2024-08-28 16:34

The group is opening a battleground-states tour with Sen. Sinema in Arizona, then it moves on to Nevada, Michigan, Wisconsin and Pennsylvania to get out the crypto vote. Crypto political advocacy group Stand With Crypto is starting up its tour across several key states in the November general election, beginning next week in Arizona. The organization has gathered more than a million online signups from people interested in digital assets and says it hopes to get them into the voting booths later this year. Stand With Crypto is the political cheerleading arm of the crypto industry's increasingly high-powered effort to insert itself into the 2024 election, and it's starting a multi-state tour on Sept. 4 with the hope of translating its 1.3 million online signups into pro-cryptocurrency votes. Its first stop in Arizona will feature U.S. Sen. Kyrsten Sinema (I-Ariz.) and a top Republican state legislator, Arizona House Speaker Pro Tempore Travis Grantham, along with crypto businesspeople, according to the organization. After that event in Phoenix, Stand With Crypto will hit several other potential tossup states in the election, hosting similar events in Nevada, Michigan, Wisconsin and Pennsylvania. "There's a large group of people who are into crypto," said Logan Dobson, the group's executive director, said in an interview. "It's our job to use sort of campaign-style tactics to motivate them to vote." "Crypto voters are already, I think, decently fired-up about this election," Dobson added. Stand With Crypto has amassed almost 27,000 signups of Arizona crypto supporters to its website, it says, and the group's studies of those individuals indicates more than 80% may be registered voters. Fewer than 11,000 votes separated former President Donald Trump and President Joe Biden when Biden won that state in 2020. Arizona has already represented a crypto political battleground. One of the industry's favored candidates, Yassamin Ansari, won her congressional primary with 39 votes over a candidate who railed against her support from crypto interests and had been endorsed by crypto critic Sen. Elizabeth Warren (D-Mass.) In presidential election polling, Arizona so far has Vice President Kamala Harris and Trump running neck-and-neck, with most of the recent polls suggesting they're within a percentage point of each other. Between them, only Trump has made pro-crypto pronouncements, though Harris' camp has reportedly been open to a friendlier digital assets stance than Biden's administration. The digital assets industry's top political action committee (PAC), Fairshake, has said it's committing $3 million each to advocate for U.S. Rep. Ruben Gallego (D-Ariz.) in the Arizona Senate race and Rep. Elisa Slotkin (D-Mich.) in her Senate race in Michigan. The announcement drew frustration from crypto's Republican supporters, even as Fairshake and its affiliate PACs attracted similar heat from Democrats when it committed $12 million to get Republican crypto fan Bernie Moreno, the opponent of powerful Senate Banking Committee Chairman Sherrod Brown (D-Ohio), elected in Ohio. Stand With Crypto, which doesn't have a direct affiliation with Fairshake despite Coinbase being a prominent backer of both, is also working on Ohio plans, Dobson said. The state is "definitely a priority" for the organization, he said. Read More: Advocacy Group 'Stand With Crypto' Says It's Exceeded 1 Million Signups https://www.coindesk.com/policy/2024/08/28/advocates-at-stand-with-crypto-seek-to-turn-crypto-enthusiasts-into-swing-state-voters/

