2024-08-20 10:30

The bank will start with tokenization and plans to offer digital asset custody once the U.S. regulatory environment improves. Due to U.S. regulatory hurdles, State Street will initially focus on tokenization rather than crypto custody, with the first tokenization client to be named soon after going live. State Street has been “very vocal” about the need to change the SEC's SAB 121, which could force banks seeking to hold crypto to maintain an onerous amount of capital to compensate for the risk. State Street, the global custody bank with $44.3 trillion in assets under its watch, chose cryptocurrency custody and tokenization specialist Taurus to provide digital assets services in anticipation of a more congenial regulatory climate in the U.S. The bank's initial focus is to go live with tokenized versions of traditional assets, with the first client named shortly afterward, State Street said. A natural role for a custody specialist like State Street would be to look after digital assets, but banks in the U.S. have been faced with a major hurdle in the form of the Securities and Exchange Commission’s (SEC) proposed Staff Accounting Bulletin 121 (SAB 121), which imposes restrictions on companies that want to hold their customer's crypto assets. State Street has been “very vocal” about the need to change SAB 121, which could force banks seeking to hold crypto to maintain an onerous amount of capital to compensate for the risk, said Donna Milrod, State Street’s chief product officer and head of Digital Asset Solutions. “While we're starting with tokenization, that's not where we're ending,” Milrod said in an interview. “As soon as the U.S. regulations help us out, we will be providing digital custody services as well. We know how to be a custodian. We don't do that on our balance sheet. We do that off-balance sheet. They're not our assets.” Lamine Brahimi, co-founder and managing partner of Switzerland-based Taurus, pointed to the benefits of tokenization, such as 24/7 trading and the ability to optimize collateral management, while echoing the need for a better regulatory climate in the U.S. “I'm quite sure this partnership with State Street will be a positive signal for the U.S. financial markets in general, which, because of SAB 121, have been lagging those in Europe,” Brahimi said in an interview. State Street has a long history in blockchain technology and digital assets, most recently working with crypto custody firm Copper before the startup pivoted away from custody to focus on its ClearLoop settlement system. https://www.coindesk.com/business/2024/08/20/state-street-selects-taurus-for-crypto-custody-tokenization/

2024-08-20 10:19

The ability to raise debt or equity in the world's deepest capital markets is a large advantage, the report said. Miners listed in the U.S. have an advantage over private peers as they can raise capital easily, the broker said. Bernstein said it sees the large publicly traded U.S. bitcoin miners as consolidators in the sector. Leading miners should focus on growing market share and increasing their hashrates, the report said. Bitcoin (BTC) miners listed in the U.S. have a large advantage over their unlisted peers because their easier access to funding offers them more financial options than privately held firms or those that trade elsewhere, broker Bernstein said in a research report on Monday. "Being able to raise debt/equity in the world's deepest capital markets, presents a natural advantage versus non-U.S. miners, particularly in a capital intensive industry, poised for market consolidation," analysts led by Gautam Chhugani wrote. Last week's fundraising showcases the argument. Marathon Digital (MARA) said it planned a private placement of convertibles to buy bitcoin as a treasury asset. Riot Platforms (RIOT) announced a $750 million equity offering. Core Scientific (CORZ) and Bitdeer (BTDR) also announced that they planned to issue convertible debt. Bernstein said this supports its long bias towards publicly listed U.S. bitcoin miners being consolidators in the sector. The broker noted that the mining industry is split between companies focused on bitcoin mining and those pivoting to artificial intelligence (AI) data centers. Both are viable opportunities, the report said, and the common theme is consolidation because scale matters. Still, "bitcoin mining and AI data centers, while adjacent due to power capacity and high density power specs, are completely different businesses," the report noted. The leading miners should remain focused on bitcoin mining market share and growing their hashrates, Bernstein said, and not selling the crypto they have mined at a loss. Bernstein reiterated its view that BTC will hit new highs of around $200,000 in 2025 on the back of increased institutional adoption and the uptake of exchange-traded funds (ETFs), the report added. https://www.coindesk.com/markets/2024/08/20/us-listed-bitcoin-miners-have-the-upper-hand-over-unlisted-peers-bernstein/

