2024-07-25 06:02

Most Ether ETFs were in the green during the Wednesday U.S. trading session, but Grayscale's converted Ethereum Trust ETF posted a net outflow of over $800 million. Ether is down over $7.5% and is trading above $3100. Ether's decline comes as ETHE outflows continue and tech giant Nvidia trades in the red. Ether (ETH) is down over 7.5% in the first hours of East Asia's business day, trading hands above $3100 as the market continues to be concerned about outflows from Grayscale's converted Ethereum Trust ETF (ETHE). Market data from SoSoValue shows that ETHE had a net outflow of over $810 million. This is similar to the first weeks of Grayscale other major crypto trust, GBTC, when it experienced heavy outflows during the first weeks of the bitcoin ETFs trading earlier this year. Most of the other ETH ETFs continued in the green for flows during the Wednesday session, with BlackRock's ETHA leading the pack with $283.9 million for inflow, followed by Bitwise's ETHW, which registered $233.6 in inflow, and in third place Fidelity's FETH that clocked $145.7 million in inflow. ETH is down 6% in the last month, but still up 72% in the last year. Overall, Ether has outperformed the CoinDesk 20 (CD20), an index that tracks the largest digital assets, year-to-date, with the CD20 up 21.6% compared to ETH which is up 35%. ETH has continued to trade closely in line with Nvidia (NVDA), which is down over 6% today. Crypto prices have been strongly correlated with the chipmaker's stock for most of the year. CORRECTION (July 25, 07:39 UTC): Corrects direction of ether's monthly move in fourth paragraph. https://www.coindesk.com/markets/2024/07/25/eth-down-over-75-as-ethe-outflows-ramp-up/

2024-07-25 05:54

The approval and subsequent trading of spot ether ETFs in the U.S. has reinvigorated the market, CME's Giovanni Vicioso said. CME ether futures see record open interest as spot ETFs start trading in the U.S. Volumes surge as ETFs open door for both directional and non-directional traders. Activity in Chicago Mercantile Exchange's (CME) ether (ETH) futures reached new heights on Tuesday as the debut of spot ETH exchange-traded funds (ETFs) in the U.S. galvanized investor interest in the second-largest cryptocurrency. The so-called open interest or the number of active bets in standard ether futures rose to a record of 7,661 contracts, equaling 383,650 ETH and $1.4 billion in notional terms, the exchange said in an email to CoinDesk. The previous peak of 7,550 contracts was set one month ago. The standard contract is sized at 50 ETH. Speaking of trading volumes, the derivatives giant witnessed 14,736 contracts change hands on Tuesday, which is three times higher than the average daily volume of 5,010 contracts seen throughout July. Tuesday was also one of the top 10 volume days for ether futures. Giovanni Vicioso, global head of cryptocurrency products at CME Group, attributed the surge in activity to the onset of spot ether ETF trading in the U.S. "The approval and subsequent trading of spot ether ETFs in the U.S. has reinvigorated the market, driving significant growth in volume across our Ether suite and leading to record open interest for our flagship Ether futures," Vicioso said in the email. "As more and more traders seek exposure to cryptocurrencies, our suite of regulated, reliable and deeply liquid bitcoin and ether futures products continue to provide transparent tools for managing risk and capitalizing on market opportunities," Vicioso added. Spot ETFs hold ether, meaning investors in the fund have exposure to the actual cryptocurrency rather than derivatives tied to the digital asset. The ETFs are widely expected to pull billions of dollars worth of investor money in the coming months. These funds can be used to take both directional and non-directional arbitrage bets, such as carry trades, as observed in the bitcoin market. Besides, authorized participants tasked with creating and redeeming ETF shares are said to use regulated products like CME futures to hedge their exposure. https://www.coindesk.com/markets/2024/07/25/cmes-ether-futures-record-highest-ever-open-interest-of-383k-eth-after-etf-debut/

