2023-11-01 20:29

FTX-related wallets unstaked and transferred millions of tokens to exchanges, which could exert some selling pressure for the asset, one observer said. Solana (SOL) continued its remarkable rally Wednesday and hit a 14-month high price, but sell pressure may soon hit the market as FTX unstaked another $65 million of tokens after moving millions of SOL to crypto exchanges over the past few days. The seventh-largest cryptocurrency by market capitalization rose 17% over the past 24 hours, topping at $46, its highest since August 2022, before giving up some of its gains. The token widely outperformed the mostly range-bound crypto market, with the CoinDesk Market Index (CMI), which tracks a basket of digital assets, up 0.6% over the past 24 hours. Solana's resurgence as one of the best-performing assets – up nearly 350% this year – has come as a surprise to many observers, defying concerns about its future after the collapse of Sam Bankman Fried's FTX crypto exchange and Alameda Research, big investors in the Solana ecosystem. Rising blockchain activity, a massive influx into SOL-focused digital asset funds and a recent tech upgrade helped the price recover, analysts said. Simultaneously, concerns about the FTX estate – now under bankruptcy protection – selling tokens en masse have proven so far to be overblown. However, a recent uptick in activity of FTX-owned crypto wallets over the last few days suggest that some selling pressure could hit the market soon. Digital asset manager 21Shares noted in a report that the FTX-Alameda bankruptcy estate has recently moved $35 million worth of SOL tokens to exchanges, possibly with the intention to sell. Blockchain data shows that an FTX-related wallet Wednesday afternoon unstaked another 1.6 million of tokens, worth some $67 million, suggesting that more tokens could be on the move. "This might exert some selling pressure in the coming weeks," 21Shares analysts said. https://www.coindesk.com/markets/2023/11/01/solana-surges-to-14-month-high-sell-pressure-lingers-as-ftx-unstakes-67m-tokens/

2023-11-01 18:05

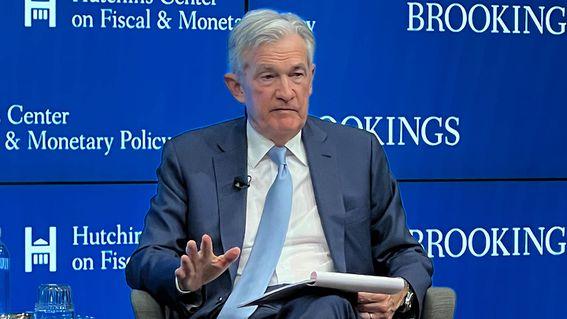

Market participants will now turn to Fed Chair Jerome Powell's post-meeting press conference to glean insight into the future path of U.S. central bank policy. In a widely anticipated move, the U.S. Federal Reserve's Federal Open Market Committee (FOMC) Wednesday left its benchmark fed funds rate range steady at 5.25%-5.50%. "Tighter financial and credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation," said the FOMC in its policy statement. "The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks." The central bank's nod towards risks to economic growth is nearly identical to that of its previous policy statement in September, suggesting that it will be incoming data that will decide whether there's another pause or rate hike at its December meeting. Bitcoin (BTC) was little changed in the moments following the news, trading just above $34,500, CoinDesk data shows. While bitcoin has been known to experience a large amount of intra-day volatility during FOMC decision days, that impact has been diminishing with the Fed likely nearing the end of its rate hike cycle, according to crypto analytics firm K33 Research. "Fed interest rate decisions have seen reduced medium-term directional impact on BTC as correlations reign moderate, K33 analysts Anders Helseth and Vetle Lunde noted in a market preview Tuesday. "We still expect a significant intraday volatility contribution from the Wednesday FOMC, as the market typically reacts with bursts of strongly correlated and heightened volatility during the FOMC hours." Market participants will now look to Fed Chairman Jerome Powell’s imminent press conference for clues about the future path of U.S. central bank policy. Over the past few weeks, Fed speakers have hinted that they are leaning towards one more rate hike before ending what's been a historic rate hike cycle. https://www.coindesk.com/markets/2023/11/01/federal-reserve-leaves-rates-unchanged-bitcoin-flat-at-345k/