2024-08-20 08:48

Ecosystem tokens and its flagship Valhalla game will be widely featured on stadium screens and as uniform sponsors, boosting the project's visibility as part of an initial one-year contract. Floki has signed deals with various English Premier League teams to feature its FLOKI token and upcoming game, Valhalla. FLOKI will be the cryptocurrency partner for Nottingham Forest, Valhalla will appear on Sunderland AFC jerseys and on-screen ads during all league games. Floki's approach to sponsorships bypasses traditional bidding processes through direct contacts, aiming to increase brand visibility and community engagement at a lower cost compared to other major crypto projects. Meme coin Floki's FLOKI token and Valhalla game will feature on various English Premier League (EPL) properties as part of an initial one-year contract to help boost visibility for the $1.2 billion capitalization token. The English Premier League sit on the top tier of England's football pyramid, and features twenty local teams. It is the most-valued football league as per sports data site Transfermarkt. Floki has been steadily trying to move away from its meme status, building the metaverse game Valhalla, real-world asset tokenization platform TokenFi, and introducing staking and banking features to boost appeal for the FLOKI token. FLOKI tokens will be the cryptocurrency partner for Nottingham Forest. Their upcoming game Valhalla will feature on the back of the Sunderland AFC jersey, and will additionally be displayed as on-screen ads throughout all league games. FLOKI jumped as much as 10% after CoinDesk's report on the EPL deals. At the time of writing, the token was up 7% at $0.0001264. “It is a potential multi-year agreement and a minimum one-year/season deal,” a Floki team member told CoinDesk in an interview. “Regarding the benefits to Floki holders, there are many such as increased brand awareness & recognition as well as the exposure to our ecosystem and community.” The team did not reveal specific costs for the various sponsorships, citing deal confidentiality. However, head of marketing Sabre told CoinDesk that there was no bidding process as the team had “direct contacts” – circumventing a key step in such deals. Crypto teams often sponsor sporting events and notable stadiums to boost the visibility of their projects. In 2021, exchange Crypto.com paid $700 million to gain naming rights for the Staples Centre in Los Angeles. Defunct exchange FTX signed multiple hundred million deals to place its brand on sports centers and avenues worldwide, and crypto project Terra signed a five-year contract worth $40 million, with the Washington Nationals in 2022. It is unclear, however, how much these partnerships eventually help the brands and influence token prices. But Floki's Sabre remains upbeat on the prospects. “Unlike many exchanges and large projects that invest heavily in securing partnerships, we achieve exceptional value by spending a fraction of the cost. Our direct relationships with well-established and highly respected organizations enable us to maximize our impact in the blockchain space.” “As we've seen with similar timing and partnerships from top exchanges, we expect this exposure to capture retail interest as we approach and enter 2025,” they added. https://www.coindesk.com/markets/2024/08/20/floki-scores-major-deals-with-english-premier-league-teams/

2024-08-20 07:09

Some traders expect market movements nearer to Friday when Federal Reserve chair Jerome Powell is scheduled to speak at the Jackson Hole symposium. Bitcoin was trading above $61K during the Asian trading day, and Polymarket bettors are forecasting some price stability for the rest of the week. Traders are looking to Jerome Powell's remarks at the end of the week for indications of where prices may go. Bitcoin (BTC) moved past $61,000 early Tuesday as U.S.-spot exchange-traded funds (ETFs) holding the asset recorded their second-highest inflow activity this month. Bitcoin ETFs recorded over $61 million in net inflows, the highest since $192 million on August 8, data from SoSoValue shows. BlackRock’s IBIT led inflows at $92 million, while Bitwise’s BITB recorded outflows at $25 million. Japan’s Metaplanet also announced that it had completed another BTC purchase worth $3.4 million (500 million Japanese yen), bringing its total holdings of bitcoin to 360.368 BTC. Major tokens followed suite, with XRP and BNB Chain’s BNB jumping over 7%, and Solana’s SOL and Cardano’s ADA gaining 4%. Toncoin (TON) declined 0.8% in the past 24 hours. The CoinDesk 20 (CD20), a measure of the performance of the largest and most liquid digital assets, is up 4.25%. Polymarket bettors are predicting some price stability, with the market giving a 66% chance that BTC will remain above $60K by the end of the week. Dogecoin (DOGE) jumped 5% amid technology entrepreneur Elon Musk posting an AI-generated image referring to the token on X. DOGE historically tends to move when Musk posts about the token. However, any price spikes are usually short lived. PoliFi tokens were also flat, as traders seemed to have lost interest in them. The Trump-themed MAGA token is down 0.3%, according to CoinGecko data, with trading value of $2.5 million. Meanwhile, on Polymarket, Kamala Harris leads Donald Trump 50%-49% as the Presidential election betting contract nears $650 million. While market catalysts remain far and few as of Tuesday, some traders are expecting market movements nearer to Friday when Federal Reserve chair Jerome Powell is scheduled to speak at the Jackson Hole symposium. “This week’s market expectations are built around the Jackson Hole symposium where Monetary Policy is to be discussed,” Abra Prime said in a market note via email. “The narrative focuses on BTC ETFs and their correlation with the stock market. “We can expect horizontal price action this week before Jackson Hole, with BTC ranging between $56K - $62K with most volume around $58K - $60K,” Abra said. Powell is expected to confirm a pivot to lower borrowing costs next month, per Bloomberg, a step that has historically buoyed bullish sentiment among traders as cheap access to money spurts growth in riskier sectors. Short-term bearish sentiment remains among some, however, on the decision to pull back on proposed options for BTC ETFs. “We have seen both NYSE and NASDAQ withdraw their applications to list BTC ETF options over the past 72 hours, adding more headwinds to wider mainstream adoption at least in the short term,” Augustine Fan, head of insights at SOFA.org, said in a Telegram message. “TradFi continues to be cautious with ETF ETH buying on the lack of clarity over staking legalities,” Fan added, referring to ether’s (ETH) underperformance compared to bitcoin in the past week. https://www.coindesk.com/markets/2024/08/20/bitcoin-pops-over-61k-xrp-leads-gains-among-majors/

