2023-11-02 17:19

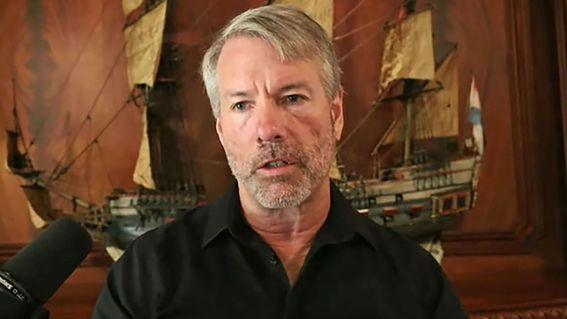

"For the industry to move to the next level, we need to migrate to adult supervision," said the MicroStrategy executive chairman. "You can never have too much bitcoin (BTC)," said Michael Saylor, appearing on CNBC one day after his company MicroStrategy (MSTR) reported its third-quarter earnings. That Saylor is a bitcoin bull will not exactly come as breaking news, but he took note of a number of specific near- to medium-term catalysts. First among them is what's soon be a sizable reduction in supply coming alongside a surge in demand. Bitcoin miners, said Saylor, need to sell bitcoin in order to keep the lights on, and he noted those sales are currently running at about $1 billion per month. The halving – expected to occur in April 2024 – however, means miners will soon have only half of that available to sell. "You're going to see $12 billion of natural selling per year converted into $6 billion of natural selling per year," he said. At the same time, he noted, spot bitcoin ETFs are going to be a source of increased buying pressure. Secondly, there are soon to be new rules implementing fair value accounting for company bitcoin holdings. "Long term," said Saylor, "this is going to open the door for corporations to adopt bitcoin as a treasury asset and create shareholder value with their balance sheets." Finally, Saylor addressed the current news cycle, including the fraud trial of former crypto wonder-kid Sam Bankman-Fried. "Early crypto cowboys, the crypto tokens that are unregistered securities, the unreliable crypto custodians" were liabilities for bitcoin, he argued. "For the industry to move to the next level," said Saylor, "we need to migrate to adult supervision. We need to rationalize away from the 100,000 crypto tokens ... that people are manipulating to bitcoin." "When the industry takes its eyes away from the shiny little tokens that have distracted and demolished shareholder value, I think the industry moves to the next level and we 10X from here." https://www.coindesk.com/markets/2023/11/02/heres-why-bitcoin-will-10x-from-here-michael-saylor/

2023-11-02 16:45

Traders on crypto-powered Polymarket have bet a grand total of $4,512 on the question, underscoring the current limitations of prediction markets. The odds are greater than 50-50 that Sam Bankman-Fried will be convicted on all seven charges in his criminal fraud trial, if you go by the betting on cryptocurrency-powered prediction market Polymarket. But there's an important caveat: only $4,512 has been cumulatively wagered, underscoring the current limitations of prediction markets, hamstrung by regulations when they operate in the U.S. and by the clunkiness of crypto when they don't. On the question "SBF guilty of all charges?" "yes" contracts were trading at 59 cents Thursday morning – which equates to traders seeing a 59% chance he will be – as the judge began reading out instructions to the jury after a month of hearing testimony and lawyers' arguments in the case. Each contract pays out $1 if the prediction turns out to be true, and zilch if it is false. "No" contracts were priced at 41 cents. The low volume could be read as an indication that crypto traders have moved on from the saga of Bankman-Fried, who stands accused of pilfering money that belonged to customers of his now-bankrupt cryptocurrency exchange FTX. After all, there are larger markets on Polymarket – the biggest, which concerns the outcome of the 2024 U.S. presidential election, had $5 million of bets outstanding so far Thursday. But there are other factors limiting participation. Straitjacketed For starters, U.S. residents are not allowed to trade on Polymarket under a 2022 settlement with the Commodity Futures Trading Commission (CFTC), so the platform is locked out of the world's largest economy. And traders in other countries can't bet in their local currencies, but must first buy and then deposit one of several cryptocurrencies (ETH, USDC or USDT), filtering out the "normies." But Polymarket at least enjoys the freedom to host bets on spicy topics like the outcome of a criminal trial. The two mainstream U.S. prediction markets, which settle their bets in dollars, are, by comparison, straitjacketed. Kalshi, the first and only federally regulated U.S. exchange devoted to trading on event outcomes, is required to certify compliance and/or seek approval from the CFTC for every market it lists. On Wednesday, the company sued the regulator for denying its application to list a market on the relatively anodyne question of which party will control each chamber of the U.S. Congress after an election. And PredictIt, which has run political betting markets under the graces of a no-action letter from the CFTC, had to sue to prevent getting shut down altogether. The situation makes it difficult to say how powerful prediction markets could potentially be in helping to forecast significant events. Theoretically, because traders are putting their money where their mouths are, they are at a minimum honestly expressing their beliefs about what will happen, in contrast to media pundits with no skin in the game. But the limited lucrativeness and obstacles to onboarding likely constrain the number of people with real expertise on a given topic who are able or willing to participate. With all those stipulations in mind, traders on Polymarket see a 32% chance that Bankman-Fried will be sentenced to 50 years or more ($17,292 bet) and a 98% chance he will be convicted on at least one charge (just $142 wagered). https://www.coindesk.com/markets/2023/11/02/market-sees-59-odds-sam-bankman-fried-is-found-guilty-on-all-charges-but-theres-a-catch/

