2024-08-27 16:58

The funding round, which brings Space and Time's total backing to $50 million, was led by Framework Ventures, Lightspeed Faction, Arrington Capital and Hivemind Capital Space and Time (SxT), a blockchain-native data warehouse that incorporates artificial intelligence (AI) tools to build applications using its data, has raised $20 million in Series A funding. The funding round, which takes SxT's total backing to $50 million, was led by Framework Ventures, Lightspeed Faction, Arrington Capital and Hivemind Capital, according to an emailed announcement on Tuesday. The company's aim is to decentralized ownership of the data which powers AI-based applications, thus preventing a few powerful entities from dominating the sector. SxT's network comprises data collected from the major blockchains such as Bitcoin and Ethereum, off-chain datasets with a zero-knowledge coprocressor which processes the data at scale. Read More: AI-Related Coins Slide as Google Search Shows Peak Retail Investor Interest https://www.coindesk.com/business/2024/08/27/blockchain-data-warehouse-space-and-time-raises-20m-series-a-to-accelerate-development-of-ai-tools/

2024-08-27 16:20

The mics probably won't be muted, traders on the crypto-based prediction market platform are signaling. Donald Trump has made noises about pulling out of a Sept. 10 debate with opponent Kamala Harris, but traders on Polymarket apparently reckon it's just that – noise. "Yes" shares for "Will Trump debate Kamala on Sept. 10?" were trading at 84 cents midday Tuesday in New York, indicating the market sees an 84% chance he will go through with it. The bets are written into a smart contract on the Polygon blockchain: Each share pays out $1 (in USDC, a stablecoin, or cryptocurrency that usually trades 1:1 for dollars) if the prediction comes true, and zilch if not. The contract was published Monday and the odds briefly dipped to as low as 72%, but have mostly traded in the 80s. To be sure, the amount staked on the question is small – $22,000 – paling in comparison with Polymarket's contract on who will win the election, which has amassed hundreds of millions in bets. The odds there gave Trump a slight lead at the time of writing. On Sunday, Trump indicated he was wavering on whether to participate in the debate because he believed ABC News, the host, is biased against him. "Why would I do the Debate against Kamala Harris on that network?" he wrote. Polymarket bettors mostly doubt the candidates' microphones will be muted during the debate, with a 40% probability. According to The Wall Street Journal, the question of whether to mute mics has been a sticking point in negotiations. "The Harris campaign has said both microphones should be live, while the Trump campaign has pushed to keep the microphones muted like they were during a June debate on CNN between Trump and President Biden," the newspaper reported. Again, at less than $7,000, there is relatively little money riding on the microphone bet on a platform that saw a record $414 million in volume last month, according to Dune Analytics data. Another important caveat is that under a settlement with the U.S. Commodity Futures Trading Commission, Polymarket is required to block U.S. users, so those making forecasts on the platform are presumably analyzing data from afar. On the other hand, the fact that these punters are putting up any money at all carries some weight. They have an incentive to do thorough research or risk taking a financial hit. On Kalshi, a regulated U.S. platform where trades are settled in dollars, bettors are giving 47% odds that there will be three presidential debates before election day, 42% for two, 11% for one, and a 2% probability of none. https://www.coindesk.com/markets/2024/08/27/trump-unlikely-to-drop-out-of-abc-debate-with-harris-despite-threats-polymarket-traders/