2023-11-01 17:01

Crypto company SafeMoon's CEO and chief technology officer were arrested, accused of withdrawing more than $200M to buy luxury cars and homes from funds that they told investors were "locked," according to the DOJ and the regulator. The Department of Justice has the CEO and CTO of SafeMoon in custody but is still looking for creator Kyle Nagy in its securities fraud case against the executives. The Securities and Exchange Commission is also pursuing a case that the company offered unregistered securities. The U.S. Department of Justice (DOJ) has arrested and charged SafeMoon's executive team with perpetrating a massive fraud on its investors in a case also targeted Wednesday by the Securities and Exchange Commission (SEC). SafeMoon CEO John Karony and Chief Technology Officer Thomas Smith were arrested, and creator Kyle Nagy remains at large, according to the DOJ. The SafeMoon executive team withdrew more than $200 million from the project, as detailed in the SEC’s complaint, and they misappropriated investors funds for personal use, authorities said. "As alleged, the defendants deliberately misled investors and diverted millions of dollars to fuel their greedy scheme and enrich themselves by purchasing a custom Porsche sports car, other luxury vehicles and real estate,” said Breon Peace, U.S. Attorney for the Eastern District of New York, in a statement. Nagy, known as "Safemoon Dev," 35; Karony, "CPT_HODL_T_MUN," 27; and Smith, known as "papa," 35, were charged with conspiracy to commit securities fraud, conspiracy to commit wire fraud and money laundering conspiracy. In one example, the DOJ said Smith diverted tokens to buy himself a Porsche 911. The token SFM fell more than 30% on Wednesday. CoinDesk's attempts to reach the three through the company website and through their social media accounts have been unsuccessful. While facing criminal charges, the defendants were also charged for securities violations by the SEC. "Unregistered offerings lack the disclosures and accountability that the law demands, and they attract scammers like Kyle Nagy, who use these vulnerabilities to enrich themselves at the expense of others,” said David Hirsch, Chief of the SEC Enforcement Division’s Crypto Assets and Cyber Unit (CACU). The agency also accused all three of "perpetrating a massive fraudulent scheme through the unregistered sale of the crypto asset security." SafeMoon (SFM) was a meme coin that rolled out in 2021 during the height of the previous bull market. Its team promised users that staked funds would be "locked" in a liquidity pool, but the SEC said that "large portions of the liquidity pool were never locked" and that executives used funds to buy homes, travel and high-end cars. At one point in April of 2021, Smith assured investors that he personally held no SFM "because I'm a software engineer," he's quoted as saying in the indictment in the U.S. District Court for the Eastern District of New York. "I don't want to create a situation where my decisions as a CTO are affected by the monetary gain of those actions, and that's why I've made that separation for myself." The SafeMoon team also allegedly used locked assets to make large purchases of SafeMoon to prop up its price and manipulate the market, the SEC said. Though the executives had denied they personally held SFM, they repeatedly traded the tokens for their own benefit, generating millions in profits while masking their proceeds through private, unhosted wallets and pseudonymous exchange accounts, according to the DOJ. Read More: Safemoon Hacker Strikes Deal With Developers to Return $7.1M https://www.coindesk.com/policy/2023/11/01/sec-charges-safemoon-team-with-fraud-offering-unregistered-crypto-securities/