2024-07-24 22:01

The surging trading volumes helped the bank reach profitability for the first time. Sygnum Bank said crypto spot and derivatives trading surged in the first half, propelling it to its first half-yearly profit. The Swiss lender plans to expand into the European Union and Hong Kong in the coming months. Sygnum Bank posted its first half-year profit as the U.S. debut of bitcoin (BTC) exchange-traded funds (ETFs) and anticipation of ether (ETH) approvals boosted trading volumes and other areas of the business expanded. The Zurich, Switzerland-based lender did not disclose its profit figure. First-half spot crypto trading volume doubled from the year-earlier period and crypto derivatives volume increased by 500%. A $40 million fundraise in January helped boost core equity capital to some $125 million. Sygnum, which is licensed in Luxembourg, Singapore, and its native Switzerland, plans to acquire new licenses in Europe under the Markets in Crypto Assets (MiCA) regulations, which started to take effect last month and introduced a single regulatory environment throughout the 27-nation trading bloc. It also plans to expand its regulated operations in Hong Kong. Read More: Bitcoin ETFs Have Proven Popular, Ethereum ETFs Could Demonstrate Crypto’s True Investment Value https://www.coindesk.com/business/2024/07/24/sygnums-first-half-spot-crypto-trading-doubles-derivatives-increase-500/

2024-07-24 21:30

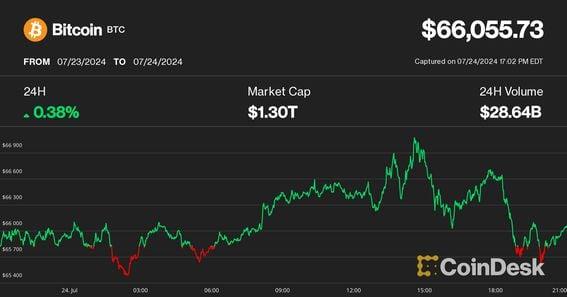

Solana's SOL and Ripple's XRP were notable outperformers. The Nasdaq and S&P 500 on Wednesday each suffered their worst declines since late 2022, but the price of bitcoin (BTC) mostly held up, remaining around the $66,000 level where it was a day earlier. The broad-market crypto benchmark CoinDesk 20 Index was also flat over the past 24 hours, with Solana's SOL and Ripple's XRP outperforming the broader market, advancing 3% to 4% over the same period. Avalanche (AVAX), Uniswap (UNI) and Ethereum Classic (ETC) were lower by 3% to 4%. Ether's (ETH) price action disappointed investors despite a fairly successful spot ETF debut Tuesday, with ETH dipping as low as $3,300, an almost 4% decline over the past 24 hours. It also hit its weakest price in two months versus bitcoin. "The real money interest was strong enough to deem the launch a marginal success, aligning with general expectations, but not yet strong enough to demand a repricing," analysts at crypto market maker Wintermute said. "This may come in subsequent sessions." The moves came amid a drop in the U.S. stock market, with the Nasdaq plunging 3.6% and the S&P 500 slumping 2.1% amid disappointing earnings results from market bellwethers like Alphabet (GOOG) and Tesla (TSLA). With ether ETFs launched, traders may shift their focus to an upcoming U.S. economic data release on Friday and Donald Trump's speech scheduled for Saturday at the Nashville Bitcoin conference. https://www.coindesk.com/markets/2024/07/24/bitcoin-holds-up-as-tech-stocks-plunge-ether-sinks-a-day-after-etf-launch/

