2024-08-15 07:39

Traders say bitcoin could drop to $55,000 in the near-term, but favorable Fed policies could set the stage for its next leg up. Bitcoin fell over 4% to around $58,000, leading to a broader market drop where other major cryptocurrencies like Ether, Solana, Cardano, BNB Chain, and XRP fared slightly better, with losses ranging from 2.5% to 3.8%. The decline came after by the release of U.S. CPI data, despite positive stock market reactions. U.S.-listed spot Bitcoin ETFs saw net outflows, with Grayscale's GBTC being the most affected, while Ether ETFs saw continued inflows, with BlackRock's ETHA notably gaining. Bitcoin (BTC) slipped more than 4% in the past 24 hours to trade near the $58,000 level in Asian afternoon hours Thursday, retracing nearly all gains from the past week. BTC led losses as the slide led to a drop across major tokens. Ether (ETH) fell 3.8%, while Solana’s (SOL), Cardano’s (ADA), BNB Chain’s (BNB) and Ripple's XRP{{(XRP}} dropped a smaller 2.5%. The broad-based CoinDesk 20, a liquid fund tracking the largest tokens by capitalization, lost 3.5%. Much of the drop came after the latest July U.S. consumer price index (CPI) figures were released late on Wednesday. July's CPI increased by 2.9% year-on-year, as expected, marking the first time since 2021 that it has fallen below 3%. Despite the NASDAQ and S&P 500 reversing an early sell-off and ending the day in the green, BTC continued its sell-off after the CPI print. Crypto prices have been "highly sensitive" to U.S. economic data in recent months, as per K33 Research, and tend to move as investors prefer stability over riskier assets. As such, some traders expect BTC prices to drop to as low as $55,000 in the near term, before a leg up, which could spell further losses for major tokens. “A new sell-off momentum is still the prevailing scenario, with a potential pullback to $55K,” Alex Kuptsikevich, the FxPro senior market analyst, shared in a Thursday note. “Data supporting the Fed's imminent easing of monetary policy may encourage the bulls to overcome the short-term downtrend and give the green light to rise to $66K.” Elsewhere, U.S.-listed spot bitcoin exchange-traded funds (ETFs) recorded $81 million in net outflows on Wednesday, ending a two-day positive streak. Grayscale’s GBTC registered $56 million in outflows, the most among counterparts, with Fidelity’s FBTC recording $18 million in outflows. Ark Invest’s ARKB and Bitwise’s BITB lost $6.7 million and $5.7 million respectively. Franklin Templeton’s EZBC and BlackRock’s IBIT were the only products with net inflows of a cumulative $6 million. Ether ETFs fared better with $10 million in net inflows, extending a streak to three days. BlackRock’s ETHA recorded $16 million in inflows, while Grayscale’s ETHE lost $16 million. Grayscale’s mini Ether trust ETH, Fidelity’s FETH and Bitwise’s ETHW took on a cumulative $11 million inflows. https://www.coindesk.com/markets/2024/08/15/bitcoin-drops-to-58k-after-us-cpi-print-btc-etfs-record-81m-outflow/