2024-08-20 06:26

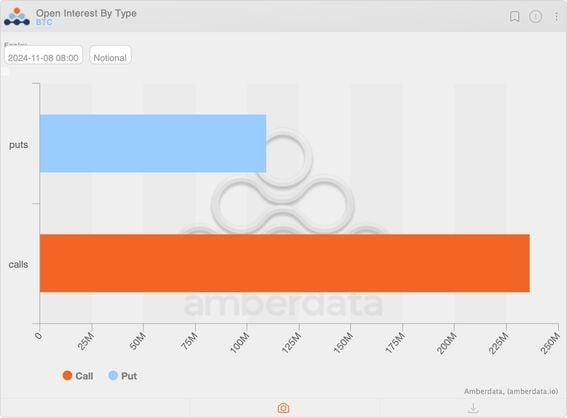

Distribution of open interest shows bullish sentiment, according to Wintermute. Traders have locked in $345 million in bitcoin options expiring four days after the Nov. 4 elections. Distribution of open interest shows bullish sentiment, according to Wintermute. Crypto traders speculating on how the impending U.S. elections might affect the digital assets industry have locked millions in bitcoin (BTC) options tied to the event. The so-called election expiry options, due for settlement four days after the Nov. 4 elections, began trading on Deribit a month ago. As of writing, the notional open interest or the dollar value of the number of active options contracts was $345.83 million, according to data source Amberdata. Call options, which offer an unlimited upside payoff potential at the expense of limited loss, accounted for 67% of the total open interest. The rest came from put options, which offer protection against price drops, amounting to a put-call ratio of less than 0.50. In other words, twice as many calls were open as puts, reflecting bullish expectations from the outcome of the elections. "These election-dedicated contracts allow investors to capitalize on the increased interest by speculating on how the election might affect the crypto markets in a targeted way. The current put-call ratio of 0.50 indicates a bullish sentiment, with twice as many calls traded as puts," algorithmic trading firm Wintermute said in a note shared with CoinDesk. The call option at the strike price of $80,000 is the most popular, boasting an open interest of over $39 million. Broadly speaking, open interest is mainly concentrated in higher strike calls, starting from $70,000 to $140,000. That's a sign of traders positioning for new record highs around the election time. Meanwhile, $39 million is locked in the $45,000 put option. "The concentration of call options' open interest at strikes around $80K and $100K suggests that market participants are positioning for potential upside in bitcoin, while the presence of puts at lower strike price of $45,000 indicates some level of hedging or downside protection," Wintermute noted. https://www.coindesk.com/markets/2024/08/20/us-elections-linked-bitcoin-options-draw-nearly-350m-in-open-interest/

