2023-11-15 05:52

The 90 day net change in the supply of the top four stablecoins has flipped positive, indicating an inflow of capital into the market. Money is flowing into the crypto market through stablecoins or the U.S. dollar-pegged tokens for the first time in over a year, according to data tracked by blockchain analytics firm Glassnode. The 90 day net change in the supply of the top four stablecoins – tether (USDT), USD Coin (USDC), Binance USD (BUSD) and Dai (DAI) – has turned noticeably positive, the first such instance since the collapse of Terra in mid-May 2022. Since 2020, stablecoins have been widely used to fund cryptocurrency purchases. Hence, an increase in the supply of stablecoins is taken to represent potential buying pressure or dry powder that investors may deploy to purchase cryptocurrencies or use as a margin in derivatives trading. "This week, the 90-day change in aggregated stablecoin supplies flipped positive for the first time in 1.5 years. This signals increased liquidity on-chain expressed through stablecoins and can be perceived as a sign of capital inflows," Reflexivity Research said in an email to subscribers on Nov. 14. The turnaround comes as bitcoin (BTC) has doubled to over $35,000 this year, with most gains happening predominantly on the back of expectations U.S. regulators will soon approve an exchange-traded fund that invests in the cryptocurrency. The indicator turned negative in the first half of May 2022, as smart contract blockchain Terra's LUNA token, meant to stabilize the blockchain's algorithmic stablecoin UST, crashed from $80 to a few cents, destroying billions in investor wealth. Liquidity continued to leave the market in the subsequent months as bankruptcies of multiple funds, crypto lenders, and FTX exchange dented investor confidence. We may earn a commission from partner links. Commissions do not affect our journalists’ opinions or evaluations. For more, see our Ethics Policy. https://www.coindesk.com/markets/2023/11/15/crypto-market-sees-net-capital-inflow-for-first-time-in-17-months/

2023-11-14 22:21

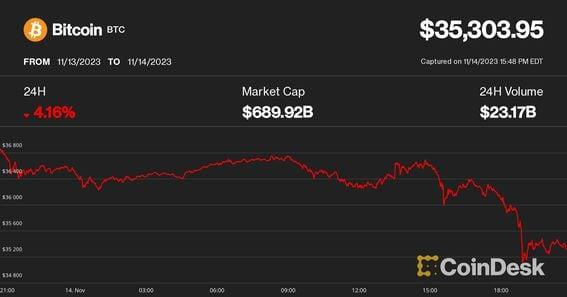

Tuesday's sharp decline in crypto prices spurred the largest daily leveraged long liquidation since August, CoinGlass data shows. Crypto traders Tuesday endured the largest leveraged long wipe-out in three months as the ETF-fueled rally for digital asset prices reversed sharply lower. Big declines across the board prompted over $307 million in liquidations of leveraged crypto long positions – bets on higher prices – over the past 24 hours, data from CoinGlass shows. This was the largest amount of liquidated longs in a day since August 17, when bitcoin (BTC) plunged from above $28,000 to about $25,000 in the space of a few minutes. Today's wipeout happened as BTC tumbled 4% to $35,000 despite a generally supportive environment for risk assets following a cooler-than-expected October inflation reading that sent stocks sharply higher and bond yields substantially lower. The decline was broad-based across crypto, including ether's (ETH) 6% fall to below $2,000. Today's action stands in contrast to that of the past few weeks which have been notable for "short squeezes" as rising asset prices forced liquidations of money-losing leveraged bets on lower prices. Liquidations happen when an exchange is forced to close a leveraged trading position due to the partial or total loss of the trader's margin, or money down. Cascading liquidations can exacerbate price volatility as traders cover their positions, flushing out excess leverage on the market. The large amount of liquidations suggests that the sudden decline in prices caught most investors off-guard, with 88,667 traders getting flushed, CoinGlass shows. Bitcoin traders suffered the most liquidations at $133 million, followed by ETH traders with some $70 million. JPMorgan analysts said in a report last week that the recent rally in cryptocurrency prices was getting "overdone," as investors became overly optimistic about the spot BTC exchange-traded fund approval's impact on asset prices. https://www.coindesk.com/markets/2023/11/14/crypto-bulls-hit-by-300m-in-liquidations-as-bitcoin-ether-buckle-on-fizzling-etf-momentum/