2024-08-28 15:58

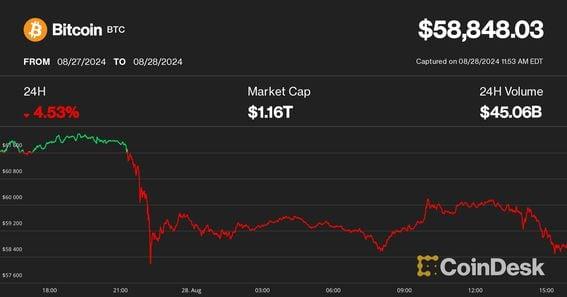

Ether's year-to-date gain has narrowed to less than 10% in crypto's latest price tumble. A pleasant Tuesday summer evening in the U.S. was upended when bitcoin (BTC) plunged nearly 6% in a handful of minutes, more than erasing sizable gains seen late last week after a dovish turn by Federal Reserve Chair Jerome Powell and the teaming up of pro-crypto presidential candidates Donald Trump and RFK Jr. After touching as low as $58,200, bitcoin managed a bounce back above $60,100 during early U.S. trading on Friday, but that's mostly evaporated as the noon hour approaches. Now at $58,800 bitcoin is lower by 4.5% over the past 24 hours. The broader CoinDesk 20 Index is down a similar amount. Ether (ETH) outperformed by a hair, falling 4% over the past day, but longer-term, the second-largest crypto has seen its price relative to bitcoin plunge 21% this year to its lowest level since April 2021. At $2,490 at press time, ether's 2024 year-to-date advance has narrowed to just 9% versus bitcoin's 39% rally. Behind the divergence, it's been a tale of two starkly different spot ETF launches this year, with the bitcoin funds pulling in more than $10 billion in net inflows while the ether vehicles on a net basis have bled assets since their introductions. Macro outlook becomes a bit less inviting Adding to pressure on crypto were declines in the major U.S. stock averages, led by 1.3% drop in the tech-heavy Nasdaq. Helping to push the Nasdaq lower was a 3% fall in Nvidia (NVDA) ahead of its quarterly earnings results due after the bell on Wednesday. Though still a bit off from an all-time high set earlier this summer, Nvidia remains up 159% year-to-date, leaving plenty of room below should the company disappoint on either its quarter or its outlook. Also prompting some nervousness is the idea that investors may have read too much into Fed Chair Powell's dovish remarks at the central bank's Jackson Hole conference late last week. Traders Friday quickly moved to price in nearly a 50% chance of the Fed cutting its benchmark fed funds rate by 50 basis points (instead of the previously presumed 25) at the upcoming September meeting. There's still plenty of data to come in between now and that September meeting, however, including the government's employment and inflation reports for August. Those numbers are likely to have to come in pretty soft for the Fed to make such a large cut in rates so quickly. At the current time, the odds of a 50 basis point move have drifted down to 36%, according to CME FedWatch. https://www.coindesk.com/markets/2024/08/28/bitcoin-bounce-fizzles-as-nvidias-slide-ahead-of-earnings-adds-to-risk-off-mood/

2024-08-28 15:56

The crypto exchange complies with anti-money laundering legislation, he said. Teng rejected claims that Binance had seized "all funds from all Palestinians," as publicized on X. The exchange complies with anti-money laundering legislation, like all financial institutions, he said. A letter in the original post shows a rejected appeal by a wallet holder against a seizure order from November, but it doesn't identify the recipient. Binance CEO Richard Teng dismissed claims the crypto exchange froze all assets belonging to all Palestinians at the request of the Israeli armed forces, an allegation publicized on social media platform X by Ray Youssef, the founder and CEO of peer-to-peer bitcoin trading platform NoOnes. "FUD," Teng wrote in a post on X, using the acronym for fear, uncertainty, and doubt. "Only a limited number of user accounts, linked to illicit funds, were blocked from transacting. There have been some incorrect statements about this. As a global crypto exchange, we comply with internationally accepted anti-money laundering legislation, just like any other financial institution." In his post, Youssef included a letter in Hebrew from Paul Landes, head of Israel's National Bureau for Counter Terror Financing, together with a translation. The letter rejects an appeal against a seizure order dating from Nov. 1, 2023, and says funds were transferred from the Dubai Exchange Company in the Gaza Strip to cryptographic wallets "yours among them." The letter doesn't identify the recipient. The Dubai Exchange Company was designated a terror organization in 2022, it says. While terror groups are said to use cryptocurrency to fund their operations, figures are hard to discern given the difficulty of identifying the owner or any specific wallet. In July, Singapore's government noted an increasing use of cryptocurrencies in terror financing while saying cash and other informal value transfer systems remain the predominant means for financial transactions. Israel has seized 190 Binance accounts it said were tied to terrorists since 2021, Reuters reported in May last year. That was before the Oct. 7 invasion that murdered 1,200 Israelis and took another 250 hostage, prompting Israel to enter the territory. More accounts on the exchange, linked to Hamas, were frozen on Oct. 10 at the request of Israeli police. Later that month, the U.S. issued a list of sanctions that included a business providing money transfers and digital assets exchange services in Gaza to squeeze Hamas, listed as a terror organization in the U.S., U.K. and other regions. https://www.coindesk.com/business/2024/08/28/binance-ceo-teng-rejects-allegations-the-exchange-froze-all-palestinians-funds/

