2023-11-03 11:46

The jobless rate is forecast to hold steady at 3.8%, while the year-on-year growth in average hourly earnings likely slowed to 4% from 4.2%. Bitcoin (BTC) is on the back foot ahead of the key U.S. data release, which could bring pain to risk assets, including cryptocurrencies. At press time, bitcoin was changing hands at $34,235, representing a 2% drop on the day, CoinDesk data show. Prices briefly topped the $36,000 mark early this week, extending past week’s 15% surge from near $30,000. At 12:30 UTC, the U.S. Labor Department will release nonfarm payrolls data, which is expected to show the world’s largest economy added 180,000 jobs in October, marking a sharp slowdown from September’s 336,000 additions. The jobless rate is forecast to hold steady at 3.8%, while the year-on-year growth in average hourly earnings likely slowed to 4% from 4.2%. Per Ilan Solot, co-head of digital assets at Marex Solutions, better-than-expected jobs data may weigh over risk assets. “Good data is bad for markets – The overly eager dovish interpretation of Powell’s comments heightens the risk around an upside surprise for today’s NFP data. A soft jobs data will probably propel markets higher,” Solot said in X. The Federal Reserve held the benchmark borrowing cost unchanged at 5.25% early this week while explicitly mentioning that tighter financial and credit conditions for households and businesses are likely to weigh on economic activity, hiring and inflation. That has convinced markets that the Fed’s tightening cycle has ended, and the next move will likely be a rate cut. The Fed started its tightening cycle in March last year and has since raised rates by 525 basis points. The rapid-fire rate hikes were partly responsible for the last year's crypto crash. A better-than-expected jobs figure may dent the dovish conviction, boosting the dollar index and adding downside pressures around bitcoin. https://www.coindesk.com/markets/2023/11/03/bitcoin-recedes-to-342k-ahead-of-us-nonfarm-payrolls-data/

2023-11-03 11:02

The 'Alameda gap' refers to the worsening of order-book liquidity following the collapse of the FTX group a year ago. On Nov. 2, 2022, CoinDesk published an award-winning story, setting in motion a chain of events that led to the quick collapse of the now-convicted Sam Bankman Fried's FTX crypto exchange, formerly the world's third largest, and its sister concern, Alameda Research. Bitcoin (BTC), the largest cryptocurrency by market value, bottomed out in the same month. It has since rallied 70% to $34,300. However, scars from the collapse of FTX and Alameda are still evident in the form of weak liquidity and market depth, which is the market's ability to absorb large orders at stable prices. The combined 2% market depth for bitcoin, ether (ETH), and the top 30 alternative cryptocurrencies by market value is currently $800 million, 55% lower than a year ago, Dessislava Aubert, research analyst at Paris-based Kaiko, said in an email. In other words, a year ago, it would have taken an order worth at least $1.8 billion to move prices 2% in either direction. Currently, an order of $800 million is enough to influence prices. The substantial deterioration in liquidity, referred to as the Alameda Gap by Kaiko, means higher slippage costs for traders looking to execute large orders. Slippage refers to the difference between the expected cost of a trade and the actual cost of execution. Weak liquidity also means a few large orders can have an outsized impact on prices and breed price volatility. Before it went bust, Alameda was the industry's leading market maker, providing billions of dollars in liquidity in bitcoin, ether, and alternative cryptocurrencies. FTX was the third-largest perpetual futures exchange by open interest and trading volumes. The chart shows market depth for bitcoin improved to $350 million in October from $250 million in the third quarter. The cryptocurrency surged 28% in October, the biggest single-month percentage gain since January. The rally in the market leader, however, did not improve the liquidity situation for ether and alternative cryptocurrencies. https://www.coindesk.com/markets/2023/11/03/bitcoin-is-up-70-a-year-after-ftx-debacle-but-alameda-gap-in-liquidity-persists/