2023-11-14 21:00

An unexpected slowdown in inflation sent stock and bond markets sharply higher, but crypto was left out, possibly due to declining enthusiasm about the imminent approval of a spot bitcoin ETF. Crypto markets suffered one of their worst drubbings in weeks on Tuesday despite welcome inflation data for October. Bitcoin (BTC) briefly dove to as low as $34,970 during afternoon hours from near $36,600 this morning after the Consumer Price Index (CPI) for October came in flat versus expectations for a slight rise. At press time, bitcoin was recently changing hands at $35,300, down 3.7% over the past 24 hours. Ether (ETH) tumbled almost 6% over the same time frame, losing the $2,000 level it previously regained last week for the first time since July on BlackRock's spot ETH exchange-traded fund (ETF) filing. Large-cap altcoins such as dogecoin (DOGE), Polygon's (MATIC) and Tron's TRON native tokens endured 6%-7% declines over the day. The CoinDesk Market Index (CMI), a broad basket of almost 200 cryptos, declined 4.5%, underscoring the market-wide losses. Is the bitcoin price rally over? Traditional markets, meanwhile, were all in on the idea that the Federal Reserve is now finished with rate hikes and indeed could be cutting rates in the first half of 2024. Late in the session Tuesday, the Nasdaq was higher by 2.3% (and now ahead more than 10% in November) and the S&P 500 was up 1.8%. The action in bond markets was even more dramatic, with the 10-year Treasury yield plunging 20 basis points to 4.44%. Just three weeks ago, panicky action had taken the yield above 5% for the first time in more than 16 years. The dollar followed suit, with the DXY Index falling by a whopping 1.55%. Despite the rough session today for crypto, slower inflation and lower bond yields may support prices, investment management firm Grayscale said in a Tuesday report. (Grayscale and CoinDesk share the same parent company, Digital Currency Group.) "We believe the recovery in crypto valuations can continue if real interest rates peak and we continue to see progress toward spot ETF approvals in the US market," the report noted. "ETF speculation is front and center for now, but the store of value narrative still holds and will give the asset a resilient and increasing floor," Noelle Acheson, author of the Crypto Is Macro Now newsletter, noted in an email to CoinDesk. "I very much doubt that the recent sell-off means the rally is done for now." Acheson opined that the decline is "more likely to do with sellers locking in profits ahead of what could be another SEC spot ETF delay." The U.S. Securities and Exchange Commission's (SEC) deadline to approve, deny or delay Hashdex's and Franklin Templeton's spot bitcoin ETF filings are due this Friday and while there's been a surge of enthusiasm regarding what could soon be approvals, most expect more delays this week. "In this scenario, momentum might slow in the crypto markets as there would likely be multiple weeks to wait for significant news relating to the ETFs," K33 Research analysts noted in a Tuesday market report. https://www.coindesk.com/markets/2023/11/14/bitcoin-drops-4-to-35k-despite-soaring-tradfi-markets-but-analysts-remain-optimistic/

2023-11-14 20:23

A check of the process for registering a trust in the state apparently leaves a ready opening for bad actors. Delaware's Department of Justice may be investigating a fake filing Monday that suggested asset management giant BlackRock (BLK) was prepping the launch of a spot XRP exchange-traded fund (ETF). The filing, which still appeared on the Delaware Department of State's Division of Corporations website as of 2:30 p.m. ET on Tuesday, is largely identical to last week's legitimate paperwork from BlackRock regarding its iShares Ethereum Trust product. That filing appeared last week just hours before the company submitted an application to U.S regulators for a spot ether ETF. The fake XRP filing in minutes sent the token higher by more than 10% before a BlackRock spokesperson told CoinDesk it was not attempting to launch such a fund. A spokesperson for the Delaware Department of State told CoinDesk on Tuesday that the matter had been referred to the state's Department of Justice. "Our only comment is that this matter has been referred to the Delaware Department of Justice," the spokesperson said. A spokesperson for the Department of Justice did not immediately return a request for comment. Questions have risen about the level of difficulty for filing for a Trust under a false name and entity and the verification process behind it. According to the Delaware website, there are seven steps required to form a new business entity, all of which seem to be able to be done by filling out interactive PDF forms on the website. The most important requirement seems to be that an entity must obtain a registered agent in the State of Delaware, which can either be a resident or a business entity that is legally allowed to do business in the state. However, it seems that if the name and address are all that’s required, it could easily be copied from another filing. In this case, the pretender appeared to do little more than copy/paste the registered agent – Daniel Schwieger, a managing director at BlackRock according to his LinkedIn profile – from the legitimate filing. https://www.coindesk.com/business/2023/11/14/fake-blackrock-xrp-filing-referred-to-delaware-department-of-justice/