2023-11-01 15:36

Jurors could begin deliberating Bankman-Fried's fate as soon as Thursday. NEW YORK — The criminal trial of Sam Bankman-Fried, tied to the collapse of the FTX crypto exchange once valued at $32 billion, entered its final moments Wednesday as prosecution and defense attorneys battling in a Manhattan courtroom gave their closing arguments. Their interpretations differed, of course. Bankman-Fried "told a story, and he lied to you," a federal prosecutor told jurors about the FTX founder. Bankman-Fried's lawyer, Mark Cohen, disagreed, replying that the government spun a Hollywood tale about FTX that strayed from reality. "Any good movie needs a villain," he said. "A nerdy high school math guy" like Bankman-Fried doesn't make a good villain, he added, so prosecutors manufactured one. The lawyers spent Wednesday walking the jury through about a month of testimony and hundreds of pieces of evidence. Bankman-Fried faces two counts of wire fraud and five counts of conspiracy tied to the operation and collapse of the FTX crypto exchange and Alameda Research, the trading firm founded by Bankman-Fried that is alleged to have stolen a huge amount of money from FTX customers. Jurors could begin deliberating Bankman-Fried's fate as soon as Thursday. Assistant U.S. Attorney Nicholas Roos, who is presenting the U.S. Department of Justice's denouement, opened by noting that there was "no dispute" that billions of dollars worth of FTX customer funds was gone. "This is a pyramid of deceit by the defendant built on lies and false promises," he said. Bankman-Fried's lawyer disputed this characterization early in his own closing statement. The government's movie-villain depiction of Bankman-Fried was built on the "false premise" that the FTX crypto empire was fraudulent "from the jump," he said. "We've got evidence of Bankman-Fried's hair, his clothes … his sex life," Cohen said, but these things have "nothing to do with how his exchange worked" or whether he committed crimes. While "FTX sure should've had a better-built-out risk management system," Cohen said, his client acted "in good faith," and he reminded jurors that this is "a complete defense to all the charges in this case." 'The defendant is responsible' Roos, the prosecutor, asked the jury to keep three questions in mind as they review the evidence: where the money went, what happened and who was responsible, repeating these questions several times. "Now that you've seen all the evidence and heard all testimonies, you know the answer," Roos said, pointing to Bankman-Fried. "This man," the prosecutor said. "The defendant is responsible." Bankman-Fried's former employees quit when they learned about the missing money, and his fellow executives testified that they didn't know customer funds were being misused until it was too late, Roos said. "Their understanding was, customer funds were not allowed to be used by FTX or anyone else," he said. "Customer funds belonged to customers." Roos pointed to witness testimony and Bankman-Fried's own turn on the stand, saying the defendant morphed into a "different person" when answering the DOJ's questions as opposed to defense attorney Mark Cohen's. "He came up with a tale," Roos said, asking the jury if they noticed how during cross-examination, Bankman-Fried couldn't remember details, whereas during the direct examination, he frequently described situations from his life. "You'd have to ignore the evidence to believe his story." Later, Roos also pointed out another seemingly obvious explanation for why Bankman-Fried was solely responsible: He was the only person who was involved in and controlled both FTX and Alameda and, thus, was the only one who had access to both companies. Alameda CEO Caroline Ellison, he said, never worked for FTX, while Gary Wang and Nishad Singh were only ever employees at FTX, and never Alameda. "So it couldn't have been them alone," Roos argued. "It was one person," he said, pointing his finger yet again in Bankman-Fried's direction. "The defendant." Digging the hole deeper After pointing out the "special privileges" on FTX that let Alameda allegedly take FTX customer funds, Roos walked the jury through six times when Bankman-Fried "chose to double-down" and dig "the hole deeper" at FTX and Alameda. The government's whirlwind review of the month-long criminal trial kicked off in 2021, when Bankman-Fried, according to analysis from a data expert's testimony, used over a billion dollars