2024-08-12 09:38

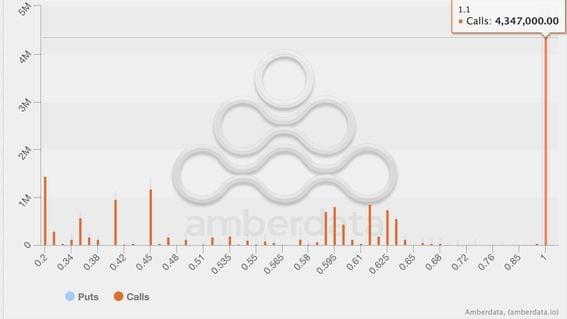

Traders have locked in over $2 million in XRP's $1.10 call option listed on Deribit, the highest across all available maturities. Traders have locked in over $2 million in XRP's $1.10 call option listed on Deribit, the highest across all available maturities. The large open interest in the nascent XRP options market likely reflects ETF optimism. Deribit's nascent options market for XRP is experiencing a surge in activity, particularly in the $1.10 call option that represents a bet that prices for the payments-focused cryptocurrency will double by the end of the month. As of writing, XRP's $1.10 call option, set to expire on Aug. 28, had an open interest of 4,347,000 contracts valued at $2.44 million, making it the most favored among all available XRP options on the exchange, according to data tracked by Amberdata. The amount is significant for an options market that is barely five months old. The so-called open interest, or the number of active bets, has increased by 838,000 contracts in the five months alone. According to Griffin Ardern, head of options trading and research at crypto financial platform BloFin, the increased activity in the $1.10 call likely reflects a net long positioning. "From the gamma distribution, it feels like a net long position expiring on Aug. 30. If the resistance level of $0.75 from the past two weeks can be broken, the price of XRP is likely to rise above $1.10," Ardern told CoinDesk in an interview. "Perhaps institutions will likely apply for an XRP ETF in the U.S., which may be an important factor driving a sharp rise in prices," Ardern added. XRP rose over 30% to 62 cents last month but has since pulled back to just over 57 cents, according to CoinDesk data. A call option gives the purchaser the right but not the obligation to buy the underlying asset, XRP, at a predetermined price on or before the expiry date. A call buyer is essentially bullish on the market, betting on a rally above the level at which the call has been bought. Gamma refers to the rate of change in an option's delta, reflecting how sensitive the option's price is to the changes in the underlying asset's price. CoinDesk reached out to Deribit for further information. Last Wednesday, U.S. District Court Judge Analisa Torres ruled on the Securities and Exchange Commission's (SEC) motion against Ripple Labs, stemming from a 2020 lawsuit over unregistered XRP sales. The court imposed a $125 million penalty for institutional sales of XRP and an injunction against further violations but rejected the SEC's demand for a $2 billion fine. Ripple hailed the judgment as a victory, sparking hopes of a potential XRP ETF debut in the U.S. The regulator approved bitcoin and ether ETFs early this year, opening doors to billions of dollars in mainstream money. Still, Martin Cheung, Pulsar Trading Capital's options trader, expressed skepticism on whether prices could rally beyond $1.10 by Aug. 28. "XRP has rallied a lot this year, plus, I think people are betting the next ETFs to be approved will be on XRP and SOL," Cheung said when asked about the increased demand for $1.10 XRP call options. "That said, the August end is too close; a potential XRP ETF announcement might drive prices higher by, say, 20%, but $1.10 looks too far,' Cheung added. https://www.coindesk.com/markets/2024/08/12/xrp-bullish-options-popularity-jump-may-be-due-to-etf-speculation-observers-say/