2023-11-14 16:42

David Kemmerer anticipates the unintended consequences of proposed new regulations on brokers reporting crypto transactions. Expensive “tax experts” are set to benefit financially, he says, even if ordinary investors won’t. The year is 2027. January is coming to an end, and you recently received five different 1099s from the crypto brokers you used over the last year. This post is part of CoinDesk's Tax Week, presented by TaxBit. David Kemmerer is the CEO & co-founder of CoinLedger, a crypto tax software company. Despite only trading $5,000 of cryptocurrencies, your 1099s are reporting $50,000 of realized taxable income! This number isn’t accurate. But, given that these same 1099s were sent to the IRS, Uncle Sam believes you earned that amount, and now he is demanding his $15,000 cut. Naturally, you start to panic. How can this be? You originally bought only $5,000 of Ethereum. You can’t owe $15,000 in taxes, can you? Confused and stressed out, you take to the internet and quickly find someone online who calls himself a crypto tax expert. “Due to increased demand,” the crypto tax expert’s website says, “we have stopped offering free tax consultations.” Reluctantly, you pay $250 up front and schedule a 30 minute consultation. You need to get this sorted out. Why is my crypto tax bill so much higher? Once on the phone, the expert explains that the 1099s you received likely reported the gross proceeds of your trades and transfers without a detailed account of the basis, essentially the amount you spent to acquire the crypto. This discrepancy is a common issue that crypto investors face, resulting in over-reported income and inflated tax bills. The misleading 1099s are the result of broker reporting regulations put into place by the IRS and Treasury department back in 2023. To resolve this, you're advised to compile a comprehensive transaction history across all of your wallets to calculate the actual gains or losses incurred. Once calculated, you need to reconcile the actual gains with what’s reported on your 1099s, a process that is not only time-consuming but also requires a specialized understanding of both crypto transactions and tax laws. The expert is quick to let you know he can handle all of this burdensome reporting for you for a one time payment of $4,000. “$4,000?!” Your jaw hits the floor. “People actually pay that?” you ask the expert. With a smile on his face, the expert replies, “My firm will do 350 of these just this week!” As you delve deeper into the maze of reconciling your trades, you start to see all of the cost basis gaps in your 1099s from when you moved crypto from exchanges to your self-custodied wallets. On many of your 1099s, simple transfers to your wallets were marked as proceeds, dramatically increasing your reported gains. After two weeks of trying to reconcile and account for everything yourself, you come to the conclusion that you are in over your head. You give the expert a call back and complete the $4,000 payment. “Thank you!” says the tax expert. “We look forward to working with you again next year.” Conclusion While this is a fictitious story, it represents a reality that the crypto industry will soon face as a result of the square-peg-in-a-round-hole broker reporting regulations proposed by the U.S. Treasury. Cryptocurrency technology is built on open protocols. Copy-pasting 1099 information reporting rules as they exist for equity brokers, as the proposed regulations say, simply doesn’t work due to this technological underpinning. Any market participant can connect to the Bitcoin blockchain. Anyone can freely send bitcoins from a wallet they possess to any other wallet in the world. No matter what laws and regulations get passed, this fact remains true. The rules coming from the Treasury, which are currently in a comment period, will not only increase compliance costs for brokers, but they will also have the unintended consequence of increasing compliance costs for everyday investors who must reconcile inaccurate 1099s with their transaction history each year. Hopefully the IRS works collaboratively and thoughtfully with industry to make sure this doesn’t happen. CoinDesk does not share the editorial content or opinions contained within the package before publication and the sponsor does not sign off on or inherently endorse any individual opinions. https://www.coindesk.com/consensus-magazine/2023/11/14/the-irs-and-the-rising-cost-of-crypto-tax-compliance/

2023-11-14 16:41

The ARK Invest founder and CEO remains bullish and said the crypto market opportunity could scale to $25 trillion by 2030. Might Gary Gensler's political ambitions be standing in the way of a spot bitcoin (BTC) approval? Given how knowledgeable U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler is about Bitcoin (BTC), it's hard to come up with a logical reason for his standing in the way of a spot ETF, said ARK Invest CEO Cathie Wood in a CNBC appearance. "This is a decentralized, transparent network. You can follow all the activity...it's highly unlikely to be manipulated," she said. And Gary Gensler knows this, she added, having taught a course in crypto and blockchain at the Massachusetts Institute of Technology (MIT) prior to being SEC Chair. Riffing, then, on what the explanation might be for the SEC's continued rejections of spot ETF applications, Wood referred to "speculation" surrounding Gensler's desire to be Treasury Secretary. "What does the Treasury Secretary do? It's very focused on the dollar," she said. Irregardless, Wood continues to be a major bull on crypto, predicting that a spot ETF would eventually be approved and that this would be among the catalysts for taking the cryptocurrency market cap from the current $1 trillion to a $25 trillion opportunity by 2030. ARK Invest's application to list a spot bitcoin ETF in the U.S. is one of a dozen that the SEC is currently reviewing. Other companies that have applied include BlackRock, Fidelity, Grayscale and Wisdomtree. Read More: Will Hashdex's 'Undeniable' Distinctions Help Win Bitcoin ETF Race? Some Analysts Think So https://www.coindesk.com/policy/2023/11/14/cathie-wood-speculates-gary-genslers-political-ambitions-are-affecting-spot-btc-etf-judgement/