2023-11-06 17:03

Plans to bring Sam Bankman-Fried's crypto exchange back to life include the Silicon Valley investment firm Proof Group, which was part of the Fahrenheit consortium that successfully bid for bankrupt cryptocurrency lender Celsius. Silicon Valley investment firm Proof Group, part of the Fahrenheit consortium that successfully bid for bankrupt cryptocurrency lender Celsius, is in the running to relaunch FTX, according to two people familiar with the plans. FTX, at the time one of the largest crypto exchanges, collapsed almost a year ago, sending shockwaves through the industry. Since then, the bankrupt exchange has received multiple bids for a potential restart, now narrowed down to a shortlist of three, according to Perella Weinberg Partners, an investment bank involved in the process. Other options being considered include selling the entire exchange and its valuable 9 million-strong customer list or bringing in a partner. A decision should be made by mid-December, said Kevin Cofsky, a partner at Perella Weinberg last month. Proof Group is a venture capital investor in crypto projects such as Aptos, Lightspark and Sui. Other firms reported to have shown an interest in reviving FTX include fintech and digital assets firm Figure, which also bid for Celsius as part of the unsuccessful NovaWulf group. Venture capital investor Tribe Capital was also reported to have submitted a bid for FTX. There are many moving parts in the FTX bankruptcy, and a restart would have to deal with various aspects of claims, token lockups and compliance issues. The process is not straightforward. Bankrupt crypto lender Voyager attracted a number of hopeful bidders looking to restructure the firm, offer tokens to creditors and so on, to no avail, offering a case study on how tricky reboot plans can be, said bankruptcy expert Thomas Braziel, founder of 117 Partners. https://www.coindesk.com/business/2023/11/06/celsius-winner-proof-group-is-in-running-to-relaunch-ftx-sources-say/

