2024-08-14 10:48

The Champions League sponsorship will be unveiled officially at Wednesday's UEFA Super Cup match between Real Madrid and Atalanta in Warsaw. Neither financial terms nor the length of contract were disclosed. Crypto.com was one of the most active digital asset firms in securing sports sponsorship deals in 2021-22. The company's aborted sponsorship of the Champions League in 2022 was said to be worth $495 million. Cryptocurrency exchange Crypto.com became the official sponsor of the UEFA Champions League, Europe's premier club soccer competition, nearly two years after pulling the plug on a similar deal. The sponsorship will be unveiled officially at Wednesday's UEFA Super Cup match between Real Madrid and Atalanta in Warsaw, according to an announcement by the exchange. Neither financial terms nor the length of the multiyear deal were disclosed. Crypto.com's aborted sponsorship of the Champions League in 2022 was reportedly worth $495 million. The Singapore-based exchange backed out of that five-year deal owing to legal issues around its licenses to trade in the U.K., France and Italy. Crypto.com was one of the most active digital asset firms in securing sports sponsorship deals in 2021-22, including the naming rights to the home of the NBA's Los Angeles Lakers and NHL's Los Angeles Kings. The ensuing bear market saw such deals dry up somewhat, but they would appear to be back in full flow now. Read More: Dragonfly, Crypto.com Weigh in on CFTC's Proposed Prediction Market Rules https://www.coindesk.com/business/2024/08/14/cryptocom-secures-multiyear-sponsorship-deal-with-uefa-champions-league/

2024-08-14 10:20

The Indian crypto exchange is facing heat from customers for the inability to withdraw their funds and an alleged lack of transparency after a $230 million exploit. WazirX said it is ending its relationship with Liminal and moving its funds into new multisig wallets. WazirX said the $230 million July hack was related to a multisig wallet using Liminal's digital asset custody service. Liminal said its infrastructure was not breached. WazirX is ending its relationship with custody provider Liminal Custody after suffering a $230 million exploit last month that saw 45% of total customer funds vanish, the Indian cryptocurrency exchange said in a post on X on Wednesday. Liminal and WazirX blamed each other for the success of the attack in July, leaving users in the dark over the security of their funds. "We are in the process of migrating the remaining assets held with Liminal to new multisig wallets," WazirX said. "This step is essential to ensure maximum security of the assets in light of recent events. While we believe our interface and systems remain uncompromised, the same cannot be said for the custodian's interface post the July 18th incident, prompting this precaution." Liminal said it is cooperating in the process. "The client could have removed the funds immediately post the incident," a Liminal spokesperson said in a WhatsApp message. "They've always had the ability to exercise full control of wallets, regardless of Liminal or the Liminal key. We have supported and will continue to support the client in moving their wallets and assets as requested.” The exchange faced criticism from customers for their inability to withdraw funds and an alleged lack of transparency. Co-founder Nischal Shetty asked customers to give the exchange some time to resolve the issue. "We are exercising extreme caution in how and when we move these assets, considering the complexity involved," the post on X said indicating the need to take precautions to avoid another attack while moving the funds. "For transparency, we'll publish the list of all new wallets once the migration is complete." Read More: WazirX Co-Founder Nischal Shetty Says All Options Are on the Table for Fund Recovery https://www.coindesk.com/business/2024/08/14/wazirx-ends-custody-relationship-with-liminal-is-moving-funds-to-new-multisig-wallets/

2024-08-14 08:47

Tweets from the crypto exchange and Jesse Pollak, the creator of Base, suggest cbBTC could run on the layer-2 blockchain. Posts on X from Coinbase and Base creator Jesse Pollak suggest the crypto exchange is developing a wrapped bitcoin similar to BitGo's wBTC to run on the layer-2 blockchain. Despite some controversy over wBTC, BitGo's protocol remains stable. Crypto exchange Coinbase (COIN) appears to be developing an alternative to BitGo's wrapped bitcoin wBTC (WBTC) to run on its own layer-2 blockchain, Base, to provide users a way of accessing the largest cryptocurrency by market value on the network. Speculation was sparked by cryptic posts from Coinbase late Tuesday U.S. time. The posts contained the wording: "cbBTC" and "Coming soon." They were followed by a post from Jesse Pollak, who runs Base, saying how the team plans to build a "massive bitcoin economy" on the network. Wrapping a crypto token is a way of making it available on protocols other than the one it was originally designed for, bringing increased liquidity to the target ecosystem. Each wrapped bitcoin represents one of the original, which is stored in custody. When a trader wants to redeem the wrapped token for bitcoin, the wrapped version is "burnt," or deleted from the chain, and the original is released. Coinbase's announcement comes as a cloud hangs over wBTC. Earlier the month, BitGo said it was establishing a joint venture with BiT Global, a Hong Kong-registered custody platform partially owned by the Tron ecosystem and Tron founder Justin Sun. The venture, it said, will continue to use the same BitGo multisignature technology and deep cold storage. The response to the announcement was generally neutral because there is no technical change to the product and all data about underlying reserves continues to be verifiable on-chain. Some chatter on the forums of DAI stablecoin issuer MakerDAO, however, expressed a negative reaction. An executive proposal for MakerDAO token holders proposes to stop wBTC borrowing and cut wBTC debt limits to 0 DAI to reduce risk is open for the next month. Still, on-chain data from Dune shows there has been no change in supply for wBTC, meaning traders aren't trying to exit the protocol en-masse. In a post on X, Sun said that there will be "no changes to WBTC" outside of the joint venture and he does not control the protocol's private keys and cannot move any of the BTC reserves. "My personal involvement in WBTC is entirely strategic," he wrote. https://www.coindesk.com/business/2024/08/14/coinbase-promotes-cbbtc-wrapped-bitcoin-version-for-base-blockchain/

