2024-07-30 15:52

The sports gambling company faces a class action lawsuit alleging its NFTs are securities. Sports gambling company Draftkings is shutting down its non-fungible token (NFT) business "effective immediately," the company said in an email to customers, ending a high-flying crossover between digital collectibles and sports culture. "After careful consideration, DraftKings has decided to discontinue Reignmakers and our NFT Marketplace, effective immediately, due to recent legal developments. This decision was not made lightly, and we believe it is the right course of action," the email said. Weeks ago, a federal judge allowed a class action lawsuit against DraftKings to proceed after finding plaintiffs "plausibly pled" DraftKings' NFTs were unregistered securities, according to Westlaw. DraftKings entered the NFT business in mid-2021 after noticing its "golden" customers were embracing digital collectibles from NBA Top Shot and other projects, co-founder Matt Kalish said last year in a podcast from Ark Invest. Built around an in-house marketplace, DraftKings' NFT business "let us play in this space that could become, in the next couple of decades, gigantic," Kalish said on the podcast. The company hired blockchain engineers, built its tech atop Polygon network, and started with a Tom Brady-themed collection that quickly sold out. Though collectors' appetite for plain Jane NFTs had fizzled by 2022, DraftKings stuck with web3 via Reignmakers: a fantasy sports game powered by NFTs. On the Ark podcast Kalish said it captured all the things DraftKings customers loved, from day-trading to fantasy gaming. "We were really looking to build the best utility-driven, NFT product out there, and we saw some really great momentum" in the first few months, Kalish said on the podcast. Its internal sales figures convinced DraftKings to expand from Football to UFC and PGA. This year, DraftKings started getting hit with class action lawsuits alleging its NFT sales violated securities laws, a charge other sports-themed NFT companies had also grappled with. In June, NBA Top Shot settled its own legal snafu with a $4 million payout. The class action against DraftKings appears to be headed to trial, according to court records. As part of the NFT shutdown DraftKings is offering buyouts to Reignmakers players, the email said. NFT collectors will still be able to access and transfer their collections. "It's important for all companies wading into the NFT and collectibles space to be buttoned up legally or else you risk an outcome like DraftKings," said Joel Belfer, who runs the Mint Condition blog on sports collectibles. "It's not the first or last time we’ll see a company face legal challenges and halt an offering due to running up against securities laws." https://www.coindesk.com/business/2024/07/30/draftkings-dumps-nft-business-citing-legal-developments/

2024-07-30 13:44

The issuer of stablecoin USDC was valued at as much as $9 billion when it first tried to go public in a failed SPAC deal in 2022. Circle stock is said to be trading around a $5 billion valuation for the company ahead of its planned listing. The firm reached a valuation of about $9 billion in 2022 when it first tried to go public via a failed SPAC deal. Circle Internet Financial’s privately held stock is trading in the secondary market at a price implying a $5 billion to $5.25 billion valuation for the stablecoin issuer ahead of a planned initial public offering, according to three people with knowledge of the matter. The issuer of USDC, the second-largest stablecoin by market cap, is allowing some trading of its shares in the secondary market ahead of the planned IPO, two of the people said, but on a case-by-case basis and only in specific situations. The sellers are said to be early-stage investors who are divesting for liquidity reasons or Circle employees, one of the people said. Employees are often given the chance to monetize stock options they hold before a company goes public. The company is not allowing trades below a $5 billion valuation, two of the people said. Circle didn’t respond to numerous requests for comment before publication time. The Coinbase-backed firm's valuation reached about $9 billion in 2022, when it tried to go public through a deal with a special purpose acquisition company (SPAC) called Concord Acquisition Corp. The companies announced the mutual termination of the proposed combination in December 2022 after the U.S. Securities and Exchange Commission (SEC) didn't grant approval for the tie-up in time, and following the collapse of Sam Bankman-Fried’s FTX a month earlier and the onslaught of the crypto winter. Investors need not fret about the difference between the 2022 valuation and the figure that's implied by the secondary-market trades, one of the people said. The secondary market is very depressed because there are many investors who need to raise cash and so will sell at any price, they added. A secondary market is where investors buy and sell securities, such as stocks and bonds, that have already been issued. In a January report entitled “State of the USDC Economy,” Circle said the number of USDC wallets with at least $10 had jumped 59% in the previous year to about 2.7 million. The number of transactions in 2023 had reached 595 million through the end of November. Circle filed to sell shares to the public for the first time in January of this year. The company filed a confidential draft S-1 document with the U.S. Securities and Exchange Commission. The number of shares to be offered and the price range for the planned offering had not been determined, the filing said. The exact timing of the planned IPO is also not known. Circle intends to make the U.S. its new legal home ahead of the planned IPO, Bloomberg reported in May. The company filed paperwork to move from its current domicile in Ireland. https://www.coindesk.com/business/2024/07/30/circle-said-to-be-trading-around-5b-valuation-ahead-of-planned-ipo-sources/