2024-08-12 08:48

On Friday, Celsius asked a U.S. court to order Tether to relinquish a total of 57,428.64 bitcoin. Tether said it will fight Celsius' "baseless" lawsuit against it and in any scenario Tether token holders will not be impacted. Bankrupt crypto lender Celsius sued Tether for fraudulently securing itself as part of a loan agreement. Tether, the company behind USDT, the world's largest stablecoin by market capitalization, said it will defend itself against what it called "shakedown" litigation brought by bankrupt crypto lender Celsius. On Friday, Celsius asked the U.S. Bankruptcy Court of the Southern District of New York to order Tether to relinquish a total of 57,428.64 bitcoin (BTC) or award the "present value of all Bitcoin," some $3.3 billion at today's price, according to a court filing. "This lawsuit incredibly now seeks the return of approximately US$2.4 billion worth of BTC from Tether, despite the BTC being liquidated at Celsius’ direction and with Celsius’ consent at June 2022 prices," Tether said in a statement on its website. Tether did not say how it calculated the $2.4 billion figure. The case concerns a loan agreement between Celsius and Tether that allowed Celsius to borrow stablecoins "to operate certain critical aspects of its business," according to the lawsuit. In the filing, Celsius alleges that when the market crashed in mid-2022, in the "ninety-day period prior" to Celsius' bankruptcy filing, Tether insulated itself from the impending bankruptcy by making "preferential and fraudulent transfers" of bitcoin. "Specifically, on several occasions, Tether demanded, and received, a significant amount of new, incremental collateral to improve its position in the impending bankruptcy," according to the lawsuit. "This baseless lawsuit is trying to claim that we should give back the bitcoin that were sold to cover Celsius’ position," Tether CEO Paolo Ardoino said in a post on X. "There are plenty of flaws in the claimant’s filing and we're very confident in the solidity of our contract and our actions ... This lawsuit will be fought till the end. It's important to set an example on behalf of the entire industry that shameless money grabs will not work." Celsius argued that in June 2022, Tether "applied Celsius’s Bitcoin against obligations owed to it for an average price of $20,656.88 each—considerably less than Bitcoin’s market closing price on June 13th, $22,487.39." "Thus, these preferential and fraudulent transfers of Bitcoin should be avoided, and the Bitcoin or its value should be recovered for the benefit of Celsius’s estate," the filing said. It also demands $100 million in damages for breaches of contract. According to Tether, when the market crashed, the agreement required "Celsius to post additional collateral to avoid the liquidation of its BTC" and "when Celsius chose not to post additional BTC it directed Tether to liquidate the BTC collateral Tether held." Tether also said that the consolidated equity of the Tether Group was nearly $12 billion as of June 30, so "even in the most remote scenario in which this baseless lawsuit will get somewhere, Tether token holders will not be impacted." Celsius' bankruptcy is officially closed after a court approved a reorganization plan in November. Read More: Tether's USDT and Circle's USDC Combined Supply Grew $3B Amid Crypto Market Rebound https://www.coindesk.com/policy/2024/08/12/tether-to-fight-celsius-33-billion-shakedown-litigation/

2024-08-12 07:35

The Canto team said a fix will be deployed on Monday at 12:00 UTC. The blockchain hasn't processed a transaction since Saturday, Aug. 10. An announcement on X said a fix will be deployed on Monday, Aug. 12 at 12:00 UTC. The blockchain's native token dropped by 21% before recovering over the course of the weekend. Layer-1 blockchain Canto has been offline since Saturday following a "consensus issue." The CANTO token initially dropped by 21%, before recovering over the course of the weekend. Data from Etherscan shows that three transactions were processed on Aug. 10 and no activity has taken place since then. "Canto chain is currently experiencing an issue with consensus that has caused the chain to halt," Canto said in an announcement on X. "An upgrade to address this issue will be carried out on Monday, August 12 UTC 12:00. All funds are safe. Once the chain resumes, users will be able to access all activities as usual." Canto experienced a period of explosive growth after going live in August last year, and total value locked (TVL) surged to more than $200 million in March as investors flocked to a series of DeFi services like lending, staking and liquidity provision. On-chain activity has rapidly subsided since then, with TVL dropping to just $13.7 million, according to DefiLlama. The CANTO token is also down by 83% since May 24. https://www.coindesk.com/business/2024/08/12/canto-blockchain-suffers-two-day-outage-amid-consensus-issue/