2024-08-14 07:01

Such expansion comes despite a recent drop in bitcoin (BTC) prices, indicating positive sentiment among miners after a bout of selling in the past few months. Miners are increasing their network hashrate despite a recent drop in bitcoin prices, signaling a positive sentiment after a capitulation event that has typically marked price bottoms. A significant miner capitulation was observed with a spike in Bitcoin outflows to 19,000 BTC on August 5, the highest since March 18. This came as bitcoin's price touched $49,000, suggesting miners sold off to cover costs as profit margins tightened. Bitcoin (BTC) miners are expanding their capacity again as network hashrate reached a fresh all-time high this week following a capitulation event, on-chain analysis firm CryptoQuant shared in a report with CoinDesk. Network hashrate set a new record of 627 exahash per second on Tuesday, recovering from the 8.5% drawdown in early July. Such expansion comes despite a recent drop in bitcoin prices and record-low hash price – or the average revenue per amount of mining power – indicating positive sentiment among miners after a bout of selling in the past few months. Hashrate refers to the computational power used by miners to mint new bitcoin and verify new transactions on the Bitcoin network. Millions of calculations are solved each second to ‘win’ new blocks, in a process broadly called mining. “We may have seen a miner capitulation event last week as miner outflows spiked after prices touched $49,000,” CryptoQuant said. “Bitcoin daily miner outflows spiked to 19K BTC on August 5, the highest level since March 18.” Miners are entities that supply computing power to any blockchain network in return for “rewards” in the form of BTC tokens. They typically sell bitcoin to keep operations afloat continually as running such systems is costly: Only five popular mining rigs were profitable in early July as prices floated around the $54,000 mark. “Miners sold some Bitcoin as their average operating profit margins were squeezed to 25%, the lowest since January 22,” the firm added. A miner capitulation event is typically seen near local bottoms for Bitcoin prices during bull markets. Since 2023, a spike in miner outflows coincided with local bottoms in March 2023 after the Silicon Valley bank sell-off – and January 2024, the price correction following the bitcoin spot ETF launch in the U.S. BTC trades just above $61,000 in Asian afternoon hours Wednesday, up 2.8% in the past 24 hours to lead gains among crypto majors. https://www.coindesk.com/markets/2024/08/14/bitcoin-miner-capitulation-and-record-high-hashrate-points-to-possible-price-bottom-cryptoquant/