2023-11-06 14:01

Traders interviewed by CoinDesk say that crypto winter is over. Here’s how they plan to get ahead in the next phase of the market. Jeff Wilser reports. Let me peel back the curtain. To get a pulse of how traders are thinking about the current crypto landscape, it’s instructive to see how this very article evolved. Originally, I had intended for it to be called, “How Traders Find Edge in Crypto Winter.” Except traders had a different message for me: It’s no longer crypto winter. “Bitcoin doesn’t go up +130% for 10 months straight in bear markets,” the trader Adrian Zduńczyk told me over Twitter/X DM. Zduńczyk believes the early phase of a bull market started in January 2023. “Many projects keep referring mistakenly to it as crypto winter or bear market,” says Zduńczyk, “while what they mean is a slow economy.” The question is more than academic. For many traders, understanding the macro environment is essential for plotting even short-term moves. It’s one of the oldest saws in trading: The trend is your friend. In a climate where prices tend to go up, you’re “long-biased” and shorting can draw blood. Vice versa in a bear market. Some traders have embraced what might be a Crypto Spring, while others are still skittish and scarred by the bear market. “It’s tough for traders. We’re human beings, we’re emotional,” says Christopher Inks, who runs the trading group Texas West Capital. Inks says that for many traders who were so accustomed to the sluggish price action of 2022, “there’s a recency bias, and it can be hard to get the idea that the bottom is in.” Inks, like Zduńczyk, is a believer in a new bull market, as “the fact is that we’ve been rallying for just about a year now.” And then there are other traders who are indifferent to the direction the wind is blowing -- they’ll happily go long or short. “From my perspective, it’s always a bull market. Always. We don’t care about which direction the market is going,” says Paweł Łaskarzewski, who runs the hedge fund Nomad Fulcrum. “Depending on the sentiment we use different strategies, and maybe go more short than long.” So that’s the first of two disclaimers: Not all traders trade the same way, have the same strategies, or view the market through the same lens. If they did, by definition, there would be no trades -- every buyer needs a seller. And the second disclaimer is one you should see a mile away: None of this is financial advice. Please don’t buy or sell anything based on a quote you read in an article. Do your own research. Eat vegetables. Wear sunscreen. Call your parents on their birthdays. With all of that said, here are seven strategies that crypto traders are using right now to find that most elusive and coveted term -- Edge. 1. More breakouts, more signals, more trades Adrian Zduńczyk, who runs a trading group called The Birb Nest, has a certain set of rules and signals he uses to enter trades, which are often breakouts. Those signals are the same in bear or bull markets, but what changes is now they “light up” more than in 2022. “I buy when there’s a confirmed price breakout,” says Zduńczyk. Often these trades fail, as Zduńczyk says his win rate is only 30%. “I lose money for a living,” he says with a laugh. But he keeps a tight stop loss (the max he can lose for each trade) and lets the winners run, so his 30% winners more than make up for the 70% losers. That math is the same in crypto winter or in crypto spring, but now he’s spending more time in trades as opposed to sitting on the sidelines. 2. The “moonbag” strategy This one’s courtesy of Wendy O, former CoinDesker and host of The O Show. If a project that she’s invested in starts to “moon,” she begins taking profits and then recoups her initial investment. “Whatever I have left is my moonbag. I own it free and clear,” says Wendy. Then sometimes she’ll plunk that bag on a staking platform (if available), so she can earn passive income while she waits for it to moon. 3. Correlated arbitrage Paweł Łaskarzewski, who’s indifferent as to bull or bear markets, shares an example of two assets that are correlated in price action. “Tesla goes in the same direction as NASDAQ,” he says. You can then draw two price curves -- one for Tesla and one for NASDAQ. “If the spread between them is growing, we can make money on the spread. We don’t care if it’s going up or down.” That same principle can be used for the forex market (such as the spread between the U.S. Dollar and Euro) or in crypto, such as the spread between Bitcoin and something like Solana or BNB. 4. Trading The “Wyckoff Method” Over 100 years ago, a financial technician named Richard Wyckoff developed a theory that the market moves in cycles, and that understanding these cycles will give signals on when to buy and sell. They’re still used by traders and are known as the Wyckoff market cycle. Christopher Inks studies the charts and uses these cycles to guide his setups. “My edge is really this understanding of market psychology,” says Inks. “Being able to read price action and volume.” Inks says these cycles occur on both the longer horizons (weeks and months) and even on the shorter timeframes (minutes). This helps clarify the direction of a trend, says Inks, “and one of the best things traders can do is trade in the direction of the trend.” 5. Trade more than just crypto Many crypto traders are also stock traders and forex traders, hunting for the best setups wherever they may appear. “Why limit yourself?” says Łaskarzewski. “Why limit yourself to only the crypto market if you can also make money somewhere else?” Łaskarzewski’s firm frequently shifts capital from crypto to oil to Tesla to gold and back to crypto, and yes, the tokenization of RWAs is part of that larger strategy. “The role of tokenization is 100% important,” says Łaskarzewski, adding that his firm will be launching its own RWA token in January, allowing more investors to buy into the fund. 6. Use leverage with caution Several times in our call Wendy O stressed that none of this is financial advice -- so I’ll repeat that message here -- and added that she doesn’t personally use much leverage. “If I do, something like 2X or 3X, max,” says Wendy. Łaskarzewski agrees, noting that over-leverage is one of the ways that rookie traders get crushed. “They do a 1-to-100 leverage and the market moves 1% in the wrong direction and they lose everything,” says Łaskarzewski. 7. Scalping An oldie but goodie, and a key part of Nomad Fulcurm’s toolkit. “We have night scalpers and day scalpers operating on different timeframes,” says Łaskarzewski. “Hours, minutes, and quarter-hours.” The basic principle: You identify a range where the price has been yo-yoing -- let’s say it tends to bounce up when it hits $15 and then gets “rejected” (moves lower) when it hits $20. There are a ton of sophisticated metrics (often focusing on volume) that help refine the criteria, but the idea is that you buy at $15 and then sell at $20, rinse and repeat. Simple in theory, difficult in practice. I know from personal experience, as I tried scalping U.S. stocks every morning for nearly two years. How did it go? Let me put it this way. If it’s easy and lucrative, do you think I’d be writing this article? Or that’s another way of saying, proceed with caution. https://www.coindesk.com/consensus-magazine/2023/11/06/7-successful-strategies-of-crypto-traders/

