2024-08-09 08:38

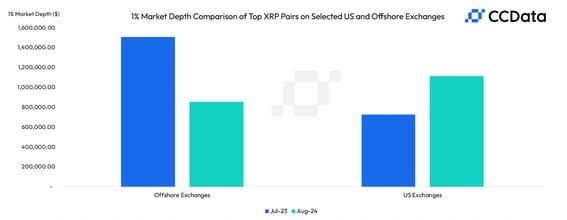

Order books on U.S. exchanges offer more liquidity than their offshore counterparts, according to CCData. XRP's order book on U.S. exchanges is 30% more liquid than offshore platforms. The greater the liquidity or market depth, the easier to execute large transactions at stable prices. XRP is having its moment not just in terms of price rally but also enhanced liquidity on U.S. exchanges, a positive development for whales looking to trade large quantities at stable prices stateside. As of Thursday, U.S. exchanges, including Nasdaq-listed Coinbase (COIN) and Kraken, boasted a 1% market depth of $1.12 million, offering 30% greater order book liquidity than offshore exchanges like Binance and OKX, according to data tracked by CCData. In other words, a trade transaction worth at least $1.12 million must go through U.S. exchanges to move the spot price by 1% in either direction. A relatively smaller amount could do the same on offshore exchanges. The 1% market depth on U.S. avenues has increased 53% since July last year, outpacing the 43.2% improvement on offshore platforms. Market depth refers to the market's capacity to handle large buy and sell orders without causing significant fluctuation in the concerned asset's going market price. The depth is quantified by analyzing the number of active buy and sell orders at various price levels. The 1% depth, which focuses on orders within the 1% range of the currency market rate, is widely used to assess liquidity conditions. The greater the depth, the easier it is to execute large orders with minimal slippage and vice versa. Trading volume in XRP markets offered by U.S. exchanges has also picked up, although offshore exchanges remain dominant. U.S. platforms' now account for 14% of the global XRP volume, matching the levels seen four years ago, according to Paris-based Kaiko. The relative improvement in trading conditions on the U.S. exchanges likely stems from dwindling regulatory uncertainty. "Since last year's landmark court ruling, which granted Ripple Labs a partial victory against the SEC, demand for XRP in U.S. markets has grown steadily," Kaiko said in a weekly note. Last year, fintech company Ripple scored a partial victory in its long-pending battle against the Securities and Exchange Commission after a court ruled that Ripple's Institutional sales of the XRP, and not sales to retail investors, amounted to an unregistered securities offering. The regulator sued Ripple for violating securities law in late 2020, leading to the XRP price crash and prompting the U.S. exchanges to delist the token. Early this week, a federal court imposed a $125 million penalty on Ripple for its institutional sales of XRP. The amount, however, fell well short of the $2 billion the SEC had sought, sending XRP's price higher by 20%. https://www.coindesk.com/es/markets/2024/08/09/heres-why-xrp-whales-may-prefer-us-exchanges-over-offshore-venues/