2024-08-15 01:03

At the opening Crypto4Harris event, industry supporters of the Democratic presidential candidate suggested Harris will lead a crypto surge, though she hasn't yet shared her view. U.S. Senate Majority Leader Chuck Schumer came out guns-blazing during a Crypto4Harris event, saying what's been considered a longshot idea of getting some kind of crypto legislation out this year could really happen. Billionaire Mark Cuban said former President Donald Trump and his party are primarily interested in crypto to make rich digital assets investors richer. Sens. Debbie Stabenow and Kirsten Gillibrand joined nearly a dozen other Democratic lawmakers, as well as industry titans like Mark Cuban and Anthony Scaramucci, in a virtual event to garner crypto support for Vice President Kamala Harris's presidential bid. U.S. crypto legislation can happen this year, Senate Majority Leader Chuck Schumer (D-N,Y,) said Wednesday at the first major event in which crypto insiders have come out for Vice President Kamala Harris as their favored presidential contender. "We all believe in the future of crypto," Schumer said at an online event hosted by Crypto4Harris. "Congress has a responsibility to provide common sense and sound regulation on crypto, and we need your support to make sure that any proposal is bipartisan." In Harris' absence, several Democratic lawmakers and prominent supporters stood in and shared assurances during the virtual town hall that she would pave the way for new U.S. crypto regulations. Crypto4Harris is among a handful of fledgling efforts aiming to drum up crypto-world backing for Harris after months in which former President Donald Trump seemed to be cementing himself as the industry's pick. Harris hasn't made any policy statements about digital assets in the U.S., and her campaign hasn't formally embraced crypto support, though campaign officials were said to be listening in at the opening online event. Schumer's legislative optimism faces a number of practical hurdles. This congressional session is careening into the general election, making potential progress difficult on major policy efforts. While the House of Representatives has made some strides this year in pushing crypto bills through final approvals, the Senate hasn't matched that progress. "I believe we can make that happen," Schumer insisted, but he didn't specify what the bill might be beyond getting "something passed out of the Senate." Still, Schumer said twice that his goal was to have a bill passed out of the Senate and signed into law by the end of the year. He mentioned the Financial Innovation and Technology for the 21st Century Act (FIT21), a House-passed bill spearheaded by Rep. Patrick McHenry (R-N.C.), as well as a yet-to-be-introduced bill being developed in the Senate Agriculture Committee, though he stopped short of explicitly endorsing either product. "Crypto is here to stay, no matter what, so Congress must get it right," Schumer said. SkyBridge Capital's Anthony Scaramucci, who briefly served as Trump's press secretary, said he was looking for crypto to remain bipartisan and "less tribal." Congressman Wiley Nickel (D-N.C.) briefly praised crypto before introducing a panel of additional lawmakers to speak to the attendees. "Let me tell you, there's only one candidate running for president who's called crypto a scam, and that's Donald Trump," Nickel said. "He did absolutely nothing for four years as president and was openly hostile up until just recently." Sen. Debbie Stabenow (D-Mich.), who chairs the Senate Agriculture Committee, said her goal is to "provide the structure that both protects consumers but also allows this innovation to really flourish," referring to crypto commodities as something the Commodity Futures Trading Commission – long seen as a potentially friendlier regulator toward crypto than the Securities and Exchange Commission – should oversee. "Our House colleagues have already moved forward a bill. In the senate, it's the Democrats that are serious about getting something done and working with our great new president," she said. Billionaire Mark Cuban, who has been heavily involved in trying to get Harris into the pro-crypto camp, said that Trump and Republicans are only interested in crypto to boost the wealth of their allies. "They just want to see the Bitcoin maxis get richer," Cuban said. Sen. Kirsten Gillibrand (D-N.Y), Gov. Jared Polis (D-Colo.) – a former House member who cofounded the Congressional Blockchain Caucus – and Reps. Elissa Slotkin (D-Mich.) and Adam Schiff (D-Calif.) – both of whom are running for their states' respective Senate seats – spoke with both pretaped and live remarks. Other lawmakers similarly took the virtual stage to speak to the innovations they saw in crypto, how they believed the Democratic Party could approach the industry and otherwise support the effort to raise support and funds for Harris. Until Harris makes her policy positions clear, she'll generally be judged on the record of the Biden administration. For crypto, that record has been marked by years of legal combat and an inability to get industry-specific regulations in place. The industry's primary election weapon – the extremely well funded Fairshake political action committee – has straddled a careful line between the parties. It lavished millions on political ads during the congressional primary elections this year, spreading that spending to both Democrats and Republicans, and its recent disclosures of ad buying for the general elections show a similar split. In the House, Fairshake and its affiliate PACs (one for Democrats and one for Republicans) is so far backing nine incumbent Democrats and nine incumbent Republicans. In the Senate, they're devoting $12 million to defeat Sen. Sherrod Brown (D-Ohio), the sitting chairman of the Senate Banking Committee, while also committing $3 million each to Democrats seeking seats in the key states of Arizona and Michigan. The industry's primary campaign-finance arm hasn't touched the presidential race, yet, and has shown no signs of weighing in. Some of the biggest sources of Fairshake's cash, though, have also backed Trump. Crypto4Harris said that "grass-roots" fundraisers will start in mid-September to raise money from the crypto crowd. Read More: Crypto Insiders Courting Vice President Harris Chase Whispers of Her Openness https://www.coindesk.com/policy/2024/08/15/us-crypto-bill-can-happen-this-year-senates-schumer-tells-crypto-backers-of-harris/