2024-07-24 16:43

As Bitcoiners descend on Nashville for a big annual conference, we're covering robust demand for new Ethereum spot exchange-traded funds (ETFs) and recapping the $230 million WazirX hack. We're headed to the Bitcoin Nashville conference this week and looking forward to a lot of deep discussions about building on the original blockchain – as well as hearing what former President Donald Trump has to say. (We understand the security will be quite tight.) I'll be moderating a panel at a side event examining how Bitcoin DeFi scales. We're aiming to get some good photos for next week's issue. This week: Ethereum spot ETFs haul in net $107M on first day – with big (Grayscale) asterisk. Recap of the $230M WazirX hack. Feature: Alkimiya – an Ethereum-based protocol to hedge Bitcoin fees. Top picks from the past week's Protocol Village column: Inscribing Atlantis, Hemi, Avail, Lightning Labs, Base. $80M+ of blockchain project fundraisings: Caldera, Bitlayer Labs, NPC Labs, Zivoe, Chainbase, Allium Labs Network news The blockchain sleuth ZachXBT posted a visual of his early efforts to trace the flow of funds after the WazirX hack. (ZackXBT/X) ETH ETF LAUNCH: Newly approved spot Ethereum ETFs started trading on Tuesday, hauling in a net $107 million of fresh investment – including $484.1 million of outflows from the Grayscale Ethereum Trust (ETHE), and $590.9 million of inflows into vehicles launched by managers including BlackRock, Fidelity and Bitwise. While analysts have predicted a far-lower uptake for the new funds than bitcoin spot ETFs that started trading about six months ago, Bloomberg analyst James Seyffart described the first day of trading for the Ethereum ETFs as "very solid." BOOTY OR BOUNTY? A $230 million exploit of the Indian crypto exchange WazirX got blockchain sleuths pointing fingers at North Korea-linked hackers, and various parties blaming each other for the security lapse. The funds were allegedly stolen from a WazirX multisignature wallet, or "multisig"– one that requires two or more private keys to execute a transaction. "Despite us taking all necessary steps to protect the customer assets, the cyber attackers appear to have possibly breached such security features, and the theft occurred," the exchange wrote in a preliminary report. WazirX identified the multisig wallet's provider as crypto custody firm Liminal in a follow-up post, hours after the initial confirmation. It later deleted the post, and Liminal said in a blog post that "there is no breach in Liminal's infrastructure, wallets and assets." The loot included shiba inu (SHIB) tokens along with ETH, MATIC, PEPE and USDT. A gallows-humor-meets-geekdom moment arrived when blockchain records appeared to show that the exploiter had created a token called "WazirX Hacker Sends His Regards." The exchange filed a police complaint, and the matter is under investigation. But as of Friday, tokens on WazirX were trading at deep discounts to their prices on other global crypto exchanges, a sign of immense local selling pressure. Earlier this week WazirX announced that it would pay a bounty of as much as $23 million, or 10%, to the hacker in exchange for the return of the funds. On a running blog post chronicling the incident day-by-day, WazirX updated that it's now "actively contacting projects associated with the stolen tokens to seek their support in the recovery process." One poster on X responded by noting that the looter had apparently already "converted almost all of the stolen crypto to ETH," inquiring, "Don't you think it's too late?" 'COPYCAT WEBSITE' Decentralized crypto-exchange giant dYdX said Tuesday that the website for dYdX v3, an older version of its trading platform, was "compromised," and warned users against visiting dydx.exchange until further notice. "The attacker has taken over the v3 domain (dydx.exchange), and deployed a copycat website that when users connect their wallets to it, it asks them to approve via PERMIT2 transaction to steal their most valuable token," a member of dYdX's community team said in the project's Discord server. The attack did not appear to impact funds traders already have on dYdX, as only the web domain, and not the underlying smart contracts, appear to be being targeted, according to statements in dYdX's Discord server. The larger dYdX v4 venue (which last week saw $6 billion in trading volume) was said to be unaffected. ALSO: Vitalik Buterin argued against supporting candidates just based on their "pro-crypto" stances. Ryan Selkis stepped down as CEO of Messari, the crypto data and research firm he co-founded, following a series of inflammatory tweets about politics, civil war and his desire for an immigrant to get expelled from the country. With U.S. Vice President Kamala Harris securing widespread endorsements as the presumptive replacement for Joe Biden atop the Democratic 2024 presidential ticket, crypto lobbyists are scrambling to assess whether she might look for a "reset" in policies toward digital-asset regulation. (Her memecoin soared to an all-time high, fwiw.) Ethereum-Based Protocol Alkimiya Creates Market for Hedging Bitcoin Fees Akimiya founder and CEO Leo Zhang (Alkimiya) Blockchain protocol Alkimiya launched, introducing a tool that allows users to hedge against volatile Bitcoin transaction fee rates. The hardest part might be getting hardline bitcoiners – sometimes known as "maximalists" or "maxis" – to use the new protocol, since it's built atop the Ethereum blockchain. Target users for the platform, described as a "blockspace markets protocol," could include traders, mining pools and foundations. "While we recognize that Bitcoin maxis may initially hesitate to use an Ethereum-based solution, our primary focus is on creating the most robust and efficient marketplace for trading Bitcoin transaction fees," Alkimiya founder and CEO Leo Zhang said in an email interview with CoinDesk. There may be little doubt about the usefulness of a solution like Alkimiya's: In April, when Casey Rodarmor's Runes protocol for minting fungible tokens atop Bitcoin went live, the Bitcoin network fee rate shot up to $125 per transaction from $4.80. Click here for the full article by Bradley Keoun Protocol Village Top picks of the past week from our Protocol Village column, highlighting key blockchain tech upgrades and news. Ephemera Kit (Inscribing Atlantis) 1. Inscribing Atlantis, led by Hell Money podcast co-host Erin Redwing, announced that its "Ephemera" auction will be launching for the first time at the Bitcoin Nashville conference, and will run from July 18 through Bitcoin block height 854,784 (approx. Aug. 2). According to the team: "This project ties Bitcoin block time to astronomical time by inscribing planetary ephemeris data on satoshis (the smallest unit of Bitcoin) from the exact moment they were mined. Through Ephemera, participants can select dates they want to memorialize on Bitcoin, creating a unique digital archaeological record. This initiative explores the concept of Deep Time, aiming to leave a lasting legacy by linking our digital age with the cosmos." The planetary data is inscribed using Bitcoin's Ordinals protocol, created by the independent Bitcoin developer Casey Rodarmor, who is Redwing's fellow co-host on Hell Money. "It's basically my gamified way of trying to get people to participate in my community archeological project," Redwing told CoinDesk in an email. 