2023-11-15 19:03

Franklin Templeton also has an outstanding bitcoin ETF application with a Nov. 17 decision deadline. The U.S. Securities and Exchange Commission (SEC) is delaying a decision on an application by Hashdex to convert its existing bitcoin futures exchange-traded fund (ETF) into a spot vehicle. The agency has also delayed action on Grayscale's attempt to launch a new futures-based ether ETF. Hashdex filed to convert its bitcoin futures ETF into a spot bitcoin ETF in September. Grayscale (a subsidiary of CoinDesk parent Digital Currency Group) filed for its ether futures ETF that same month. Both filings faced initial deadlines of Nov. 17 for a decision, but the SEC today said it was extending this window, according to a pair of Wednesday filings. The delays come amid heightened anticipation of a spot bitcoin ETF approval by the federal regulator, which has so far rejected every attempt to list such a product for the general investing public. Over a dozen companies have filed to launch spot bitcoin ETFs in 2023, with several others now applying for similar products exposed to ether, the second-largest cryptocurrency by market capitalization. The regulator has yet to indicate how it might ultimately rule on the latest slate of applicants. Previous rejections raised concerns about the susceptibility of bitcoin to market manipulation and a lack of surveillance-sharing agreements, among other concerns. Applicants now say these concerns have been addressed or are no longer relevant after the approval of bitcoin futures ETFs, a view an appeals court echoed earlier this year. The SEC has so far delayed making final decisions on these applications. Today's delays don't seem to be putting a dent in the price of bitcoin (BTC), which has moved higher by more than 5% this afternoon to $37,500. Franklin Templeton, another bitcoin ETF applicant, also faces a Nov. 17 deadline, while other companies will not see any further decisions until 2024. https://www.coindesk.com/policy/2023/11/15/sec-delays-decision-on-hashdex-bitcoin-spot-etf-application-grayscale-ether-futures-filing/

2023-11-15 17:07

The company's plan highlights Hong Kong's rising profile as a digital asset hub. Boyaa Interactive, a Chinese gaming company listed on the Hong Kong Stock Exchange, unveiled plans this week to potentially buy up to $100 million worth of cryptocurrencies, mostly bitcoin (BTC) and ether (ETH) within a year. "The purchase and holding of cryptocurrencies is a pivotal move for the Group to path its business layout and development in the field of Web3," the company said in a stock exchange filing released Monday. "The online gaming business has high compatibility with Web3 technology, and its focus on communities, users and virtual assets may enable an easier and wider application of Web3 technology to the online gaming industry." Boyaa outlined a plan to allocate $45 million to acquire BTC, $45 million to ETH and the remaining $10 million to Tether's (USDT) and Circle's (USDC) stablecoins within a 12-month period. The company said it will fund the purchases with cash and the buys are subject to market conditions.The company's board is seeking its shareholders' approval of the plan, and will dispatch details on or before Nov. 30, according to the filing. The $100 million crypto acquisition is a substantial amount for the company, constituting roughly 38% of its total assets, the filing said. Boyaa's digital asset plan highlights Hong Kong's rising ambition as a global hub for crypto and Web3 industries. Local authorities rolled out a new digital asset regulatory regime this year, accepting applications for crypto trading platform licenses and started allowing exchanges to serve retail customers. "In view of the virtual assets’ attraction to global investors and the future opportunities that will be opened up as virtual assets move into the field of Web3, the Hong Kong Government has been committed to providing a facilitating environment for promoting the sustainable development of virtual asset transactions, " the company said in the filing. https://www.coindesk.com/business/2023/11/15/hong-kong-gaming-company-boyaa-interactive-seeks-approval-to-buy-100m-in-crypto-to-boost-web3-strategy/