2024-08-19 16:00

Plus, bettors see RFK Jr. dropping out by November without a Trump endorsement, and China's 'bitcoin ban' is more complicated than what Justin Sun thinks. This week in prediction markets: Trump-Harris makes for a volatile market RFK is seen dropping out by November, but probably won't endorse Trump China's "bitcoin ban" is more complicated than Justin Sun thinks Bettors trade volatile election markets This past weekend was an active one for Polymarket traders betting on the 2024 U.S. presidential election. They pushed down shares representing Kamala Harris' chances of winning the election by nearly 8 percentage points, leading to a brief tie between herself and Donald Trump, before she regained a 4-point lead (as of Monday morning U.S. time). One theory on Trump's buoyancy despite polls shifting toward Harris is some traders are sticking with outdated assumptions from when President Joe Biden was still the expected Democratic nominee instead of Harris. On a recent episode of the political betting podcast Star Spangled Gamblers, one of the guests, a political gambler known as Gaeten Dugas, argued that the market wasn't correctly pricing in Trump's chances after Biden quit and needed to adjust. "A Trump win was pretty well priced in with Biden being the candidate," he said. "Once I had convinced myself it was going to be [candidate] Kamala, then I thought that I was basically buying the no's at the highest price that they would be for Trump." It's important to note that Polymarket, which officially bans U.S. residents from using the platform, began the election with a significant premium for Trump, and it's tempting to dismiss its accuracy because of the embargo on Americans – the actual voters – as market participants. Another prediction market, PredictIt, which has U.S. regulators' blessing to operate, currently gives Harris a more significant edge against Trump. And, to be sure, prediction markets aren't perfect. PredictIt gave Hillary Clinton an 82% chance of beating Trump (she didn't) in 2016 – in line with New York Times models – and priced in only a 16% chance that Brexit would happen (it did) as polls closed in the U.K. For now, Harris seems to have the lead in the race. RealClearPolling gives her a 1.4-percentage-point lead over Trump, while Nate Silver's Silver Bulletin model gives Harris a 2.5-percentage-point advantage. Whether that means PredictIt or Polymarket are more fairly priced is an open question. With the Democratic National Convention taking place this week in Chicago – the event where Harris will officially become the party's candidate – this could be a busy week for punters on prediction markets. And with leverage also coming soon to these markets, even more volatility may loom. Prediction markets show end to RFK Jr.'s campaign Robert F. Kennedy Jr.'s presidential campaign has struggled to regain its momentum after getting close to 12% in the polls in February, with numbers now languishing around 8% to 9%. Prediction market bettors are more sour on RFK Jr. than pollsters: one Polymarket contract that asks bettors to predict his share of the popular vote is giving a 50% chance that he takes less than 1% of the overall vote, and only a 7% chance that he'll be able to match what the polls currently give him. Bettors are also putting their money on him dropping out before November, with a 56% chance of that happening. Conservative commentator and former Fox News host Bill O'Reilly put it frankly on a recent show, calling the RFK Jr. campaign "done". “I told you from the very beginning that this was going nowhere,” O’Reilly recently said on his No Spin News podcast. “I told you, this was never going to work.” This drop-out will likely not mean an endorsement of Donald Trump, despite a friendly call (which was later leaked by Kennedy's camp) in July after the assassination attempt on Trump. Recently, reports emerged that Kennedy attempted to meet with Kamala Harris to discuss a potential role in her administration, but he later stated he has "no plans to endorse" her and intends, he says, to "defeat" her instead. Bettors are putting the chances of a Trump endorsement at 35%, which shows a fair amount of doubt that relations between the two candidates will improve. China's relationship with bitcoin is complicated Tron's Justin Sun recently posted on X: "China unbans crypto. What's the best meme for this?" which, in turn, fueled headlines like "Justin Sun’s Cryptic Post Sparks Crypto Community Speculation of China Lifting Bitcoin Ban" and "Justin Sun Sparks Rumours of China Lifting its Ban on Crypto." Bettors on Polymarket are writing the prospect off almost entirely, giving it a 10% chance of happening before the end of the year. The question of whether bitcoin is banned in China is a complicated one, and there's no absolute answer. As CoinDesk reported earlier this year, while China has imposed significant restrictions on crypto activities, a court in Fujian province and a Chinese law firm have noted that certain actions, like holding and peer-to-peer trading, are not explicitly banned, highlighting legal gray areas that allow for continued crypto use. Beijing just doesn't want to normalize crypto trading in-country because it poses a threat to its strict capital controls, which are designed to regulate the flow of money in and out of the country to prevent currency flight and maintain the stability of the yuan. This is also why mainland China traders aren't allowed to touch Hong Kong's crypto ETFs, which have unique in-kind redemption models. Until there are significant monetary policy changes in China, crypto can't have a foothold. https://www.coindesk.com/markets/2024/08/19/harris-leads-trump-on-polymarket-as-dnc-begins-but-they-got-tied-earlier-amid-volatility/