2023-11-06 13:06

Driven by favorable macro conditions and increased willingness among traders to dive into real-world assets, the market for tokenized debt is flying. Jeff Wilser reports for Trading Week. If the 2021 bull run was known for cartoon apes, meme coins, and gushing endorsements from celebrities, the next wave of crypto adoption -- or even “crypto spring” -- could come from something less sexy but more substantive: the tokenization of RWAs, or Real World Assets. At least that was my thesis earlier this year, when I reported on the projected $16 trillion market of tokenized RWAs. Since then? The tokenization space has caught fire, providing new tools (and profits) for investors and traders alike. This is especially true of tokenized U.S. treasuries. According to 21.co, the market value of tokenized treasures increased nearly six-fold since the beginning of January, jumping from $104 million to $675 million. One reason has nothing to do with crypto and everything to do with macro-economic forces. “The exceptional growth was fueled by the rise in U.S. treasury yields,” says Carlos Gonzalez Campo, a Research Analyst at 21.co. Thanks to the gauntlet of rate hikes by the Fed, the three-month treasury yield surged from virtually 0% at the end of 2021 to over 5% at the time of this writing. Not bad for the “boring” asset. “Amidst the uncertain macro and geopolitical environment,” says Gonzalez Campo, “there has been a ‘flight to safety’ to U.S. Treasuries.” Traditional banks might not have much interest in Dogecoin or NFTs, but they love things like instant settlement (which you get with RWAs), 24/7 trading, lower costs, and the transformation of illiquid assets into liquid instruments. So the bankers are getting in on the action. Franklin Templeton, for example, tokenized over $300 million of its U.S. Government Money Fund on Stellar and Polygon. The European Investment Bank issued 150 million Euros of tokenized bonds. And the CEO of BlackRock, Larry Fink, called tokenization “the next generation for markets.” The buyers of these tokens include traders, investors, DAO treasurers, and wealth management firms. “This is specifically interesting for people who are already in stablecoins, and looking for diversification, and who are looking for yield with very little risk,” says Nils Behling, COO of Tradeteq, a U.K-based private debt and real-world asset marketplace, which recently launched tokenized treasuries on the XDC blockchain. In the world of traditional finance, it’s common to diversify a portfolio with treasuries and bonds, which provides a sort of “shock absorber” in case the stock market collapses. Crypto investors (sometimes) use the same kind of risk management, but instead of U.S. treasuries they use stablecoins. The good thing about stablecoins is that they’re (theoretically) risk-free, the bad thing is they offer no yield. “The U.S. government bond is seen as a risk-free rate,” says Behling, and if you can get 5% instead of 0% -- and do it on-chain -- then why wouldn’t you? The other problem with stablecoins, of course, is that sometimes they’re not entirely stable. (Exhibit A: Terra.) So Behling considers tokenized treasuries to be “a nice hedge against de-peg risk.” Given today’s juicy yields, many in the crypto space now see treasuries as essential to modern investing. Allan Pedersen, the CEO of Monetalis (which worked to tokenize RWAs for Maker DAO), even compares tokenized treasuries to carbon, as in the chemical element. “You need carbon for life on earth,” says Pedersen, “and you need U.S. treasuries for life on-chain.” Trade finance Treasuries make up the bulk of tokenized RWAs – for now – but more asset classes give investors more options, some with higher risk and returns. Consider “trade finance,” or the arcane world of invoices and receivables. If someone sends an international shipment from Copenhagen to Cairo, that invoice is part of trade finance. Companies like Tradeteq are working to tokenize these invoices, which brings more liquidity to the market, gives more borrowing options for small businesses, and provides yet another asset class for investors. Behling thinks market alone is over $1 trillion and considers trade finance “the last frontier in finance.” Or take small business lending. “This is kind of a niche area of underwriting,” says Sid Powell, co-founder of Maple Finance, which also tokenizes RWAs. Small business loans can offer yields of well over 10%, says Powell, and he gives the example of a COVID-era tax rebate program. Let’s say you’re a pizza shop that kept your employees during COVID in 2020. “The government created a stimulus program through taxation, where they effectively rebated the taxes you would have paid,” says Powell. Thanks to government bureaucracy, these rebates took years to process and don’t sunset until 2025. Now they can be tokenized and traded as an asset, bringing yield to investors. “Once a real world asset yield gets above 10%, it starts to become much more interesting to funds, high net-worth investors, and other institutional allocators,” says Powell. Some of these deep pockets might wish to invest in both cryptocurrencies (like bitcoin) and traditional equities (like Apple stock), and RWAs let them do both in the same ecosystem. “For people who are investing and trading in crypto -- and there’s not always a clear distinction between the two -- then you kind of want to have all of the above including stocks and bonds,” says Timo Lehes, co-founder of Swarm Markets, which also brings RWAs on-chain. “You don’t want to do all these wire transfers in between applications.” More aggressive traders are finding ways to leverage tokenized treasuries to squeeze even more yield. “I’ve seen people who do loans via various protocols and leverage five or six times,” says Pedersen. You buy a tokenized treasury, then use that as collateral to get a loan, and then buy more treasuries, and so on. “You can lock in 10% to 15% of interest by layering on top of each other,” says Pedersen. (This is the obligatory time to say THIS IS NOT FINANCIAL ADVICE, and over-leverage can backfire.) Or, as DeFi researcher Thor Hartvigsen explained in a widely shared X thread, you could get a 16.3% yield by “looping” various RWAs and acknowledged, “Alright this is getting outta hand.” Putting the merits of leverage aside, there’s every reason to believe that the tokenization pie will keep growing. Adam Lawrence, CEO of RWA.xyz, a data provider, suspects that the tokenized treasuries market is entering its “scale phase,” and predicts that over the next few quarters, tokenized treasuries will “easily 10x the current market size.” One final thought. While the words “risk-free” should make everyone in crypto do a double-take -- we’ve seen that movie before -- in the case of U.S. treasuries, that really is how investors view the asset. But then again… as the House of Representatives descends into chaos and another government shutdown always looms, it might also be fair to ask, tongue firmly in cheek, “What could possibly be risky about the U.S. government?” So, as with all things in crypto investing, caveat emptor. https://www.coindesk.com/consensus-magazine/2023/11/06/us-treasuries-spearhead-tokenization-boom/

