2023-11-15 10:24

The decentralized exchange debuted its layer 1 blockchain based on Cosmos this week. DYDX, the native token of the newly-released dYdX chain, has risen by more than 20% in the past 24 hours, just 16 days before more than $500 million worth of tokens will be unlocked to early investors and core team members. The surge in the DYDX price comes as the project, previously just a decentralized exchange (DEX), launched its layer-1 blockchain based on Cosmos – a move that enables validators to receive a portion of trading revenue as a reward for staking. Over the past 30 days, DYDX has more than doubled in price as speculators anticipated the token's migration from Ethereum to the dYdX chain. However, a large token unlock in just over two weeks has the potential to damp spirits. There are 179 million DYDX tokens in circulation, and the upcoming unlock will increase that to 395 million, according to token.unlocks. The unlock was meant to take place in January this year, but was shelved until December, a decision that spurred an initial price hike earlier this year. Research published earlier this year from The Tie reveals that large token unlocks lead to a decline in price as demand for the asset can't keep pace with the increase in supply, known as inflation. DYdX CEO Antonio Juliano has attempted to remedy that by incentivizing staking, a method that involves locking tokens on a blockchain to receive rewards. Juliano revealed on Tuesday that stakers will receive "cold hard USDC," for staking and that validators will receive 100% of trading fees. USDC is a dollar-pegged stablecoin. https://www.coindesk.com/markets/2023/11/15/dydx-pumps-ahead-of-massive-500m-token-unlock/

2023-11-15 09:54

The test will explore bilateral digital asset trades, foreign currency payments, multicurrency clearing and settlement, fund management and automated portfolio rebalancing. Singapore's central bank is starting to test tokenization use cases alongside major financial services firms including JPMorgan (JPM), DBS (D05) and BNY Mellon (BK). The tests will examine bilateral digital asset trades, foreign currency payments, multicurrency clearing and settlement, fund management and automated portfolio rebalancing, the Monetary Authority of Singapore (MAS) said Wednesday. JPMorgan and Apollo have carried out a "proof of concept" to demonstrate how asset managers could tokenize funds on the blockchain as part of the project, the firms announced concurrently with MAS' statement. The initiative is part of Project Guardian, a policymaker group that includes Japan's Financial Services Agency (FSA), the U.K's Financial Conduct Authority (FCA) and the Swiss Financial Market Supervisory Authority (FINMA) to advance asset tokenization. The MAS is also exploring the design of a digital infrastructure to host tokenized assets and applications, called Global Layer One (GL1), to enable cross-border transactions and allow tokenized assets to be traded across global liquidity pools. Tokenization, the term used for minting real-world assets as blockchain-based tokens, is one use case for digital asset technology attracting the attention of the world's most prominent mainstream financial institutions due to its potential to expedite processes and make them more efficient and less costly. Read More: Upbit Receives Preliminary 'In-Principal' Approval in Singapore https://www.coindesk.com/policy/2023/11/15/monetary-authority-of-singapore-starts-tokenization-pilots-alongside-financial-services-heavyweights/

2023-11-15 09:31

Libeara will enable the creation of a tokenized Singapore dollar government bond fund. SC Ventures, the fintech investment and venture arm of banking group Standard Chartered, announced a new tokenization platform, Libeara, on Tuesday. The platform will enable the creation of a tokenized Singapore dollar government bond fund for accredited investors, according to the announcement. Libeara has also partnered with FundBridge Capital, an organization for fund managers in Singapore. "By partnering with Libeara to offer a tokenized Singapore dollar government bond fund for all our investors, we are ensuring that we can provide additional investment opportunities enabled by lower operating costs, higher transparency and higher operational efficiency,” Sue Lynn Lim, CEO and COO of FundBridge Capital said in the press statement. Banks and other financial players are increasingly offering tokenized assets. HSBC said last week that it had recently introduced tokenized gold and that it planned to offer a tokenized securities custody service for institutions. Last month, Singapore, Japan, U.K. and Swiss regulators said they planned to conduct tokenization tests for asset management products. https://www.coindesk.com/tech/2023/11/15/standard-chartered-investment-arm-launches-tokenization-platform/