of FTX users' money to repurchase stock from investor-turned-rival, Binance. He then moved to a second key moment later that year, when Bankman-Fried continued to spend billions on new investments at a time when the prosecutor said it should've been clear Alameda, which had already borrowed billions from FTX users, had less assets than liabilities. "You don't have to go to MIT to know that if you have more debts than money, and you want to spend more money, then you're going to be more in debt," he quipped to the jury. Roos used the next two moments – Bankman-Fried's instruction to Alameda to pay back third-party loans following a June 2022 market crash, and his alleged involvment in creating "fake" Alameda balance sheets for lenders – to point out specific gaps in Bankman-Fried's testimony. Roos alleged that Bankman-Fried "lied on the stand" when he claimed he wasn't aware, for example, that Alameda was already verging on insolvency by this point (a fact Ellison testified she discussed with him at the time). The prosecutor pulled up Google metadata showing that Bankman-Fried created a spreadsheet showing Alameda owed a large amount to FTX and then set up a meeting to discuss it with several deputies. The spreadsheet and meeting were present in the testimony of other witnesses, but went unaddressed by Bankman-Fried, Roos noted. The prosecutor wrapped up by moving to late 2022, when Bankman-Fried continued to make investments in companies like Modulo and SkyBridge Capital despite testimony from other witnesses, like senior FTX executive Nishad Singh, that Bankman-Fried knew this would mean drawing on user deposits. Roos then pointed out the final key moment: Bankman-Fried's public "assets are fine" tweet on Nov. 7, 2022, a day after he wrote in a private memo that "we have enough to process 1/3 of remaining client money." The defense's emotional closing argument Bankman-Fried appeared to be on the verge of tears late Wednesday at the end of his attorney's closing remarks, the former FTX CEO's last, best hope for acquittal, or at least a hung jury. Cohen spent several hours poking holes in the government's depiction of Bankman-Fried, and he placed special focus on sowing doubt in the credibility of key government witnesses Ellison, Singh and Wang – all of whom took government plea agreements that could drastically reduce their sentences in exchange for their cooperation. "In a three-and-a-half-hour summation the government didn't mention their cooperation agreements at all," Cohen remarked. He also reminded the jury that Bankman-Fried had at one point pondered shutting down Alameda. Bankman-Fried ultimately reasoned in a memo that the firm would be too difficult to unwind – evidence, according to Roos' argument earlier in the day, that the firm had borrowed too much money from FTX customer funds that it was unable to repay. Cohen took an alternate view: "If Sam is a criminal mastermind and Alameda is the key to the fraud to stealing customer money, why would he be the one proposing to close it in the first place?" "Sam did his best to start and operate two multi-billion-dollar businesses in a new market," Cohen said at the conclusion of his emotionally charged remarks to jurors. "Some decisions turned out well," he added. "Some decisions turned out poorly." At the end of the proceeding, which stretched past 6 p.m., he offered an appeal for the jury to find Bankman-Fried acted in "good faith" throughout his time running FTX and Alameda, and therefore could not be convicted of fraud. Cohen asked the jury to consider the real world when they begin their deliberations. In Cohen's telling, it was "real world miscommunications," "mistakes," and "delays" that imperiled FTX and the rest of Bankman-Fried's crypto empire – not intentional acts of fraud. Bankman-Fried spent these final few moments of his team's closing arguments, a ramrod stillness replacing his usual jitters. He stared at his parents, blinking heavily and drinking big gulps of water. Sitting a few rows back in the gallery, Joseph Bankman and Barbara Fried appeared similarly taken by the proceedings. As Bankman-Fried walked out of the courtroom on Wednesday evening, his mother watched. Sullen and steely-eyed throughout the trial, she uncrossed her crossed arms, palmed her heart and then sunk her face into her hands. https://www.coindesk.com/policy/2023/11/01/a-pyramid-of-deceit-prosecutors-begin-closing-argument-in-sam-bankman-fried-fraud-trial/