2024-08-14 16:44

The previous two occasions when exchanges saw similar USDT outflows earlier this year occurred near local tops in bitcoin's price. Bitcoin started a downtrend soon when USDT exchange outflows surpassed $1 billion earlier this year, "suggesting investors may be adopting a risk-off stance," IntoTheBlock said. The current price action "feels eerily similar" to last year's when bitcoin traded sideways for two months after a large capitulation in August, one analyst noted. Cryptocurrency prices sharply rebounded from last week's turmoil as bitcoin (BTC) rebounded to above $60,000 after falling below $50,000 during the Aug. 5 crash. But further upside might be elusive – at least based on one metric that has foreshadowed recent local tops. Crypto analytics firm IntoTheBlock noted that more than $1 billion of Tether's USDT stablecoin was withdrawn from crypto exchanges on Tuesday, the most in a day since May. "In recent cases where withdrawals exceeded $1 billion, bitcoin began a downtrend soon after, suggesting investors may be adopting a risk-off stance, moving funds to safer environments like cold wallets in anticipation of market volatility," IntoTheBlock analysts said. However, there are nuances to interpreting the data. While stablecoin deposits to exchanges are positive, signaling fresh funds arriving to buy assets, withdrawals are not always negative as users might move funds to decentralized finance (DeFi) to earn yield. Notably, yields for providing USDT liquidity in DeFi pools have been trending lower, DefiLlama data shows. Bitcoin fell to $59,000 during Wednesday U.S. trading session, fully retracing yesterday's surge above $61,000 despite Wednesday's U.S. CPI inflation report reassuring expectations of an interest rate cut in September. Zooming out, seasonal trends are neither in favor of higher crypto prices. Most of the time during bitcoin's history, August and September brought negative monthly returns, data compiled by CoinGlass shows. Well-followed crypto analyst Miles Deutscher pointed out that bitcoin's current price action resembles last year's action. Then, BTC tumbled to $24,000 from the top of its range at $30,000 during a large leverage flush in August and traded mostly sideways for two months before commencing a rally in October. "Retail interest is evaporating fast, apathy amongst existing market participants, lack of clear narratives," he said. "This feels eerily similar to August-October last year." https://www.coindesk.com/markets/2024/08/14/bitcoin-price-may-turn-lower-as-crypto-exchanges-see-1b-usdt-withdrawal-intotheblock/