2023-11-15 15:58

In Europe and the U.S., there are a host of initiatives placing new requirements on participants in digital asset markets to report on transactions and meet other new provisions. This op-ed is part of CoinDesk’s Tax Week, presented by TaxBit. Erin Fennimore is the VP of Tax Solutions at TaxBit. The digital asset industry has seen significant regulatory movement in the United States and abroad, all to promote tax transparency. This trend for global transparency is driven by many factors, such as tax evasion and avoidance, and the overall goal of ensuring a fair and transparent global tax system. The primary vehicle of tax transparency is the exchange of information between enterprises and local tax authorities. Outside of the U.S., the Organization for Economic Co-operation and Development (OECD) and G20 have led the initiative to promote global tax transparency. This article will help highlight the key takeaways from the proposed digital asset broker regulations in the U.S. and other key initiatives across the globe, highlighting important commonalities and timelines. U.S. proposed digital asset broker regulations The U.S. Treasury Department issued proposed regulations clarifying the definitions, requirements and implementation timelines for digital asset brokers' tax information reporting requirements as outlined in the Infrastructure Investment and Jobs Act (IIJA) passed by Congress in 2021. "These proposed regulations are designed to help end confusion involving digital assets and provide clear information and reporting certainty for taxpayers, tax professionals, and others," said IRS Commissioner Danny Werfel. The regulations are a significant step in the regulation of digital assets in the United States. They are expected to have a significant impact on the digital asset industry. The regulations are also expected to increase transparency in the digital asset market and help combat money laundering and other financial crimes. Key takeaways: It is important to note that these regulations are not finalized. The IRS is accepting comments on the proposed regulations and held a virtual public hearing on Nov. 13. All comments made to the IRS are public and can be viewed on the federal commentary docket website. The key areas that highlight the impact on the digital asset community are summarized below. Digital asset broker A “digital asset broker” in the proposed regulations is defined as any person who provides services facilitating the sale or exchange of digital assets, including centralized exchanges, digital asset payment processors and certain decentralized protocols where there is sufficient control or influence over the protocol to make changes to it. Along with the clarification and more narrowly tailored digital asset broker definition, the proposed regulations refined the language to focus on three types of enterprises. Centralized exchange operators that facilitate digital asset transfers on behalf of users Digital asset payment processors Decentralized protocols accessible to U.S.-based individuals that meet certain requirements. The third categorical example necessitates the most nuanced analysis. At a high level, an enterprise that falls into the third category will need to determine if two factors are met under the proposed regulations: Provides a facilitative service and Based on the nature of the service, would know or be in a position to know both (1) The identity of the party making the sale and (2) the nature of the transaction potentially giving rise to the proceeds from the sale. Looking at the first factor, the regulations define facilitative services as facilitating the sale (or exchange) of digital assets regardless of whether that is done through an autonomous protocol, access to a trading platform, automated market maker systems or any order matching service. This approach illustrates the Treasury’s understanding of how digital asset trading services differ from traditional financial broker services. Regarding the second factor, the regulations explain that a person would know or be in a position to know if they can set or change the terms under which the services are provided. This focuses on whether a person has sufficient control over an autonomous protocol to make changes, updates or otherwise influence its operation. Suppose the DeFi protocol can be managed, controlled or overwritten by a centralized group in any way. That protocol will likely be viewed as sufficiently centralized to be treated as a digital asset broker. Conversely, suppose the protocol truly operates autonomously, without any oversight, intervention or influence from a particular group. In that case, it will not be considered a digital asset broker and not be subject to the reporting requirements. Along with helping to define who is in scope, the proposed regulations specified who will be considered out of scope, including miners, stakers and wallet software providers. Digital assets defined Digital assets are defined as assets that include any digital representation of value that is recorded on a cryptographically secure distributed ledger, even if not every transaction is individually recorded. These proposed regulations clarified that stablecoins and non-fungible tokens (NFTs) are considered in scope and is already a key area of focus for the commentary that the IRS has received. Form 1099 reporting The core function of being a broker involves broker related onboarding procedures, cost basis tracking and ultimately 1099-B reporting. Historically, Form 1099-B has been used in traditional finance to report the required information. Although