2024-08-28 11:00

The main feature of the upgrade is to give Cardano the ability to introduce on-chain governance features. Cardano, launched in 2017 by Ethereum co-founder Charles Hoskinson, is pushing toward its biggest upgrade in two years, with major changes to the structure of its main network, introducing mechanisms to users to participate in on-chain governance. The upgrade, known as the "Chang hard fork," is a major milestone in Cardano’s roadmap, punctuated by the much-awaited addition of smart-contracts functionality in 2021. The Chang hard fork was initially set to go through this week, but Hoskinson announced on Friday that it had been pushed back to Sept. 1 so some exchanges, including Binance, could prepare their systems. "The magic of deadlines is that people who aren't taking upgrades seriously suddenly say damn we got to get moving," Hoskinson wrote on X. Cardano ranks as the 30th biggest blockchain by the website DeFILlama, but the project tends to be closely watched in crypto circles partly because of the colorful personality and outsize popularity of Hoskinson, known for his frequent video and podcast appearances. Hoskinson introduced Ethereum alongside co-founder Vitalik Buterin in 2014 but split from the project soon afterward. A hard fork is a major change to a blockchain that makes the older versions invalid. Sometimes contentious, but often planned and coordinated, hard forks can bring big changes for users and developers including new features or fixes to problems in the chain. The main feature of the latest upgrade is to give Cardano the ability to introduce on-chain governance features. Those that hold ADA, Cardano’s native token, will be able to elect representatives (called Delegate Representatives, or dReps) and vote on improvement proposals as well as future technical changes to the blockchain. “This will mark the first step towards a minimum-viable community-run governance structure outlined in CIP-1694, meaning that the Cardano community will be responsible for maintaining and shaping the blockchain network,” the Cardano Foundation, the main organization supporting the blockchain, wrote in a blog post. CIP-1694 is the Cardano Improvement Proposal at the core of the upgrade, which introduces various governing structures to the Cardano ecosystem including its Constitutional Committee, dReps, and Stake Pool Operators (SPOs.) Once CIP-1694 is implemented, the Cardano blockchain and any changes made to it will be in the hands of these groups. The Chang upgrade is part of the Voltaire Era, the final era on Cardano’s current roadmap. Voltaire is supposed to “provide the final pieces required for the Cardano network to become a self-sustaining system,” the foundation writes. https://www.coindesk.com/tech/2024/08/28/cardano-blockchain-heads-for-chang-hard-fork-biggest-upgrade-in-two-years/

2024-08-28 06:54

Toncoin's TON performed better than the CoinDesk 20 as the protocol announced its blockchain had restarted. TON performed better than most of the market as the protocol restarted its blockchain. Most major tokens were in the red, including AI tokens which had been riding high on anticipation of strong Nvidia earnings. Toncoin (TON) has trimmed some of its losses as the blockchain restarted after a nearly five-hour downtime. Though the downtime was partially blamed on the popularity of the DOGS airdrop, part of the Ton Foundation's way to raise awareness of what it believes is the unjust arrest of Pavel Durov, it wasn't a 'dog day afternoon' for the protocol's native token. TON trimmed some of its losses throughout the east Asia trading day and is now only less than 1% according to CoinDesk Indices data. In comparison, the CoinDesk 20 (CD20), a measure of the largest and most liquid digital assets, is down over 6.5%. The CD20 is down as a bitcoin (BTC)-led market slide caused over $300 million in crypto futures liquidations, the highest since August 5. BTC dropped 6%, with ether (ETH), Solana's SOL, Cardano's ADA and dogecoin (DOGE) falling over 5%. Xrp (XRP) showed relative strength with a 3.4% decline, while Tron's TRX was the best performer among majors with a 2% drop. Ether futures racked up the highest liquidations at $102 million, followed by bitcoin at $96 million and a collection of smaller alternative tokens at $40 million. The sudden liquidations likely contributed to a long squeeze that exacerbated losses. A long squeeze occurs when traders betting on higher prices feel the need to or are forced to sell into a falling market to cut their losses - thereby creating a cycle. As such, CoinGlass data shows open interest on bitcoin futures is down to $31 billion from Monday's $34 billion as the asset's prices dropped - indicating waning sentiment among traders. Open interest refers to the number of unsettled futures and show whether new money is entering or exiting the market. The dump came as U.S.-listed bitcoin exchange-traded funds (ETFs) saw over $127 million in net outflows on Tuesday, breaking an eight-day streak of inflows. Outflows on ether ETFs continued into their ninth-straight day with over $3.45 million leaving the products. "BTC ETFs saw a very large $127 million in outflows as traders appeared to take profit after the Jackson Hole rally, while ETH continued its poor momentum with the 9th consecutive day of outflows as the Ethereum mainnet remains caught in a bit of an identity crisis," Augustine Fan, head of insights, at on-chain financial products provider SOFA said in a Telegram message. "Short-dated volatility was bid, with traders scrambling to buy downside protection (puts), as underlying momentum remains poor from the supply overhang and lack of on-chain catalysts in the near term," she continued. AI tokens are also in the red, even though the prospect of Nvidia producing blockbuster earnings made some investors move into AI tokens. NEAR is down 10%, according to CoinDesk Indices data, while ICP is down 6.5%, FET is down 11.8%, and Bittensor's TAO is in the red 11.3%, while RENDER (RNDR) dropped 9.5%. "Sentiment around AI has definitely shifted, as seen in the performance of AI tokens and NVIDIA. After a pullback and recovery, NVIDIA still holds significant influence, especially with its upcoming earnings report," Fairlead Strategies founder and Managing Partner Katie Stockton said on a recent interview on CoinDesk TV. "This could either push the market higher before a potential September correction or start that correction. We expect NVIDIA and the mega caps to enter a more range-bound environment amid increased volatility, regardless of AI exposure," she continued. Elsewhere, Hong Kong-based custodian Hex Trust announced that it had launched a staking partner program, giving clients further access to staking offerings, signaling continued institutional interest in the asset class. https://www.coindesk.com/markets/2024/08/28/toncoin-trims-losses-beats-bitcoin-and-ether-as-ton-blockchain-comes-back-online/