2024-08-12 06:07

The BOJ recently raised rates for the first time in over a decade, destabilizing global markets, including bitcoin. Makoto Sakurai ruled out additional rate hikes this year, offering hope to risk assets. The next move may come in March 2023, the official said A former Bank of Japan (BOJ) official said the central bank would defer additional interest rate hikes to next year, suggesting a preference for market stability over the near term. "They won’t be able to hike again, at least for the rest of the year,” former board member Makoto Sakurai said late Friday, according to Bloomberg. “It’s a toss up whether they can do one hike by next March.” The BOJ raised its key interest rate to about 0.25% from a range of zero on July 31, delivering the first hike in over a decade. The central bank also signaled additional rate hikes. The shift away from the zero interest rate policy pushed the Japanese yen higher, triggering an unwinding of the "risk-on" yen carry trades. The resulting slide in traditional risk assets weighed heavily over BTC, crashing the cryptocurrency from roughly $65,000 to $50,000 in less than seven days. Bitcoin has since recovered to trade above $58,000 amid signs of risk reset on Wall Street. The market turmoil saw BOJ's Deputy Governor Shinichi Uchida walk back on the bank's hawkish commitment, saying it wouldn't hike rates when the markets are unstable. “Uchida’s remarks were appropriate because market stabilization is very important now,” said Sakurai. "The BOJ is moving from excessive monetary easing to appropriate monetary easing, and the biggest problem is that Ueda failed to communicate firmly they will maintain easing. That’s always been a condition they’ve kept," Sakurai added. https://www.coindesk.com/markets/2024/08/12/ex-bank-of-japan-official-rules-out-another-rate-hike-this-year/

2024-08-12 05:26

Crypto markets lack a clear anchor and are susceptible to continued position adjustments based on traditional finance markets, one analyst said. BTC and the broader crypto market experienced a selloff over the weekend, with BTC trading slightly above $58,500, down 4.8% in the last 24 hours. U.S.-listed exchange-traded funds (ETFs) tracking these assets recorded outflows on Friday, with BTC ETFs losing $89 million and ETH ETFs seeing $15.7 million in outflows. A slide in bitcoin (BTC) led to a wider crypto market selloff over the weekend as some traders looked for cues ahead of a busy week to determine positioning. BTC sunk 4.8% in the past 24 hours trading just above $58,500 in Asian morning hours on Monday, CoinDesk Indices data shows, with the broader crypto market tracked by CoinDesk 20 (CD20), falling 5.2%. Ether (ETH) lost 3.5%. U.S.-listed exchange-traded funds (ETFs) tracking the assets recorded outflows on Friday. BTC ETFs lost $89 million, while ETH ETFs saw $15.7 million in outflows, according to market data. Solana’s SOL and toncoin (TON) led losses among majors with a 7% slide. BNB Chain’s BNB lost 3%, dogecoin (DOGE) dropped 6%, while Cardano’s ADA and xrp (XRP) slid 5%. Elsewhere, tokens of blockchains Aptos (APT), Arbitrum (ARB), and metaverse The Sandbox’s SAND dropped as much as 7% ahead of unlocks in the week, which will cumulatively release more than $120 million worth of the tokens in the open market, data shows. These tokens belong to the team and early investors. Some market watchers warned of a further BTC decline in the coming weeks citing technical weakness, but pointed to upcoming traditional market releases that could provide upward pressure. “Crypto prices will likely be rangebound with a bias to the weak side,” Augustine Fan, head of insights at SOFA.org told CoinDesk in a Telegram message. “However, the technical damage and sentiment drag remain, with on-chain cost models and MVRV models suggesting further possible shake-out before Jackson Hole.” “Crypto markets lack a clear anchor and are susceptible to continued position adjustments. We continue to see muted ETF inflows for BTC and ETH over the past few sessions,” Fan added. Both the U.K. and the U.S. will release July’s Consumer Price Index (CPI) readings on Wednesday. Australia’s consumer confidence, which tracks sentiment around family finances, and Japan’s Producer Price Index (PPI), a measure of price developments of goods traded within the corporate sector, are scheduled for a Tuesday release. Later in the week, retail behemoths Alibaba Group and Walmart will release earnings on Thursday, while Hong Kong and Taiwan will publish updated gross domestic product (GDP) on Friday. Traditional market events tend to move crypto prices as they reveal spending behavior and the state of the general economy. Favorable releases tend to sway prices upward as investors are expected to bet more on riskier assets, such as technology stocks or cryptocurrencies, while an earnings or data miss tends to drive assets lower, as investors shift to safer bets. https://www.coindesk.com/markets/2024/08/12/bitcoin-nears-58k-in-selloff-ahead-of-busy-data-week/