2024-08-14 12:41

Bitcoin continued with modest daily gains at $61,300 following the report. Inflation in July for the U.S. came in mostly as forecast as the stage continues to be set for the Federal Reserve to begin cutting rates at its upcoming mid-September meeting. The Consumer Price Index rose 0.2% in July, according to a U.S. government report Wednesday morning. That's up from a decline of 0.1% in June and against expectations for 0.2%. On a year-over-year basis, the CPI was higher by 2.9% versus 3% expected and 3% in June. The core CPI – which strips out food and energy costs – was higher by 0.2% in July versus 0.2% expected and 0.1% in June. Year-over-year core CPI was 3.2% against forecasts for 3.2% and June's 3.3%. The price of bitcoin (BTC) continued modestly higher for the day at $61,200 following the mostly in line report. Prior to this morning's data, the subject of whether the U.S. Federal Reserve would cut its benchmark fed funds rate range at the bank's next meeting was closed: There was zero percent chance that the range will remain at its current 5.25%-5.50%, according to CME FedWatch, which figures odds based on positions taken in short-term interest rate markets. In fact, the gauge showed a 52.5% chance of a 50 basis point rate cut versus 47.5% for a 25 basis point move. The report seems unlikely to change those calculations in any major way. Next up in U.S. macro will be tomorrow's initial jobless claims and retail sales reports. Prior to August's end will also see the Fed's Jackson Hole gathering, and previous Fed chair's have on occasion have used the conference to announce or float important policy changes. https://www.coindesk.com/markets/2024/08/14/us-cpi-rose-02-in-july-matching-expectations/

2024-08-14 12:00

The new offering will allow MetaMask users to purchase directly from their self-custodial crypto wallet. The MetaMask Card is first available in a pilot phase to a few thousand users in the EU and UK, with a wider release expected later this year. Users will be able to make purchases directly with their USDC, USDT and wETH assets held on the layer-2 network Linea. MetaMask, the popular self-custodial crypto wallet for the Ethereum (ETH) network, is starting the rollout of its blockchain-based debit card developed with payments giant Mastercard (MA) and crypto payments specialist Baanx. The MetaMask Card will initially be available in a "limited pilot of a few thousand digital-only cards" to users based in the European Union countries and the UK, Metamask told CoinDesk on Wednesday. The company plans broader distribution later this year, with a "full rollout" in the EU and UK and more pilot launches in other regions through the coming quarters. The offering comes as traditional financial services and blockchain-based digital assets are getting increasingly intertwined. As global institutions tokenize old-school instruments like bonds and credit and asset managers start offering bitcoin (BTC) and ether (ETH) exchange-traded funds, payments giants are exploring ways to implement blockchain tech into financial rails. Mastercard has been working with Baanx on its web3 payments initiative, connecting traditional payments with crypto platforms like hardware wallet firm Ledger and decentralized exchange 1inch. Rival company Visa (V), meanwhile, has partnered with Circle's USDC stablecoin and the Solana (SOL) network to speed up cross-border payments. CoinDesk broke the news in March that MetaMask was testing a blockchain-based payment card with Mastercard and Baanx. "We saw a significant opportunity to make purchases for self-custody wallet users easier, more secure, and interoperable," said Raj Dhamodharan, executive vice president of blockchain and digital assets at Mastercard. "Anybody who has access to a mobile phone should be able to get access to a basic range of financial services by default," said Simon Jones, chief commercial officer at Baanx. "This would have huge implications in countries with large numbers of unbanked or underbanked individuals." The card works like a typical debit card but allows purchases directly with digital asset holdings in Metamask's self-custodial wallet. This means that users retain custody of their funds until the moment of payment. Users will be able to spend their USDC, USDT and wETH cryptocurrencies held on the Linea blockchain, an Ethereum layer-2 network developed by Consensys, which is also the developer of MetaMask. “This gives people more freedom to spend their assets; in this case, crypto,” said Lorenzo Santos, senior product manager at Consensys. https://www.coindesk.com/business/2024/08/14/metamask-starts-rollout-of-blockchain-based-debit-card-developed-with-mastercard-baanx/