2024-08-27 16:10

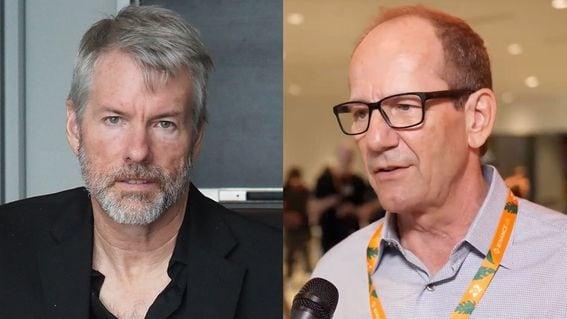

Marathon Digital sold bonds to fund bitcoin purchases, following the route Saylor's MicroStrategy has taken to big stock market gains, as mining profits dwindle. Marathon Digital sold debt to buy bitcoin, after BTC mining profits deteriorated this year. The miner is following Michael Saylor's footsteps in using borrowed money to add BTC to its balance sheet. Billionaire Michael Saylor famously pioneered large-scale corporate purchases of bitcoin (BTC), using borrowed money to turn his publicly traded software developer MicroStrategy (MSTR) into one of the world's largest holders of the cryptocurrency. Now, another company – a surprising one – is following a similar strategy. It's a bitcoin miner, a company that can theoretically snag discounted BTC through mining. The fact that it's following Saylor's playbook, selling debt to fund bitcoin purchases, not using that borrowed money to buy equipment to mine more coins, puts a spotlight on how tough the mining sector has gotten this year. The miner is Marathon Digital (MARA), which this month sold $300 million of convertible notes, or bonds that can be turned into stock, and purchased 4,144 bitcoin with most of the proceeds. Rather than purchase more mining rigs, "given the current mining hash price, the internal rate of return (IRR) indicates that purchasing bitcoin using funds from debt or equity issuances is more beneficial to shareholders until conditions improve," the largest publicly traded miner posted recently on X. "Hash price" is a measure of mining profitability. MicroStrategy's bitcoin accumulation strategy was widely criticized when prices crashed in 2022, putting the company's stake underwater. No one is laughing now, given MicroStrategy's bitcoin hoard is worth billions more than the company paid. MicroStrategy and Marathon's paths in the stock market were largely similar after Saylor began buying bitcoin in 2020. Both were essentially a proxy for bitcoin's price – an attractive quality in the era before bitcoin ETFs were approved early this year. But this year, there's been a massive divergence. MicroStrategy's stock has soared 90% as it continued to track bitcoin's price. Marathon has plummeted about 40% as the mining business got much harder. The Bitcoin halving in April slashed the reward for mining bitcoin in half, substantially reducing miners' primary source of income. Amid that plunge, Marathon adopted a "full HODL" strategy of keeping all the bitcoin it mines – and raising money to buy more. "Adopting a full HODL strategy reflects our confidence in the long-term value of bitcoin," Fred Thiel, Marathon's chairman and CEO, said in a statement last month. "We believe bitcoin is the world's best treasury reserve asset and support the idea of sovereign wealth funds holding it. We encourage governments and corporations to all hold bitcoin as a reserve asset." Not long after debuting that HODL strategy, it announced the $300 million debt offering. Marathon now owns more than 25,000 bitcoin, second only to MicroStrategy among publicly traded companies. Profit squeeze The share price divergence between MicroStrategy and Marathon isn't a surprise, given the woes in mining. The industry is overcrowded, more competitive and facing increased costs. To make matters worse, the Bitcoin network's hashrate and difficulty – two measures of how hard it is to create new bitcoin – are getting higher. JPMorgan recently said that mining profitability fell to all-time lows as the network hashrate rose in the first two weeks of August, while hashprice (the average reward miners get per unit of computing power they direct toward mining) is still around 30% lower than the levels seen in December 2022 and about 40% below pre-halving levels. Miners are now so stressed that they've been forced to pivot from purely being miners – once a highly profitable strategy – to diversifying into other ventures such as artificial intelligence just to survive. Swan Bitcoin, a miner, even just canceled its initial public offering and shut down some of its mining business due to a lack of revenue in the near term. "At current hashprice levels, a meaningful proportion of the network is still profitable, but only marginally," Galaxy Research said in a note on July 31. "Some miners on the fence may continue to operate because they can generate positive gross profits. However, when factoring in operating expenses and additional cash costs, many miners find themselves unprofitable and slowly running out of cash," the report added. Moreover, the January launch of bitcoin exchange-traded funds in the U.S. gave institutional investors that don't want to buy