2024-08-14 06:22

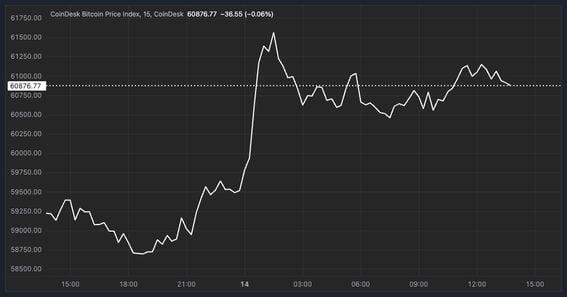

BTC beat the CoinDesk 20 during the Asia trading hours, while traders remain bullish on TON because of its GameFi integration. BTC moved past $61K during the Asia trading day, beating the CD20. Traders continue to remain bullish on TON because of its integration with Telegram and growing GameFi ecosystem. Bitcoin (BTC) surged above $61,000 in early Asian trading hours Wednesday to lead gains among major tokens, reversing losses from a steep price drop earlier this month. Bitcoin added over 3%, CoinGecko data shows, with majors ether (ETH), Solana’s SOL, Cardano’s ADA, xrp (XRP) and BNB Chain’s BNB rising as much as 2.8%. Major memecoins dogecoin (DOGE) and shiba inu (SHIB) rose just 1%, suggesting sentiment wasn’t in favor of riskier bets. Gains in bitcoin beat the 2.45% rise in the broader CoinDesk 20 (CD20), a liquid index tracking the largest tokens by market capitalization, minus stablecoins. Despite the modest gains, some trading funds remain cautious amid a busy data week, warning of possible short-term tremors that could impede the ongoing rally. “Investors remain cautious ahead of US CPI this week,” crypto trading firm QCP Capital said in a Telegram broadcast. “They will closely watch inflation numbers for guidance on whether the Fed will cut rates by 50 or 25 bps in September. The odds are now evenly split.” Wednesday’s recovery helped chalk up gains for traders nursing losses after a 20% market-wide drop earlier in August as the popular yen carry trade unwinded. And some strategists warn of further losses related to the carry trade, stating its impact is not entirely over. In a CNBC interview earlier this week, Richard Kelly, head of global strategy at TD Securities, said he is “very hesitant” to declare the end of the carry trade unwind. “I’d push back on a lot of those narratives. You don’t have any real data to price your carry trades that we know,” Kelly said in the CNBC interview. “I think there is still a lot that can unwind, especially if you look at how undervalued yen is.’ “That is going to change the valuations for the next one to two years to come. That’s going to have spillover effects,” he added. The Bank of Japan (BoJ) recently raised rates for the first time in over a decade, destabilizing global markets and risk assets, including bitcoin. When rates were low, traders borrowed yen for cheap to invest in another asset that provided a higher rate of return – creating the carry trade. A bump in rates impacted the profitability of trading strategies, creating a ripple effect that impacted nearly all markets. BTC fell 15% in a 24-hour period, one of its largest drops in recent years, while major tokens slid at 22%. Earlier in August, the deputy governor of the BOJ said that the central bank would avoid raising rates amid unstable markets, impacting yen carry trades and risk assets. A former BOJ official has since said the central bank would defer additional interest rate hikes to next year, suggesting a preference for market stability over the near term. Aside from bitcoin, traders continue to be bullish about TON. Toncoin’s TON rose 7% during the Wednesday Asia trading session, according to CoinDesk Indices data. Stakeholders in the Toncoin ecosystem point to the growth of GameFi on the platform, as well as its close integration with Telegram as reasons for the token's continued growth. "The number of players of TON games break the ceiling glass of previous blockchain games by the viral social growth in Telegram. And some TON games have already verified the significant revenue from game play itself, not token selling," John Cheang, the TON Foundation's Asia-Pacific lead said in an email interview, while also pointing to TON's record-high blockchain transactions per seconds as a reason why it can scale. Ben El-Baz, Managing Director of HashKey Global, which is an investor in TON-ecosystem projects like Catizen, added in an email comment that leveraging Telegram's advantage will "attract more developers represents a significant opportunity for TON." https://www.coindesk.com/markets/2024/08/14/bitcoin-crosses-61k-as-traders-remain-cautious-ahead-of-us-cpi-further-unwinding-of-yen-carry-trade/

2024-08-14 06:15

The investment bank says it owns over $400 million in bitcoin ETFs, according to a recently filed 13F. Goldman Sachs owns positions in seven out of the 11 bitcoin ETFs. Earlier, the bank had said "we're not believers in crypto." Goldman Sachs (GS) holds positions in a variety of bitcoin (BTC) exchange-traded funds (ETFs), according to a 13F filing. The investment bank in its quarterly 13-F report disclosed that it holds positions in seven out of the 11 BTC ETFs in the U.S. Its largest holding is the iShares Bitcoin Trust (IBIT) at $238.6 million, followed by Fidelity's Bitcoin ETF (FBTC) at $79.5 million, then $56.1 million of Invesco Galaxy's BTC ETF (BTCO), and $35.1 million in Grayscale's GBTC. It also holds smaller positions in BITB, BTCW, and ARKB. BTC ETF flows continued in the green during the U.S. Tuesday trading day with $4.39 million in daily inflow recorded, according to SoSoValue. During CoinDesk's Consensus 2024 festival in Austin, Mathew McDermott, the bank's global head of digital assets, said the BTC ETFs were a "big psychological turning point" for the industry. "The bitcoin ETF obviously has been an astonishing success," McDermott said on stage. Goldman Sachs' digital asset desk is primarily focused on the digitization of assets. "Institutions like ours actually see the potential in how it can transform where parts of the financial system can operate in a much more efficient way," he also said during Consensus. Previously Goldman Sachs has said that its clients were not interested in crypto. “We do not think it is an investment asset class,” Sharmin Mossavar-Rahmani, chief investment officer of the bank's Wealth Management unit, told the Wall Street Journal in April. “We’re not believers in crypto.” https://www.coindesk.com/markets/2024/08/14/goldman-sachs-holds-over-400m-in-bitcoin-etfs/