2. Hemi Labs announced the Hemi Network, "a modular layer-2 blockchain network focused on delivering superior scaling, security, and interoperability between Bitcoin and Ethereum." According to the team: "Hemi Labs was co-founded by early Bitcoin core developer Jeff Garzik and blockchain security pioneer Max Sanchez, who was the principal developer behind Hemi’s unique method for inheriting Bitcoin’s unique security characteristics – the Proof-of-Proof (“PoP”) consensus protocol." 3. Avail, a blockchain "data availability" project spun out of Polygon in early 2023 that has raised $75 million of funding, is finally launching. The project's main network was set to go live on Tuesday, along with a native token, AVAIL, according to a press release. "The launch of Avail DA marks the first step in Avail’s mission to give developers the tools they need to boost blockchain scalability, enhance liquidity and provide seamless usability across any blockchain ecosystem," according to a press release. 4. Lightning Labs announced the release of Taproot Assets on Bitcoin's Lightning Network, claiming to be the "first multi-asset Lightning protocol on mainnet." According to a blog post by Lightning Labs' Ryan Gentry: "With this release, assets can be minted on bitcoin and sent via the Lightning Network instantly for low fees. As such, we now have the ability to make bitcoin and Lightning multi-asset networks in a scalable manner anchored in bitcoin's security and decentralization. This step forward will give users access to the world's currencies on an open, interoperable payments network while routing through bitcoin liquidity, making bitcoin the global routing network for the internet of money." 5. Base, the layer-2 network backed by the publicly traded crypto exchange Coinbase, said that fault proofs are now live on the Base Sepolia testnet. According to a blog post: "Today’s launch paves the way for bringing fault proofs securely to mainnet, and completing other milestones to reach Stage 1 decentralization... In Stage 1 decentralization, or 'limited training wheels,' the chain state is verified with fault proofs but there is an override mechanism that can act in the event of a bug. The override mechanism requires consensus from both chain operators and a designated number of external stakeholders, which reduces the dependence on chain operators alone." Money Center Fundraisings Caldera, a "rollup-as-a-service" platform that helps developers quickly spin up layer-2 blockchains, has closed a $15 million Series A funding round led by Peter Thiel's Founders Fund. CEO Matt Katz said in an interview with CoinDesk that the new funds will help him expand Caldera's 15-person team so they can build out the Metalayer, an interoperability ecosystem meant to simplify the process of launching applications across multiple blockchains. The fundraise was led by Founders Fund, with participation from Dragonfly, Sequoia Capital, Arkstream Capital, Lattice. Bitcoin layer-2 blockchain Bitlayer Labs said it raised $11 million in a Series A funding round at a valuation of $300 million. The investment was led by ABCDE and Franklin Templeton, one of the issuers of a spot bitcoin (BTC) exchange-traded fund in the U.S. Bitlayer's layer 2 is based on the BitVM paradigm, which was unveiled last October, laying out a path for Ethereum-style smart contracts on the original blockchain. NPC Labs, a developer looking to build a GameFi ecosystem on the Base protocol, has closed an $18 million funding round led by Pantera Capital. Zivoe, a real-world asset credit protocol atop Ethereum, raised $8.35 million in their last round, aiming to broaden credit access by connecting blockchain liquidity with real-world borrowers, according to the team. Omnichain data network Chainbase has raised $15 million in Series A funding with Tencent Investment Group, Matrix Partners and Hash Global among the investors. Data platform Allium Labs, which provides enterprise-grade blockchain data to companies like Visa, Stripe and Uniswap Foundation, has raised $16.5 million in a Series A funding round, it announced Thursday. Data and Tokens Bitcoin Traders Brace For 'Fat Tails' as Focus Shifts to Trump's Nashville Conference HNT Token Beats Bitcoin With 40% Surge as Helium's Mobile Subscriber Count Tops 100K Tokenized Asset Manager Superstate Debuts New Fund to Profit From Bitcoin, Ether 'Carry Trade' BlackRock's $500M Tokenized Fund Pitches for Ethena's RWA Investment Plan Calendar July 24-25: Blockchain Rio, Rio de Janeiro. July 25-27: Bitcoin 2024, Nashville. Aug. 19-21: Web3 Summit, Berlin. Sept. 1-7: Korea Blockchain Week, Seoul. Sept. 12-13: Global Blockchain Congress, Southeast Asia Edition, Singapore. Sept. 18-19: Token2049 Singapore. Sept. 19-21: Solana Breakpoint, Singapore. Sept. 25-26: European Blockchain Convention, Barcelona Sept. 30-Oct. 2: Messari Mainnet, New York. Oct. 9-11: Permissionless, Salt Lake City. Oct. 9-10: Bitcoin Amsterdam. Oct. 10-12: Bitcoin++ mints ecash: Berlin. Oct. 15-17: Meridian, London. Oct. 21-22: Cosmoverse, Dubai. Oct. 23-24: Cardano Summit, Dubai. Oct. 25-26: Plan B Forum, Lugano. Oct. 30-31: Chainlink SmartCon, Hong Kong. Nov. 10: OP_NEXT Bitcoin scaling conference, Boston. Nov 12-14: Devcon 7, Bangkok. Nov. 15-16: Adopting Bitcoin, San Salvador, El Salvador. Nov. 20-21: North American Blockchain Summit, Dallas. Feb. 19-20, 2025: ConsensusHK, Hong Kong. May 14-16: Consensus, Toronto. https://www.coindesk.com/tech/2024/07/24/the-protocol-ethereum-etfs-arent-blockchain-but-buyers-ape-in/