2023-11-15 09:20

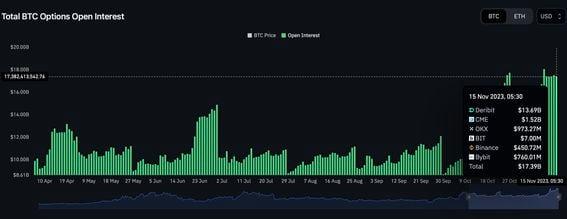

The notional open interest in BTC options worldwide stood at $17.5 billion at press time, while open interest in the futures market was $15.84 billion. The bitcoin options market is now bigger than the BTC futures market in terms of notional open interest. The flipping is a sign of market maturity and the influx of sophisticated traders in the market. The crypto market has come back to life this year, with bitcoin (BTC) doubling in value, supposedly on the back of haven demand, spot ETF excitement in the U.S. and dovish Federal Reserve expectations. While most activity was initially concentrated in bitcoin's spot and futures markets, options tied to the cryptocurrency, which offer a cheap way to bet on a price rise or drop, have become more prominent. In terms of open interest (OI), the BTC options market is now bigger than the futures market. At press time, the U.S. dollar value locked in active options contracts stood at $17.39 billion, almost 10% more than futures' open interest of $15.84 billion, according to data source CoinGlass. Increased activity in the options market is a sign of market sophistication, according to Luuk Strijers, chief commercial officer of leading crypto options exchange Deribit. "The surpassing of BTC options open interest over futures OI is a clear sign of the market maturing," Strijers told CoinDesk. "This shift indicates a growing preference for options as tools for strategic positioning, hedging, or access to the recent rise of implied volatility, reflecting the market's evolving sophistication." A bigger options market also means traders need to consider the impact of quarterly and monthly settlements and market makers' hedging activities on spot prices. Options are derivative contracts that give the purchaser the right, but not the obligation, to buy or sell the underlying asset at a predetermined price on or before a specific date. A call option gives the right to buy, while a put confers the right to sell. Traditionally, options are used to mitigate risk, although some speculators use them like futures to amplify returns. Bulls typically buy puts to protect against a potential downside, while bears use call options to protect from a sudden upswing in prices. Efficient use of options is contingent on a thorough understanding of key metrics, the so-called Greeks – delta, gamma, theta and rho, that affect the price of an options contract. One possible reason for options' growing popularity is that they allow traders to not only hedge against and profit from the bitcoin price, but also other factors such as volatility or the degree of price turbulence and time. Writing or selling options to profit from a market lull and collect an additional yield on top of the spot market holdings were popular strategies earlier this year. More recently, traders have bought options to benefit from the renewed volatility explosion. Volatility has a positive impact on options' prices. Unlike options, spot and futures markets are one-dimensional, allowing speculation only on the direction of the price. Futures contracts commit a buyer to pay for and a seller to deliver a particular asset at a future date. Futures are generally considered more risky than options, involving greater leverage and allowing traders to control assets of much greater value. That exposes futures traders to outsized losses that exceed the value of their initial deposit and to forced liquidations by exchanges. https://www.coindesk.com/markets/2023/11/15/bitcoins-options-market-has-overtaken-its-futures-market/

2023-11-15 07:42

Large movements in spot markets led to open interest surging to $35 billion over the weekend, indicating highly leveraged bets from traders hoping for even higher prices. Funding rates on the futures of major tokens have started to revert to normal levels after recent euphoria led to traders paying unusually high fees to remain in their long positions. Large movements in spot markets led to open interest surging to over $35 billion over the weekend, indicating highly leveraged bets from traders hoping for even higher prices. This was a near 40% increase since the $24 billion level at the end of October, data shows. The levered pile-on meant funding levels moved to some of their highest in recent months. Funding rates are periodic payments made by traders based on the difference between prices in the futures and spot markets. Data shows traders were paying anywhere from 0.2% to 0.5% in fees every eight hours on their borrowed funds to remain in their long positions. This meant speculators paid as much as 50 cents to exchanges on a $100 position. However, some market watchers warned of a dump as traders were more incentivized to go short or bet against, a price rise as such positions earned fees from those going long. In futures trading, longs pay shorts when funding is positive, and vice-versa when funding is negative. This likely culminated in Tuesday’s market drop as traders took profits on a week-long rise. Nearly 90% of bullish bets were liquidated, amounting to over $300 million, with bitcoin traders losing $120 million as prices sank 4%. Ether traders lost $63 million, while XRP and Solana’s SOL-tracked futures saw over $30 million in cumulative liquidations. Liquidation refers to when an exchange forcefully closes a trader’s leveraged position due to a partial or total loss of the trader’s initial margin. It happens when a trader is unable to meet the margin requirements for a leveraged position (fails to have sufficient funds to keep the trade open). Large liquidations can signal the local top or bottom of a steep price move. As such, funding rates are back to normal levels of an average of 0.01% on most exchanges as of Wednesday morning. Crypto markets added over 6% in the past week on the back of heightened expectations of a spot bitcoin exchange-traded fund (ETF) approval in the U.S., with some analysts reiterating a 90% chance of a January nod. Elsewhere, traditional finance giant BlackRock filed for an ether (ETH) ETF – buoying the token higher, alongside alternatives such as Avalanche, Solana and Polygon. https://www.coindesk.com/markets/2023/11/15/crypto-futures-funding-rates-normalize-after-bitcoin-drops-to-356k/

2023-11-15 07:30

Asset manager CoinShares, along with crypto custody joint venture Komainu, are aiming for TradFi standards in derivatives settlement with much-reduced counterparty risk. OKX, the second largest cryptocurrency trading platform, is providing derivatives trading without the counterparty risk associated with assets being held on the exchange, enriching an existing partnership with asset manager CoinShares and custody joint venture Komainu. Since FTX blew up last year, a number of players in the crypto space have devised ways to trade and settle off-exchange from the safe confines of a trusted custody setup. Off-exchange settlement is relatively easily done for spot markets, said the head of hedge fund solutions at CoinShares, Lewis Fellas. A big differentiator, he said, is providing a similar arrangement when it comes to derivatives trading. “We've taken a collateral mirroring agreement and embedded that so we can trade the full suite of OKX products in the derivatives platform,” said Fellas in an interview. “This is a lot more complicated, because you've got margin financing, you have to deal with risk mitigation on the downside, for instance; so if the client puts on a huge position and it goes down, how do you deal with collateral calls, etc.” As well as rolling out Komainu custody-based derivatives trading with the main Coinshares entity, a gaggle of other hedge funds will be using the new system, Fellas said without naming the funds. The settlement system will also be expanded to other exchanges in due course, he said. OKX began working with custody specialist Komainu, a joint venture between Japanese bank Nomura, CoinShares and crypto storage firm Ledger, back in June of this year. As well as dealing with the complexity of derivatives and swaps from the trading perspective, the firms have also created a standardized legal agreement that can then be adopted by a multitude of counterparties, said Sebastian Widmann, head of strategy at Komainu. “If spot settlement is 0.1 of this phase, I think now with derivatives, we have reached 0.2,” Widmann said in an interview. “We are trying to bring standards into the marketplace as more firms enter, especially institutional players who are accustomed to having custody and exchange segregated.” https://www.coindesk.com/business/2023/11/15/crypto-giant-okx-goes-live-with-off-exchange-derivatives-trading/