2024-08-28 14:38

The head of the popular social-media and messaging platform was arrested on Saturday as part of an investigation into money laundering, drug trafficking, child pornography and non-cooperation with law enforcement crimes. Telegram CEO Pavel Durov was indicted Wednesday evening in a French court, days after the head of the popular social-media and messaging platform's arrest on Saturday at an airport near Paris. According to a press release published by French authorities late Wednesday, Durov is being charged with being complicit in the administration of an online platform allowing illicit transactions, refusing to comply with police requests for documents or other communications in ongoing investigations, being complicit in the dissemination of child exploitation material and a host of other charges. He's also being accused of providing encryption services without embedding controls in Telegram. "The almost total absence of response from Telegram to the judicial requisitions was brought to the attention of the cybercrime section (J3) of the JUNALCO (National Jurisdiction for the Fight against Organised Crime, within the Paris prosecutor's office), in particular by the OFMIN (National Office for Minors)," the release said when translated from French. "When consulted, other French investigation services and public prosecutors as well as various partners within Eurojust, particularly Belgian ones, shared the same observation. This is what led JUNALCO to open an investigation into the possible criminal liability of the managers of this messaging service in the commission of these offenses." The investigation began in February 2024, and an initial indictment was returned on July 8, the release said. French police said they released him from custody ahead of his court appearance, which led to some confusion – and a brief jump in the price of the TON cryptocurrency linked to Telegram – that he'd been fully freed. In reality, he was just headed to the courthouse. Wednesday evening's press release said he had to pay a 5 million euro deposit, report to a French police station at least twice a week and was barred from leaving the country. "The investigating judge has released Pavel Durov from custody and has had him brought to court for initial questioning and possible indictment," a spokesperson said in a statement earlier in the day. Telegram, in a statement published after Durov's arrest, said it "abides by [European Union] laws" and its practices remain within industry norms. "It is absurd to claim that a platform or its owner are responsible for abuse of that platform," Telegram said in its statement. https://www.coindesk.com/policy/2024/08/28/telegram-ceo-pavel-durov-set-to-appear-in-french-court-after-weekend-arrest/

2024-08-28 12:13

The application initiates an automatic moratorium of 30 days. WazirX has filed an application with the Singapore High Court for a moratorium. The plan proposes to alloocate the impact from the cyberattack pro-rata across users. Indian cryptocurrency exchange WazirX has asked the Singapore High Court for six months to restructure its liabilities, it announced on Wednesday. WazirX lost $230 million to a hack in July. The move initiates an automatic moratorium of 30 days. A date for the hearing in which the court will decide whether to grant the moratorium has not yet been scheduled. Co-founder Nischal Shetty submitted an affidavit to support the application under the name of Zettai Pte, which is incorporated in Singapore. Zanmai India is the subsidiary of Zettai and operates WazirX. A dispute with Binance is ongoing over who owns the platform. Due to "confidentiality obligations ... we may not be able to disclose certain information relating to the dispute," WazirX said in a blog post. The affidavit asks the court to order that "No resolution shall be passed for a winding up of Zettai; No execution, distress or other legal process may be commenced, continued or levied against any property of Zettai, except with the leave of the Court." The moratorium will provide Zettai with breathing space while it progresses with a restructuring, "the most efficient way to address users’ cryptocurrency balances on the Platform and facilitate recovery for users," it said. Under the "restructuring, the impact from the cyberattack will be allocated pro-rata across users who rank equally with each other as unsecured creditors, and users will receive a share of available token assets associated with the Platform proportionate to their share of all users’ unsecured claims for their account balances," according to the announcement. https://www.coindesk.com/business/2024/08/28/wazirx-asks-singapore-high-court-for-6-months-to-restructure-its-liabilities/