2024-08-14 11:00

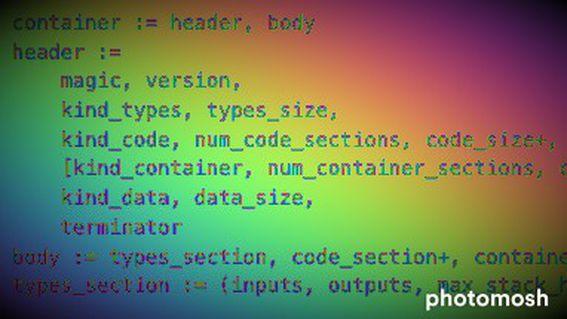

The EOF proposal is a series of planned changes aiming to update the ubiquitous Ethereum Virtual Machine (EVM) – the programming environment that executes smart contracts on the blockchain, and an evolving industry standard in its own right. The new EVM Object Format (EOF) proposal aims to make the de facto industry standard Ethereum Virtual Machine more developer-friendly. Concerns were raised by some developers that the risk of implementing the proposal weren't worth the benefits. Ethereum developers are steering toward an upgrade that could bring the most fundamental changes in the network's programming environment since the original smart-contracts blockchain shook up the crypto industry when it launched nearly a decade ago. The Ethereum Improvement Proposal (EIP) known as EVM Object Format (EOF), which has been discussed extensively in developer circles this year because of some participants' concerns about possible security risks, is now set to be included in a major package of changes expected later this year or early next, known as the Pectra hard fork. The EOF proposal is a series of smaller changes aiming to update the Ethereum Virtual Machine (EVM), the programming environment that executes smart contracts on the blockchain, and arguably Ethereum’s secret sauce that made it different from Bitcoin and other early distributed networks when it launched in 2015. Specifically, EOF would make smart contracts more developer friendly, especially for those building decentralized applications in Solidity or Vyper programming languages. The series of changes are incredibly delicate that can break existing smart contracts, so developers have added in a new version, allowing dapp builders to choose which version of the EVM to use when deploying their code. “EOF will be the first major EVM related change in years,” said Parithosh Jayanthi, a core developer at the Ethereum Foundation, over a text message on Telegram to CoinDesk. “It sets the stage for future upgrades to the EVM and showcases the base layers intent to continue to improving the EVM.” The EVM standard As the first and largest smart-contract blockchain, Ethereum has defined the programming standard that many other blockchains have adopted. Other layer-1 blockchains have also found ways to be compatible with the EVM, recognizing how important this piece of technology is in the blockchain industry. But developers are now looking to introduce a newer version of the EVM, so they can write more secure smart contracts and dapps. With this, some developers have a few concerns that the procedure might create some unintended consequences for the network. Currently, the EOF component of the Pectra upgrade, Ethereum’s next hard fork, consists of 11 Ethereum Improvement Proposals (EIPs). EOF proposals were suggested in the previous upgrade, Dencun, but when Ethereum developers wanted to be heads-down working on proto-danksharding – another crucial innovation that makes data storage on the blockchain cheaper and faster – they pushed EOF out and suggested to revisit it for Pectra. One notable critic of EOF was the core developer Marius Van Der Wijden. “The problem that I see is that now performing these operations, performing these verifications, these checks, is also part of the consensus," he told CoinDesk in an interview at the Ethereum Community Conference in Brussels. "That means if there's a bug in there, and we deploy something that passes our verification, but has a bug in it, then it will later on crash in a very unexpected way.” Van Der Wijden’s high-level concern with EOF is that “the big disadvantage that we will have is to maintain this EVM alongside the old one. Because the old one is not going to go anywhere, right? And everyone has sort of been making use of the old one.” Most of the core developers, however, say that EOF will bring benefits to the Ethereum ecosystem that outweigh the risks. “EOF is ready, implementations are complete, and downstream users such as Solidity are advocating for it,” Danno Ferrin, an independent contributor to the client team Besu, told CoinDesk in a message over Telegram. “When the feature is ready and done it's time to ship it or to permanently mothball it. EOF also fixes a large amount of technical debt the EVM has had since its inception,” Ferrin said. https://www.coindesk.com/tech/2024/08/14/ethereum-set-for-overhaul-of-crucial-programming-standard-with-evm-object-format/