2024-08-09 05:49

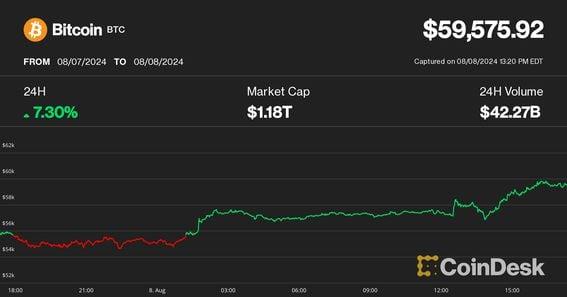

“Regardless of the next 60 days, the bull market will continue along traditional four-year cycle lines with solid gains in October and November,” one trader said. Bitcoin surged over $62,000 briefly before retreating, following a broad market rally that reversed steep losses from earlier in the week. Some analysts predicted a $100,000 target for the cryptocurrency later this year. The rally was influenced by favorable stock market sentiment and expectations of bitcoin mirroring its past market cycles, with liquidated short positions contributing to the surge. Bitcoin (BTC) briefly spiked over $62,000 before retreating during the Asian morning hours on Friday as the broader market rallied to reverse a steep rout from earlier in the week. The recovery has some bitcoin bulls revisiting their $100,000 year-end target. U.S. markets rallied on Thursday with the S&P 500 marking its best day since November 2022 and the tech-heavy Nasdaq 100 rising 3.1%. This helped reverse losses from a Monday rout, which saw major losses across stock indexes and cryptocurrencies. BTC jumped 7.2% in the past 24 hours, one of its biggest single-day percentage gains in recent months. The move liquidated nearly $100 million in shorts, or bearish bets, on bitcoin-tracked futures. The $100 million liquidation was the fourth largest hit for bitcoin bearish bets this year. Some market watchers attributed the gains to favorable stock market sentiment and expectations of BTC mirroring its past market cycles. "Now that the Bank of Japan has indicated they will not raise interest rates further — and Jump Trading will run out of coins to sell, just like Germany did a few weeks ago — I do not see the price going much below $50,000 (other than a quick wick), perhaps ever again,” Transform Ventures founder Michael Terpin told CoinDesk in an email Friday. “Regardless of the next 60 days, the bull market will continue along traditional four-year cycle lines with solid gains in October and November,” he added. “If Trump wins, a rush of new buyers could take the bitcoin price over $100,000,” Terpin said, adding that the six months after the halving have had pullbacks — and this fifth bitcoin cycle is no exception. “October and November are historically strong months for bitcoin, especially in the year of the halving and the year after,” he said. BTC’s rise revived gains among major tokens. Ether (ETH) and toncoin (TON) surged 10%, Solana’s SOL and Cardano’s ADA rose 5%. XRP slightly dropped after a 17% surge on Thursday, likely on profit taking. The broad-based CoinDesk 20 (CD20), a liquid index tracking the largest tokens by capitalization, minus stablecoins, zoomed 5.35%. https://www.coindesk.com/markets/2024/08/09/bitcoin-bulls-revisit-100k-year-end-target-as-btc-spikes-over-62k/

2024-08-09 04:57

Coinbase argues the definition is vague, and urges the CFTC to make determinations on a contract-by-contract basis rather than broad categorization Coinbase responded to the CFTC's proposed rules regarding prediction markets, taking aim at how the CFTC proposes to define 'gaming'. Coinbase would like the CFTC to regulate prediction markets on a contract-by-contract basis instead of using broad categories or definitions. Proposed rules by the Commodities Futures Trading Commission (CFTC) regarding prediction markets should be withdrawn because they exceed the commission's statutory authority and ignore the positive impact of prediction markets on the economy, Nasdaq-listed crypto exchange Coinbase wrote Thursday in a letter to Commissioners. "We firmly believe that this all-or-nothing approach to the treatment of event contracts is not consistent with the promotion of responsible innovation and growth in regulated, transparent markets with appropriate safeguards to protect market integrity and protect customers," Coinbase's Chief Legal Officer, Paul Grewal, wrote in the letter. In May, the CFTC published a proposal on event contracts (prediction markets) that defined "gaming" as betting on outcomes of political contests, awards, or athletic events. This proposal had the support of three Democratic commissioners, CoinDesk reported at the time, who cited concerns over market integrity and the agency's role. In Thursday's letter, Coinbase wrote that it objects to the CFTC's broad definition of "gaming," arguing that it unfairly restricts valuable event contracts by categorically banning them without considering their individual public interest merits. "If adopted, the rule would capture contracts as "gaming" that by any common understanding are not, in fact, gaming," Coinbase wrote, arguing that this is inconsistent with "legislative history related to gaming, neither of which suggest that gaming should extend beyond sporting events". Coinbase gave one use case for prediction markets for sporting events: a vendor hedging the costs of printing t-shirts in anticipation of a team winning a championship by taking a position in favor of that team's loss. The exchange complained in the letter that the Commission equates speculation with gaming but fails to distinguish between market speculation and actual gambling in its proposal. "Few would agree that elections or professional awards such as Nobel Prizes or Academy Awards are granted through a process that should generally qualify as games, yet these are the examples presented as constituting such a definition," Coinbase continued. The proposal would also ban contracts on war, terrorism, and assassination. Polymarket offers several contracts about geopolitical outcomes that would fit into this category, such as one that asks bettors if Iran will launch military action against Israel by next week in response to Israel's assassination of Hamas' leader in Tehran. These may be useful for forecasting world events, and Coinbase argued that the CFTC is overlooking what it calls the significant benefits of prediction markets. Coinbase cites research showing that prediction markets can efficiently aggregate information and outperform traditional forecasting methods. Instead, Coinbase proposes that the CFTC withdraw the broad, categorical ban on event contracts and continue evaluating them on a contract-by-contract basis, considering the public interest merit of each prediction market category. "We urge the CFTC to withdraw this proposal and work alongside academic, industry, and policy stakeholders to develop a more balanced approach that promotes innovation while protecting the public interest," Coinbase's Chief Legal Officer Paul Grewal posted on X. https://www.coindesk.com/policy/2024/08/09/coinbase-takes-aim-at-cftcs-definition-of-gaming-in-proposed-prediction-market-rules/

