2023-11-02 10:47

In August, PayPal said it would introduce its own U.S. dollar-pegged stablecoin, PayPal USD. PayPal (PYPL) received a subpoena from the U.S. Securities and Exchange Commission (SEC) requesting documentation about its USD stablecoin, the global payments giant said in a filing, without providing more details. The firm entered the market with a U.S. dollar-pegged stablecoin, PayPal USD (PYUSD), in August. "On November 1, 2023, we received a subpoena from the U.S. SEC Division of Enforcement relating to PayPal USD stablecoin," PayPal revealed in its quarterly earnings report filed Wednesday. "The subpoena requests the production of documents. We are cooperating with the SEC in connection with this request." PayPal's stablecoin was the first from a major financial service firm. The announcement raised concerns in Washington because it was a reminder of the Libra stablecoin, a previous effort by Facebook, now Meta Platforms (META), that didn't come to fruition. The fear from some U.S. regulators is that a token tied to a major tech platform could expand quickly to wide usage and present a threat to U.S. financial stability. PayPal's stablecoin threatened to push a divided Congressional debate over crypto legislation further apart. Some members, such as House Financial Services Committee's ranking Democrat Rep. Maxine Waters (D-Calif.), said a stablecoin bill would allow big tech to claim that sector of the crypto industry. PayPal's arrival offered a live example of that possibility. Read More: PayPal to Issue Dollar-Pegged Crypto Stablecoin Based on Ethereum In September, stablecoin issuer Circle intervened in the SEC's case against Binance, arguing that financial trading laws shouldn’t apply to stablecoins, whose value is tied to other assets. PYUSD is an Ethereum-based token offered to online-payments customers before expanding to the company's Venmo app. PayPal has allowed customers to buy and sell cryptocurrencies since 2020. Since April 2021 it allowed the same service on Venmo. In 2022, PayPal began allowing users to transfer their crypto assets to third-party wallets and expanded that capability to Venmo in April 2023. https://www.coindesk.com/policy/2023/11/02/us-sec-subpoenas-paypal-about-usd-stablecoin-company-says/

2023-11-02 08:44

The bankrupt crypto lender appears to be no longer seeking to reorganize, after a lawsuit from the New York Attorney General dimmed hopes of a deal with parent company DCG. Genesis is now focused on liquidation after making material changes to its bankruptcy plans last week, the U.S. government has said. The change threatens to delay bankruptcy proceedings further. An updated bankruptcy plan filed by crypto lender Genesis last week represents a significant change of plans, the U.S. government said in a filing on Wednesday. The lender is now seeking to liquidate its assets rather than reorganize them. The apparent U-turn by Genesis – made after the crypto lender and its parent company Digital Currency Group (DCG) were sued by the New York Attorney General (NYAG) – could add extra delays to the wind-up process, the filing by U.S Trustee William Harrington said. DCG is also CoinDesk’s parent company. “The prior plan provided for the sale of assets of the debtors and a non-debtor affiliate, a discharge of the debtors, and the reorganization of any unsold assets for the benefit of the claim holders,” said Harrington, a Department of Justice official with responsibility for bankruptcy cases. “The liquidating plan provides for the liquidation of all three debtors … the debtors have substantially and materially modified the sale plan.” Harrington argued creditors will need more time to digest the impact of the significant changes made on Oct. 24 before deciding whether to approve them in a vote. The bankruptcy, which commenced in January, has stumbled over how to treat over $1.65 billion Genesis is owed by DCG. In a filing made last week, Genesis said a DCG deal is now “not a viable route” after NYAG Letitia James accused DCG, Genesis and business partner Gemini of defrauding investors. The three companies have all denied James’ charges. A spokesperson for Genesis did not immediately respond to a request for comment on the latest filing. https://www.coindesk.com/policy/2023/11/02/genesis-new-liquidation-plan-is-a-material-swerve-us-government-says/