not specifically referenced in the proposed regulations, the IRS has commented publicly about creating a new form (1099-DA) to be used for digital assets. Similar to reporting on traditional financial assets, digital asset reporting will require a broker to include the following pieces of information for each transaction: Name, address, taxpayer identification number Digital asset details (name, type, number of units) Date and time (UTC) Gross proceeds of the sale and adjusted cost basis Transaction ID or hash Digital asset addresses involved Form of consideration received For assets that were transferred into a Broker and subsequently disposed of, the following information will also be required: Date and time of such transfer-in transaction Transaction ID or hash of such transfer-in transaction Digital asset address (or digital asset addresses if multiple) from which the transferred-in digital asset was transferred Number of units transferred in by the customer as part of that transfer-in transaction Customer tax onboarding requirements To effectively comply with 1099 reporting, digital asset brokers will need to know who their customers are for tax reporting purposes. This means they will need to be able to identify and collect the following information for reportable accounts: Identification of accounts as U.S. or non-U.S. Collection of names, addresses, and certified U.S. tax identification numbers (TIN) Brokers within the traditional finance industry currently have an obligation to collect certified tax identification numbers (TINs). Accordingly, digital asset brokers will assume that same obligation. This requirement will impact digital asset customer onboarding in a significant way. Digital asset brokers will be required to collect certified taxpayer identification numbers (TINs), achieved by collecting a Form W-9 or Substitute W-9. The information collected on a Form W-9 is used to populate and file Form 1099-B, and the new Form 1099-DA, specific to digital asset broker reporting. Global trends for tax transparency The U.S. is not the only country issuing regulations related to digital asset tax transparency. With the rise of use cases with digital assets across the globe, there has been a myriad of proposals and frameworks that have also arisen for enterprises within digital assets and e-money. While the objectives of these frameworks and regulations all center around tax transparency, it is important to understand their differences, timelines and impact to your enterprise. Crypto-asset reporting framework On Oct. 10, 2022, the 38-member country OECD published the final guidance for the Crypto-Asset Reporting Framework (CARF). It read: “In light of the rapid development and growth of the crypto-asset market...” On Nov. 10, approximately 47 countries published a statement that they plan to “swiftly transpose” the CARF into domestic law, and intend for active exchange of information to commence by 2027. The intended effective dates for the remaining 38 countries are still unknown, but the OECD, intends to work towards global adoption and implementation of the framework, so it’s incorporated into the local laws of member states. The DAC8 On the heels of CARF, on Dec. 8, 2022, the E.U. Commission issued the seventh amendment to the Directive on Administrative Cooperation (DAC8). The adopted directive entered into force on Nov. 13, 2023 and E.U. member states will have until Dec. 31, 2025 to transpose the new rules into local law with the first application from Jan. 1, 2026. The DAC8 will extend the scope under DAC to crypto service providers on exchanges and transfers of crypto assets and e-money. The provisions of DAC8 have significant overlap with CARF, and will ultimately mean that crypto asset service providers will be obligated to report certain information about transactions involving EU residents. Markets in Crypto Assets Regulation (MiCA) On June 30, 2022, the European Parliament and Council reached a provisional agreement on the Markets in Crypto-Assets (MiCA) regulation. MiCA’s objective is to increase the safeguards for digital asset investors by requiring common E.U.-wide definitions and rules. MiCA requirements will be effective as of Dec. 30, 2024. As a result, crypto-asset service providers operating in E.U. providers will be required to have registered offices within the trading bloc. CESOP The Central Electronic System of Payment Information (CESOP) is a new E.U. initiative to combat Value Added Tax (VAT) fraud related to cross-border payments. By Q1 2024, payment service providers in the E.U. will be required to report cross-border payments on a quarterly basis. This initiative aims to bring transparency and compliance to cross-border transactions, particularly those involving e-money institutions. Crypto exchanges should be aware of CESOP as it will likely have an impact when an exchange facilitates the buying and selling of cryptocurrencies between a buyer and seller across different E.U. member states CESOP reporting will be triggered when a buyer (i.e. payer) is located in the E.U. and has engaged in a cross-border transaction with a seller (i.e. payee) in either an EU or non-E.U. state CESOP limits reporting in a variety of ways, primarily by requiring 25 or more cross border payments to a seller (i.e. payee) CoinDesk does not share the editorial content or opinions contained within the package before publication and the sponsor does not sign off on or inherently endorse any individual opinions. https://www.coindesk.com/consensus-magazine/2023/11/15/the-global-movement-to-promote-crypto-tax-transparency-what-you-need-to-know/