2024-07-30 12:06

The latest price moves in crypto markets in context for July 30, 2024. Latest Prices Top Stories Bitcoin has inched toward $66,000, paring all gains from last week, with sentiment dented as a significant amount of the asset was moved from U.S. government-linked wallets, raising concerns of looming selling pressure among traders. BTC lost as much as 5%, before slightly recovering, in the past 24 hours as the U.S. Marshals Service shifted $2 billion worth of BTC to two new wallets. Tracking service Arkham estimated that at least one of the wallets was likely to be a custodial service. Bitcoin was trading around $66,550 at the time of writing, a drop of 4.3% from 24 hours ago. The wider crypto market, as measured by the CoinDesk 20 Index, is 3.5% lower. Spot ether ETFs saw negative net flows in their first week as massive outflows from the incumbent Grayscale Ethereum Trust (ETHE) overwhelmed interest in the competing products. The equivalent bitcoin funds, which debuted in January, raked in $1 billion in net inflows during the first four days, even as they too suffered sizable outflows from a previously existing Grayscale fund. Overall, the spot ETH ETFs lost $340 million in net outflows with more than $1.5 billion exiting from the Grayscale Trust, according to Farside Investors. Ether has outperformed the wider digital asset market following Monday's slide. ETH is priced at $3,330, a drop of 1.67% compared with the CD20's 3.5%. Donald Trump's crypto pledges may mean the near-term bitcoin price is tied to the likely outcome of November's presidential election, investment bank Jefferies said. Trump promised to maintain a strategic bitcoin reserve and never sell the government’s seized bitcoin (BTC) at BTC 2024 in Nashville on Saturday. “His overtures to the industry to install crypto-friendly regulators may have the effect of near-term BTC price being tied to the outcome of the U.S. presidential election,” analysts Jonathan Petersen and Joe Dickstein wrote. Jefferies notes that Trump pledged to pick crypto-friendly regulators, to create a crypto industry presidential advisory council, and to make the country the “crypto capital of the planet.” Trending Posts Dogecoin Pup Owner’s New Shiba Inu Ends Up in NEIRO Memecoin Drama SEC Intends to Amend Complaint Against Third Party Tokens (Like SOL) in Binance Case Trump's Talk of Bitcoin Reserve for the U.S. Leaves Industry Waiting for More Details https://www.coindesk.com/markets/2024/07/30/first-mover-americas-btc-slides-as-us-government-linked-selling-pressure-looms/

2024-07-30 09:12

Trump’s policy shift towards crypto is very recent, but it may impact the price of bitcoin in the near term depending on who wins the U.S. election in November, the report said. Trump’s promises to the crypto industry may mean the near-term bitcoin price is tied to the outcome of the election, the report said. Jefferies said bitcoin mining profitability following the halving is better than feared at the start of the year. Larger bitcoin miners are still in growth mode, the bank said. With multiple politicians, both Republican and Democrat, and former president Donald Trump in attendance at the Bitcoin Nashville conference last week, there was a political undertone to the crypto event, investment bank Jefferies said in a research report on Monday. “His overtures to the industry to install crypto-friendly regulators may have the effect of near-term BTC price being tied to the outcome of the U.S. presidential election,” analysts Jonathan Petersen and Joe Dickstein wrote. Trump promised to maintain a strategic bitcoin reserve and never sell the government’s seized bitcoin (BTC), he said in his Nashville speech. Jefferies notes that Trump pledged to pick crypto-friendly regulators, to create a crypto industry presidential advisory council, and to make the country the “crypto capital of the planet.” This positive shift in Trump’s policy towards crypto is very recent, the bank noted, but it could impact the price of bitcoin in the near term, depending on who wins the election in November. With bitcoin having gained about 5% since the halving in April, and the network hashrate dropping a total of 8% in May and June, the “profitability of mining is modestly better than feared at the beginning of the year,” the authors wrote, with mining revenue per exahash down 40%-45% instead of 50%. Jefferies notes that the larger bitcoin miners are still in growth mode, and have orders in place to materially expand their installed hashrate. Hashrate is a proxy for competition in the industry and mining difficulty. The bitcoin mining consolidation phase is here, the report said, with CleanSpark (CLSK) recently agreeing to acquire GRIID (GRDI) and Riot Platforms (RIOT) making a public offer for Bitfarm (BITF), which was subsequently rejected. Comments from mining firm management teams suggest that there will likely be more M&A in the sector, “with access to power as far more valuable than the mining fleets,” the report added. https://www.coindesk.com/markets/2024/07/30/bitcoins-future-could-be-tied-to-the-outcome-of-the-us-election-jefferies/