2023-11-02 06:28

Historically, puts have seldom traded at cheaper valuations for a prolonged period. Put options or bearish bets tied to bitcoin (BTC) are trading at a discount to historical standards, offering a rare opportunity for bulls to snap up downside hedges at cheap valuations. The conclusion is based on the ratio between two metrics – implied volatility for 25-delta out-of-the-money (OTM) BTC put options and the 30-day implied volatility (IV) of at-the-money (ATM) options. The ratio has dipped below 1.00, according to data provided by Amberdata. It’s a sign that 25-delta put options listed at strikes below bitcoin’s current market price are undervalued in volatility terms relative to those at strikes near the spot price. Implied volatility, traders’ collective expression of expected price turbulence, reflects demand for options. Professional traders often quote and compare options’ valuations in implied volatility terms. A put option gives the purchaser the right but not the obligation to sell the underlying asset at a predetermined price on or before a specific date. A put buyer is implicitly bearish on the market, while a call buyer is bullish. Traders with bullish exposure in the spot/futures market often buy puts as a hedge against potential price correction. The latest discount comes as traders scramble to add bullish exposure through calls amid bitcoin’s price rally. The cryptocurrency topped the $36,000 mark early today, extending October’s 28% gain. That said, the window of opportunity to buy cheap hedges could be short-lived, as puts have rarely traded at a discount since early 2022. “Put IV seldom dips below ATM IV, let alone for extended periods. Despite the current bullish market sentiment and reduced demand for downside protection, it’s difficult to imagine a scenario where BTC puts consistently maintain a discount relative to ATM volatility,” Chepal told CoinDesk. “This prompts us to question whether this phenomenon will persist in the weeks to come," Chepal added. https://www.coindesk.com/markets/2023/11/02/bitcoin-put-options-which-offer-downside-protection-look-unusually-cheap-will-the-situation-last/

2023-11-02 00:00

The FTX founder's downfall began on Nov. 2, 2022 – a year ago Thursday – when CoinDesk published a big scoop. Jurors are poised to begin deliberating his fate on the anniversary of that story, at a time when the SOL tokens FTX owns just got $1 billion more valuable. A year ago Thursday, the first domino fell that led to the collapse of Sam Bankman-Fried's crypto empire. On Nov. 2, 2022, CoinDesk published a now-award-winning scoop that revealed Bankman-Fried's trading firm Alameda Research was mysteriously brimming with FTT tokens issued by his FTX exchange. It was the first sign that Alameda and FTX were more closely intertwined than Bankman-Fried had let on and that he was in a financially precarious position, but that wasn't the half of it. As was learned later, Alameda and Bankman-Fried allegedly – and, according to prosecutors, improperly – took FTX customers' money for their own use. FTX and Alameda filed for bankruptcy nine days later, Bankman-Fried was arrested soon after and his criminal fraud and conspiracy trial is now close to its conclusion. But what about FTX the company? It's still in bankruptcy court. Matrixport, a crypto financial services company, estimated in September that the company's reorganization would on average return 37 cents on the dollar to creditors – which seems surprisingly high, given how dire things looked a year ago when the company was in freefall, customers were scrambling to get their money and the company infamously got hacked hours after its Chapter 11 filing. And that recovery estimate could even be conservative. For instance, the value of the bankruptcy estate grew by around $1 billion over the past two weeks thanks to a massive rally in the price of the Solana blockchain's native token SOL, a cryptocurrency and project championed by Bankman-Fried. FTX holds some 55.8 million SOL tokens, the majority of which (42.2 million) are locked up and not immediately tradable on the market, according to CoinGecko. Last month, reports emerged about FTX's holdings in the form of an official debtor venture portfolio, which pegged the SOL holdings at a market value of $1.16 billion. But since then, SOL has risen from around $20 per token to around $40 now. 'Amazing to think about SOL' "It's amazing to think about SOL here," said Thomas Braziel, CEO of 117 Partners, which advises investors on buying distressed assets. There are $10 billion of customer claims against the company, said Braziel, who expects them to recover at least 80% of their money – in other words, they'd lose out on $2 billion or so. But if SOL's price gets to $50 to $60, that "leads to 100%+ certainty for creditors," he said. And the secondary effects are "huge," Braziel added. "Creditors like the Voyager estate, for instance, would start to be in the money." That said, FTX's SOL holdings only start to unlock next year, and the majority of the tokens are frozen until 2027 or 2028. "This is great, but it's not entirely straightforward because a lot of the solana is locked," Braziel said. "Some of it is being moved around, being staked and perhaps there are plans to explore selling some of it. Just like with Anthropic, it's fantastic news, but the estate has to get liquid on this stuff." The Anthropic that Braziel mentioned is an artificial intelligence startup that Bankman-Fried bankrolled. Anthropic has recently enjoyed a wave of funding from the likes of Amazon and Google that has boosted its valuation and, presumably, the value of FTX's stake. There have also been discussions about reopening the FTX exchange to squeeze out more money for creditors. Against all odds and despite the allegations of misdeeds, FTX's fortunes have turned around massively even as Bankman-Fried's personal situation has worsened: Jurors could start deliberating his fate as soon as Thursday, the anniversary of the CoinDesk story that undid him. https://www.coindesk.com/business/2023/11/02/a-year-after-sam-bankman-frieds-downfall-solana-and-other-ftx-holdings-are-flying-high/