2023-11-02 16:10

A verdict in the SBF trial could come before the end of Thursday – on the first anniversary of the CoinDesk scoop that caused his empire to crumble. NEW YORK — Twelve New Yorkers have started deliberating FTX founder Sam Bankman-Fried's fate, and a verdict could come later Thursday – the first anniversary, coincidentally, of the CoinDesk scoop that spurred the former crypto mogul's downfall. The jurors were dispatched Thursday afternoon to do their duty – reviewing the seven fraud and conspiracy charges Bankman-Fried faces – after Judge Lewis Kaplan finished reading them 60 pages of instructions. Jurors will break for dinner from 6 to 7 p.m. ET (22:00 to 23:00 UTC), and deliberate as late as 8 p.m. (midnight UTC). Thursday morning, prosecutors gave their final remarks to the jurors. Promising customers that their "assets are safe" and then taking that money and spending it on yourself and your companies, "is not a 'reasonable businesses decision,'" Assistant U.S. Attorney Danielle Sassoon said of Bankman-Fried's behavior – invoking a phrase used by a defense attorney in his closing argument a day earlier. "That is fraud." The government's core argument is that Bankman-Fried misused billions of dollars worth of funds belonging to users of his FTX crypto exchange, siphoning them to businesses, political candidates and real estate ventures via Alameda Research, his crypto trading shop. Bankman-Fried broke a "sacred, unbreakable rule" when dealing with FTX customer money, Sassoon told the jury. "Your money is your own," she said. "It's not for others to use." Sassoon used her final remarks to poke holes in the closing statement of defense attorney Mark Cohen, who appealed to the jury Wednesday to consider whether a real fraudster would agree to an interview on "Good Morning America" just days after he was accused of committing crimes. Bankman-Fried's post-collapse media blitz "was part of an effort to present himself as reliable," Sassoon said. As for why the FTX founder continued to pay back lenders in his crypto empire's final days – rather than hoard customer funds for himself – the prosecutor said that Bankman-Fried didn't plan to "run with the money" and risk being exposed. Even after Nov. 7, the day she said FTX collapsed, "he still thought he could fool the world," she said. The defense argument that most incensed Sassoon, according to her, was Cohen's statement to the jury that the government's star witnesses – top FTX and Alameda executives Caroline Ellison, Gary Wang and Nishad Singh – were incentivized to lie when testifying. "That's outrageous," Sassoon said loudly, calling it a "desperate and unsupported accusation." Again and again, she told the jury Bankman-Fried's testimony and the defense's arguments don't make sense. "You know that it's a made-up story," she said. "You should reject it." Regarding perhaps the defense's favorite argument, that FTX didn't have a risk manager and thus Bankman-Fried didn't know what he was getting himself into, Sassoon said it proved the opposite of what defense lawyers claimed: "That's not a defense, it was a strategy." "The defendant knew what he was doing was wrong, and that's why he didn't hire a chief risk officer," she told the jury. "Don't fall for his lies," she concluded her statement. "Find him guilty." Jury instructions Judge Kaplan spent more than two hours reading the charging document, which detailed the specific charges Bankman-Fried faces, the different legal theories the jury could use to find he is guilty or not guilty, and other pieces of information about how they should conduct their deliberations. While jurors have access to the written charge document during deliberations, the judge is required by law to read it out loud as well, he said as he began. The judge denied a defense motion to seat the jury on Friday, when court is scheduled to be on break. A three-day weekend is not that different from a two-day weekend, he said. If the jury does not return a verdict Thursday, court will be in recess until 9:30 a.m. Monday. Just before Kaplan began, a courtroom deputy told those present they could not be allowed to leave during the reading, and instructed the Marshals to lock the doors. Read all CoinDesk's SBF trial coverage here. https://www.coindesk.com/policy/2023/11/02/sam-bankman-fried-sbf-fraud-trial-jury-to-decide-fate/