2024-07-24 16:18

Tokenization is one of the hottest corners of the blockchain ecosystem. Coinbase Asset Management is creating a tokenized money-market fund, according to four people familiar with the plan. Tokenization of real-world assets is a hot corner of crypto. BlackRock's tokenized U.S. Treasuries fund quickly grabbed $500 million of assets this year. The asset management arm of U.S.-listed cryptocurrency exchange Coinbase (COIN) is creating a tokenized money-market fund, jumping into one of the hottest crypto-powered corners of finance, according to four people familiar with the plan. Tokenization, or representing ownership of real-world assets (RWAs) through blockchain-based products, has become one of the big trends in crypto of late. BlackRock, the world's biggest asset manager, introduced a fund called BUIDL that holds U.S. Treasuries. That fund quickly hit $500 million of assets following its introduction in March. For investors, tokenized funds provide numerous potential benefits, including the transparency provided by blockchain-linked assets and the possibility of greater liquidity. For issuers, there are efficiency gains. For Coinbase Asset Management specifically, this would represent an expansion of the company's already publicly known attempt to break into the tokenization space. In December, the company received in-principle approval from an Abu Dhabi regulator to start tokenizing traditional assets on Base, the exchange's Ethereum scaling network. Two of the people familiar with the matter said Coinbase Asset Management has been working with Bermuda-based Apex Group to help facilitate its tokenized fund. Apex services over $3 trillion of assets across custody, administration, depositary and managed funds. In March 2023, Coinbase acquired One River Digital Asset Management, which led to the creation of Coinbase Asset Management. Coinbase declined to comment. Apex Group did not comment by publication time. https://www.coindesk.com/business/2024/07/24/coinbase-asset-management-plans-tokenized-money-market-fund-a-hot-area-after-blackrocks-buidl-success-sources/