cryptocurrencies, yet still want crypto investment exposure, a more direct route than buying stock in bitcoin miners. After the rollout of ETFs, short selling the miners and going long on ETFs became a prevalent trading strategy among institutional investors, essentially capping the share price appreciation of the miners. To stay competitive and to survive the squeeze, miners have few choices besides diversifying. Even if a miner with a strong balance sheet like Marathon wants to stay a pure-play mining company, it needs to either invest more capital into an already capital-intensive business or buy competitors. Both options take time and come with significant risk. In light of that, it's not hard to see why Marathon took a page out of MicroStrategy's successful playbook and bought bitcoin in the open market. "During periods of significant price appreciation, we may focus solely on mining. However, with bitcoin trending sideways and costs increasing, which has been the case recently, we expect to opportunistically 'buy the dips,'" Marathon said. Nishant Sharma, founder of BlocksBridge Consulting, a research and communications firm dedicated to the mining industry, agrees with Marathon's BTC accumulation strategy. "With bitcoin mining hashprice at record lows, companies must either diversify into non-crypto revenue streams like [artificial intelligence or high-performance computing] or double down on bitcoin to capture investor excitement around an anticipated crypto bull market, similar to MicroStrategy’s approach," he said. "For MARA, the largest bitcoin producer, it makes sense to choose the latter: HODLing bitcoins mined at lower costs than the market rate and raising debt to buy more, increasing its BTC stockpile." Return of debt financing? Marathon's bitcoin buying isn't new. The miner bought $150 million worth of bitcoin in 2021. What's new is Marathon used convertible senior notes, a type of debt that can be converted into the company's shares, to raise money to buy more BTC – similar to MicroStrategy's strategy. According to Bernstein, Saylor's company has raised $4 billion to date to buy bitcoin, which helped the company benefit from potential bitcoin upside while having a lower risk of being forced to sell the digital assets on its balance sheet – a strategy that seems to have resonated well with institutional investors. Additionally, convertible debt tends to cost companies relatively little and avoids immediately diluting the equity stakes of shareholders like a stock offering would. "With bitcoin prices at an inflection point and anticipated market tailwinds, we see this as an opportune moment to increase our holdings, employing convertible senior notes as a lower-cost capital source that is not immediately dilutive," said Marathon. The miner offered its notes at a 2.125% interest rate, cheaper than current 10-year U.S. Treasury rate of 3.84% and comparable to MicroStrategy's latest raise at 2.25%. The miner was able to offer such a low rate and still attract investors because investors get the steady income from the debts and retain the option to convert the notes into equity, tapping into potential upside of the stock. "The advantage of convertible notes over traditional debt financing is that $MARA will be able to acquire a much lower interest rate than they otherwise would due to the fact that the notes may be converted into equity," Blockware Intelligence said in a report. Being able to raise debt at a cheap interest rate also helps Marathon shore up its war chest for potential acquisitions. "The bitcoin mining industry is in the early phases of consolidation, and the natural acquirers are the companies with large balance sheets," said Ethan Vera, chief operating officer or Luxor Tech. "Adding a Bitcoin balance sheet position allows companies to raise capital with a clear use of funds, while preparing their balance sheet for potential M&A." In fact, such debt financing could make a comeback for the entire mining industry, after disappearing from the market during the crypto winter as many miners defaulted on their poorly structured loans. "Previously, debt financing options available to miners were primarily structured around collateralizing ASICs," said Galaxy, adding that lack of liquidity on those loans after the 2022 price collapse hurt the entire sector. Other miners tapping into debt markets recently also include Core Scientific (CORZ) and CleanSpark (CLSK). "We believe the industry is in a much better position now to take on some debt and not rely solely on equity issuance for growth," Galaxy said. https://www.coindesk.com/business/2024/08/27/bitcoin-mining-is-so-rough-a-miner-adopted-michael-saylors-successful-btc-strategy/