2023-11-06 12:38

One year after the exchange's collapse, bitcoin is up nearly 70%. CoinDesk spoke to market watchers to find out what comes next. Sam Bankman-Fried has been found guilty on all seven counts of fraud, and his first trial has come to a close with FTX's founder and former CEO facing a possible century in prison. Last November, FTX's collapse kicked off a deep, dark crypto winter with the possibility of billions in customer funds lost and regulators hell-bent on suffocating the industry. Fast forward a year, and there's the very real possibility of FTX's estate returning 90% of customer funds. Bitcoin is now above $35,000, according to data from CoinDesk Indicies, up from a low of $15,625 on the coldest crypto winter day last year. Bitcoin's growth powered by utility potential – and an ETF It didn't take long for bitcoin to shake off fear of a broader crypto contagion and recover to where it once was before the collapse. On January 18, CoinDesk reported that bitcoin had erased its entire FTX-related decline. Certainly, macroeconomics played a role in bitcoin's quick recovery, but so did the growing field of utility applications around the Bitcoin blockchain. "The price of Bitcoin, whether it's 200k or 400k, won't be just due to speculation; it will be because people see the value in Bitcoin's utility," Jason Fang, the managing partner at Sora Ventures, told CoinDesk in an interview. Fang, whose Sora Ventures invests in utility applications for bitcoin, believes that the future gains of bitcoin will be a testament to its technology first and foremost. Part of the advantage, he says, is its decentralization. It's questionable how decentralized Ethereum, or leading layer-1s like Solana, are when both are heavily reliant on cloud providers like Amazon's AWS. As Fang also points out, both – and other layer-1s – are reliant on their foundations for maturing the technology, a big problem if they run into trouble. "They're centralized in tech and funding. If one fails, they're in trouble. Bitcoin, however, is funded by miners, who are incentivized by the utility to support the network," he told CoinDesk. "This leads to a more profitable business for them. Bitcoin's path is unique and not dependent on being Ethereum-compatible, which gives it a stronger narrative." But it’s not like ether or sol have been slouches in their performance over the last year. Ether is up 17% on-year, while sol is up 26%. But bitcoin is up 70%. That’s because as Metalpha's Lucy Hu explains, the market is anticipating an ETF and movement from the Fed. "Bitcoin's price, in the short and medium term, will still be determined by the approval of ETFs, possible Fed rate cut, bullish sentiment from institutional investors such as Microstrategy as well as the halving event in the first half of next year," she told CoinDesk. The consensus wisdom currently is that spot bitcoin ETFs are likely to be approved as early as January 2024, with a raft of big names, including BlackRock and Fidelity, readying offerings. Trading Volumes Ending the Year Strong An ETF that seems months away from being approved, and renewed interest from institutions, has attracted attention from traders. Crypto trading volume was slow throughout most of the year, with publicly-listed Coinbase feeling the chill as it reported earnings throughout the year. In September, CoinDesk reported that crypto spot market activity hit a 4.5-year low. But then, in late October – despite Coinbase reporting soft transaction volumes at the start of the month – something changed as the ETF narrative picked up and the market thawed. Trading volumes surged. By the end of the month, crypto investment funds recorded their largest inflow in 15 months at $326 million, according to CoinShares. "Bitcoin has proven its resilience, especially after the FTX implosion — it didn't go to zero, showing it's not just some scam chain. It's here to stay," Fang said. "In contrast, many top-20 tokens are still in their infancy and haven't faced a real bear market. Bitcoin, however, is expected to survive multiple downturns and last for a long time," he continued. https://www.coindesk.com/consensus-magazine/2023/11/06/post-ftx-bitcoin-is-ready-for-its-next-chapter/