2024-07-30 08:48

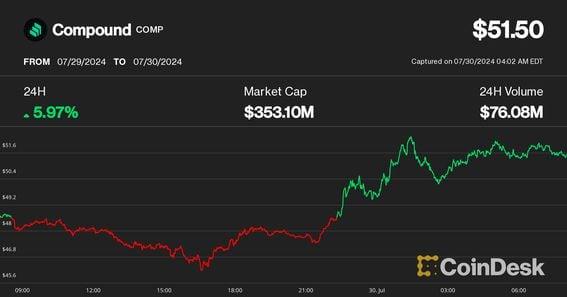

A new staking product will be offered instead of what Humpy and the Golden Boys initially proposed. A crisis that had been called a governance attack on the Compound lending protocol seems to have been averted. Humpy and the Golden Boys have signaled they will accept a counter-proposal to build a yield-bearing protocol similar to goldCOMP that will be controlled by the Compound DAO. A move to create a new yield-bearing protocol called goldCOMP by a large group of COMP holders, the native token of the Compoud lending protocol, has been called off, and the market is reacting positively. COMP added 5.6% to $51.27 after the proposal's backers, a whale named Humpy and a group of COMP holders known as the Golden Boys, agreed to cancel their proposal and vote for an alternative that involves creating a staking product that will be controlled by the CompoundDAO decentralized autonomous organization. The goldCOMP proposal, which critics are calling a governance attack, involved coordinated efforts to push a resolution through the DAO to allocate $24 million in COMP tokens to create a yield-bearing protocol intended to provide passive income. It was unpopular with many large stakeholders in the Compound ecosystem, including Wintermute, owing to allegations of vote manipulation by the proposers, concerns about the centralization of control and potential risks of mismanaging the $24 million COMP treasury funds. Now, the crisis has been averted. Instead, Humpy and the collective have agreed to a counter-proposal that will create a staking product that distributes 30% of existing and new market reserves annually to staked COMP holders, proportional to their stake. The new staked product will be controlled by the Compound DAO – directly addressing a concern many had that Humpy and the Golden Boys would have outsized control – and will be audited by a designated security partner appointed by Compound and continually audited by the DAO's Market Risk Manager. This is all contingent on Humpy formally withdrawing Proposal 289, which passed, that allocated COMP tokens into a trust to create goldCOMP. Humpy did not withdraw the offer by the initial deadline, but said in forum posts that he "fully approves" the idea. https://www.coindesk.com/business/2024/07/30/comp-token-rises-as-whale-backs-down-on-supposed-governance-attack-on-compound/

2024-07-30 08:35

A new class of memecoins was birthed on Solana and Ethereum networks over the weekend as the owner of the dog that inspired Dogecoin got a new pup - despite her officially distancing from all such tokens. Kabosu's owner announced her new Shiba Inu dog, Neiro, on X, sparking the creation of numerous NEIRO tokens on Solana. Two prominent NEIRO tokens emerged, with the most popular initially amassing a $100 million market cap but seeing a sell-off later as communities started to argue among each other on which was the actual NEIRO token. The trading frenzy propelled Solana's on-chain volumes to surpass Ethereum's, with the NEIRO deployer profiting $5.4 million from the token's popularity. Neiro's actual owner has distanced herself from the drama and cautioned users to be on the lookout for "token scams." Little did Kabosu’s owner know what was in store when she took to X on Sunday to announce her new Shiba Inu pet, Neiro. Kabosu was the pet dog whose photo birthed the dogecoin (DOGE) memecoin and, subsequently, the $37 billion dog-themed memecoin sector that includes shiba inu (SHIB), floki (FLOKI) and others. Kabosu passed away in May at the age of 17, leaving a legacy that includes a statue and a memecoin worth $18 billion. But @Kabosumama, the X account of Kabosu's human owner, adopted a ten-year-old Shiba Inu dog named Neiro last week, calling her a “new family member.” Initial replies to that announcement were filled with support for the new pet, but it soon turned into a shill fest as people quickly launched tokens on Solana using Neiro’s liking. Hundreds of Neiro, or Neiro-themed tokens, were issued on Solana token generator Pump Fun, with one quickly running to tens of millions in market capitalization. Later, some traders discovered that while the token at a $100 million capitalization was the most popular, another one was actually the first one to exist – shifting dynamics and causing a brief sell-off. The discovery resulted in traders quickly allocating capital to or trading both tokens, resulting in two Solana tokens themed after Neiro—both amassing a cumulative trading volume of $340 million. Such trading behavior pushed Solana to the forefront of total blockchain activity on Monday, with on-chain volumes surpassing those of Ethereum, the usual leader. DefiLlama data shows that Solana racked up $1.8 billion in trading volumes each on Sunday and Monday, while Ethereum did under $1 billion. As such, the price pump for the NEIRO deemed more popular pocketed its deployer at least $5.4 million in profits, on-chain analysis tool Bubblemaps said in an X post. The deployer bought up a large chunk of the initial supply shortly after the token went live using several wallets, and sold as it went viral. Both NEIRO tokens are actively traded and listed on exchanges as of Tuesday. Each community crowns itself as the real one and aims to replicate Dogecoin’s success. However, as far as Neiro’s owner @Kabosumama is concerned, none of the tokens are legitimate. “I see many tokens related to Kabosu and Neiro. To clarify, I do not endorse any crypto project except @ownthedog $dog because they own the original Doge photo and IP,” she said in an X post. “They are committed to doing only good every day, charitable works, and Doge culture.” “Please watch out for token scams.” https://www.coindesk.com/business/2024/07/30/dogecoin-pup-owners-new-shiba-inu-ends-up-in-neiro-memecoin-drama/