (SEC) to finally approve a spot bitcoin ETF. The neutering of Binance and exit of CZ, they said, might have eased the agency's concerns regarding overseas manipulation of bitcoin prices. "With this plea deal, the expectations for a spot Bitcoin ETF might have increased to 100% as the industry will be forced to follow the rules that TradFi firms must follow," wrote crypto services provider Matrixport. "Binance uncertainty out of the way, its activities will now be monitored by an independent compliance monitor," said economist Alex Kruger. "Waiting for the market to agree with me that this is actually bullish." https://www.coindesk.com/markets/2023/11/22/bitcoin-and-crypto-markets-shake-off-binance-news-turn-higher-for-week/