2024-08-08 20:11

The debacle underscores the wild world of memecoin markets, where grifts and rug pulls abound. A newly launched cryptocurrency on Solana (SOL) called Restore the Republic, or RTR, which was rumored to be the official token of Donald Trump, ballooned to $155 million market value before cratering 95% on Thursday after the former president's son warned that his father doesn't yet have an official token. Hopes for Donald Trump's crypto aspirations were kindled earlier this week when Eric Trump, his son, tweeted that he has "fallen in love with Crypto / DeFi. Stay tuned for a big announcement." Then on Thursday, Restore the Republic began trading, soaring to a $155 million market capitalization just hours after launch. Ryan Fournier, conservative activist and chair of Students for Trump, amplified the hearsay, saying that "rumor has it that the official trump coin is out...called Restore the Republic." That post on X has since been deleted. Subsequently, Eric Trump popped the bubble and chaos ensued. He warned users of "fake tokens" and said that the "only official Trump project has not been announced." The post sent RTR spiraling. It fell 95% from its peak price. "I was told by sources that Don Jr. would be backing this token," Fournier posted on X on Thursday. "That is why I said rumor. I'm not a big crypto guy and I was not in any way involved in this project." Crypto observers also pointed to evidence that Kanpai Labs, the entity behind the Kanpai Pandas non-fungible tokens (NFT), boosted the token with advertisements prior to the launch. Bags, the pseudonymous creator of Kanpai, said the Trump family picked the launch date then "hard rugged us." That post was deleted soon after. Blockchain data shows that early investors, or insiders, made $4 million of profits in six hours on the token's rise and fall, onchain sleuth Lookonchain found. Five crypto wallets bought 105 million of RTR with $882,000 worth of SOL, then sold 95 million tokens for $5 million in SOL. The debacle underscores the wild west nature of the burgeoning memecoin market, where grifts and rug pulls abound. Recently, another Trump-themed token DJT was in the spotlight as Martin Shkreli claimed that he and Donald Trump's son Barron created the token. DJT tanked 90% last week as a large token holder appeared to sell en masse. The episode also highlights Donald Trump's sway among crypto enthusiasts. Analytics firm LunarCrush said that there are currently 162 Trump or MAGA (the shortened version of Trump's famous campaign slogan: Make America Great Again) crypto tokens, up from 111 two weeks ago. https://www.coindesk.com/markets/2024/08/08/a-trump-themed-token-soars-then-dives-95-after-his-son-dashes-hope-the-former-president-backed-it/

2024-08-08 17:33

While the crypto rally was broad-based, with ETH, SOL, NEAR gaining 8%-10%, prices rarely go up in a straight line following major capitulation events such as Monday's crash, one observer noted. Cryptocurrencies continued their rebound higher on Thursday with bitcoin (BTC) nearing $60,000 for the first time since last weekend's carnage. Bitcoin advanced 6.4% over the past 24 hours, currently changing hands at $59,500. Ether (ETH) topped $2,600, up 8.8% during the same period, snapping its losing streak against BTC. The broad-market benchmark CoinDesk 20 Index also booked similar gains, with altcoin majors solana (SOL), near (NEAR), avalanche (AVAX) and filecoin (FIL) up nearly 10%. Ripple's XRP ran hottest with its 22% surge, driven by optimism on a fresh court decision in a long-running case that weighed on the token's price. Investors were upbeat that a U.S. court ordered Ripple to pay a $125 million fine for violating securities laws, a much smaller fine than the $2 billion the Securities and Exchange Commission requested. Market observers pointed to two favorable developments that supported the rally in bitcoin and crypto prices. A U.S. judge approved on Thursday that FTX and its sister trading firm Alameda Research will pay out $12.7 billion to creditors. Many hope that part of the funds will flow back to crypto markets as former users reinvest the proceedings in digital assets. Meanwhile, Russian President Vladimir Putin signed a bill that legalizes crypto mining in the country. "Russia seems to be acting to keep up with the US. Nation-level bitcoin FOMO (fear of missing out) is heating up," said Ki Young Ju, CEO of crypto analytics firm CryptoQuant. "Their entry will boost the hashrate, strengthen network fundamentals, and diversify miner politics." With today's gain, bitcoin has now completely reversed its weekly candle that wicked to as low as $49,000 early Monday to positive. While there's plenty of time until Sunday's weekly close, if BTC finishes the week around the current prices, it would form a hammer candlestick. That's a bullish chart pattern in technical analysis that often appears at the bottom of downtrends, hinting at a trend reversal. Some analysts, however, warned that future price action could be choppy. Caleb Franzen, founder of Cubic Analytics, noted that BTC reached its 200-day moving average cloud that could act as a resistance, arresting the rally. "I'm hopeful that we can break above this level, but I'm not ignorant to the fact that it can just as easily act as resistance," he said. "Bullish if we break and close above it." Cryptocurrencies rarely rebound in a straight line after capitulation events such as Monday's crash, K33 Research analyst David Zimmerman pointed out. "V-shaped recoveries are not the norm, there is no need to rush into new positions," said Zimmerman. "The prices within these wicks are usually revisited, and looking to get positioned into coins showing relative strength during this time is the focus." "Even if we assume the bottom is in, we are likely in for some chop first," he added. https://www.coindesk.com/markets/2024/08/08/bitcoin-nears-60k-as-crypto-bounce-accelerates-but-recovery-might-be-choppy/