2023-11-15 15:00

Intent-centric programs are quietly transforming how we use blockchains, but they bring risks as well as benefits. A quiet revolution is underway transforming how we use blockchains, and at its core is one of crypto's latest buzzwords: "intents." Simply defined, an intent is a specific goal a blockchain user wants to accomplish. While no two "intent-centric" systems are the same, they all work similarly: users, be they traders or protocols, submit their intent to a service, and then it is outsourced to a "solver" – it could be a person, or an AI bot, or another protocol – that does whatever it takes to get the job done. These are becoming important now because blockchains are expanding so rapidly. With Bitcoin, Ethereum, a host of alternative layer-1 networks, layer-2 networks, and now even layer-3 networks proliferating, accompanied by myriad "bridges" and other "interoperability" solutions connecting them all, it's all becoming more daunting to navigate. As the crypto market has matured, "the number of possibilities that you can do on blockchains has compounded," Arjun Bhuptani of Connext, an interoperability protocol, explained. "You have an infinite possible way of doing a transaction at a given time." Newer intent-centric services promise to find users the best way to get things done – allowing them to maximize trading profits and save on gas fees, among other benefits. But with the advantages of these platforms come risks, and some observers are already ringing alarm bells: While we might welcome the help of third-party solvers to take care of our blockchain busy work, new services could give rise to a new breed of monopolists. Understanding intents Blockchains can be thought of as massive, global computers. Traditionally, users provide detailed instructions (e.g., use Uniswap to swap token A for token B at a specific price), which the blockchain executes step-by-step. In the new world of intents, however, this model is flipped on its head. Users express what they want to get done (e.g., swap A for B at the best price) without specifying the how, letting the protocol manage the details. Consider the analogy of hailing a taxi. Traditional blockchain services are like giving the driver turn-by-turn directions, which can be tedious and costly if your route involves twists or hard-to-find shortcuts. With intents, all you need to do is provide the taxi driver with a destination, then sit back and trust your driver. A new wave of blockchains and protocols, including Anoma, Flashbots and CoW Swap, are already offering intent-centric services to crypto users. Users can submit a general goal to one of these services, like "swap these tokens for the best price," and have it handled by a third-party solver for a fee. How it all works Different platforms apply different verbiage to the idea of 'intents,' but the general premise remains the same. Most intent-based protocols today start with some kind of "intent-discovery" system, a place "where users broadcast the things that they want," Bhuptani explained. In blockchain parlance, these discovery venues could be considered "mempools" – waiting areas for yet-to-be-processed transactions. An intent "could be something like, 'I have USDC, I want to figure out how to turn it into XYZ asset, and I want to do that on another chain or in some specific way,'" said Buhptani. "There's no limitation as to the complexity of the intent that one could express." "Then you have a marketplace of solvers," Bhuptani continued. Solvers "listen" for intents, and they fulfill them if the price is right. "These intent solvers are automated actors that are basically saying, 'Oh, a user wants to do XYZ?' Okay, let me do it on their behalf because I can earn some fees for it." At a high level, this might all sound familiar. Aren't we expressing an intent when we ask Coinbase to swap ether (ETH) for bitcoin (BTC), or if we instruct an exchange aggregator like 1inch to sell our Solana tokens to whatever market features the highest price? Well, yes. "Intents," like so much else in the world of crypto, are a fancy way of describing a phenomenon that already exists. The trick with intents in 2023 – and the reason why the term has picked up steam in the past year – is due to the number of services, new and old, that are trying to squeeze user-friendly intents into boxes that conform to crypto's