2023-11-01 14:00

This week's launch of the new "data availability" network Celestia came with an airdrop of the project's TIA tokens, one of the most anticipated giveaways in the crypto industry of the past year. Mustafa Al-Bassam was a Ph.D. student in computer science in 2019 at University College London when he published a paper titled "LazyLedger." Not meant for a lazy reader, the paper went on to describe, in excruciatingly complex terms and Greek mathematical characters, what was then a radical rethinking of how blockchains could work: separating out the various functions of a distributed ledger – especially the way users query the network for data – into distinct "application layers." A key benefit would be to minimize the total resources needed to run the main blockchain. Al-Bassam now serves as CEO of Celestia Labs, the primary developer behind the Celestia project, which launched this week as a new "data availability" network, and in various pronouncements heralded the accomplishment as the start of a new "modular era" in blockchain architecture. It's presumed that a primary use case for Celestia will be to relieve the Ethereum blockchain of the burden of storing and transmitting reams of data produced by the fast-growing ecosystem of "layer-2" networks known as "rollups," where users can make cheaper and faster transactions. "The theory is that Celestia can become the backbone for a highly scalable and interoperable network of rollups and, most importantly, achieve this modular vision without sacrificing decentralization or security," Christine Kim, a vice president of research at the crypto firm Galaxy, wrote in an Oct. 19 report. Of course, this being crypto, the primary focus of most news coverage (and social-media posts) was on the project's buzzy airdrop Tuesday of some 60 million of its native TIA tokens, or roughly 6% of the supply, with a final tally of some 191,391 claims. Another 140 million tokens will be allocated to future initiatives. Read More: Celestia Airdrops TIA Token as Network Goes Live, Claims Start of 'Modular Era' The airdrop was so highly anticipated that, in the lead-up to the giveaway, traders were speculating on the price using pre-launch futures contracts. According to the website CoinMarketCap, the TIA token has already been listed on a host of crypto exchanges, including Binance, KuCoin, Kraken, Bybit and MEXC. As of late Tuesday, CoinMarketCap listed the project's circulating supply of TIA tokens around 141 million, and price of $2.44 each, for a market capitalization of $344 million. The airdropped tokens represent a portion of a total of 1 billion tokens minted, and this being crypto, just over half of those are getting allocated to early investors and initial contributors. Many of those are locked up for now: Seed investors will receive their tokens evenly between October 2024 and October 2025, with initial core contributors receiving their tokens until October 2026. The TIA airdrop is one of the biggest in the crypto industry over the past year, and of course a big airdrop is no guarantee of a project's ultimate success. Two mammoth projects, Sui and Aptos, both layer 1 blockchains staffed by former Meta employees, have similarities with Celestia in that they airdropped tokens to developers and test network users, but they have struggled to wrangle market share from the likes of Ethereum. Aptos rose to a market cap of $2.9 billion on the release of its main network while Sui debuted at $750 million. Yet in spite of inflated token values, the total amount of capital locked on either blockchain has failed to surpass $100 million. What does Celestia do? On Tuesday, X (formerly Twitter) was filled with go-go posts – "$10 soon," wrote one user in reference to TIA's price. Another poster asked where they could dump the airdropped tokens. Jesse Pollak, who oversees Coinbase's new Base layer-2 blockchain atop Ethereum, offered congratulations. Such euphoria may have served to gloss over the reality of just how hard the project is to understand. "Data availability" is such an arcane term that even Dankrad Feist, an Ethereum Foundation researcher who's the namesake for the equally arcane blockchain concept of "danksharding," said recently that he found it too confusing. Sean Farrell, a crypto analyst at FundStat, simplified it for investors in a note on Tuesday: Data availability "allows network nodes to download, store, and make transaction information accessible for verification." The big idea is that Celestia aims to help solve scalability and stability issues that have plagued monolithic blockchains like Ethereum and Solana – partly by creating a new venue for hosting and accessing the reams of data created by the rapidly proliferating ecosystems of "layer 2" networks working atop primary "layer 1" blockchains. Data availability is considered so crucial to alleviating the load on Ethereum that two rival projects, Avail and EigenDA, are working on it in addition to Celestia. Avail is headed by a former Polygon co-founder, Anurag Arjun, while EigenDA is a project of EigenLayer, headed by Sreeram Kannan, an associate professor at the University of Washington. The push to erect these new networks reflects this year's push by developers toward a "modular blockchain" architecture that separates the core functions of a blockchain – consensus, settlement, data availability, and execution – and then segment them into layers that ensure efficiency. "It's the start of a new era," the Celestia Foundation, which supports development on the network, wrote in a blog post on Tuesday. "The modular era." Read More: What Is Ethereum’s ‘Data Availability' Problem, and Why Does It Matter? How does Celestia work? According to the Celestia’s project documentation, the TIA tokens represent "an essential part of how developers build on the first modular blockchain network." To use Celestia for data availability, rollup developers submit a type of transaction known as "PayForBlobs" on the network for a fee, denominated in TIA. Modular blockchains are designed with a focus on using specific channels for speed and execution, unlike monolithic blockchains that can only scale at the expense of decentralization or security. "Instead of one blockchain doing everything, modular blockchains specialize and optimize to perform a given function," Celestia spokesperson Ekram Ahmed told CoinDesk. Al-Bassam, the former Ph.D. student who went on to found Celestia, co-authored three academic books with the Ethereum's famous founder. Vitalik Buterin. In a talk earlier this year, Buterin touted Celestia as a scaling solution for Ethereum rollups. On Tuesday, the official Celestia account on X posted: "What was once considered a wild moonshot is now a reality four years after the LazyLedger white paper was published." What sets Celestia apart from other blockchains? "Data availability sampling answers the question," Ahmed replied before highlighting the importance of verifying data on a blockchain. "Users of a monolithic blockchain usually download all the data to check that it is available." Currently, this problem isn't necessarily in the forefront of the mind of Ethereum or Solana users, but that may be because neither blockchain has scaled to the masses. Ethereum averages around 1 million transactions per day, according to ycharts, with Solana racking up a fraction of that. Last week, fund manager VanEck modeled a scenario that would see Solana reach 100 million users. If blockchains manage to scale to this level, projects like Celestia aim to ensure that the data for every blockchain node is verified and validated. "Modular chains solve this problem by making it possible for users to verify very large blocks using a technology called data availability sampling," Ahmed said. The flagship feature of Celestia is data availability sampling (DAS) – a way of verifying all data that is available on a blockchain. Intended users include those running so-called light nodes – able to be run on small computers that don't need massive amounts of computational power or data-storage capacity – who could then verify data availability without having to download all data for a block. These light nodes conduct several rounds of random sampling of block data, as more rounds are completed it increases its confidence that the data is available. "Once the light node successfully reaches a predetermined confidence level, for example 99%, it will consider the block data as available," Ahmed concluded. Eventually, if Al-Bassam's vision takes hold, day-to-day crypto users might interact with Celestia without knowing it. And understanding it all? Seems a lot less likely. https://www.coindesk.com/tech/2023/11/01/how-a-phd-students-research-paper-turned-celestia-into-345m-blockchain-project-overnight/