2024-08-27 15:31

The new collection will offer buyers a piece of the candidate’s suit from his debate with President Joe Biden. Former President Donald Trump is out with another collection of digital trading card non-fungible tokens (NFTs), which were once a lucrative business line for the Republican nominee. This time around, Trump’s fourth collection will offer high-rollers a piece of the candidate’s suit from his debate with President Joe Biden, according to a post on social media platform Truth Social. People who spend $24,750 on the cards will also get access to Trump sneakers, Trump cocktails and dinner at Trump National Golf Club in Jupiter, Florida, with Trump. It was at a May gala, celebrating collectors of the third NFT set, that Trump pushed crypto into the political spotlight with the declaration that he would be the industry’s champion in the White House — and that the Democrats its ruin. Trump continued to build his crypto-politics persona with a speech at the Bitcoin conference in Nashville and pro-Bitcoin language on the Republican Party platform. The industry’s biggest players have rewarded his turnabout (he had previously lambasted Bitcoin as a scam) with mountains of campaign cash. But the money raised by Trump’s NFT collection is separate from his political war chest and goes to his personal coffers. In his most recent financial disclosures, Trump revealed that his NFT businesses had netted him well over a million dollars in crypto. https://www.coindesk.com/business/2024/08/27/trump-releases-fourth-drop-of-his-nft-trading-cards/

2024-08-27 15:11

The proposed Nasdaq Bitcoin Index Options would track the CME CF Bitcoin Real-Time Index. Nasdaq is seeking approval to launch and trade bitcoin options. This follows an announcement by the New York Stock Exchange earlier this year that is was also looking to list bitcoin index options. Neither have yet received the green light from regulators. Nasdaq is seeking approval from regulators to allow the launch and trading of options tied to the price of bitcoin (BTC), the exchange said Tuesday. The proposed Nasdaq Bitcoin Index Options (XBTX) is in partnership with index provider CF Benchmarks and would track the CME CF Bitcoin Real-Time Index operated on the Chicago Mercantile Exchange exchange. This will help investors hedge investments in the asset class, the Nasdaq (NDAQ) said. “This collaboration further combines the innovative crypto landscape with the resiliency and reliability of traditional securities markets and would mark a significant milestone for expanding the maturation of the digital assets market,” said Greg Ferrari, Vice President and Head of Exchange Business Management at Nasdaq. Options are an important vehicle for investors looking to manage risk as they give the buyer the right to buy or sell an asset at a set price and on an agreed date. The move follows an earlier announcement by the New York Stock Exchange this year that it was planning to list bitcoin index options. It is still awaiting approval by the Securities and Exchange Commission, however. https://www.coindesk.com/markets/2024/08/27/nasdaq-looks-to-offer-bitcoin-options-following-rival-nyses-plans/

2024-08-27 12:27

Five of the six new billionaires became so through bitcoin investments. 88,000 new crypto millionaires have been created during the market rise this year. Six new crypto billionaires were also created, five of which held bitcoin. Singapore continues to be the "premier crypto hub." The recent cryptocurrency bull market has created more than 88,000 new crypto millionaires and six crypto billionaires in 2024, according to a report by New World Wealth and Henley & Partners. Globally there are now 172,000 people that hold over $1 million worth of cryptocurrency, a 95% increase from last year. This comes after a market surge that saw bitcoin (BTC) reach record high of $73,800 in March. Buoyed by bullish sentiment and the release of several U.S. spot exchange-traded funds (ETFs), bitcoin has experienced its strongest period of growth since 2020, when. it was trading at $42,500. The report adds that the amount of centi-millionaires, individuals with assets of over $100 million, has increased 79% to 325. Bitcoin was the largest contributor to the rise in billionaires, with five of the six billionaires becoming so through bitcoin investment. Crypto-wealthy investors have also demonstrated a trend of securing residency in crypto and tax-friendly jurisdictions. Singapore remains the the "premier cryptocurrency hub" due to excelling in regulatory framework and infrastructure development, whilst the UAE ranks third with its significant tax advantages. “The crypto millionaires of 2024 are not content with digital riches alone; they seek the freedom of global mobility to match their borderless assets," said Dominic Volek, group head of private clients at Henley & Partners. https://www.coindesk.com/business/2024/08/27/the-crypto-bull-market-has-created-88k-new-millionaires-in-2024-henley-global/