2023-11-06 11:15

XRP traders often react to Ripple developments even as the company maintains distance from the token. XRP has spiked in the past 24 hours to become the top-performing crypto majors, as bitcoin (BTC) and ether (ETH) held steady. Prices rose over 11% before slightly retreating on Monday, with trading volumes spiking to $2 billion from Sunday’s $1 billion, CoinGecko data shows. At the time of writing, XRP traded at 69 cents and replaced BNB as the fourth-largest token by market capitalization. Data suggests the gains were largely spot-driven as liquidations on XRP-tracked futures breached just over $4.4 million. A large liquidation amount may have suggested that the use of high leverage may have boosted prices. No immediate catalyst for the gains existed on Monday. However, bulls may have reacted to two positive developments for payments firm Ripple from last week as the company won key approvals to operate and offer services in Georgia and Dubai. Ripple said last Thursday that the Dubai Financial Services Authority (DFSA) approved XRP under its virtual assets regime – allowing licensed firms in the Dubai International Financial Centre, a financial sandbox, to incorporate and offer XRP to clients as part of their crypto services. On the same day, the firm said it would start working with the National Bank of Georgia (NBG) on the Digital Lari (GEL) pilot project, which will use the firm’s central bank digital currency (CBDC) platform. Hong Kong and Taiwan governments are already using the CBDC service, which launched in May. Institutions can use the platform to manage and customize the entire life cycle of the CBDC, which includes minting, distribution, redemption and token burning. Central banks can issue both wholesale and retail CBDCs, which can make offline transactions as well. Ripple has historically maintained a distance from XRP, the token that powers some of its products and the XRP Ledger network. But any progress in Ripple’s court cases, or licenses, clearly impacts XRP prices as traders consider the two related. https://www.coindesk.com/markets/2023/11/06/xrp-spikes-10-as-several-institutions-adopt-ripples-services/

2023-11-06 10:23

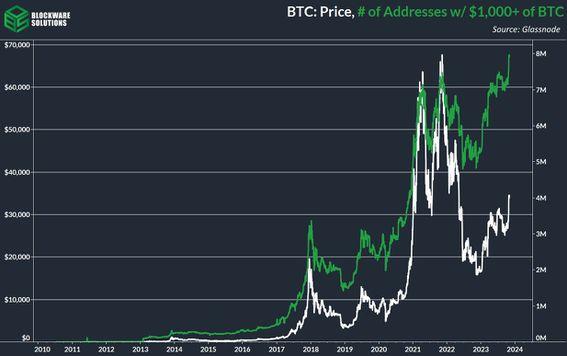

The number could grow exponentially, representing a tremendous amount of purchasing power, one observer said. The number of blockchain addresses holding at least $1,000 worth of bitcoin (BTC), which equates to 0.028 BTC at the current price of $35,115, has increased to a record high of 8 million, according to data tracked by Blockware Solutions and Glassnode. Per Blockware, the above number could grow exponentially as bitcoin continues to monetize, a long-term bullish development for the cryptocurrency. Monetization, in theory, refers to the process of creating income potential from a non-revenue generating asset. “If there are 10s or 100s of millions of addresses that contain thousands of dollars worth of BTC, that’s a tremendous amount of purchasing power,” Blockware Solutions said in an email. The record figure comes as bitcoin has gained nearly 25% in four weeks amid speculation the U.S. Securities and Exchange Commission will soon approve one or more spot bitcoin exchange-traded funds. The optimism has also galvanized whale activity on the Bitcoin blockchain. https://www.coindesk.com/markets/2023/11/06/bitcoin-addresses-with-over-1k-of-btc-hits-record-8m-data-shows/