2023-11-03 02:49

Damian Williams, the U.S. attorney for the powerful Southern District of New York, set an ominous warning following the conviction of former crypto kingpin Bankman-Fried. Sam Bankman-Fried's conviction is a "warning" to crypto wrongdoers, the chief government prosecutor overseeing his case said at the courthouse entrance late Thursday. Damian Williams, the U.S. Attorney for the powerful Southern District of New York, told a gaggle of reporters crowded on the courthouse entrance that federal agents and lawyers have "handcuffs for all" fraudsters and crooks. "Here's the thing: The crypto cryptocurrency industry might be new. The players like Sam Bankman-Fried might be new. But this kind of fraud, this kind of corruption is as old as time," Williams said. Williams' statement came minutes after his team of federal prosecutors secured a "guilty" verdict on all seven counts of fraud and conspiracy against the former CEO of FTX, a crypto exchange that was once worth $32 billion. Exactly one year ago, the young billionaire's crypto empire began to crumble when CoinDesk published a story based on the private balance sheet of Alameda Research, his trading firm. As prosecutors and even defense lawyers outlined during the five-week trial, that article set off a chain of events that ended in FTX's bankruptcy and the revelation that Alameda had taken billions of dollars of FTX customers' cash. Williams was on hand to watch some of the trial's highlights, including closing arguments and the reading of the verdict. He walked into the packed courtroom late Thursday wearing a tan peacoat and a tightly tailored suit. At times during the proceeding he smiled, including when Judge Lewis Kaplan discussed Bankman-Fried's sentencing, scheduled for next March. His district – the federal judicial system's influential artery for prosecuting high-profile financial frauds, including Bernie Madoff's – has more crypto cases on the way. Next month, Mango Markets exploiter Avraham Eisenberg is scheduled to stand trial for the theft of over $100 million in crypto from a decentralized exchange. That case and others will push the limits of the government's policing of crypto's wild west. It may well force prosecutors to delve deep into complex crypto concepts, like "decentralized exchanges," "decentralized autonomous organizations," "perpetual swaps" and other mumbo-jumbo from an industry that is constantly rewriting itself. The prosecutors' success against Bankman-Fried stems at least in part from their efforts to keep things simple – or as simple as possible given the heady circumstances. Throughout the trial they deemphasized the hard-to-follow crypto concepts in favor of a (relatively) simple narrative of traditional fraud, while avoiding entirely thornier, tertiary issues, like the legality of the FTT token issued by FTX. That might not be possible in the cases to come, some of which are intrinsically tethered to mind-bending crypto concepts. But if Williams' courthouse statement is anything to go by, the SDNY is gearing up to take down more complex cases. "This is what relentless looks like," he said. https://www.coindesk.com/policy/2023/11/03/sam-bankman-fried-prosecutor-promises-handcuffs-for-all-crypto-crooks/