decentralized ethos, and can be dragged and dropped into virtually any use-case. Most new intent-based protocols "decentralize" their systems by outsourcing to a network of solvers that compete to fill user requests for the best possible price. This competitive system is meant to ensure that no central third party is tasked with satisfying all user needs. Intents in action Intent-centric systems are already live for a variety of use cases. Bhuptani's Connext protocol uses intents to shepherd transactions between different blockchains. Users can express the intent to transfer a token from one chain to another, for instance, and a network of solvers will find the optimal route. Anoma, the protocol that popularized the concept of blockchain-based intents, offers what it calls, simply, "intent-centric infrastructure." In basic terms, Anoma's infrastructure is designed to extend intent-centric functionality to virtually any use case, helping other services match intents to a network of solvers. SUAVE, an upcoming blockchain from the maximal extractable value (MEV)-focused infrastructure firm Flashbots, is one of the most talked-about services designed around a version of intents, which it calls "preferences." When SUAVE launches, users will be able to submit "preferences" to a competitive market of network operators that bid against one another to fill them. The system is built to help to balance user priorities with MEV. The risk of rent-seekers While intent-centric services offer a wide array of user experience benefits, one need only look to the taxi analogy to see where the systems can go wrong. Providing detailed directions for all of our taxi rides, akin to the traditional model of specifying every step in a blockchain transaction, would be burdensome and error-prone. But there's also a problem with the "trust the driver" approach that more closely resembles intent-centric systems: We've all had the experience of hopping into a taxi in an unfamiliar city for what we expect to be a quick ride, only to sit awkwardly as our driver takes a suspiciously long route, running up the meter. The taxi driver in this analogy is like the solver in an intent-centric system: trusting the solver to take care of a task means trusting them to execute it honestly. Intent-centric programs typically have systems in place to keep solvers honest, meaning a more apt analogy might be to Uber, which keeps drivers in check with its up-front pricing and in-app routing. But ride-sharing apps only further underscore the risk of intent-based systems: anyone who has experienced the rising prices of Ubers in recent years has seen firsthand how convenience can entrench big players at the expense of end users. The real risk with intent-centric systems isn't just dishonesty, but the potential for new monopolies. Paradigm, a prominent blockchain investor and researcher, highlighted these risks in a blog post: "While intents are an exciting new paradigm for transacting, their widespread adoption may imply an acceleration of a larger trend of user activity shifting to alternative mempools," wrote Paradigm’s researchers. "If improperly managed, this shift risks centralization and entrenchment of rent-seeking middlemen." As we become more comfortable relying on these third parties to satisfy user intents, it is possible that these companies will begin to act in their own self-interest – either by charging higher fees (e.g., Uber) or by filling orders in a manner that serves them instead of users. Although most intent-centric services outsource to a competitive market of solvers – ostensibly as a way to avoid centralization – there's still the potential that some companies might dominate the space. For instance, one could imagine a crypto exchange building solvers to dominate the "buy" and "sell" use-case – effectively driving all market activity to its own book. The exchange could subsidize its fees at first as a way to edge out competitors, only to hike up its prices once it has taken over the marketplace. In the best case, intent-based models can usher in a new wave of blockchain-based systems that save time and money for users – making the technology more accessible to more users. But realizing this future will require proceeding with care. https://www.coindesk.com/tech/2023/11/15/intents-are-blockchains-big-new-buzzword-what-are-they-and-what-are-the-risks/