2023-11-01 12:29

The crypto's weekly RSI has crossed above 70, indicating a strengthening of upward momentum. The Bitcoin (BTC) bull move could soon run wild, bringing a steep multi-week uptrend in the leading cryptocurrency. That's the message from bitcoin's 14-week relative strength index (RSI), a momentum indicator used to measure the speed and change of price movements. The indicator has crossed above 70, a threshold that marked the FOMO (fear of missing out) phases of the mid-2019 and late 2020 bull runs. These FOMO phases are characterized by both retail and savvy traders pouring money into an already-trending asset in fear of missing out on a significant opportunity. Developed by J. Welles Wilder, the RSI measures the speed and change of price movements and oscillates between zero and 100. The default period for calculating RSI is 14 days, but traders use 14-week and 14-month RSIs to gauge long-term momentum. A reading above 70 is often erroneously taken to represent overbought conditions and a sign of an impending bearish reversal. However, per technical analysis textbooks, an above-70 RSI, especially on longer duration charts, suggests bullish momentum is strong and the asset could continue to rally in the weeks ahead, similar to what happened in 2019 and 2020. To paraphrase a Wall Street saying, indicators can stay overbought longer than bears can stay solvent. Traders, however, should note that macro developments can single-handedly make or break technical chart patterns and should be vigilant of potential black swans. https://www.coindesk.com/markets/2023/11/01/raging-bitcoin-bull-market-ahead-according-to-key-indicator/