2023-11-02 23:49

A tentative sentencing date was set for March 28, 2024. Bankman-Fried could spend decades in prison and potentially up to 115 years. NEW YORK — Sam Bankman-Fried defrauded his customers and lenders, a New York jury found after a five-week trial for the FTX founder and former chief executive. A tentative sentencing date was set for March 28, 2024. Bankman-Fried could spend decades in prison (and theoretically up to 115 years). "Sam Bankman-Fried perpetrated one of the biggest financial frauds in American history," U.S. Attorney Damian Williams said outside the courthouse after the guilty verdicts on all seven charges were revealed. "This kind of fraud, this kind of corruption is as old as time. We have no patience for it." An appeal seems likely: In a statement, defense attorney Mark Cohen said Bankman-Fried respects the jury's decision but maintains his innocence and will continue to "vigorously fight the charges." Jurors began deliberating a little after 3 p.m. ET. Just before 7:40 p.m., the judge said they had reached a verdict. The attorneys and Bankman-Fried returned to the courtroom and the guilty verdict was read out shortly thereafter to the packed courtroom. Bankman-Fried kept still when the verdict was read. He'd been instructed by the judge to look toward the jury box, and jurors were told to look toward the court clerk and judge. "The verdict unanimous, your honor," was the message from the 12 New Yorkers who voted guilty on all seven counts. The judge thanked the jurors for their service. The jury reached the guilty verdicts on the first anniversary, coincidentally, of the award-winning CoinDesk scoop that spurred the former crypto mogul's downfall. Sam Bankman-Fried's parents As the foreperson read the guilty verdicts, Joseph Bankman, the defendant's father, buried his head into his lap from a seat in the viewing gallery. His mother, Barbara Fried, kept still, back straight, with a kind of sullen expressionlessness – staring straight ahead. After the judge left the courtroom, Bankman-Fried stood up and his lawyers leaned in and spoke to him. He didn't look back at the viewing gallery, even as his parents shuffled over to the wooden divider directly behind him. Read More: The Sam Bankman-Fried Trial Is a Family Affair Arms around each other, they stared at Bankman-Fried's back while roughly three dozen reporters swarmed around them. Bankman-Fried still hadn't looked back at his parents or the rest of the gallery by the time he was escorted toward an exit at the front of the courtroom. Just as he was about to reach the door, he shot back a final glance at his parents – with a blink-and-you'll-miss-it half-smile and nod. His mother brought her hand to her chest with an audible thump. A month-long trial Bankman-Fried, 31, was arrested last December and tried on allegations of defrauding FTX investors and customers, and Alameda Research's lenders. The once-prominent crypto exchange CEO pleaded not guilty to all charges, and went to trial at the beginning of October. Federal prosecutors sought to paint him as someone who deliberately set out to steal his customers' funds – around $8 billion – for use in a variety of purchases and investments, including real estate, sports sponsorships and venture investments. His defense team argued that Bankman-Fried was an overworked businessman who made the mistake of assuming the company funds he used belonged to those companies, rather than their customers or investors. Bankman-Fried acknowledged "there were significant oversights," but said on the stand he did not defraud anyone or set out to take their funds. "A lot of people got hurt – customers, employees – and the company ended up in bankruptcy," Bankman-Fried said on his first day of testimony before the jury. "I made a number of small mistakes and a number of larger mistakes." FTX collapsed nearly a year ago, after CoinDesk's Ian Allison reported that Alameda held a massive amount of FTX's exchange token, FTT, a revelation which, combined with a tweet from Binance CEO Changpeng Zhao, sparked what Bankman-Fried described as a "run on FTX" – ultimately leading to FTX, Alameda and the companies' various subsidiaries filing for bankruptcy. Key FTX and Alameda executives, including former Chief Technology Officer Gary Wang, former Head of Engineering Nishad Singh and former Alameda CEO Caroline Ellison, pleaded guilty to various charges and testified against Bankman-Fried during the trial, saying that they had taken direction from the MIT grad who co-founded the companies. A number of other former employees similarly testified that Bankman-Fried set the direction for FTX's operations. Bankman-Fried, however, argued that he trusted his handpicked lieutenants to safely operate the companies while he was busy with his own roles as the head of the multibillion-dollar empire, including acting as the public face of FTX and lobbying regulators and lawmakers. All told, Bankman-Fried was charged with wire fraud and conspiracy to commit wire fraud against FTX's customers, wire fraud and conspiracy to commit wire fraud against Alameda's lenders, conspiracy to commit securities fraud against FTX's investors, conspiracy to commit commodities fraud against FTX's customers and conspiracy to commit money laundering. Read all of CoinDesk's coverage here. https://www.coindesk.com/policy/2023/11/02/sam-bankman-fried-guilty-on-all-7-counts-in-ftx-fraud-trial/