2024-08-12 04:30

Both parties argue the CFTC's move to regulate prediction markets is an overreach, with Dragonfly arguing that the recent 'Chevron' court ruling limits its power. The CFTC's notice of proposed rulemaking for prediction markets drew various comments from the public, including the crypto industry. Crypto industry stakeholders say the rules are too broad and would constitute an overreach, considering the recent 'Chevron court decision. Dragonfly Digital Management and Crypto.com have joined crypto exchange Coinbase (COIN) in criticizing the Commodities Futures Trading Commission's (CFTC) proposed rules on prediction markets. Critics say that the CFTC's proposed rules broadly categorize and ban certain event contracts, including those related to gaming – with Coinbase calling the CFTC's proposed definition of gaming too ambiguous – and elections, raising concerns that this overreach exceeds statutory authority, stifles innovation, and neglects the economic benefits these contracts provide. "Political event contracts should not be equated with gambling on games of chance like the Super Bowl. Rather, elections have significant economic implications," Dragonfly's Jessica Furr and Bryan Edelman, its counsel, wrote in a letter to CFTC. "These contracts were designed to serve crucial risk hedging functions, aligning with the requirements of the Commodity Exchange Act (CEA), and offer valuable predictive data to the public." Dragonfly also argues that the CFTC's proposed rule overreaches by broadly banning prediction markets without proper evaluation, especially given the Supreme Court's recent 'Chevron' decision, which limits the agency's interpretive authority without a Congressional mandate. Crypto.com's Steve Humenik, its Special Vice President in charge of Capital Markets, argues that the CFTC's attempt to ban prediction markets violates a rulemaking process dictated by the CEA, which involves a three-step approach. According to the CEA, the three-step process requires the CFTC to assess whether a contract involves an excluded commodity, whether it engages in specified activities, and whether it's contrary to the public interest before banning it. "The CFTC must articulate its justification for determining that a given contract has an underlying excluded commodity. This should not be a foregone conclusion," Humenik wrote. "We urge the CFTC not to sidestep its obligations to undergo a three-step review process with respect to these types of event contracts, and to eliminate this aspect of the Event Contracts NOPR [notice of proposed rulemaking]." Others not directly involved in the crypto industry also weighed in on the issue. Joseph Fishkin, a Law Professor at UCLA, wrote that prediction markets offer valuable insights into public opinion and political events and should not be regulated in a way that shuts them down in the U.S. "I think they enrich our understanding of politics, the news media, political 'conventional wisdom,' and the extent to which crowds consistently get certain types of political predictions wrong," Fishkin wrote. "I hope you will not regulate them out of existence in this country." https://www.coindesk.com/markets/2024/08/12/dragonfly-cryptocom-weigh-in-on-cftcs-proposed-prediction-market-rules/