2023-11-02 16:07

The world's largest crypto remains in the green over the past 24 hours, but has slumped nearly 4% from its overnight high. A late Wednesday/early Thursday pump higher in bitcoin (BTC) saw the price nearly punch through $36,000 for what would have been the first time since the spring of 2022. The move, however, appeared to trigger a wave of sell orders, with bitcoin now having tumbled almost $1,300 over the past few hours to the current $34,700. The slide in bitcoin's price is particularly notable as risk assets across the board are sharply higher on Thursday. In the U.S., the Nasdaq and S&P 500 are each ahead by 1.5%, and Europe's Stoxx 600 is up 1.8%. Traditional markets are rallying alongside steep declines in interest rates on growing conventional thinking that major Western central banks may be done with rate hikes. The Bank of England this morning followed the U.S. Federal Reserve yesterday in holding policy steady. One week ago, the European Central Bank did the same. Despite the pullback, bitcoin does remain higher by 1.25% over the past 24 hours, slightly underperforming the broad CoinDesk Market Index's (CMI) 1.6% gain. "Exponential Gold" Perhaps inspired by bitcoin's big gains of late, Fidelity Director of Global Macro Jurrien Timmer tweeted that it might be time to revisit his 2020 bullish thesis on the crypto. "Bitcoin is a commodity currency that aspires to be a store of value and a hedge against monetary debasement," said Timmer. "I think of it as exponential gold." He continued: "During structural regimes in which inflation runs hot, real rates are negative, and/or money supply growth is excessive, gold tends to shine ... Can bitcoin be a player on the same team? I think the potential is there." https://www.coindesk.com/markets/2023/11/02/bitcoin-round-trips-its-way-back-under-35k-as-fidelitys-timmer-calls-it-exponential-gold/

2023-11-02 11:07

The Financial Conduct Authority’s new ad regime took effect in October. The U.K.’s financial watchdog published guidance on its new crypto advertising rules Thursday. The Financial Conduct Authority’s new regime took effect on Oct. 8, and the regulator has been consulting on guidance since June. Under the new rules, firms are required to include appropriate risk warnings on all their communications to U.K. customers that have a “promotional” element. The regulator has already added 221 firms it deems non-compliant with the new regime to an alert list, and has promised enforcement action on companies that are not careful with approving ads. https://www.coindesk.com/policy/2023/11/02/uk-regulator-publishes-guidance-on-new-crypto-marketing-regime/

2023-11-02 11:01

Bitcoin could rise to $56,000 by Dec. 31, in line with its record of maintaining bullish momentum in final months of the year. One of the most famous sayings on Wall Street is that a bull market tends to stay in motion unless an external force acts upon it. Bitcoin (BTC) has historically lived up to the adage modeled along Sir Isaac Newton’s third law of motion and could do so again, rising as high as $56,000 by the end of the year, according to crypto services provider Matrixport. “If bitcoin is up at least +100% by this time of the year, then there is a +71% chance or five in seven that bitcoin would finish the year higher with average year-end rallies of +65%," Markus Thielen, head of research and strategy at Matrixport, said in a note to clients on Thursday. “As bitcoin tends to reach its peak by December 18th, we could call the six to seven weeks from early November to mid-December Bitcoin’s Santa Claus Rally.” As of writing, bitcoin is trading above $35,000, representing a 114% on a year-to-date basis. The impressive gain could be attributed to several reasons, including spot ETF optimism, speculation the Federal Reserve’s liquidity tightening cycle has peaked and haven demand. The expected 65% price rise means bitcoin could trade above $65,000 by the year-end. “Based on these statistics, bitcoin continues to offer upside potential, and a +65% year-end rally would lift prices back to $56,000,” Thielen added. The chart shows the historical performance of bitcoin in the first ten months and the final two months of the year from 2010-2022. In seven out of the past 12 years, bitcoin scored at least 100% gains in the first 10 months. In these seven years, bitcoin rallied by an average of 65% in the final eight weeks. “When bitcoin is up at least +50% by the end of October, there is, on average, a 78% chance that bitcoin will advance even more into year-end. Bitcoin rallied another +68% until year-end on seven of nine previous occasions. This analysis is based on thirteen years of bitcoin history,” Thielen noted. Note that past data is no guarantee of future results. That said, the probability of history repeating itself is high, given the bullish mining reward halving is due early next year. https://www.coindesk.com/markets/2023/11/02/santa-rally-could-propel-bitcoin-to-56k-by-year-end-matrixport-says/