2023-11-02 20:14

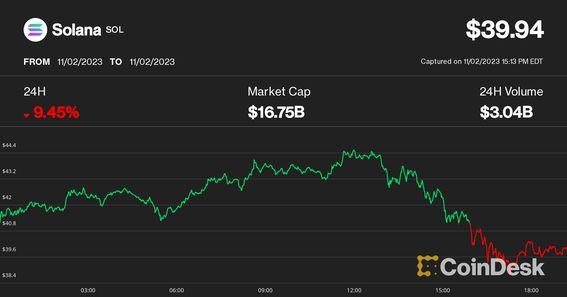

The token is up more than four-fold in 2023 after starting the year at around $10. Solana almost doubled in price over the past weeks, but gave up some of its gains Thursday. BitMex co-founder Arthur Hayes said he's been a buyer during the rush. Institutional inflows to funds and rising activity supported the trend, but some signs suggest the rally could halt. Solana's (SOL) spectacular comeback – up over 300% this year – has captivated crypto market participants after the coin was one of the most beaten-down assets during the bear market. The seventh-largest cryptocurrency by market capitalization hit $46.60 early Wednesday, a 14-month high price. It began the year at around $10. The momentum captured the attention of widely-followed crypto investor and BitMex exchange co-founder Arthur Hayes, who tweeted earlier this morning that he had purchased some. After roughly doubling in price over the past two-plus weeks, however, SOL has stumbled a bit since, lower by about 15% since that Wednesday morning peak to the current $40. Why solana (SOL) rallied Solana's run came after many observers questioned its future following the implosion of Sam Bankman-Fried's FTX exchange and Alameda Research trading firm almost a year ago. Bankman-Fried and his companies were large investors in the Solana ecosystem. It's been institutional interest and large investment fund inflows helped the price recover, according to David Shuttleworth, research partner at Anagram. Indeed, crypto funds holding SOL enjoyed nearly $100 million of inflows this year, CoinShares reported, the second largest amount after bitcoin (BTC). Ether (ETH) funds, meanwhile, suffered $125 million of outflows. Shuttleworth also took note of a recent uptick in developer activity. A recent upgrade also helped the network to become more decentralized by lowering validator hardware requirements and enabling confidential transactions using zero-knowledge (ZK) tech, asset management firm 21Shares said in a report. What's next for solana's (SOL) price? Despite the bullish developments, some signs suggest the rally could halt, at least for a while. Derivatives traders with leveraged short SOL positions – bets on lower prices – endured nearly $10 million of liquidations during the buying rush Wednesday, the most in over the past three months, CoinGlass data shows. The action of traders forced to capitulate by closing directional bets often mark a local top or bottom for the price, say market observers. Despite the encouraging signs of rejuvenation for the ecosystem, total value locked (TVL) on the Solana network still lingered at $855 million, down from $10 billion two years ago, per DefiLlama data. Lookonchain pointed out that the last two Novembers have not been good ones for SOL. While the reasons seem obvious – early November 2021 was the epic top of the entire cryptocurrency market and November 2022 included the FTX meltdown – Lookonchain noted that the Solana Breakpoint conference, an annual gathering for the ecosystem, is an early November event (this year's version is currently taking place in Amsterdam) and has coincided with local tops in price. Blockchain data by Lookonchain also shows that crypto wallets of FTX sent a total of 2.1 million SOL worth roughly $90 million to exchanges in the past 10 days, making the company a likely seller as the price soared. The FTX estate – which held $1.16 billion of SOL as of late August – is benefiting from rising prices. The estate received permission to sell digital assets from the bankruptcy court in September and hired asset investment firm Galaxy Digital to manage its holdings. "Maybe someone is jacking up the price and selling," Lookonchain said on X. https://www.coindesk.com/markets/2023/11/02/solana-is-down-15-since-hitting-a-14-month-high-is-the-rally-over/

2023-11-02 19:29

Recent reports that terrorism organizations such as Hamas pocketed as much as $130 million in crypto funding have been proved incorrect but were resurrected in Congress today. Despite a raging online debate discrediting the scale of crypto support for terrorist groups, the story continues to resonate in important places. Most recently on Thursday, the ranking Democrat at a hearing in the U.S. House of Representatives quoted a figure of $130 million in digital assets flowing to terrorists. Rep. Brad Sherman (D-Calif.) lamented those vast crypto donations to groups such as Hamas and praised the industry crackdown from the U.S. Securities and Exchange Commission (SEC) as one of the things the agency is "doing right." "Some $130 million of cryptocurrency has gone to Hamas and Palestinian Islamic Jihad," Sherman said at an SEC oversight hearing of one of the subcommittees of the House Financial Services Committee. He said the assets are "designed to be perfect means for hidden money, hence the term cryptocurrency, getting to the worst actors in the world." Massive industry pushback on those initial reports – including an Oct. 10 account from the Wall Street Journal – led to some backtracking. The Wall Street Journal issued a partial correction to clarify what it knew about the flow of virtual currency to terrorists, which had originally cited more than $90 million tied to Palestinian Islamic Jihad (PIJ). And the crypto analytics company the newspaper had relied on for data, Elliptic, put out a detailed blog post explaining how its transaction data had been misconstrued and that an actual amount of crypto donated to Hamas since Oct. 7 by the most prominent funding campaign – Gaza Now – was closer to $21,000. Read More: Media Reported Hamas Got Millions Via Crypto, but the Data Provider They Cited Says It Was Misconstrued A spokesperson for Sherman didn't immediately respond to questions from CoinDesk on his use of the statistics, which are now reflected in the congressional record. Sherman had been among more than a hundred lawmakers signing an Oct. 17 letter that used the WSJ reporting as the impetus for a demand that the administration do more to combat illicit use of digital assets, especially in light of Hamas' attack on Israel. That letter cited more than $130 million in cryptocurrencies being raised by Hamas and PIJ. https://www.coindesk.com/policy/2023/11/02/discredited-crypto-terrorist-funding-figures-gain-fresh-life-in-house-hearing/