2023-11-01 23:01

The alleged fraudster and ex-FTX CEO acted "in good faith," Bankman-Fried's attorney said in an emotional closing argument. NEW YORK — Sam Bankman-Fried appeared to be on the verge of tears late Wednesday at the end of his attorney Mark S. Cohen's closing remarks, the former FTX CEO's last, best hope for acquittal, or at least a hung jury. Bankman-Fried spent these final few moments of his team's closing arguments almost ramrod-still, without his usual jitters. He stared at his parents, blinking heavily and drinking big gulps of water. "Sam did his best to start and operate two multi-billion-dollar businesses in a new market," Cohen said at the conclusion of his emotionally charged remarks to jurors. "Some decisions turned out well," he added. "Some decisions turned out poorly." At the end of the proceeding, which stretched past 6 p.m. in the Manhattan courtroom, he offered an appeal for the jury to find Bankman-Fried acted in "good faith" throughout his time running FTX and Alameda Research, his crypto trading firm, and therefore could not be convicted of fraud. Cohen offered what he called an "alternative history" than the prosecutors regarding the events and decisions that ended in FTX’s bankruptcy last November, as well as the revelation that Alameda had spent billions of dollars of the exchange’s customer funds. In Cohen's telling, it was "real-world miscommunications," "mistakes" and "delays" that imperiled FTX and the rest of Bankman-Fried's crypto empire – not fraud by his client. Sitting a few rows back in the gallery, Joseph Bankman and Barbara Fried appeared similarly taken by the proceedings. As Bankman-Fried walked out of the courtroom on Wednesday evening, his mother – sullen and steely eyed throughout the trial – uncrossed her crossed arms, palmed her heart and then sunk her face into her hands. Emotional closing Cohen clutched the lectern as he addressed the jury in a soft, nearly pleading voice. He relied on submissive language (literally: "I submit to you" x, y and z), underscoring the power these 12 New Yorkers will soon hold over his client, who if convicted could face what amounts to a life sentence. The former federal prosecutor's closing style differed in every way from that of his opposing counterpart, Assistant U.S. Attorney Nicholas Roos. Roos, physically the largest member of the government's team, used his imposing frame to telegraph the gravity of the criminal fraud allegations. When he pointed at the defendant he wagged his entire arm with each part of the name: Sam. Bankman. Fried. It was among the most vivid moments of this five-week trial, alongside Caroline Ellison’s tears on the witness stand – and Sam's display of emotion at the close. Rhetorically, Roos leaned in, too. He resurrected a passive-voice turn of phrase his team had invoked repeatedly in opening arguments – FTX's collapse meant "billions of dollars from thousands of people, gone" – and reversed it, making it active: "thousands of people lost billions of dollars." The changeup raised the stakes just as the trial entered its final phase. The jury listened most attentively to Roos, who, going first in the day (and acting with what Cohen described, not in a complimentary way, as "cinematic" flair) had the performative upper hand. By the afternoon and Cohen’s testimony they started to fade, yawning and glancing at the clock at the back of the gallery. Judge Lewis Kaplan’s decision to extend an already long and sometimes plodding day only compounded their tiredness. Even so, a handful of jurors remained alert and engaged for Cohen, taking notes throughout. It takes only one to cause a hung jury. https://www.coindesk.com/policy/2023/11/01/sam-bankman-frieds-defense-argues-ex-ftx-ceo-acted-in-good-faith-in-emotional-closing-argument/