2024-08-08 07:03

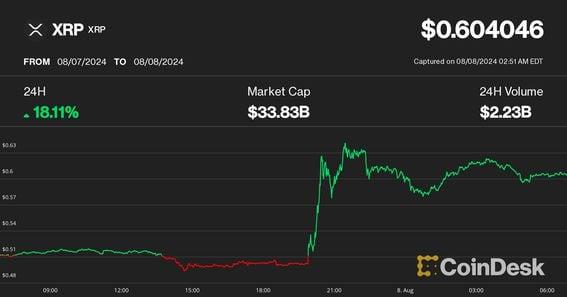

Trading volumes nearly tripled and open interest on XRP-tracked futures jumped $200 million in the past 24 hours. XRP surged 17% after a court ruling in the case involving Ripple Labs and the U.S. Securities and Exchange Commission (SEC). This led to a jump in its price from 50 cents to 65 cents and a significant increase in trading volumes. The judge ordered Ripple to pay $125 million in civil penalties and agreed to an injunction against future securities law violations, although an appeal by the SEC is expected, potentially extending the legal proceedings. XRP surged 17% to lead market-wide gains after a U.S. judge made a milestone ruling in the long-running case between the closely related Ripples Labs and the U.S. Securities and Exchange Commission (SEC). Crypto traders widely expected a settlement in the case throughout July, with the tokens drawing outsized attention from South Korean markets and beating gains in major tokens on several days, as reported. On Wednesday, a federal judge ordered Ripple to pay $125 million in civil penalties and imposed an injunction against future securities law violations. Although the case is said to have reached its end, SEC is expected to appeal the ruling – likely extending legal matters. Markets positively reacted to the ruling as prices of XRP zoomed to 65 cents from 50 cents after the ruling, with trading volumes jumping to $4.2 billion in the past 24 hours from Tuesday’s $1.2 billion. As such, there were just $6 million in short liquidations on XRP-tracked futures, suggesting the movements were spot driven. Meanwhile, open interest—or the number of unsettled futures contracts—on XRP-tracked futures rose by $200 million in the wake of the ruling, indicative of new money entering the market. Data shows that over 60% of these traders have a long bias and expect prices to increase further. XRP was one of the few major tokens in the green during the Asian morning trading hours amid a flat market. Meanwhile, Toncoin (TON) jumped nearly 6% to $6.33 after Binance announced it will list TON on its marketplace. Bitcoin (BTC), Solana’s SOL and BNB Chain’s BNB were unchanged in the past 24 hours, data shows, while ether (ETH) dropped 3.4%. The broad-based CoinDesk 20 (CD20), a liquid index tracking the largest tokens, minus stablecoins, is up 0.3%. Inflow into bitcoin exchange-traded funds (ETFs) came in at $45.1 million for the August 7 trading day, according to market data. GBTC saw outflow of $30.6 million, while BTCW had inflow of $10.5 million and IBIT had $52.5 million. Ether ETFs, saw outflows of $23.7 million. Grayscale's ETHE hit $31.9 million in outflow, while Fidelity's FETH had $4.7 million in inflow, ETH saw $1.7 million in inflow, and EZET had $1.8 million of the same. The rest registered no flow. BTC's lack of movement might be the market beginning to price in a potential Kamala Harris White House, with Semir Gabeljic, Director of Capital Formation at Pythagoras Investments pointing to Harris' rise as a market catalyst to watch. Harris, who recently tied Donald Trump both in the polls and on Polymarket (the latter of which has historically favored Trump), now has a pro-crypto advocacy group called "Crypto for Harris" attached to her name which hopes to make smart crypto legislation a bi-partisan issue. Many stakeholders, including Coinbase's Chief Legal Officer Paul Grewal, are also calling for crypto policy not to be the domain of one party so that the U.S can play catch-up to Asia in rule-making. Meanwhile, other coins that are in the green during the Asia trading day are TONCoin, up 9.7%. TON may have some momentum as the TON-themed 'The Open Summit', part of ABS 2024 in Taipei, wraps up Thursday. At the same time, Trump-themed PoliFi coins are struggling as their namesake is challenged in what's now a very competitive election. MAGA (TRUMP) is down 12.5%, or 44.5% on-month, while Solana's TREMP is down 6% on-day and 43% on-month. Harris-themed KAMA is trading flat, and up over 160% in the last month. CORRECTION (August 8, 12:15 UTC): Corrects the lede to clarify that the judge made a ruling in the Ripple-SEC case. https://www.coindesk.com/markets/2024/08/08/xrp-jumps-17-beating-bitcoin-gains-as-ripple-sec-case-ends/