2023-11-15 14:43

It's been a bit more than two years since the country made bitcoin legal tender there. In November 2022, El Salvador President Nayib Bukele announced a country-level dollar cost averaging (DCA) plan, promising to buy one bitcoin every day. At the time, the country – based on public statements from Bukele - was already the owner of 2,381 bitcoins purchased at an average price of roughly $44,300. The price then was just $19,000, putting the country at about a $60 million loss on its holdings. Bukele has kept pretty quiet about El Salvador’s purchases since and the exact amount of bitcoin that the country owns is not clear as there is no public government record. Assuming that the country did indeed purchase one bitcoin per day over the past year, CoinDesk estimates El Salvador's holdings would sum to 2,744 bitcoin as of Nov. 14. Based on the median price of BTC over each of those days, the country's average purchase price would have drifted down to roughly $41,800. Figuring a current bitcoin price of $36,000, El Salvador would now be sitting on a loss of about $16 million on its bitcoin holdings. Since Bukele moved to make bitcoin legal tender, the International Monetary Fund (IMF) has repeatedly warned of increased risks to the country's economic growth and ability to make good on its debt. Despite the modest paper losses on the nation's bitcoin holdings, things to this point appear to be on a good path. El Salvador's bonds in mid-August had posted a 70% year-to-date return, with a number of big-name banks recommending that more gains were coming. The country's debt earlier this month was upgraded at S&P Global to B- from CCC+. Bukele recently announced his intention to run for re-election in 2024 and polls show him with an overwhelming lead. As to whether the populace is rushing to adopt a bitcoin standard, questions remain. One place to check would be remittances from outside the country, given the economy's reliance on those payments. According to central bank data, of $7 billion in remittances from abroad in 2022, just 1.2% used cryptocurrency wallets. CoinDesk reached out to the President’s team who did not respond to comment. https://www.coindesk.com/markets/2023/11/15/el-salvador-remains-in-the-red-on-bitcoin-holdings-but-losses-are-narrowing/

2023-11-15 14:38

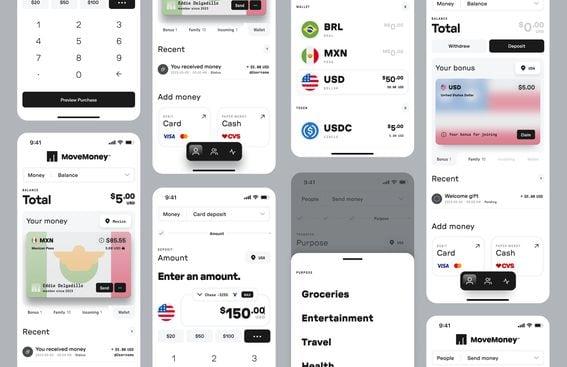

Remittances are one of the most compelling use cases for stablecoins, offering fast, non-stop settlements and cheap transactions using blockchains as payment rail. U.S.-based fintech firm CFX Labs disclosed Wednesday that it raised $9.5 million in seed investments to expand its Solana blockchain-based stablecoin payment and remittances network globally. The fundraising was oversubscribed, the firm said in a press release, with Shima Capital, Decasonic, Antalpha, CMT Digital, Corazon Capital, Kraken Ventures, New Form Capital and Illinois-based Metropolitan Capital Bank & Trust participating. Remittances are one of the most compelling use cases for stablecoins, as transactions on the blockchain can settle almost instantly, offer lower fees and are open 24/7. U.S. dollar-backed stablecoins are digital dollars in a token form and serve as a key role in bridging traditional currencies and blockchain-based digital assets. CFX Labs' payment network enables people to send and receive fiat dollars overseas to countries such as India, Mexico and Nigeria using the firm's proprietary stablecoin fxUSD and the Solana (SOL) blockchain as payment rail for transactions. Customers can also initiate money transfers from brick and mortar convenience stores across the U.S including Walmart, CVS, Walgreens and Rite-Aid. When users deposit cash, they receive digital dollars in the company's MoveMoney embedded wallet. Since MoveMoney opened in October, customers have opened some 4,000 accounts, founder Nick Cavet said in an interview with CoinDesk. The company will use the fresh investment to expand its network to more countries, aiming to reach 1.2 billion people by 2024 Q2, according to the press release. "CFX Labs plans to expand into new geographies and has an enormous total addressable market, encompassing over one billion people who have sent or received remittances globally with a product that boasts low fees, convenience and quick settlements," Stuti Pandey, principal of Kraken Ventures, told CoinDesk in a note. CORRECTION (Nov. 15, 15:53 UTC): Metropolitan Capital Bank & Trust is based in Illinois, U.S., not in the Philippines. https://www.coindesk.com/business/2023/11/15/solana-based-stablecoin-remittances-get-a-boost-with-cfx-labs-fresh-95m-fundraise-to-expand-globally/