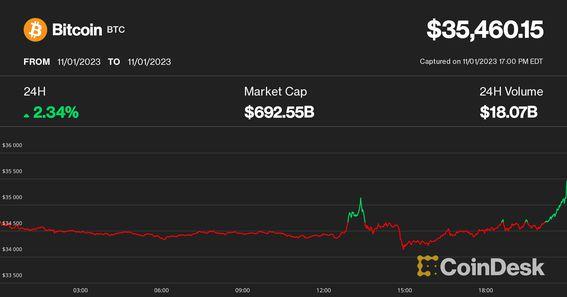

2023-11-01 21:23

The Federal Reserve pulled no surprises on Wednesay as it kept policy on hold but promised a continued focus on bringing inflation to heel. Led by solana's (SOL) 16% surge, altcoins rallied sharply throughout the session Wednesday, while a late move higher in bitcoin (BTC) pushed its price to a new 17-year high above $35,500. Bitcoin at press time was changing hands at around $35,400, ahead 1.7% over the past 24 hours and firmly breaking above the $35,000 level which has capped its upward move over the last two weeks. Solana (SOL) continued its remarkable rise, soaring 16% over the past 24 hours to a 14-month high. Native tokens of layer 1 blockchains such as Avalanche's (AVAX), Polkadot's (DOT) and Near Protocol's (NEAR) rose 6% to 10%. Decentralized finance (DeFi) tokens – which were laggards during October – also popped, with uniswap (UNI) and aave (AAVE) advancing 15% and 10%, respectively. Ether (ETH), the second largest crypto by market cap, was up nearly 2%, outperforming bitcoin by a few basis points. The CoinDesk Market Index (CMI), a proxy for a broad basket of digital assets, was up 2% over the past 24 hours. Checking the downside, SafeMoon's token SFM plummeted over 50% today as the Department of Justice (DOJ) arrested the project's executives for fraud and the U.S. Securities and Exchange Commission (SEC) filed unregistered security offering charges. FOMC Meeting The U.S. Federal Reserve's Federal Open Market Committee (FOMC) left its benchmark fed funds rate range steady at 5.25%-5.50% on Wednesday, which was widely anticipated. Fed Chairman Jerome Powell said at the post-FOMC press conference that a run-up in U.S. Treasury yields have contributed to tightening financial conditions, but left the option open for an additional rate hike if necessary. "Fed's likely done after back-to-back holds kept rates at a 22-year high," Edward Moya, market analyst at OANDA, noted in a newsletter. "The Fed did not rule out a rate increase in the coming months, but swap contracts showed traders weren't convinced." Market participants now see 74% probability that the Fed will leave rates at the current level in January, up from 59%, and could start cutting at rates around mid-2024, according to the CME FedWatch Tool. Equities concluded the day sharply higher, with the S&P 500 index up 1.1% and the tech-heavy Nasdaq 100 gaining 1.5%. 10-year U.S. Treasury yields buckled to 4.73%, down from near 5% earlier this week, pricing in the lower odds of further hikes. "BTC is a hedge against loose monetary policies and so lower yields would strengthen that value proposition and investors' willingness to buy and hold crypto," Justin d'Anethan, head of business development at crypto market maker Keyrock, said in an email. "Should the hint of a change in rate policy become more pronounced, one would expect crypto markets to rise." https://www.coindesk.com/markets/2023/11/01/bitcoin-retakes-35k-after-fomc-as-solanas-sol-leads-sharp-altcoin-rally/