2024-08-28 02:00

The network has gone to the DOGS as it struggles to catch up with the popularity of a new TON memcoin. The TON blockchain stopped producing blocks in the morning on Wednesday. The network resumed producing blocks in the early afternoon Hong Kong time after a nearly six-hour outage. This downtime might have been a result of a new memecoin called DOGS crashing the network. Toncoin (TON), the native token of the TON blockchain, has resumed producing new blocks after a nearly six-hour outage caused by a surge in network traffic. A blockchain not producing blocks for an extended period of time is concerning because it disrupts network stability, potentially leading to security risks and transaction delays. These crashes are uncommon with blockchains, but do occur during times of high network activity. In an earlier post on X, the official TON blockchain account had written that the "issue is occurring due to the abnormal load currently on TON." "Several validators are unable to clean the database of old transactions, which has led to losing the consensus," the team explained. For TON, a recent airdrop of the DOGS memecoin might have been the culprit as the popularity of the token caused a surge in transactions, and some observers pointed out that the network struggled to catch up to meet demand with its transactions per seconds (TPS) coming well under what was expected. Solana experienced something similar in February when the chain failed to produce new blocks for over 5 hours, leading to significant sell pressure on its native token (SOL). Bybit announced that as a result of TON's network halting block production it was temporarily suspending withdrawals and deposits citing network instability, according to a post by Wu Blockchain. Recently the CEO of Telegram, Pavel Durov, was arrested in France which caused the price of TON to plunge. Telegram and TON are separate entities even though one is often used with the other. Before the blockchain froze, TON's price had bucked a broader market trend, trading up over the past 24 hours while other major cryptocurrencies fell 4% or more. https://www.coindesk.com/markets/2024/08/28/ton-blockchain-grinds-to-a-standstill-with-no-blocks-produced-for-over-3-hours/

2024-08-27 22:56

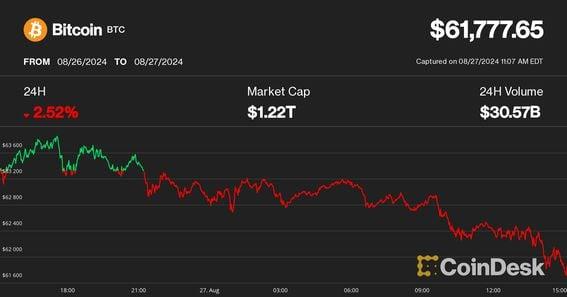

Bitcoin hit the lowest price since Aug. 19. It was not immediately clear what sparked the sell-off. Cryptocurrencies suffered substantial losses as the U.S. business day came to a close, with bitcoin (BTC) tumbling below $59,000 and Ethereum's ether (ETH) losing almost 10%. Bitcoin had topped $62,700 earlier in the day, but recently was down 6.5% from 24 hours earlier. Amid the rout, it got as low as $58,240, the lowest price since Aug. 19. Ether traded as high as $2,700 earlier Wednesday, but recently fetched less than $2,500. It was not immediately clear what sparked the sell-off. The sudden downturn triggered $313 million in liquidations of leveraged crypto derivatives positions over the past 24 hours, the biggest washout since Aug. 5 crash, CoinGlass data shows. ETH traders suffered over $100 million in liquidations, while BTC traders endured $95 million. Other top-10 cryptocurrencies by market capitalization have seen similar declines, with BNB (BNB) falling nearly 4% to $528, Solana's (SOL) dropping 7% to $146 and (XRP) trading down 4% to $0.56. Dogecoin (DOGE) and Tron (TRX) were also down 6.5% and 2.25% respectively, trading at $0.098 and $0.158. The Telegram-associated (TON) token was actually up nearly 5% over the past 24 hours, after falling precipitously on the news that Telegram founder Pavel Durov had been arrested in France on various charges. https://www.coindesk.com/markets/2024/08/27/bitcoin-price-falls-below-59k-amid-broad-market-rout-ether-slumps-almost-10/