2024-08-28 12:00

The report, commissioned by OKX, shows that a growing number of institutional investors are examining new digital asset products for their portfolio Institutional investors continue to remain bullish about digital assets, embracing instruments beyond holding crypto like staking and derivatives. Even though they are bullish, challenges to further adoption remain on the horizon. Institutional investors are set to increase digital asset allocations in their portfolio to 7% by 2027, with the market for tokenized assets projected to surpass $10 trillion by 2030, signaling significant growth in the sector, but challenges remain on the horizon according to a new report on the topic from The Economist commissioned by crypto exchange OKX. Currently, asset managers allocate between 1%-5% of their assets under management (AUM) to digital assets. "The positioning of digital assets within institutional portfolios has been focused on trading of cryptocurrencies, with bitcoin and ether representing the largest investment avenues," the report reads. "But institutional investors are exhibiting greater optimism around digital assets, encouraged by the expanding availability of a wider range of investment vehicles that take them beyond just cryptocurrencies." The report says 51% of institutional investors are considering spot crypto allocations, 33% are looking at staking digital assets, 32% are exploring crypto derivatives and 36% are looking at funds that track crypto. More institutional investors are now considering digital assets outside of just holding cryptocurrencies, such as staking, crypto derivatives, and tokenized bonds, highlighted by the uptick in digital assets on the market like the European Investment Bank's pounds 50 million ($66 million) digitally native bond, the $1 billion in tokenized U.S. treasuries, and the HK$6 billion ($766.8 million) Hong Kong digital currency bond. Custodians are also playing an important role in allowing institutional investors to embrace digital assets, with 80% of traditional and crypto hedge funds surveyed using a custodian, the report says. Within Asia, many crypto custodians are obtaining the same custodian licenses as their TradFi counterparts, such as Hong Kong's Trust or Company Service Provider (TCSP) while in Singapore, the country's Monetary Authority has created its own crypto custodian framework. But there are still challenges on the horizon, such as the lack of regulatory harmony. "The lack of uniformity in regulatory frameworks across different jurisdictions creates uncertainty, making it challenging for institutional investors to navigate compliance requirements and manage the risks associated with regulatory changes," the report reads while praising Europe's MiCA as an example of regional regulation that works. "Varying approaches across regions can lead to market instability and complicate efforts for institutions to integrate digital assets into their portfolios," the authors continued. The report said the fragmentation of liquidity is another concern for investors, as it can cause market instability and make it difficult for institutions to execute transactions efficiently in the digital asset space. "Liquidity fragmentation across different blockchain networks and digital asset markets can lead to price inefficiencies, posing a significant challenge for institutional investors handling large-scale transactions," the report reads. There are attempts to solve this problem with technology like native token transfers, which are considered to be an evolution in wrapped crypto. Native token transfers, as CoinDesk previously reported, enable seamless cross-chain movement of tokens while maintaining their unique properties and ownership, unlike wrapped assets, which create multiple, non-fungible versions. This report from OKX reached a similar conclusion to a recent Nomura survey, which found that 54% of Japanese institutional investors plan to invest in cryptocurrencies within the next three years, with 25% having a positive view of digital assets and a preferred allocation of 2%-5% of AUM. https://www.coindesk.com/markets/2024/08/28/institutional-investors-continue-to-increase-digital-asset-allocation-economist-report/