2024-08-27 20:42

The company earlier this year listed its iShares Bitcoin Trust ETF in the South American country. The ether ETF will trade under the ticker code ETHA39 as a Brazilian depositary receipt, a certificate that represents shares of foreign companies. In March, BlackRock’s iShares Bitcoin Trust ETF (IBIT) started trading on the Brazilian stock exchange. BlackRock will list its iShares Ethereum Trust (ETHA), on Brazil’s B3 exchange on Wednesday, according to local media outlet Portal do Bitcoin. The ETF will trade under the ticker code ETHA39 as a Brazilian depositary receipt (BDR), a certificate that represents shares of foreign companies traded in the South American country. “The launch of ETHA39 now allows investors to have access to the two largest cryptocurrencies by market capitalization,” said Nicolas Gomez, BlackRock's head of ETFs, index investments, and products for Latin America. In March, BlackRock's iShares Bitcoin Trust ETF (IBIT) also started trading on the Brazilian stock exchange, which has become a solid market for institutional products. Beyond Bitcoin and Ethereum, the Brazilian Securities and Exchange Commission (CVM) also recently approved two Solana-based ETFs to be listed on B3. In August, BlackRock's ETHA surpassed $1 billion in cumulative net inflows in the United States, becoming the first of 11 issuers to cross that mark in net inflows. https://www.coindesk.com/business/2024/08/27/blackrock-lists-ethereum-etf-on-the-brazilian-stock-exchange/

2024-08-27 17:49

More than five months of sideways price action is testing investors' patience, but similar low-volatility episodes led to break-outs to new record prices, one observer noted. BTC is down 3% in the past 24 hours, with ETH, AVAX, LINK and UNI leading altcoin losses. Bitcoin's weekly Bollinger Bands compressed to similar levels seen not just last October, but in other episodes prior to big rallies, crypto trader CryptoCon noted. Altcoin investors face more pain ahead, but Q4 and next year might promise more upside. Bitcoin (BTC) tumbled below $62,000 during U.S. morning trading Tuesday as the crypto market halted its bounce from early August lows. The largest crypto fell to as low as $61,500, now down more than 5% since its swift rally to $65,000 following Federal Reserve Chair Jerome Powell's dovish speech at Jackson Hole on Friday. It's down 3% through the past 24 hours. The weak action spread to the wider market, with the broad-based CoinDesk 20 Index down 2.8% during the same period. Ethereum's ether (ETH) continued its losing streak against BTC, falling more than 5% below $2,600 and dragging the ETH/BTC ratio to its lowest level in more than three years. Altcoin majors also suffered losses, with the native cryptocurrencies of Avalanche (AVAX), Chainlink (LINK) and Uniswap (UNI) leading with 4%-7% declines. Volatility ahead Bitcoin's sideways actions since its March all-time highs is testing investor patience, but similar multi-month consolidation phases happened every previous bull cycle, including last year's action between March and October. Well-followed crypto trader CryptoCon noted that the current low-volatility phase for BTC is likely the precursor of a break-out to the upside to new all-time highs, based on an analysis of the Bollinger Band Width on the weekly timeframe. Bollinger Bands, named after well-known traditional market technical analyst John Bollinger, represent the volatility of an asset and are placed two standard deviations above and below the 20-week simple moving average of the price. "This is the 3rd and final low volatility phase that comes mid-cycle, every cycle on Weekly Bollinger Band Width," CryptoCon said in an X post. "5 months of sideways price action is not new…," he added. "Missing out on 2025 is missing out on 2021, 2017 and 2013." Notably, a similar compression of the Bollinger Band Width happened last October, just ahead of bitcoin breaking out of a long consolidation and eventually surging nearly 200% to $73,000 by March. Altcoin pain Altcoin holders might face some more pain before lower-cap cryptocurrencies would break out higher and outperform bitcoin, market research firm ByteTree pointed out in a Tuesday report. "Altcoin investors need to keep the faith. It’s tough out there, but the underperformance of alts vs. bitcoin has been difficult," Charlie Morris, founder of ByteTree, wrote in the report. "The good news is that positioning is light, and so when the good times return, there is the potential for yet another strong altcoin rally." During past market cycles, altcoins followed bitcoin's rally six months after Bitcoin's quadrennial halving, Morris noted. The last halving took place on April 19, 2024, which would point to a potential rally later this year around October. "In each case, alts got a little worse before they got better," Morris added. "If history repeats itself, alts should kick off in the new year, but only once Bitcoin has surged. The good news is that we are on track for a run in Q4." https://www.coindesk.com/markets/2024/08/27/bitcoin-slides-below-62k-as-consolidation-drags-on-but-traders-eye-possible-parabolic-rally/